milehightraveler

Introduction

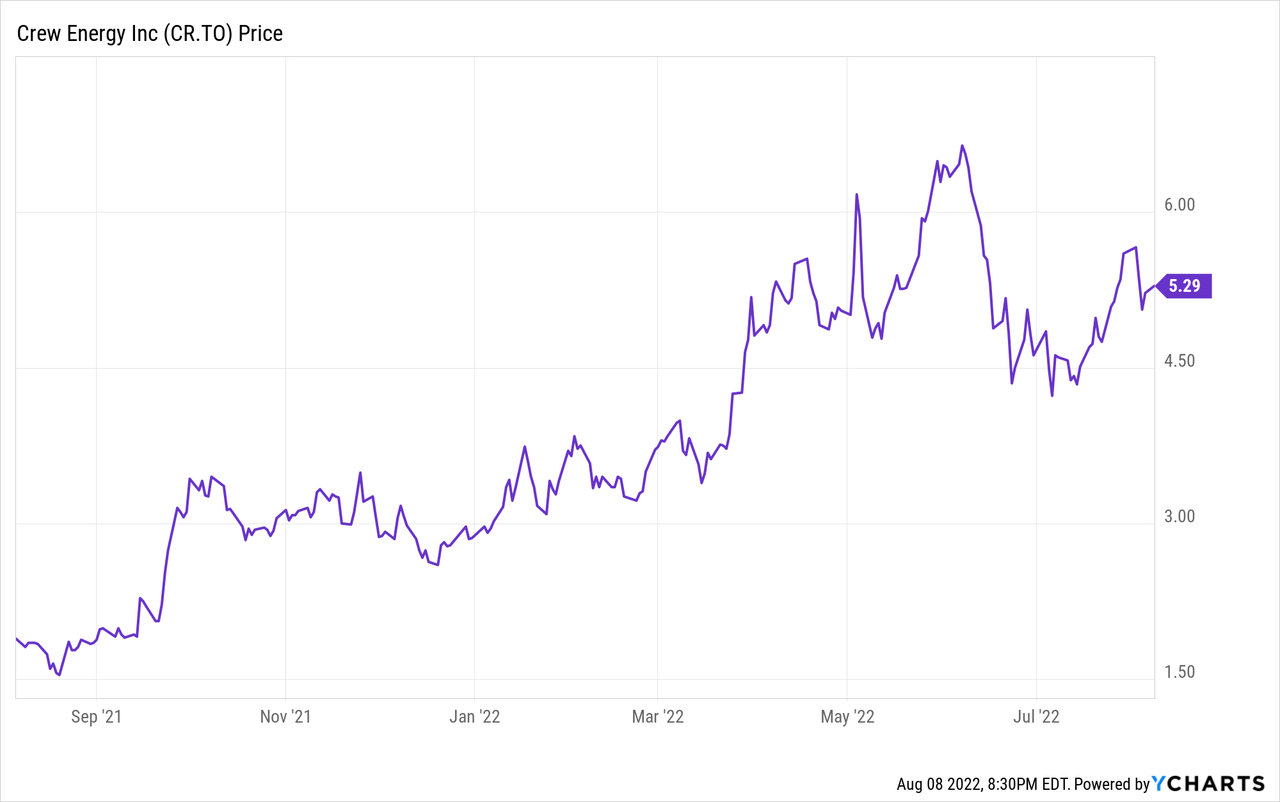

As the natural gas price was exceptionally strong in Canada in the second quarter of the year, I was very keen on seeing the financial results of the natural gas producers. Gas-heavy producers like Crew Energy (OTCQB:CWEGF) were supposed to put in a good performance and the free cash flow should rapidly improve the balance sheet. And Crew did not disappoint.

As Crew Energy is a Canadian company, its primary listing is on the Toronto Stock Exchange where it’s trading with CR as its ticker symbol. The average daily volume on the TSX is approximately 1 million shares, so I would strongly recommend to use the most liquid trading venue for the company’s shares. The current share count is approximately 153 million shares resulting in a market capitalization of approximately C$800M. As Crew trades in Canadian Dollar and reports its financial results in Canadian Dollar, I will use the CAD as base currency throughout my article.

A strong result in the second quarter thanks to the lack of capex spending

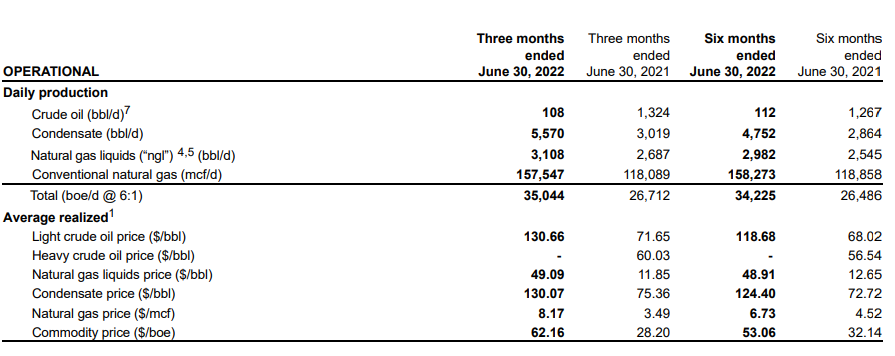

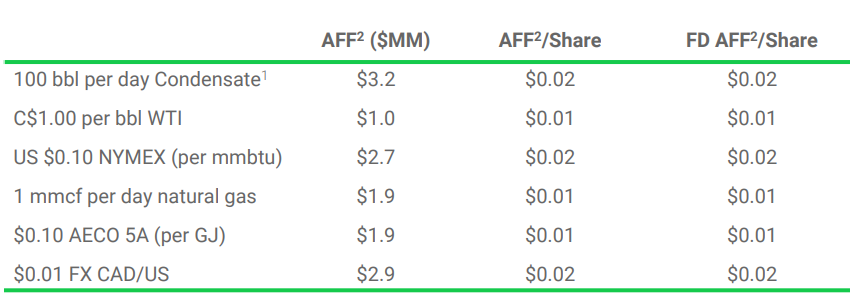

In the second quarter of this year, Crew Energy produced just over 35,000 barrels of oil-equivalent per day but looking at the breakdown of the production below, you can clearly see natural gas represents the vast majority of the oil-equivalent calculation with a weight of approximately 75%. With an average realized price of in excess of C$8 per mcf for the natural gas and C$130 per barrel of condensate (the second largest contributor to the revenue), Crew performed well in the second quarter. While the production was relatively flat, the average received price per barrel of oil-equivalent increased by almost 50% thanks to the higher commodity prices.

Crew Energy Investor Relations

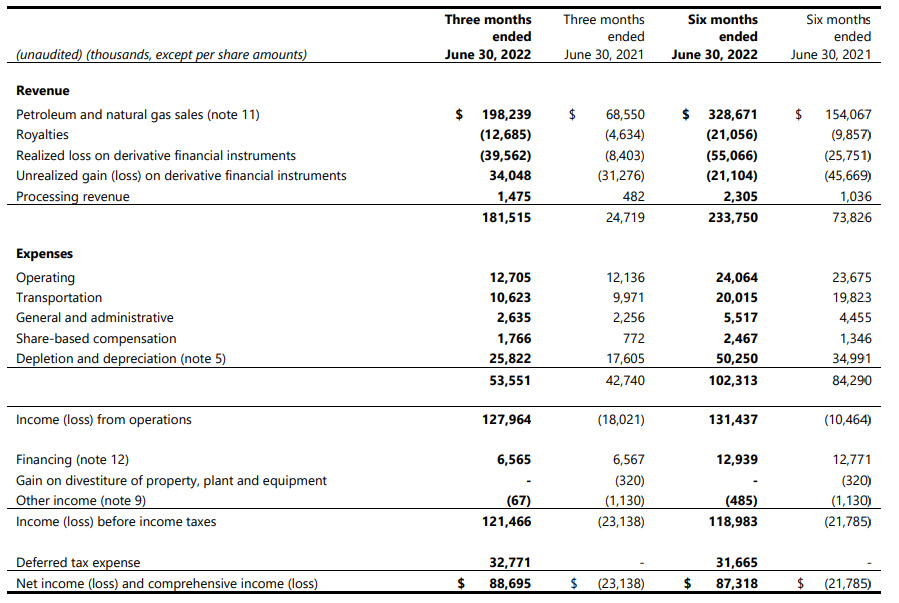

This resulted in a total revenue of almost C$200M and a net revenue of approximately C$182M after taking the royalty payments and hedging losses into account. The production expenses remained very low at just C$53.6M (with almost half of these expenses consisting of depletion and depreciation expenses) resulting in a pre-tax income of $121.5M and a net income of just under C$89M.

Crew Energy Investor Relations

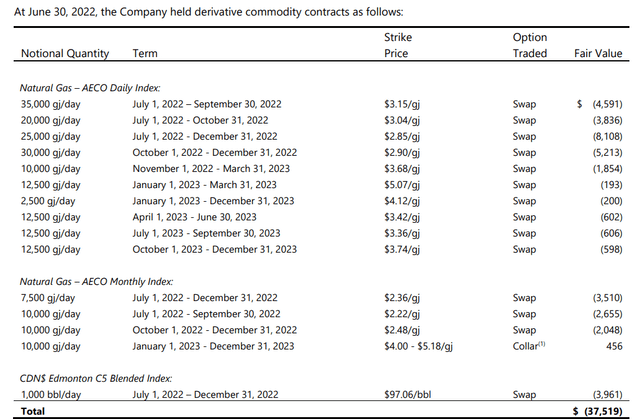

That’s approximately C$0.58 per share. And as you can see in the revenue section of the income statement, it includes a net C$5.5M loss on derivatives.

That’s an important element as it does skew the cash flow statements a little bit. After all, the unrealized gains on the hedge positions have been deducted (as they have not been realized) while the C$39.6M in hedging losses were integrally included in the operating cash flow.

The operating cash flow was C$117M but this included about C$2.7M in working capital changes and a deferred tax expense of almost C$33M. As Crew Energy has in excess of C$500M in accumulated losses on the balance sheet, it likely won’t have to pay taxes in the foreseeable future.

Crew Energy Investor Relations

The adjusted operating cash flow was C$115M and as the company spent just C$7M on capital expenditures, the net free cash flow was C$108M or just over C$0.70 per share.

Does this mean Crew is a steal at the current share price which is less than two times the annualized Q2 free cash flow? Not necessarily.

First of all, the Q2 capex was exceptionally light. The full-year capex is estimated at C$130-140M which indicates an average quarterly capex spend of about C$35M. Deducting this from the adjusted operating cash flow would result in a ‘normalized’ free cash flow of C$80M or C$0.52.

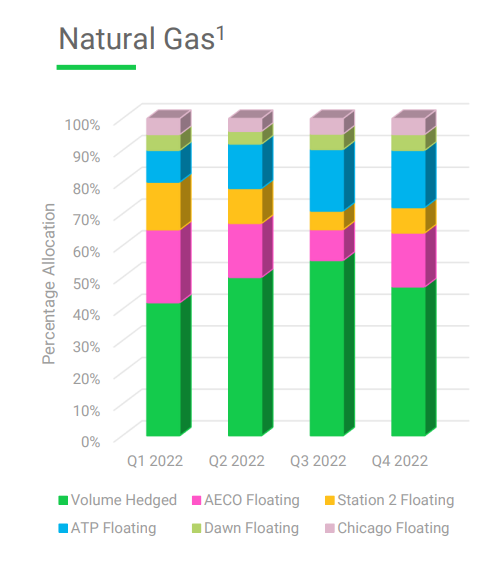

That’s still good. But there’s more. The natural gas price is the elephant in the room. The average natural gas price in the second quarter was in excess of C$8/mcf. Right now, the AECO natural gas price is C$3. A 65% decrease. That’s not really surprising considering the summer season tends to result in lower prices and we should hopefully see the AECO (and US) natural gas price pick back up again later this year. Keep in mind Crew is not solely exposed to the AECO price as it sells a portion of its natural gas in the US at US prices as well.

Crew Energy Investor Relations

There is a mitigating factor. Keep in mind the company recorded a hedging loss of almost C$40M which works out to be almost C$2.80 per mcf (in the theoretical assumption the entire hedging loss is attributable to the natural gas price, so treat this as just a ‘thinking exercise’). This also excludes Crew’s taxes. So in a way, the C$115M in operating cash flow is the pre-tax result with an effectively realized natural gas price of approximately C$5.40.

Crew Energy Investor Relations

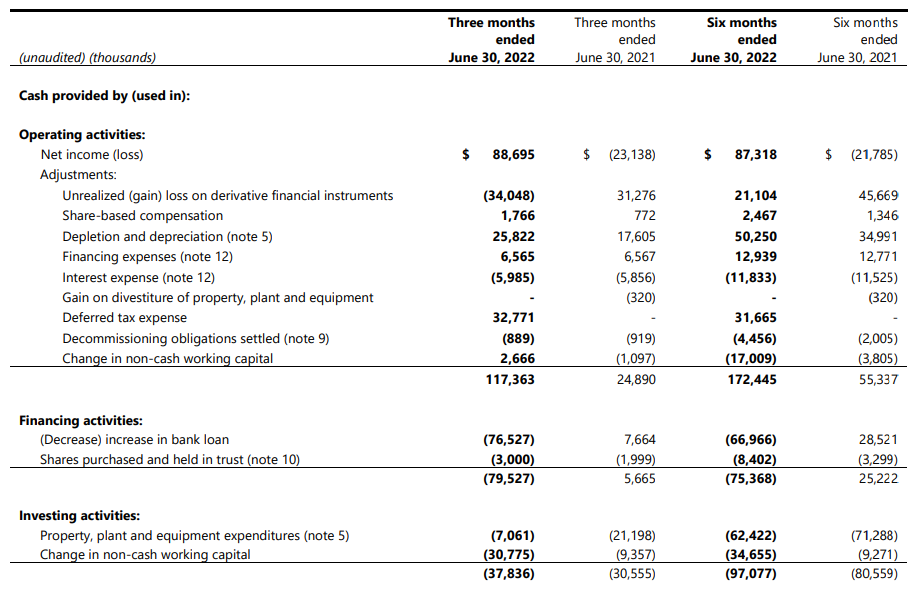

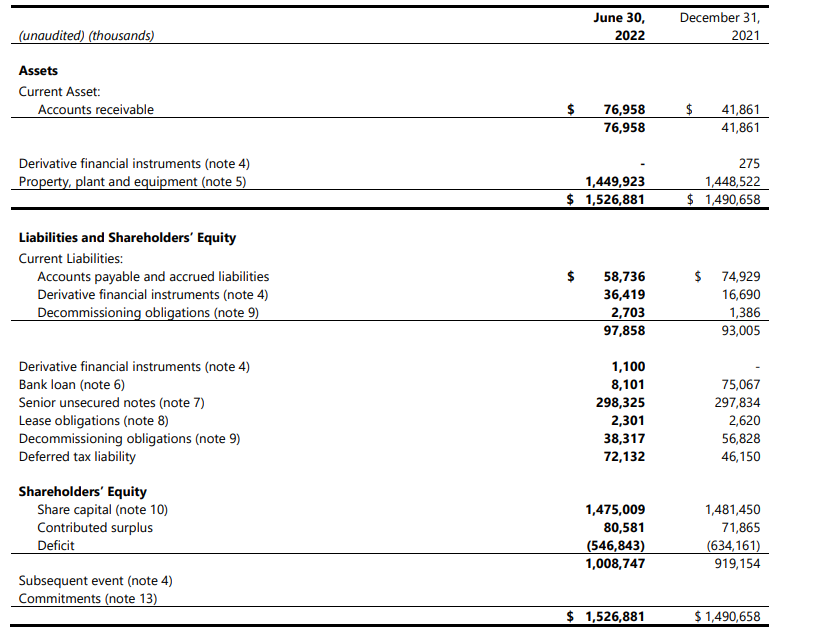

This has rapidly reduced the net debt

The capex will pick up again in the second half of the year but Crew Energy should remain free cash flow positive. That being said, the low capex level in the second quarter resulted in the company gradually reducing its net debt. As of the end of June, the company reduced its net debt to just C$306M, down from C$373M as of the end of last year.

Crew Energy Investor Relations

As you can see above, Crew repaid its bank loan as the senior unsecured notes can only be repurchased at a premium. The 2024 senior unsecured notes can be repurchased at 101.04% of the par value and from March 2023 on, no premium will be due on a repurchase. It makes it much easier to just repay the bank debt and then hoard some cash in anticipation of either a partial call of the notes in 2023 or a complete refinancing.

Once the bank debt has been retired (which I expect to happen this quarter), the net interest expenses will drop to C$19.5M per year. That’s less than C$5M per quarter which means Crew’s C$6M interest expense during Q2 will drop in the next few quarters, further improving the free cash flow profile. And to put things into perspective, a quarterly interest reduction of C$1M is the equivalent of C$0.07 per mcf of produced natural gas. Meanwhile, the existing hedges could result in the company posting a (cash and non-cash) hedge gain in the second semester.

Crew Energy Investor Relations

Investment thesis

Crew’s share price is up by just 40% compared to the C$3.22 when my previous article on the stock was published and that’s perhaps a little bit surprising given the exceptionally strong quarter in the second quarter. Perhaps the market wants to see Crew reduce the net debt at an even faster pace but I’m okay with a moderate amount of leverage.

Crew Energy is in a good shape and offers great exposure to the natural gas price. I currently have no position in Crew Energy, but I am keeping tabs on the company.

Be the first to comment