Khosrork

Chicken Soup for the Soul Entertainment (NASDAQ:CSSE), which offers an on-demand video streaming platform, appears substantially undervalued. In my opinion, further assessment of data from viewers and successful integration of recent M&A deals could bring more stock demand. Besides, as more investors learn about the expectations of the market, I believe that interest in the stock could increase. I executed my DCF model, and obtained a fair valuation close to $27.4 per share. Even considering risks from M&A failure or the total amount of debt outstanding, CSSE appears to be a stock to follow carefully.

Chicken Soup

In my view, Chicken Soup for the Soul Entertainment has kept its promise to give back to the world through stories and storytelling. For this reason, it has included, within its catalogs of narratives, products from all kinds of authors regardless of their beliefs, religions, ethnic groups, sexual orientation, or gender identity. In the same way, it has historically shared its profits with non-profit organizations, among which American Humane, Toys for Tots, and Dress for Success stand out as the most important.

The purpose of the company is to sustain and develop its on-demand video streaming platform. For this, it has, of course, diversified its business model, including several internal areas for the production of audiovisual content, content distribution, and investment area. Some of the subsidiary brands with the most capital flow in their day-to-day operations are Screen Media, A Plus, Landmark Studio Group, and Chicken Soup for the Soul Entertainment Original, where they still concentrate most of their production on what refers to digital content for televisions, computers, and mobile devices.

Currently, its catalog of productions, including television series and movies, exceeds 20,000 under its ownership, which makes it one of the largest distribution platforms globally, with Crackle Plus its biggest bet in the ad-supported streaming market. This market has a growth projection of $26.5 billion dollars in 2020 to $53.5 billion in 2026. In my view, this is undoubtedly one of the great values of Chicken Soup for the Soul Entertainment.

Just as the streaming market is growing aggressively, in my opinion, the traditional market for advertising through television services is experiencing one of its worst declines in history despite the advancement of these new digital business models. This is one of the reasons why the company is not only positioned as one of the leaders in the digital content production and distribution market, but also has a promising outlook for the coming years.

Since its insertion in this market in 2015, the company has achieved unprecedented growth in its financial area. This is demonstrated by the profit of $100.4 million dollars during 2021 as compared to previous year’s profit of $66.4 million. This number shows even greater magnitude when we learn that although it created its facilities and began to develop its business model for the AVOD market in 2015, it only began to offer its services in 2017.

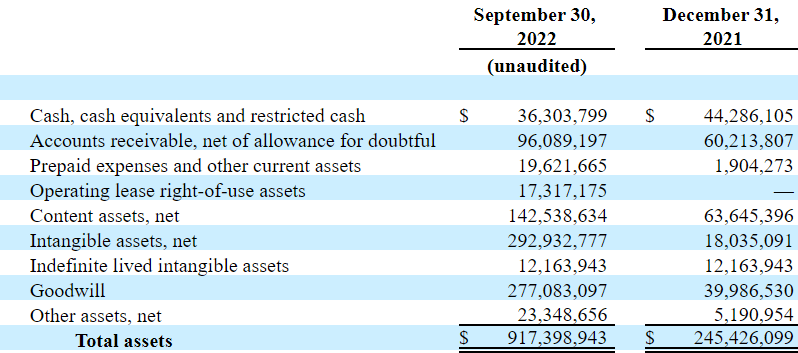

Balance Sheet: The Acquisition Of Redbox Meant Significant Asset Growth

As of September 30, 2022, cash stood at $36 million, with accounts receivable worth $96 million and content assets worth $142 million. Besides, intangible assets were equal to $292 million, with goodwill worth $277 million and total assets of $917 million.

Let’s note the impressive increase in assets reported in 2022. Total assets increased more than 199% due to the acquisition of Redbox. I am quite optimistic about the company’s M&A activities. Further inorganic growth may lead to fair stock price increases.

Source: 10-Q

On the liability side, the company reported account payables worth $41 million and accrued expenses of around $89 million. Programming obligations were $55 million along with the film library acquisition obligations worth $40 million. Debt stood at $461 million, and total liabilities were equal to $792 million. Considering that the asset/liability ratio stands at 1x, I would say that the balance sheet appears quite stable. With that, some investors may be worried about the total amount of debt.

Source: 10-Q

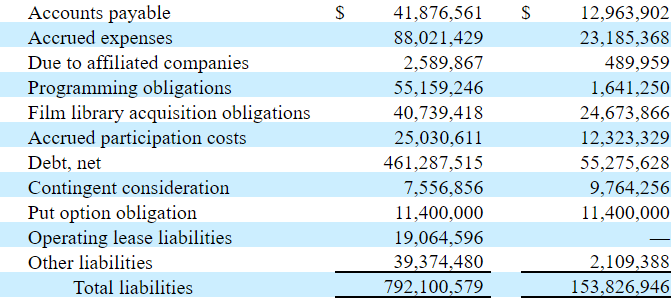

Beneficial Market Expectations

Market estimates include 2024 net sales of $540 million with sales growth of 7.36%. 2024 EBITDA is expected to be $125 million with 2024 EBITDA margin of 23.15%. The operating profit would be -$39.5 million with an operating margin of -7.30%. 2024 FCF is expected to be close to $96.6 million with an FCF margin of 17.89%.

Source: Marketscreener.com

With More Assessment Of Data From Viewers And Perhaps New Acquisitions, I Obtained A Fair Price Of $27.4 Per Share

In my view, if management continues to acquire, assess, and store data about viewers, and correctly uses the know-how to personalize view experience, revenue growth will trend north. Management clearly made a comment about its capabilities and how it will enhance targeting advertisers.

As we grow viewership, we are creating a large, valuable data base that we use to better understand what our viewers watch and how they engage with advertising. We are increasingly investing in capabilities to manage and analyze our data with the goal of better personalizing viewer experiences and enabling targeted advertising. Source: 10-k

Besides, if the company successfully digests previous acquisitions, and lowers its debt, new acquisitions could be very beneficial. Keep in mind that management has in mind several opportunities to acquire additional AVOD networks, which may accelerate the company’s path to greater scale.

As we grow our content libraries, we are also continuously evaluating opportunities to create new thematic networks that focus on certain genres and types of programming, and we expect these networks to deliver more targeted advertising opportunities to marketers. These efforts are exemplified by our acquisition of 1091 Pictures in March 2022. We are also actively evaluating opportunities to acquire additional AVOD networks that can accelerate our path to even greater scale. Source: 10-k

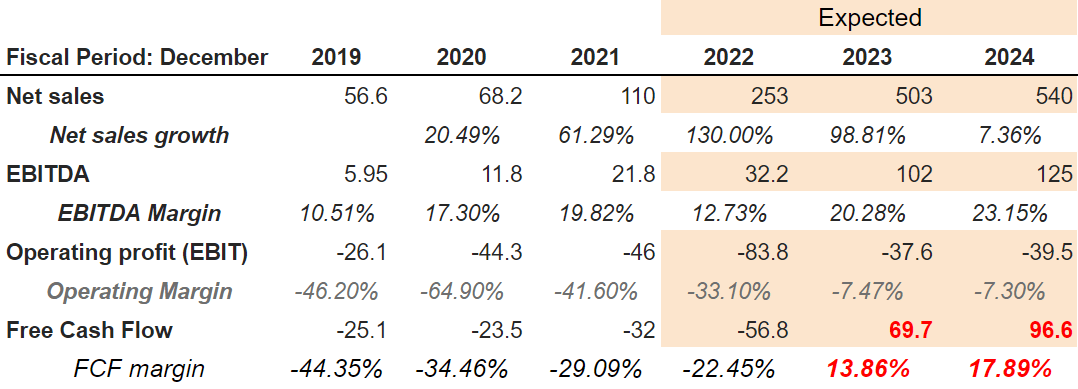

The global video on demand market is expected to grow at a CAGR of close to 14.8% from 2020 to 2027. I tried to be as conservative as possible with my financial model, so I used a bit lower sales growth for Chicken Soup than that of the market.

The global video on demand market size is projected to reach USD 159.62 billion by the end of 2027. The market was worth USD 53.96 billion in 2019 and will exhibit a CAGR of 14.8% during the forecast period, 2020-2027. Source: Video on Demand Market to Rise at 14.8% CAGR and Reach USD.

I assumed net sales of $925 million with sales growth of 6%. I also included 2032 EBITDA of $201 million and an EBITDA margin of 21.70%. My results included an FCF of $99 million and FCF margin of 10.70%.

With a discount of 8.60% and an EV/EBITDA multiple of 8.5x, the sum of future FCF would lead to an enterprise value of $1.102 billion. If we take into account obligations worth $569 million and cash worth $36 million, the equity valuation would stand at $569.13 million. Finally, the fair price would be $27.4 per share.

Source: My DCF Model

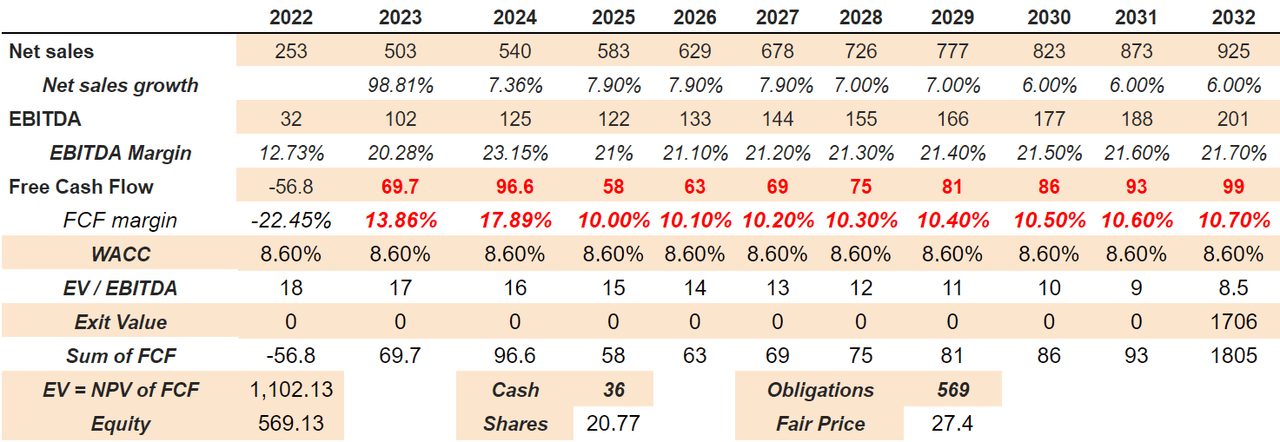

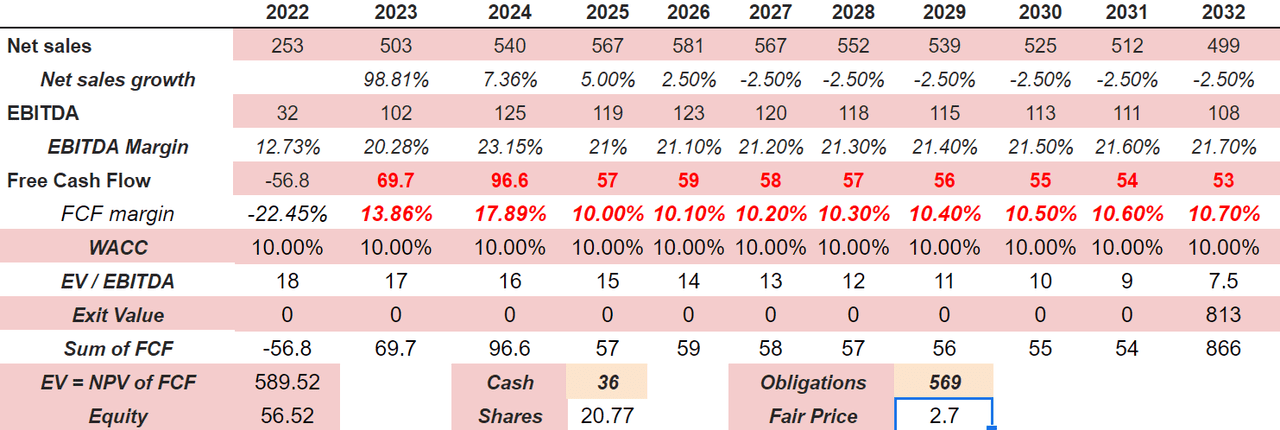

Bearish Case Scenario: Risks Related To The Company’s Debt Or M&A Failures Could Bring The Fair Price To $2.7 Per Share

For the full year 2021, Chicken Soup for the Soul Entertainment’s EBITDA was $21.8 million as compared to $11.8 million in 2020. This calculation includes $59.4 million in losses for the full year 2021. This also demonstrates that despite the iconic growth and the early success that the company has, configuring a new business model also combats certain risks.

In the company’s own legal documents, it clarified some of the biggest risks it faces when betting on its future, for example not generating cash earnings to pay off corporate debts. In my opinion, this is very common in this type of business model of on-demand streaming platforms, since the monthly payment of the clients is very low as compared to the real cost of the company’s products, and the company requires the development for a few years to stabilize the flow of income and expenses.

In the same way, the company had to go through major adaptations during the COVID-19 pandemic, which changed the requirements in the forms of production, thus delaying the arrival of new content. We can’t say that new pandemics or disasters will not come again.

Another risk that the company indicates is the possibility of losing key employees, such as the executives and strategists if its business area. Also, being involved in digital incident events, such as hacking and cybersecurity breaches, is also a risk. This is essential in the case of the AVOD market, since a large amount of the data collected from users is third-place cookies. These risks could diminish future revenue growth, and damage the company’s revenue line.

Considering the company’s aggressive M&A strategy, let’s note that acquisitions may fail. If new or existing acquisitions don’t bring expected synergies, management may have to impair goodwill accumulated. Besides, management may have to lower future revenue growth and free cash flow expected. In sum, the intrinsic valuation of the company would lower, which may lead to stock price declines.

Part of our growth strategy has been and will continue to be the acquisition of scalable assets to build our business. Our relatively recent acquisitions of the assets of Crackle, Sonar, 1091 Pictures and others, require time-consuming and costly integration efforts. We may not be successful in the efficient integration of assets into our operations as we acquire them, and may not realize the anticipated benefits of such acquisitions. Source: 10-k

Under my previous conditions, I assumed 2032 net sales of $499 million and sales growth of -2.50%. 2032 EBITDA would stand at $108 million with an EBITDA margin of 21.70%. Besides, I obtained a free cash flow of $53 million with an FCF margin of 10.70%.

With a discount of 10% and an EV/EBITDA multiple of 7.5x, I obtained a discounted sum of free cash flow close to $585 million. The implied equity valuation would be $56.52 million with obligations around $569 million. Finally, the fair price would stand at close to $2.75 per share.

Source: My DCF Model

Conclusion

Chicken Soup for the Soul Entertainment saw significant increase in assets thanks to a recent acquisition, and many analysts are expecting beneficial free cash flow growth. In my view, more assessment of data from viewers and further growth driven by the global video on demand market would justify a larger stock valuation. My sum of future free cash flow discounted at a reasonable WACC implied a valuation of $27.4 per share. I obviously see risks from M&A failures and risks from the total amount of debt. However, the current valuation does seem too low.

Be the first to comment