Michael M. Santiago

Goldman Sachs BDC Inc. (NYSE:GSBD) is a well-managed business development company with a First Lien focus, a solid and covered 11.3% dividend yield, and net investment income that has the potential to grow due to the company’s exposure to floating rate interest rates.

The BDC’s investment portfolio is also expanding, and credit quality remained stable in the third quarter.

Goldman Sachs BDC is a top-rated business development company that provides investors with a high yield as well as income upside, in my opinion.

The stock is currently trading at a small premium to net asset value, making GSBD appealing to passive income investors.

First Lien-Focus Equals Recession Protection

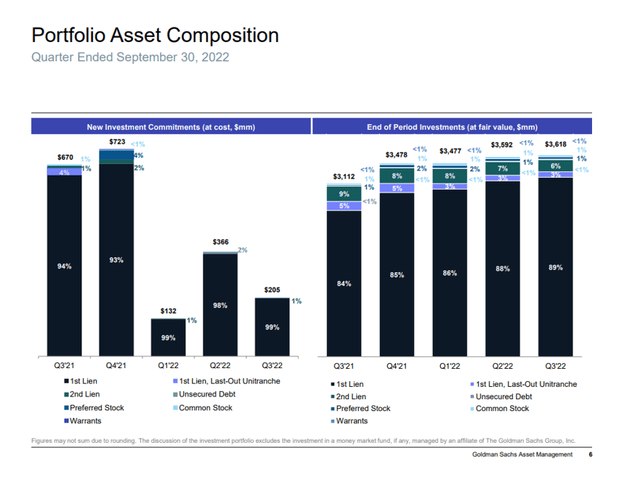

For its investment portfolio, Goldman Sachs BDC only selects the more secure types of debt: 92% of investments have been made in high-quality first liens, with the remaining 6% in second liens, providing passive income investors with important layers of protection even during recessionary periods.

During recessions, business development companies typically see a decline in average loan quality, which manifests itself as an increase in non-accruals.

A non-accrual loan is one in which the borrower is not performing as expected and has typically fallen behind on interest payments due to some type of financial stress.

Goldman Sachs BDC’s investment portfolio was valued at $3.62 billion as of September 30, 2022, a 16% increase YoY. Non-accruals amounted to 1.4% of the company’s investment value at amortized cost, up from 0.9% as of June 30, 2022.

Portfolio Asset Composition (Goldman Sachs BDC Inc)

Only 1% of new loan commitments made in the third quarter referred to Second Liens. Goldman Sachs BDC increased its emphasis on First Liens, accounting for 99% of the $205 million in new loan commitments made during the quarter.

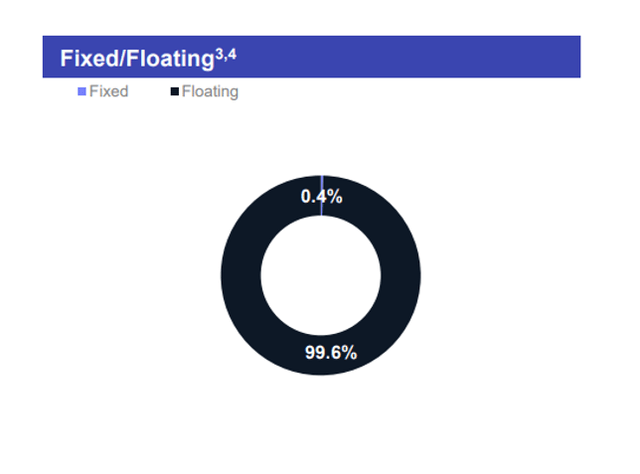

Almost all of Goldman Sachs BDC’s loan contracts have floating rates (99.6% to be exact), which creates portfolio income upside for passive income investors as long as the central bank prioritizes inflation control.

Fixed And Floating Rates (Goldman Sachs BDC Inc)

Improving Dividend Coverage

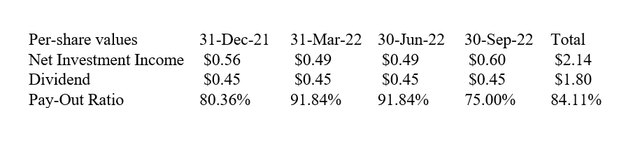

Goldman Sachs BDC earned $0.60 per share in net investment income in the third quarter, a 22% increase QoQ, and paid a $0.45 per share dividend.

The dividend pay-out ratio in the quarter ending September 30, 2022 was 75%, an improvement from the previous quarter’s dividend pay-out ratio of 92%.

The dividend is easily covered, and unless the business development company’s portfolio quality deteriorates significantly, I see no problem with Goldman Sachs BDC continuing to pay the $0.45 per share per quarter it is currently paying.

Dividend (Author Created Table Using BDC Information)

Now A Premium Valuation

When I last looked at Goldman Sachs BDC, the company’s stock was trading at a 6% discount to net asset value. Because of the BDC’s stock price recovery since my last coverage, the stock is now trading at a 6% premium to Goldman Sachs BDC’s net asset value of $15.02.

Why Goldman Sachs BDC Could See A Lower Stock Price

Given the quality and focus on safety that Goldman Sachs BDC’s investment portfolio provides passive income investors, I believe investors are currently paying a very fair price.

However, there are obvious levers that could reduce the company’s net asset value. Among them are fewer new loan originations and a rise in non-accruals.

A drop in interest rates, as opposed to an increase in rates that benefits the BDC’s floating rate asset base, could be a drag on the BDC’s net investment income.

My Conclusion

Goldman Sachs BDC is unquestionably a higher-quality business development company, and the BDC’s portfolio performed admirably throughout the third quarter.

What I like about GSBD is that it focuses solely on First and Second Liens, which gives the investment portfolio a very defensive character, which is exactly what I want in preparation for the next recession.

To secure my income streams, I want well-managed, securely invested BDCs with a track record of execution and a growing portfolio value, which GSBD provides.

The 11.3% dividend is easily covered by net investment income, and the pay-out ratio is low enough to indicate that the BDC will be able to meet its dividend commitment to shareholders.

Be the first to comment