Spencer Platt/Getty Images News

Thesis

When you hear of a game by Rockstar or 2K Games, what is your first impression? Many might not know the publishers, but if you asked about “Grand Theft Auto” or “NBA 2K”, I’m sure most eyes will open wide. This is because Take-Two Interactive (NASDAQ:TTWO), the parent company behind these studios, has created a longstanding track record of ultra-quality games, grounded on a backdrop of revolutionary narratives and gameplay experiences. In fact, many of their top IPs have moved the needle with each iteration in gaming. For example, where “Grand Theft Auto” revolutionized the open world concept, “Red Dead Redemption” pushed narrative storytelling and unforgettable gameplay mechanics to a new dimension.

Opportunities in the market come ever often, and it is surprising to see Take-Two’s stock down 32% YTD. After all, the company is in a strong financial position and is executing on three core, long-term value generating themes:

-

Rapidly growing a diversified portfolio of high quality, next-generation games by swiftly expanding their development team sizes.

-

Continued monetization of its existing, successful IPs through digital currencies and add-on content.

-

Expanding their mobile presence to fully realize their $282 billion total addressable market (TAM) size.

With all this said, let’s take a look at why I believe the bear market may present an opportunity for the patient investor.

The Financials

Bookings

While much of the decline in the stock’s price is a direct result of the poor macroeconomic environment, bookings in fiscal 2022 were lower than 2021. This result would have surely left investors pessimistic about future growth potential.

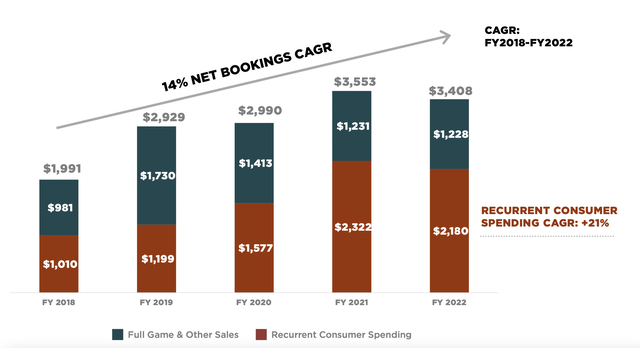

Take-Two Bookings (Take-Two Interactive)

The $100 million drop in net bookings from 2021-2022 was largely the result of a reversal on COVID-19 lockdowns, where consumer demand for gaming related activities declined. According to the research group NDP, consumer spending on video games dropped 8% from January through March compared to the same period last year. In addition, game delays halted growth throughout 2021. For example, a smaller title named “Kerbal Space Program 2” got delayed until 2023. Despite these almost predictable circumstances, investors are being myopic.

Take a look at the chart above. The trend shows a 14% net bookings CAGR from fiscal 2018-2022. In addition, look at the distribution of bookings between its two categories: actual sales of video-games and recurrent consumer spending. While the distribution was about 50% between the two in fiscal 2018, recurrent consumer spending is quickly taking the majority of sales today, holding 61.5% of net bookings. This is extremely beneficial in the current macro environment because Take-Two can compensate game delays with micro-transactional content in its existing IPs. When “Grand Theft Auto V” first launched, it became the quickest medium of entertainment to reach $1 billion sales in history. Despite this feat, Take-Two innovated by launching “Grand Theft Auto Online”, which 9 years later, is still releasing regular content to its large gamer base.

Margins

In fiscal 2022, Take-Two grew its gross profit margin from 50.1% in fiscal 2021 to 54.5%. Its operating margin grew from 13.8% to 17.8% during the same period. At the bottom, the company’s net income margin fell from 17.4% in fiscal 2021 to 12% in fiscal 2022.

Cash & Debt

According to the data provided by Seeking Alpha, Take-Two had roughly $2.5 billion in cash at the end of fiscal 2022. This figure is slightly lower than the $2.7 billion in 2021, but higher than 2020’s figure of $2 billion.

The company also has roughly $2.7 billion in long-term debt. Therefore, with its current cash reserves, it can pay off over 90% of its debt obligations quickly. If we include all the other current assets on its balance sheet, it can cover the entire debt obligation if needed.

Okay, so Take-Two is in good financial standing, has respectable margins and has little solvency risk. So, financial positioning should not be a concern for even the myopic investor. Why, then, should one be optimistic about Take-Two?

Growing a Diversified Portfolio Of Highly Successful Games

Take-Two has four main subsidiaries under its belt: Rockstar Games, 2K, Private Division and T2 Mobile Games. Of these four studios, they have developed 12 series with individual titles that have sold over 5 million units each. Within each series, each title has a track record of surpassing its predecessor, which is often rare in the entertainment industry.

Titles with at least 5 million units sold (Take-Two Interactive)

For example, “Red Dead Redemption 2” has sold 44 million units, a whopping 21 million more copies than its predecessor. The “Grand Theft Auto” series has sold over 375 million units globally. However, its last title, “Grand Theft Auto V”, holds 165 million units of that figure. The “Borderlands” series has amassed sales of over 75 million units, but its last two titles have contributed roughly 45 million to that figure.

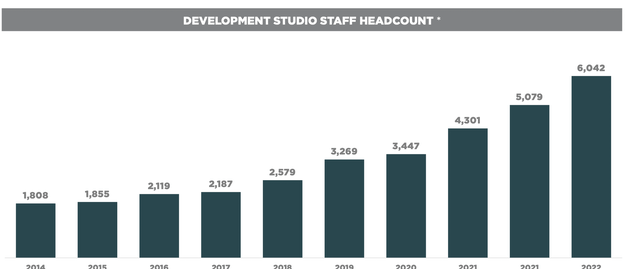

Without a doubt, Take-Two is leveraging this philosophy of “each title better than the next” by increasing the size of its development teams. The chart below shows Take-Two’s development studio headcount since 2014. The figure has nearly tripled since its midpoint in 2018 from 2,500 to over 6,000 today.

Headcount of Take-Two Development Studio (Take-Two Interactive)

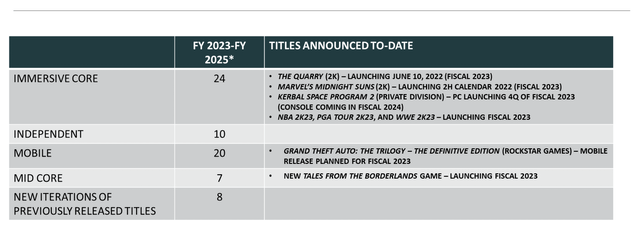

6,000 people developing games may seem like a lot, but Take-Two currently has its largest development pipeline ever. Between fiscal 2023 and 2025, the company expects to release 24 games that revolve around immersive core (deep gameplay), 10 independent titles, 20 mobile games, 7 mid core and 8 new iterations of previously released titles. Let’s not forget the elephant in the room; “Grand Theft Auto VI”. Rockstar has finally indicated that the game is in development, but has not provided a release date. We can assume it will be launching this decade (or century at this rate), but it’s still worth mentioning the almost guaranteed success it will bring to Take-Two.

Pipeline Fiscal 2023-2025 Take-Two (Take-Two Interactive)

One needs to remember that at the core of Take-Two’s business are the games it produces; both a combination of new IPs and improvements in existing ones. With each new successful game, the company can expect to see anywhere from 20 million units sold to over 300 million. Extrapolating these figures to an average unit cost of $60 U.S. can rake in anywhere from $1.2 billion to $18 billion in sales. While the latter is far reaching, the success of “Grand Theft Auto” speaks to the opportunity the company has.

Continued Monetization Strategy

As previously mentioned, recurring revenue contributed over 60% to net bookings in fiscal 2022. Therefore, there is something to be said of the current strategy Take-Two is undertaking to have a predictable revenue stream every year.

The virtual currency system is currently present in a number of uber-successful titles. According to Somawk Banerjee at Sportskeeda, “GTA Online” makes approximately $1 billion a year. This would translate to over $6 billion during its lifetime. Of the $1 billion in sales, roughly $800 million comes from “shark cards”. Shark cards are similar to PlayStation Network or Xbox gift cards in that purchasing a shark card translates to in-app currency. If these figures are true, then Take-Two has amassed more money in monetization of “GTA Online” than actual sales of “Grand Theft Auto V”. Other titles are introducing add-on content to maximize revenue on their respective IPs. These include “Borderlands 3”, “Civilization VI” and “The Outer Worlds”.

By using monetization strategies, Take-Two is achieving two things that prove beneficial to its shareholders: a recurrent and predictable revenue stream and extending the life of its IPs. Without “GTA Online”, we would have likely already had a “Grand Theft Auto VI”. However, because monetizing the IP has proven successful, Take-Two has successfully extended the life of the game. This means that instead of spending hundreds of millions to build a new entry into a series every 3-4 years, it can extend development to 10+ years, all while earning a steady stream of revenue.

Realizing True TAM By Rapidly Growing Mobile Presence

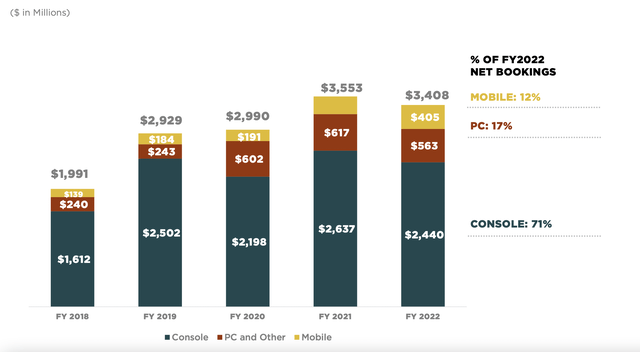

The video game market is expected to reach $235 billion by the end of this year. After which, it will grow by an estimated CAGR of 5% to reach $282 billion by 2026. Mobile is expected to retain its 50% share of the entire market throughout the entire projection. This implies the mobile gaming market will be worth roughly $141 billion by 2026. Mobile gaming is beginning to become a prominent platform for Take-Two as indicated by the figure below.

Distribution of sales by platform (Take-Two Interactive)

In fiscal 2022, mobile gaming accounted for 12% of net bookings. This is 6% growth compared to fiscal 2020. So what is Take-Two doing to penetrate this market?

Firstly, it is following its philosophy with its console and PC games. That is, producing high quality IPs. A game called “Dragon City” has ranked among the top 15 simulation games worldwide for more than 8 years running. “Two Dots” has been downloaded over 115 million times. Of this figure, it has over 1 million daily and 5.5 monthly active users. Another IP called “Top Eleven” is the world’s most successful mobile soccer management game with over 250 million users.

Another strategy it is undertaking is optimization of its core gaming experiences for smaller screens (mobile). These include many of the “Grand Theft Auto” titles, “NBA 2K”, “Max Payne” and others. There is a lot of value added by undergoing this transformation. For one, it gives millions of players without a console or a PC access to Take-Two’s beloved titles, exposing them to addicting gameplay and storytelling. Secondly, it entrenches these “new” gamers into the ecosystem whereby they become addicted to the games and spend more through micro-transactions.

One other strategy of notable importance that I can see adding value to the mobile strategy is the acquisition of Zynga. A few weeks ago, Take-Two completed its acquisition of Zynga for $12.7 billion. Zynga is a behemoth in the mobile gaming industry, creating some of the most successful IPs in history. These include “FarmVille” and “Words with Friends”. With this title of the best in mobile, they also bring their expertise. Frank Gibeau, Zynga’s CEO, will remain with the company, working alongside Take-Two executives to deliver on their mission of growing their mobile presence. I expect Zynga to quickly pick up on its quality and, having access to the resources and development teams at Take-Two, deliver exceptionally well in the future of mobile gaming.

By delivering on its promise of high quality mobile games, coupled with the optimization of quality console games to mobile, I am certain with the help of Zynga, Take-Two will quickly grow its mobile presence and capture some of the $141 billion expected market.

Risks

With all this said, there must be risks, right? After all, consumer spending in video games is on the decline. I am of the opposite opinion.

Despite the reduction in consumer spending on video games, the total number of video game players is expected to grow at a CAGR of 4% through 2024. In addition, 90% of gamers were expected to continue playing video games after social distancing rules were lifted. While the decrease in video game spending contradicts this, it is worth noting that many gamers who would have started playing during the pandemic are not really gamers at all, but casual gamers. When restrictions lifted, they would have likely returned to their regularly scheduled lives. However, the pandemic brought an opportunity where at least some of these gamers would have become “sticky”. By this, I mean that they would have been introduced to gaming for the first time and stuck with it. Once “stuck”, you are often stuck for life. This is the kind of gamer Take-Two needs. Therefore, the reduction in consumer spending on video games is nothing more than the reduced demand seen from the people who would have never stuck along in the first place. What is of more value is looking at the average spend of a “sticky” gamer. If that figure is increasing, then we know that the industry will continue to expand. Look at the chart below.

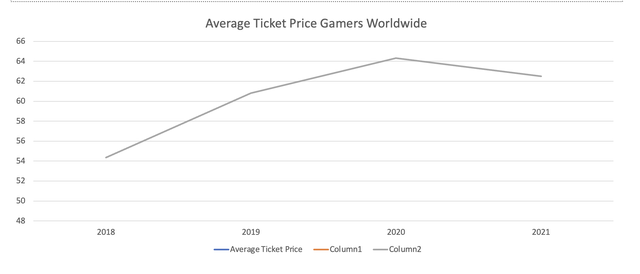

Average Ticket Price Worldwide Gamers (William Sabga-Aboud)

I extrapolated data from 2018 to 2021 using gaming market size for each year and dividing it by the estimated number of gamers. The trend shows a quick rise from 2018, to plateau around 2020-2021. While the plateauing effect does have some merit, the general trend shows an increase from 2018-2021 in average ticket prices.

Conclusion

Based on its current financial positioning and long-term strategic goals of growing a diversified portfolio of the highest quality games, continued expansion of its monetization strategy and realizing its true TAM by focusing on mobile gaming, Take-Two is currently presenting an opportunity for the patient investor. I believe there is little risk in the company at this time and that it is one of the safer plays in the market at this time.

While no valuation was done in this article, the current market is very bearish and waiting a bit longer might allow prudent investors to extract even more value from this long-term play.

Be the first to comment