MF3d

A Quick Take On Allot

Allot Ltd. (NASDAQ:ALLT) reported its Q3 2022 financial results on November 15, 2022, beating expected earnings per share estimates.

The company provides a variety of IT and internet security technologies to customers worldwide.

ALLT has announced a recent win to provide its security as a service offering to some of Verizon’s customers.

Until we see results show up in the firm’s financials and reverse its significant slide across all metrics, I’m on Hold for ALLT.

Allot Overview

Hod HaSharon, Israel-based Allot was founded in 1996 to provide security software and related services to organizations worldwide.

The firm is headed by Chief Executive Officer Erez Antebi, who was previously CEO of Gilat Satellite Networks and CEO of Clariton Network.

The company’s primary offerings include:

-

Secure Management Platform

-

NetworkSecure

-

HomeSecurre

-

DNSecure

-

EndPoint Secure

-

BusinessSecure

-

IoTSecure

-

Secure Cloud

-

-

DDoS Secure/5G Protect

-

NetXplorer

The firm acquires customers through its in-house direct sales and marketing efforts, resellers, original equipment manufacturers and system integrators.

Allot’s Market & Competition

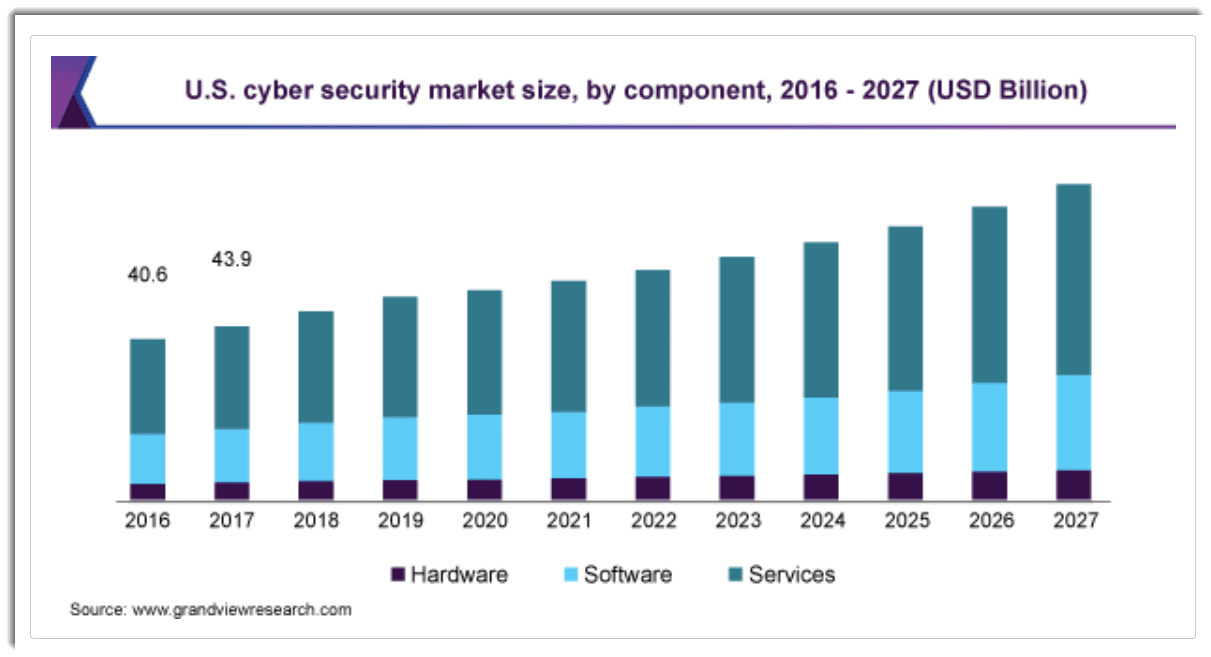

According to a 2020 market research report by Grand View Research, the global market for cybersecurity software and services was an estimated $157 billion in 2019 and is expected to exceed $300 billion by 2027.

This represents a forecast CAGR of 10.0% from 2020 to 2027.

The main drivers for this expected growth are constantly changing cyber threats against a backdrop of more complicated consumer and enterprise software requirements and infrastructures.

With the increasing use of cloud-based applications and solutions, along with the rise of the Internet of Things [IoT], there is a greater need for security solutions that can protect against a wider range of threats.

There is also an increasing awareness of the importance of cybersecurity, which is driving demand for more effective solutions.

The market is expected to be further boosted by the broad implementation of new regulations and standards, such as the General Data Protection Regulation in the EU region.

Also, the transition of enterprise IT from on-premises to the cloud will create significant new opportunities for new services and capabilities.

Below is a chart showing the historical and projected U.S. cybersecurity market dynamics by component:

U.S. Cyber Security Market (Grand View Research)

Major competitive or other industry participants include:

-

CrowdStrike

-

VMware

-

McAfee

-

Symantec

-

Microsoft

-

Palo Alto Networks

-

Others

Allot’s Recent Financial Performance

-

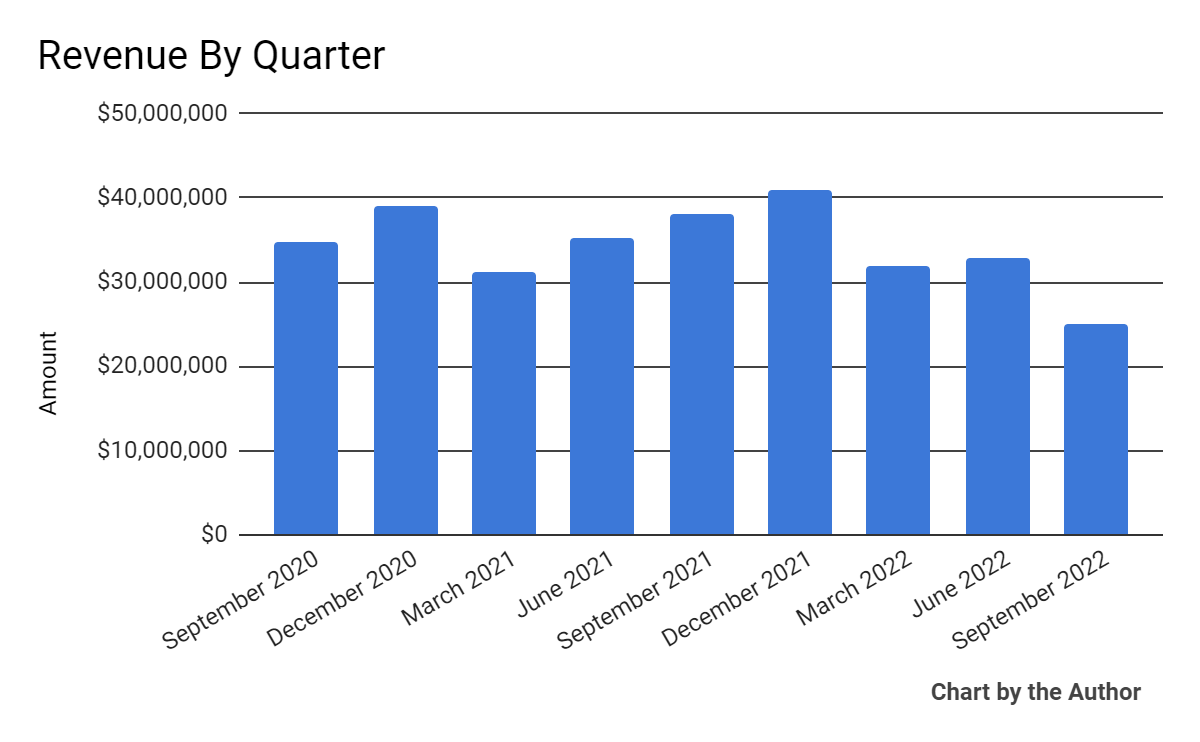

Total revenue by quarter has trended lower in recent quarters:

9 Quarter Total Revenue (Seeking Alpha)

-

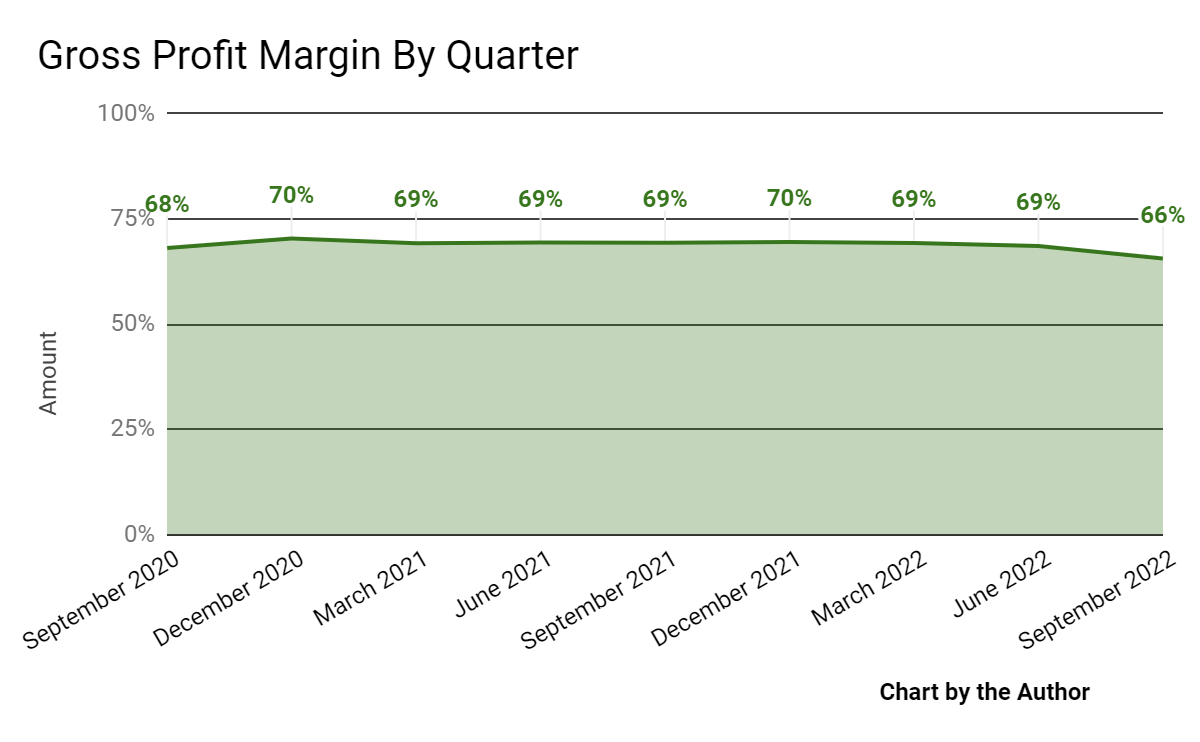

Gross profit margin by quarter has remained within a relatively narrow range, although dropping in Q3 2022:

9 Quarter Gross Profit Margin (Seeking Alpha)

-

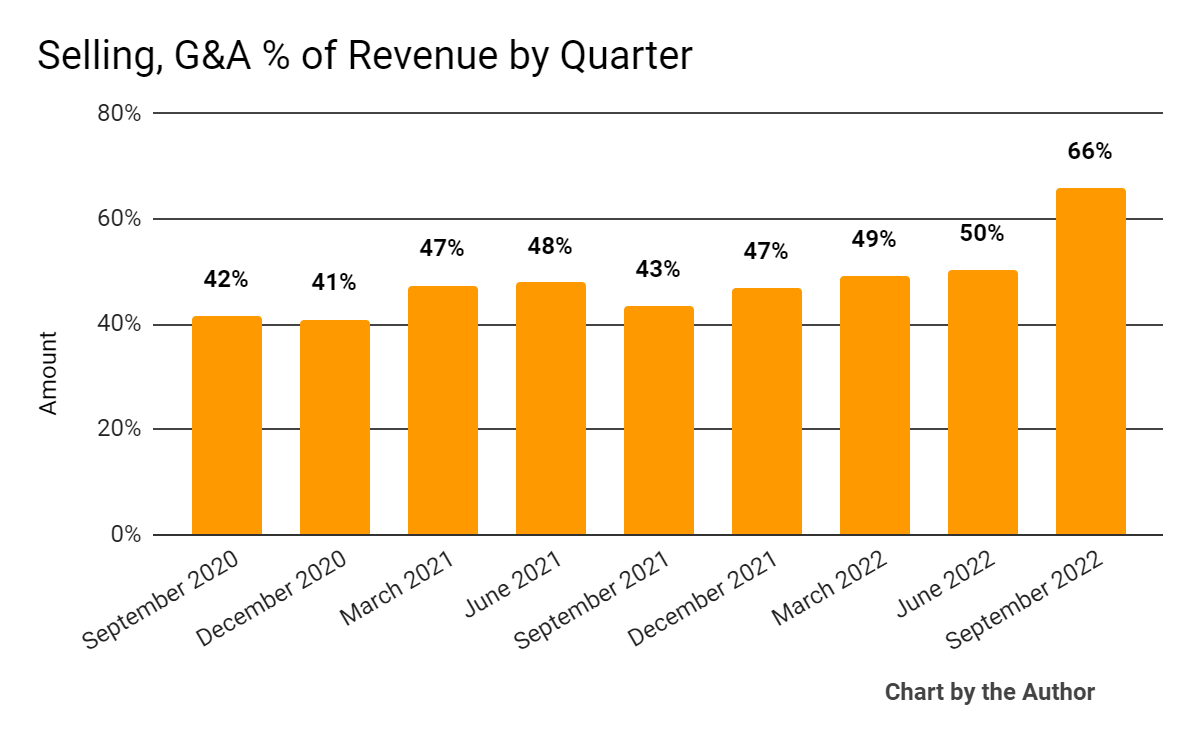

Selling, G&A expenses as a percentage of total revenue by quarter rose sharply in Q3 2022:

9 Quarter Selling, G&A % Of Revenue (Seeking Alpha)

-

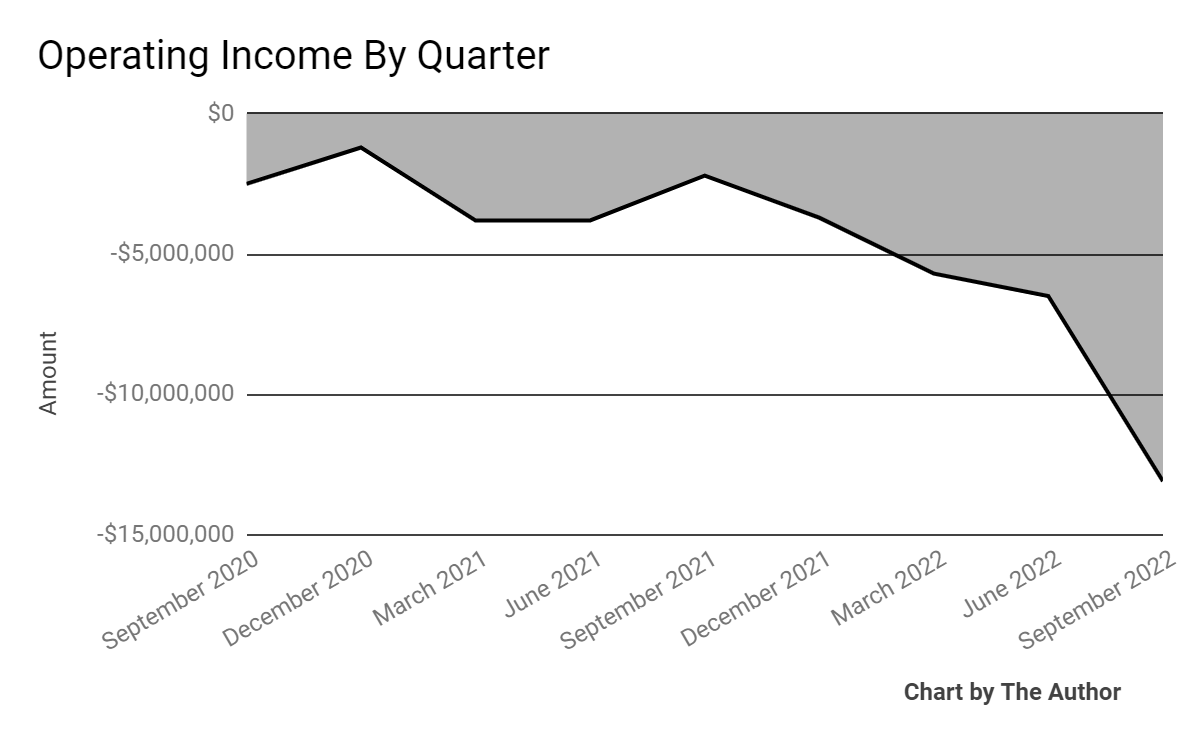

Operating losses by quarter have worsened dramatically in recent quarters:

9 Quarter Operating Income (Seeking Alpha)

-

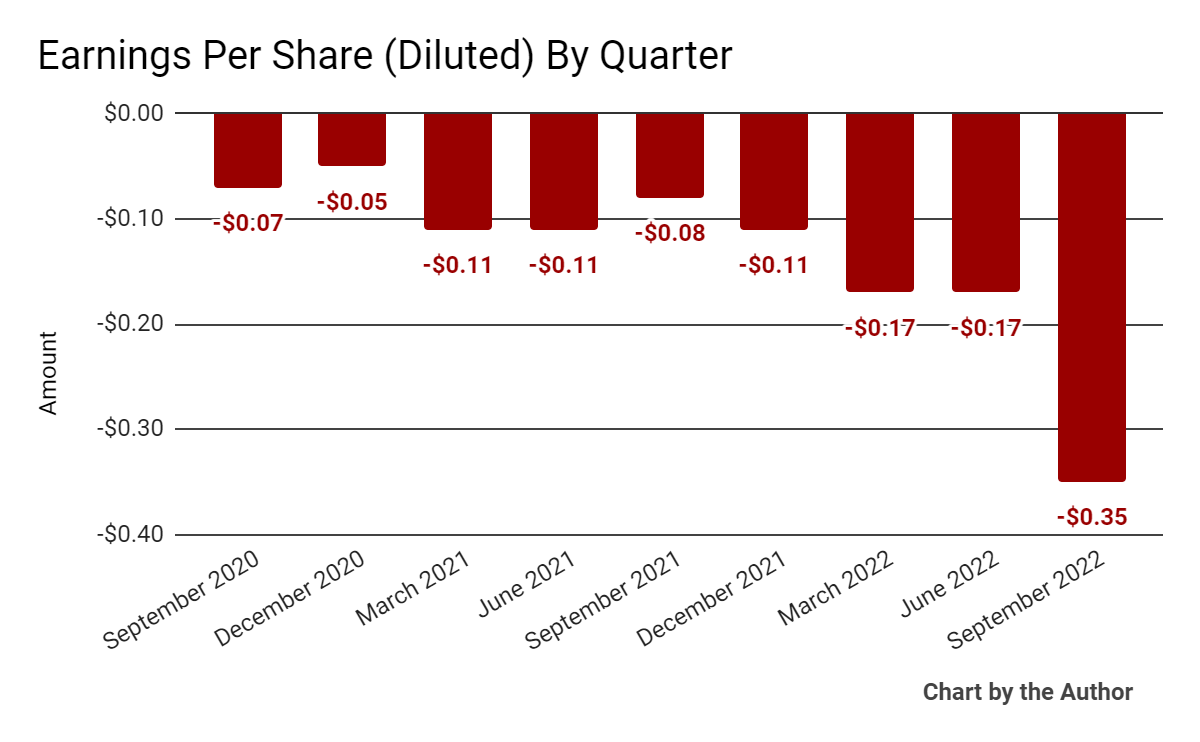

Earnings per share (Diluted) have also worsened with the same trajectory as operating income:

9 Quarter Earnings Per Share (Seeking Alpha)

(All data in above charts is GAAP)

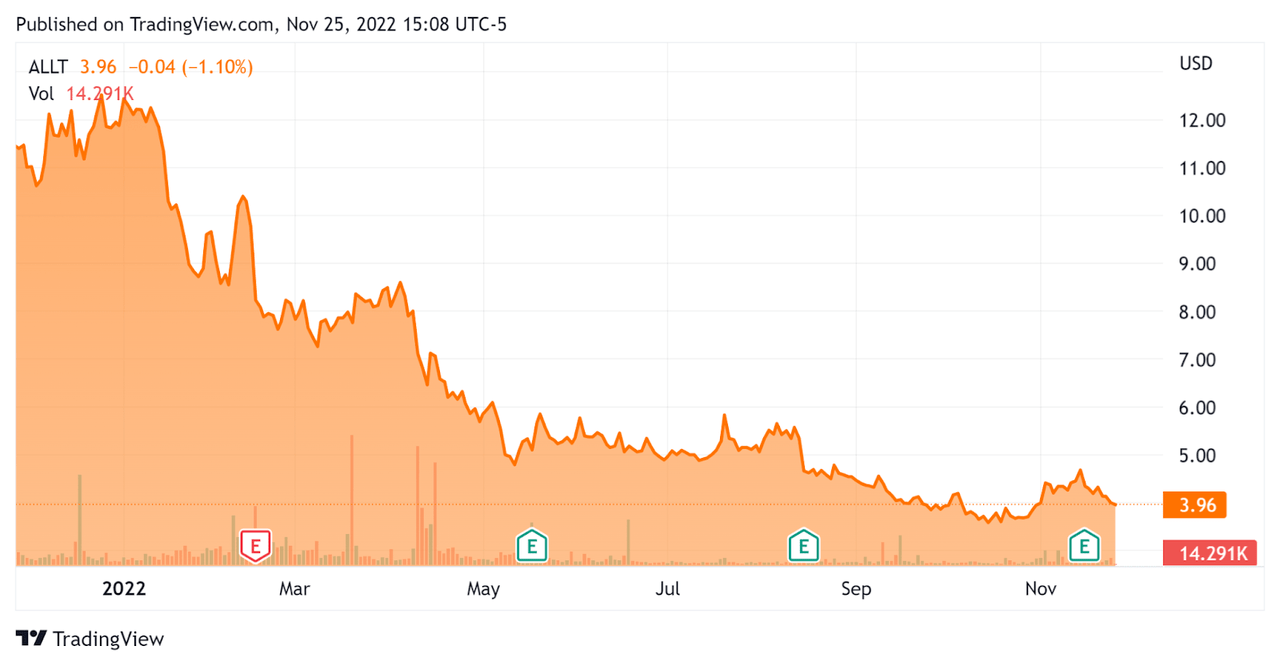

In the past 12 months, Allot’s stock price has fallen 65.7% vs. the U.S. S&P 500 index’ drop of around 12.3%, as the chart below indicates:

52 Week Stock Price (Seeking Alpha)

Valuation And Other Metrics For Allot

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure [TTM] |

Amount |

|

Enterprise Value / Sales |

0.7 |

|

Revenue Growth Rate |

-9.1% |

|

Net Income Margin |

-22.4% |

|

GAAP EBITDA % |

-17.3% |

|

Market Capitalization |

$149,340,000 |

|

Enterprise Value |

$97,030,000 |

|

Operating Cash Flow |

-$33,410,000 |

|

Earnings Per Share (Fully Diluted) |

-$0.80 |

(Source – Seeking Alpha)

The Rule of 40 is a software industry rule of thumb that says that as long as the combined revenue growth rate and EBITDA percentage rate equal or exceed 40%, the firm is on an acceptable growth/EBITDA trajectory.

ALLT’s most recent GAAP Rule of 40 calculation was negative (26.4%) as of Q3 2022, so the firm has performed poorly in this regard, per the table below:

|

Rule of 40 – GAAP |

Calculation |

|

Recent Rev. Growth % |

-9.1% |

|

GAAP EBITDA % |

-17.3% |

|

Total |

-26.4% |

(Source – Seeking Alpha)

Commentary On Allot

In its last earnings call (Source – Seeking Alpha), covering Q3 2022’s results, management highlighted a change in focus from a previous ‘land grab’ approach to sales to greater focus on customers that will purchase and deploy its solutions within a shorter time frame.

The company’s efforts will be to continue to penetrate the tier-1 CSPs (Communications Service Providers) and the enterprise market. In the third quarter, the firm had 2 tier-1 CSP customers that started to deploy significant projects, and leadership expects to see a material contribution from these in the fourth quarter and in 2023.

In the enterprise market, management sees the same use cases as in the past, but the deployment models are changing. While in the past, large enterprises were mostly deploying hardware on their premises to realize these use cases, there is now a move towards network-based services provided by the Service Providers or as managed services delivered by managed security service providers or MSSPs.

The company is now seeing this trend broaden among the CSPs that now are starting to look at providing software solutions based on the network, solutions that will be offered as a service and be more flexible, easy to consummate and affordable.

As to its financial results, total revenue dropped 35% year-over-year.

Management did not disclose any retention rate metrics, which are important for determining the health of its product/market fit and sales efficiency.

ALLT’s Rule of 40 results have been very poor, with a negative 26.4% result for the last twelve months.

SG&A expenses as a percentage of revenue rose sharply, while operating losses increased substantially, leading to the worst EPS result in the past 9 quarters.

For the balance sheet, the firm finished the quarter with cash, equivalents and short term investments of $97.0 million and total debt of $39.5 million.

Over the trailing twelve months, free cash use of $40.6 million, of which capital expenditures accounted for $7.2 million use of cash.

Looking ahead, for full year 2022, management expects total revenue of around $127.5 million at the midpoint of the range and full year loss to be as much as $24 million.

Regarding valuation, the market is valuing ALLT at an EV/Sales multiple of around 0.7x.

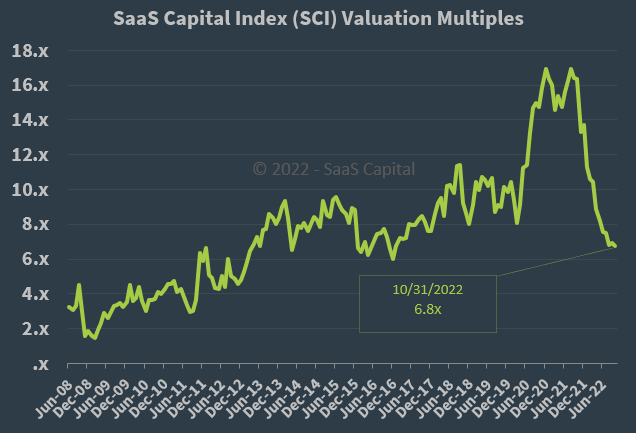

The SaaS Capital Index of publicly held SaaS software companies showed an average forward EV/Revenue multiple of around 6.8x at October 31, 2022, as the chart shows here:

SaaS Capital Index (SaaS Capital)

So, by comparison, ALLT is currently valued by the market at a large discount to the broader SaaS Capital Index, at least as of October 31, 2022.

The primary risk to the company’s outlook is an increasingly likely macroeconomic slowdown or recession, which may accelerate new customer discounting, produce slower sales cycles and reduce its revenue growth efforts.

While Allot has produced a recent marquee customer win in a deal with Verizon ‘to provide network-based security to provide — to Verizon SMB, Small and Medium Businesses and IoT, Internet of Thing customers,’ this really appears to be a focus on its fixed wireless and IoT connection customers.

Until we see results show up in the firm’s financials and reverse its significant slide across all metrics, I’m on Hold for ALLT.

Be the first to comment