We Are

New Mountain Finance Corporation (NASDAQ:NMFC) increased its dividend by 7% in the fourth quarter, owing to strong portfolio performance and credit quality.

The portfolio’s exposure to variable rate interest rates also significantly boosts the BDC’s future income potential, implying that pay-out metrics might improve.

Given that the business development firm is covering its dividend payments with net investment income, that it just increased its dividend, and that the stock is selling at a discount to net asset value, I continue to suggest NMFC to yield seekers seeking consistent dividend income.

Portfolio Status, Credit Quality And Originations In 3Q-22

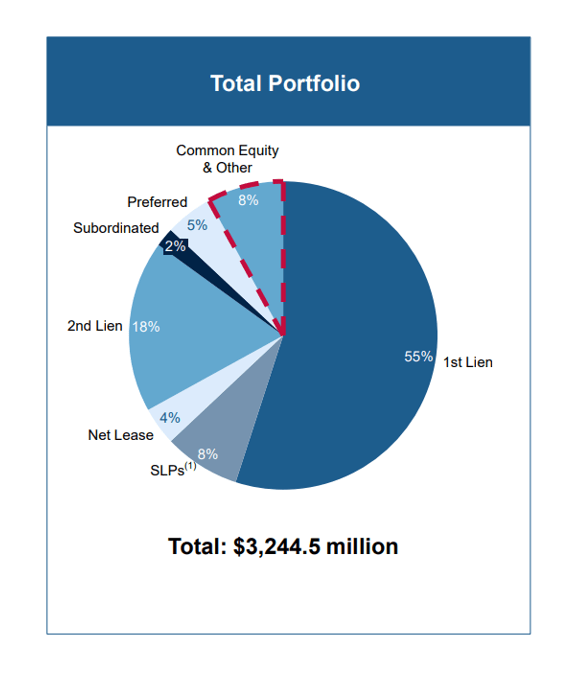

As of September 30, 2022, New Mountain Finance’s portfolio was worth $3.2 billion and included 106 investments. The portfolio was predominantly composed of First Liens (55%) and Second Liens (18%), with the BDC also investing in Equity (13%), in order to gain better returns by accepting more risk.

Because about 88% of the BDC’s assets are floating rate, the central bank’s efforts to curb inflation are a powerful driver for New Mountain Finance’s net investment income growth in the future.

Total Portfolio (New Mountain Finance Corp)

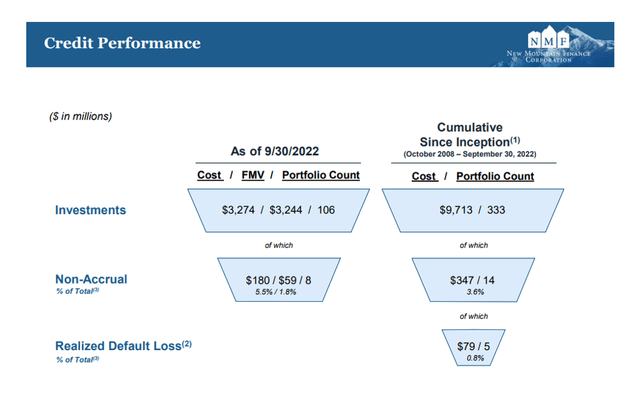

Although the BDC’s portfolio credit quality deteriorated slightly, New Mountain Finance maintained good asset quality overall. At the end of the September quarter, eight of 106 investments were non-accrual, representing a total investment fair value of $59 million.

New Mountain Finance had seven non-accrual investments in the second quarter, totaling $45 million in at-risk investment value. As of 30 September, 2022, New Mountain Finance’s non-accrual ratio was 1.8%, down from 1.4% the previous quarter.

Credit Performance (New Mountain Finance Corp)

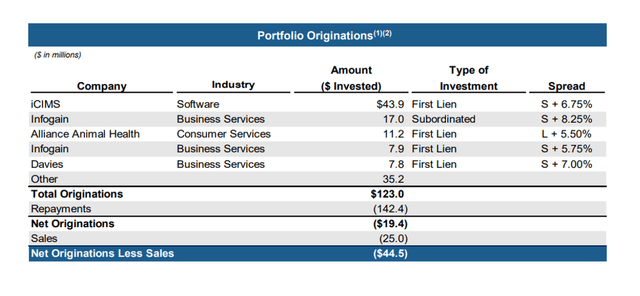

In terms of new loan originations, the business development company originated $123.0 million in new loans, mostly First Liens, in the third quarter.

Portfolio Originations (New Mountain Finance Corp)

Dividend Is Just Covered

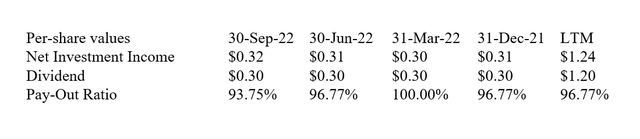

In the third quarter, New Mountain Finance earned $0.32 in net investment income, which was enough to cover the $0.30 per share dividend payment.

The third-quarter pay-out ratio was 94%, which was slightly lower than the dividend pay-out ratio of 97% in the previous twelve months.

Dividend (Author Created Table Using Trust Information)

Due to strong portfolio performance in the third quarter, New Mountain Finance increased its quarterly dividend by 7% to $0.30 per share. The dividend increase will go into effect in the fourth quarter, when passive income investors will receive a $0.32 per share per quarter dividend.

New Mountain Finance’s stock has a dividend yield of 10.1% based on the increased dividend payout.

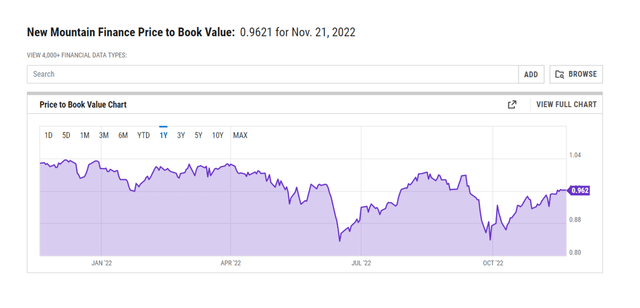

Valuation

New Mountain Finance is currently trading at a small (4%) discount to net asset value. The BDC’s net asset value as of September 30, 2022 was $13.20, a 1.6% decrease QoQ due to a widening of credit spreads.

I believe New Mountain Finance’s stock could trade at a premium to net asset value as long as the portfolio quality of the business development company does not deteriorate significantly.

Why New Mountain Finance Could See A Lower Valuation

Although New Mountain Finance has good credit quality, an increase in non-accruals would obviously pose a challenge to the business development company and the valuation multiple that investors are willing to place on the value of the BDC’s investment portfolio.

Deteriorating asset quality in the sector would be a major issue for New Mountain Finance going forward.

There are some BDCs with better credit quality than NMFC, such as Oaktree Specialty Lending Corporation (OCSL), and I continue to recommend this BDC for safety-focused passive income investors.

My Conclusion

New Mountain Finance is a good BDC choice for passive income investors seeking a high yield that is covered by net investment income.

Simultaneously, the business development company has positive interest rate exposure, which positions New Mountain Finance for portfolio income gains if the central bank continues to raise benchmark interest rates, which I believe it will do as long as inflation remains high.

The BDC’s valuation is also appealing because investors can currently purchase New Mountain Finances’ portfolio at a discount to net asset value.

Be the first to comment