mantaphoto

Africa Oil Corp. (OTCPK:AOIFF) reported blowout 2Q 2022 earnings. The company trades at a $940 million market capitalization, and has performed well since its 52-week low. However, with the company’s blowout earnings, impressive assets, strong hedging, and more, we see the company as having long-term 10-bagger potential.

Africa Oil Corp. Overview

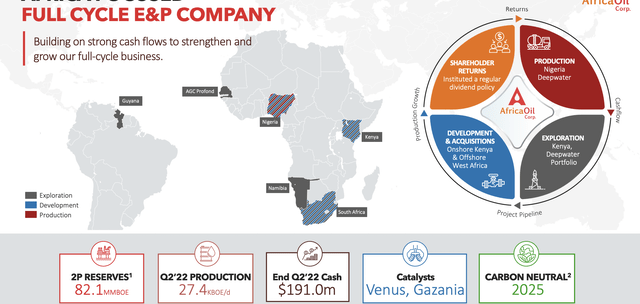

Africa Oil Corp. has an incredibly strong portfolio of assets underlying its business.

Africa Oil Corp. Investor Presentation

Africa Oil Corp. has 82.1 million barrels of reserves currently producing at roughly 27.4 thousand barrels / day. That’s just over the 8-year reserve life for the company’s assets, although it’s continuing to explore in this asset. The company has a strong net cash position and a number of potentially exciting exploration assets.

Africa Oil Corp. Prime Oil and Gas

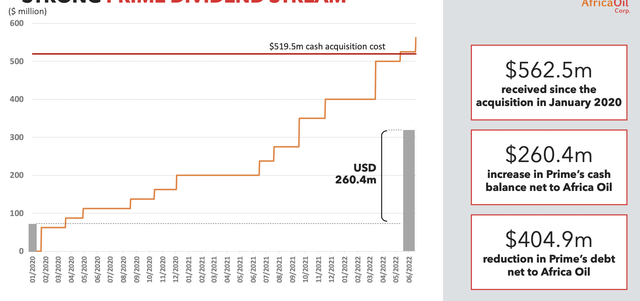

The company’s crown jewel asset is Prime Oil and Gas.

Africa Oil Corp. Investor Presentation

Africa Oil Corp. has received more than $560 million since the acquisition in January 2020 less than 3 years ago. Additionally, on top of that payment, the retained cash and paid down debt of Prime Oil and Gas, which was originally acquired with substantial debt, has been improved significantly. That net financial payout is more than $1 billion.

The company has operations in 3 of West Africa’s top oil fields. Lifting costs are incredibly low at just over $7 / barrel, and in OML 130, the company is drilling 9 development wells across Egina and Akpo. The Preowei development project is expected to add roughly 10 thousand barrels / day to Prime Oil and Gas, and we would like to see production remain strong.

This asset will continue generating massive cash flow.

Africa Oil Corp. Kenya

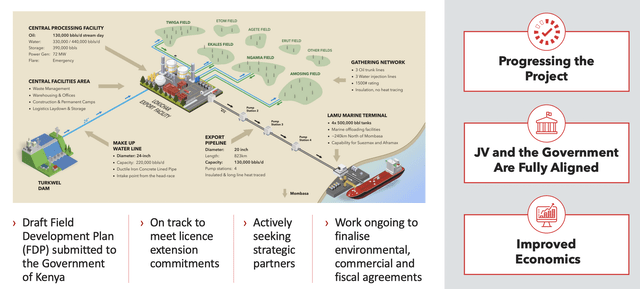

Africa Oil Corp.’s focus continues to be on its original Kenyan assets, which the company has valued at a risked $290 million.

Africa Oil Corp. Investor Presentation

The company’s Kenyan assets have the potential for more than 100 thousand barrels / day of production and are current undergoing small scale trucked production. The company is looking at potential farm-outs for the project and other ways to develop the project, but since the first day it’s been stuck on a single problem.

To drive the value of the assets and produce them effectively, the company needs to build an export pipeline. That’s expected to be the most significant cost at $1.4 billion out of a proposed $2 billion in upstream costs and $3.4 billion cost. Overall, the spending is expected to come in at just over $20 / barrel with first oil in 2025-26.

A FID could come anytime in the next few months and would cost the company roughly $850 million for its share of the development costs. That’s a number that the company can comfortably afford.

Africa Oil Corp. Other Opportunities

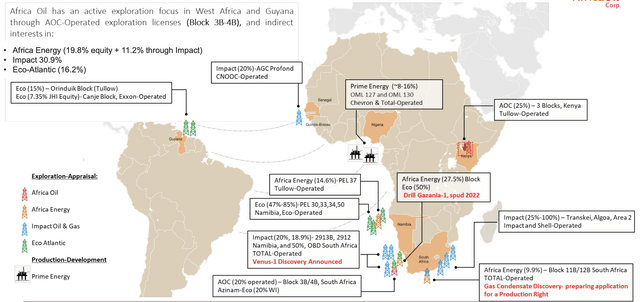

Africa Oil Corp. has a unique portfolio of other assets distributed throughout the world.

Africa Oil Corp. Investor Presentation

The Venus-1 discovery is expected to be at least 3 billion barrels. The company’s subsidiaries have made several discoveries, but we expect that investors will have to wait at least a few years to see production plans from the assets. Unfortunately, until that happens, there’s not much to talk about here.

Several of these discoveries look like they’re headed towards that, but Kenya was half a decade ago. Best not to put too much value on them until more details are released.

Africa Oil Corp. Financial Performance

The company has an incredibly strong financial position.

Africa Oil Corp. Investor Presentation

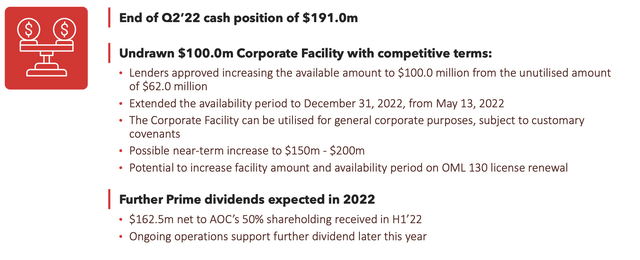

The company ended 2Q 2022 with a cash position of $191M, as its Prime Oil and Gas attributable debt dropped to $170 million giving the company a $20 million overall cash position. The company doesn’t need to pay down Prime Oil and Gas debt anymore, but it is looking into turning the RBL into long-term debt.

The company’s dividends are volatile, but we would expect it to receive more than $200 million in dividends before the end of the year. The company currently has a modest dividend of 2.5%. However, among the most exciting pieces of news is the company’s plan to repurchase 10% of its shares over a 1-year period.

The company’s strong financial positions, especially if it continues to consolidate debt and financials, means the ability for substantial returns.

Africa Oil Corp. Hedging

Africa Oil Corp. has decided to undergo a unique hedging strategy.

Africa Oil Corp. Investor Presentation

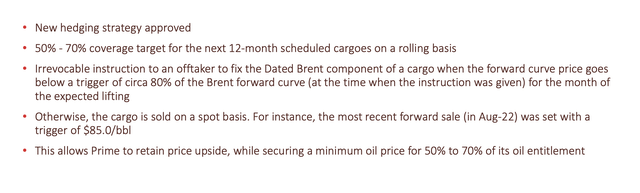

The company has set a 50-70% coverage target for the next 12-months with an irrevocable instruction to fix the Brent component based on the falling forward price curve. The company otherwise sells cargo on a spot basis. The company expects to get a minimum oil price for roughly 60% of its oil entitlement as a result.

The company has yet to guide for the cost of its hedging strategy, but we expect that to be fairly minimal. The company has also shared here that the next oil cargo is in October which will earn at least $85 / barrel.

Africa Oil Corp. Shareholder Returns

Africa Oil Corp. has already guided to strong 2H 2022 cash flow. The company has already said that it’s sold two July cargoes at more than $100 / barrel and it’s guided towards another August cargo at more than $85 / barrel. The company’s cargoes average roughly 1 million barrels, which implies roughly $300+ million in revenue for the 3rd quarter.

The company is at a net cash position counting Prime Oil and Gas, and without that, the company is at a much stronger net cash position. The company can afford to repurchase the targeted 10% of the float over 12 months, which we expect that the company will do on top of its dividends. All of that put together means double-digit shareholder returns.

That makes Africa Oil Corp. a valuable investment.

Thesis Risk

The largest risk to our thesis is crude oil prices. The company is incredibly profitable at current prices and its strong assets mean that it can earn incredibly high margins. Lifting costs are low. However, at less than $60 / barrel, things change, hurting the company’s ability to drive equally strong returns.

Conclusion

Africa Oil Corp. has a unique portfolio of assets and has recovered heavily since its COVID-19 lows. The company’s Prime Oil and Gas asset has more than paid itself off and the company has a positive net cash position, even when accounting for the debt from Prime Oil and Gas. That’s the first time the company has hit that point since the acquisition.

The company is repurchasing the maximum amount of shares it’s allowed to by the stock exchange. It has the cash to do so and that will enable the company drive double-digit returns counting its dividend. Overall, we see the spigots as on given the financial strength, combined with growth potential from alternative assets.

Be the first to comment