IAM-photography/iStock via Getty Images

With rumors that Netflix (NASDAQ:NFLX) will acquire Roku, Inc. (ROKU) swirling, there were some concerns that the merger would face regulatory scrutiny. While regulators would certainly have a look at the merger if it were to occur, it’s likely to pass with ease.

This article will review the 2020 Vertical Merger Guidelines for insights into what aspects regulatory agencies might consider in a potential Netflix-Roku merger, and why the rumored merger would likely be unchallenged by regulatory agencies.

2020 Vertical Merger Guidelines

While the Federal Trading Commission withdrew from the 2020 guidelines over the interpretation of the benefits of eliminating double marginalization (more on that later), the guidelines still offer key insights into the FTC and DOJ enforcement practices when it comes to vertical mergers.

The guidelines highlight the agencies’ focus on two key questions when it comes to vertical mergers: what is the impact of the measure on consumers? And would it hinder competition in the industry?

Historically, regulatory agencies generally view vertical mergers in a positive light, mainly due to the elimination of double marginalization. But first, let’s define what vertical mergers are; it’s when two firms from different points of the same supply chain merge with one another. This is obviously the case with Netflix and Roku given the former is a creator of content and the latter is a distributor of it. Now, what is double marginalization? It’s the margin each company would make from making a sale. Given that the two companies sell to one another (they are in different parts of the same supply chain), some of the margins they charged would go away when they merge. The premise of the Double Marginalization Problem is simply that having two monopolies in different parts of the same supply chain creates inefficiencies that lead to higher prices, lower production, and lower profits. A detailed explanation of double marginalization is beyond the scope of this article, but a brief video describing the problem can be found here.

So regulatory bodies would like to see that the merger would create efficiencies that would hopefully be passed on to consumers. Netflix and Roku can easily make a case that their merger creates efficiencies that accomplish that, particularly since Netflix will offer an ad-supported subscription tier. Merging with Roku would eliminate the margin Roku would have made providing the Netflix ad-tier subscription to customers, and that margin could accrue to customers in the form of a lower price point for the new service. Netflix can also make more of its programming available via the free-to-air Roku Channel, increasing its value to consumers.

Well, what about competition? Surely, it’s clear the merger harms competition? Here is the key quote to consider from the guidelines:

The Agencies are concerned with harm to competition, not to competitors.

While it’s clear the merger would represent a setback to Netflix’s current competitors, regulatory bodies will find little evidence that the merger hinders competition. In fact, based on the guidelines, regulatory bodies are likely to focus more on competition in the TV OS space, where the merger would be seen favorably given the nature of the competition with tech giants in that space. Every single concern regarding competition with other streamers can be dismissed due to the competition in the TV OS space. Any threat that Netflix and Roku can engage in practices that hinders competition in streaming can be mitigated by the fact that such moves would boost the position of competing TV operating systems. Netflix and Roku could actually argue that their merger will enhance competition in streaming, simply because it will improve Roku’s competitive position against Apple Inc. (AAPL), Amazon.com, Inc. (AMZN), and Alphabet Inc. (GOOG) (GOOGL), who have Apple+, Amazon Prime Video, and YouTube, respectively.

Saved by Comcast and AT&T

The FTC will likely look into previous vertical mergers in the space for clues on whether the merger would raise antitrust concerns. The previous two mergers will be a boost to Roku and Netflix; the merger of AT&T Inc. (T) with Time Warner failed miserably. And while the acquisition of NBCUniversal by Comcast Corporation (CMCSA) was successful in creating shareholder value, NBCUniversal didn’t really gain monopolistic advantages from Comcast’s position in cable or broadband. In fact, its streaming product Peacock languishes in the streaming wars despite the vertical integration. These two examples suggest that the FTC and DOJ would likely not view the rumored merger as posing an anticompetitive threat. Another thing is if Roku and Netflix can produce evidence that there is significant customer overlap, then they can abate any regulatory concerns that their merger could lead to a spike in market share (an important consideration in vertical mergers).

One of the biggest concerns however is that Netflix will benefit enormously from having its competitors’ data available on Roku. While that is true, Netflix and Roku can make a case that this negatively impacts their competitors but not competition. Cable and broadband companies like Comcast and AT&T have all kinds of data on the same streaming competitors, yet that never boosted the fortunes of their media subsidiaries as discussed above. And sure, it would mean Roku will sell more ads using that data, but the agencies can’t really prove that Netflix would be able to use that data in a way that harms competition. Apple and Amazon already have these data sets from their TV operating system products, and that didn’t stop Netflix from dominating the streaming space.

Readers might disagree with these points of view, but the key here is that the agencies have the burden to prove that the merger would hinder competition. That could be difficult given Comcast, AT&T, Amazon, and Apple all didn’t overcome Netflix (which isn’t vertically integrated) in streaming. Some could point to Netflix’s first-mover advantage in streaming, but a quick look at the number 2 player in the space would reveal another non-vertically-integrated player in The Walt Disney Company (DIS).

FTC and DOJ are Likely to be More Concerned by Competition with Apple and Amazon

The agencies will likely be more concerned with whether the merger will mean Netflix will prioritize being on Roku rather than other platforms (something some analysts voiced concerns over). This is something both companies can easily provide assurances over, given it would be detrimental to Netflix’s subscription business. They could also point out how other streamers that have their own distribution channels (Apple+ and Peacock) are available on Roku to establish the need for streaming products to be on multiple platforms. Netflix reportedly has 21 million users on iPhone in the US. That’s close to a third of its U.S. customer base, meaning Netflix would suffer greatly if it were to take its service off of Apple products.

The competition with Amazon and Apple will also be very useful for Netflix and Roku in allaying many regulatory fears. One of the things the agencies will look into is whether Roku and Netflix could raise costs on competitors who wish to have a presence on Roku devices, in order to benefit the Netflix service. The two companies can easily point out that any efforts to favor the Netflix business will come at the expense of the Roku side of the business. For example, competing streaming services could simply decide to drop out of Roku, making competing products like Apple TV or Amazon Fire TV more differentiated. They could point to HBO’s decision to pull HBO Max out of Amazon to establish this case.

Regulators could also view the efficiencies created from the merger as enhancing competition in the TV operating system space. A bigger Roku with profits and higher margins would mean it would be able to better compete with Apple, Amazon, and Alphabet Inc in the space.

Cost Synergies From the Merger Would be Staggering

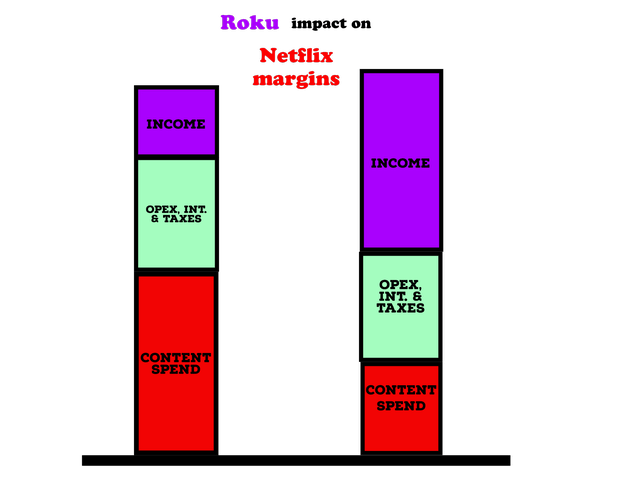

My other article covered the many advantages Netflix gets out of a merger with Roku, yet I missed a big one; its impact on margins. I previously mentioned that the majority of $17 billion Netflix spends on content spend is allocated to licensing, with only $6-$7 billion going to original content. If Netflix acquires Roku, why would it need to spend $10 billion a year to license someone else’s content? Many of the customers would remain in the Netflix ecosystem regardless as long as they are on a Roku device. The company will be able to monetize content it does not license through advertising or the cut it will make from competing streaming services. As soon as the merger closes, Netflix would have the option of an additional $10 billion in gross profit that it used to spend on licensing content.

Roku can transform Netflix’s margins, lowering licensing costs (created by author using regulatory filings)

This doesn’t mean that Netflix would quit spending on licensing content altogether, but it would give the company more flexibility. It could decide to license less content in the US where Roku has higher market share, and use the savings to offer better rates for the same licensed content internationally, where Roku is still trying to grow. The company could also decide to use the money to invest more in original content, expand more aggressively into their other verticals, pass the savings to consumers, or even drop those savings to the bottom line and buyback stock with it (as much as 10% a year if the combined company sells for $100 billion).

Conclusion

The 2020 Vertical Merger Guidelines suggest the rumored Netflix-Roku wouldn’t face much regulatory resistance. The merger could add as much as $10 billion to net income for the combined firms, which at current P/E multiples for Netflix would be worth an additional $160 billion in market cap post-merger. The prospect of the deal being truly in the works however is speculative at best and there was no confirmation from either company that they are in talks over merging.

Be the first to comment