Zoran Zeremski/iStock via Getty Images

Haleon plc (NYSE:HLN) is a global healthcare company with a recognised portfolio that includes “Voltaren,” “Rinazina” and “Theraflu,” among others. Its shares began trading on the London and New York stock exchanges last July, following the completion of the spin-off from GSK plc (GSK). Pfizer Inc (PFE) is currently the largest shareholder with a 32% stake. The consumer healthcare sector is worth about $180 billion and Haleon controls only a small part of it (about 6%), although the company is one of the world leaders in this specific sector.

To be precise, the second largest player after Johnson & Johnson (JNJ), which will also spin off its own CHC division: Kenvue, over the next year. A third major player, Sanofi’s CHC division, is likely to join the group in the next few years, albeit with lower annual sales and probably worse performance than its larger peers. In this group, Haleon appears to be the most promising investment (and also the only one currently listed), given its extensive product portfolio with strong brands (see figure below).

This is why another strong consumer goods company like Unilever (UL) tried to acquire Haleon a year ago. Interestingly, the £50 billion offer that was rejected at the time now represents a premium of over 40% to Haleon’s current enterprise value: either Unilever got it wrong or the market missed something here: I am definitely in favour of the second option.

Recent Results

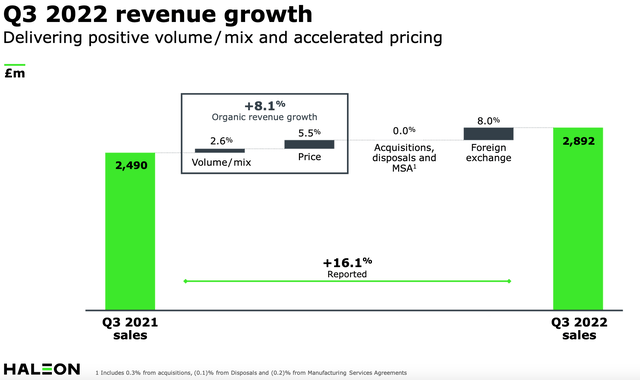

The updated third quarter saw a 16% increase in Haleon’s revenue, half of which was due to favorable exchange rates as the company reports in British pounds (see image below).

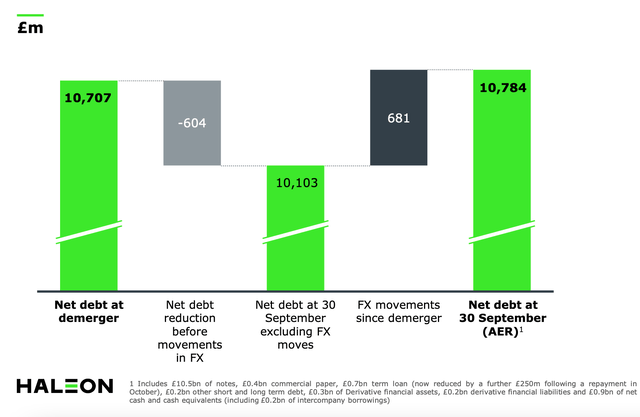

Net debt showed an opposite pattern, as a significant portion of the company’s bonds are denominated in non-UK currencies.

These numbers directly translate to a net debt/EBITDA of slightly less than 4, which is admittedly a bit high. However, management has set out to reduce this ratio to below 3 by the end of 2024.

Moreover, thanks to high cash flow conversion, FCF this year will be between £1.2-1.5 billion, which is about 4.5 times the annual cost of debt (2.8%). Finally, the debt has an average duration of c. 8.4 years, enough to sleep well at night.

Guidance for the year has been increased after Q3 release, both for the company’s top-line and operating margin.

It is likely that a dividend will be announced during the next year with a payout of about 2.5% (at current prices), although I would prefer that the company waits until it has achieved its financial targets (I refer in particular to net debt/EBITDA < 3) before distributing cash to shareholders. It is worth noting that dividends from UK companies are not subject to withholding tax.

In the table below, you will find some ratios that will allow you to compare Haleon’s current valuation with that of other major consumer staples companies.

|

Forward P/E |

Price to Book Value |

EV/EBITDA |

|

|

Procter & Gamble (PG) |

24.5 |

7.8 |

17.2 |

|

Unilever (UL) |

17 |

5.9 |

13.5 |

|

Kimberly-Clark (KMB) |

21 |

101 |

16.4 |

|

Colgate (CL) |

24 |

103 |

24 |

|

Average |

21.6 |

54.4 |

17.8 |

|

Haleon |

14.3 |

1.0 |

25.6 |

Source: Author’s elaboration

the EV/EBITDA is significantly higher due to debt, which is currently much higher at Haleon than at the rest of the Group. The other two parameters show a clear undervaluation. The interesting thing is that Haleon’s niche is intrinsically more stable and subject to a secular upward trend. In addition, the UK company arguably has better pricing power on its products and is smaller than its quasi-peers. All of this should lead to a premium valuation for Haleon, not a discount!

Main Risks

It is likely that Haleon’s valuation is now affected by a number of issues that could be headwinds for the company in the short or medium term.

First, we have the “problem” of Zantac: the drug OTC was withdrawn from the market in 2020 after allegations that one of its ingredients could lead to the formation of carcinogens under certain circumstances. There are currently more than 2000 lawsuits pending in the US alone and more could follow. The drug was sold by Pfizer (PFE) and Glaxo (GSK), the former parent companies (and current major shareholders) of Haleon. However, the outcome of such lawsuits is far from certain, as it is difficult to establish a direct link between taking the drug and developing an actual disease. In addition, Haleon claims that it cannot be held liable for claims related to Zantac because the company itself was formed in 2018 as a joint venture between Pfizer and Glaxo, and the two companies had already sold the rights to market Zantac by that time: that could well be true!

However, another point perhaps deserves more attention: as mentioned above, Glaxo and Pfizer are Haleon’s major shareholders: together they own about 45% of the total outstanding shares. Many believe they will sell their shares in the coming months, which will naturally put pressure on Haleon’s stock price. In fact, there was a lock-up period that expired a few weeks ago, and they may have already reduced their stake to about one-third. In any case, according to this way of thinking, it makes little sense to buy Haleon now, since the company does not pay dividends yet and the share price will fall, in other words, it’s “dead money.”

I would not dismiss these claims out of hand, but I would still like to emphasize that trying to time the market is always a dangerous practice. We cannot know exactly what the intentions of Haleon’s major shareholders are, and assuming that they will sell their shares as quickly as possible, at whatever price, seems somewhat naive to me. Moreover, we have no idea how many potential buyers will want in. It could well be that some major players will bid for the shares of the two insiders and strike a private deal that completely bypasses the public market. We know of at least one company (Unilever) that might be interested in such a deal. All in all, if one appreciates Haleon’s business concept and prospects, it does not seem to be the best choice at this point to wait to get involved.

The last risk is related to Haleon’s admittedly high debt mountain. We have already talked about this at length. In short, yes, the debt is uncomfortably high right now, but the financials are absolutely under control and the company is committed to significantly reducing its debt in the coming quarters. I do not think they will have any particular problems in doing so.

Bottom Line

Haleon Plc is a recent spin-off that offers a unique commitment to the consumer health market. For a number of reasons listed at the top of the article, the stock appears cheap both in absolute terms and relative to the valuation of its peers. The aforementioned risks do not appear to be material from a long-term perspective, making the stock a buy at the current price. However, conservative investors might reasonably place their bets in four or five tranches, one for each of the next quarters.

Be the first to comment