RiverNorthPhotography

Investment Rationale

Shell plc (NYSE:SHEL) has a disciplined financial framework and a strong asset base. The company has also managed to deliver a positive financial performance in volatile times. Shell’s valuation indicates a good upside potential in the medium to long-term. Investors can expect a steady dividend growth in the coming years.

About the Company

Shell is a global group of energy and petrochemical companies with operations in more than 70 countries. The company’s operations are divided into Upstream, Integrated Gas and Renewables and Energy Solutions (formerly new energies), Downstream, and Projects and Technology. The Integrated Gas business manages liquefied natural gas activities and the production of gas-to-liquids fuels and other products.

Renewables and Energy Solutions is the part of Shell focused on finding commercial ways to meet the evolving energy needs of its customers. The research and innovation relating to new products is managed by Projects & Technology segment.

Delivering positive performance in volatile times

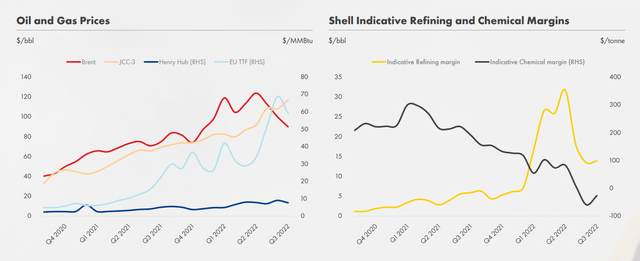

The oil and gas prices have been quite volatile in the third quarter of 2022 and touched record high levels as shown below –

Shell

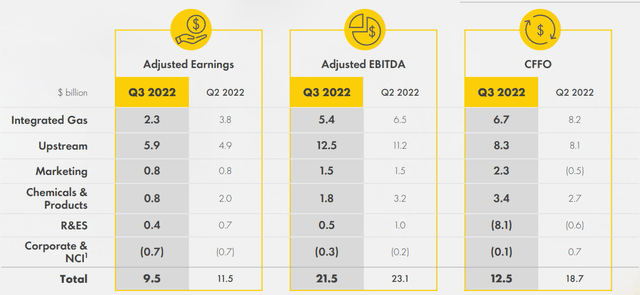

Shell reported earnings of $9.5 billion and adjusted EBITDA of $21.5 billion for the quarter. The company’s earnings were led by strong upstream segment delivery despite a decrease in brent prices since the previous quarter. However, lower LNG trading and optimization results as well as contracted chemicals and refining margins hurt its earnings from Integrated Gas and Chemical and Products segments. Shell’s Q3 sales volume for refining and trading improved to 1,803 kb/d from 1,596 kb/d in Q2 2022, whereas the sales volume for chemicals shrunk from 3,054 kb/d to 2,879 kb/d. The company’s refining margins, however, shrunk from $28/bbl in Q2 2022 to $15/bbl in Q3. Lower refining margins were due to a recovery in global product supply to meet demand. Its chemical margins also shrunk on account of higher feedstock and utility costs.

The following tables summarize Shell PLC’s performance segment-wise in terms of adjusted earnings, EBITDA, and Cash Flow from Operations (CFFO) –

Shell

A reduction in CFFO was due to lower Adjusted EBITDA on a Q-o-Q basis and working capital outflows.

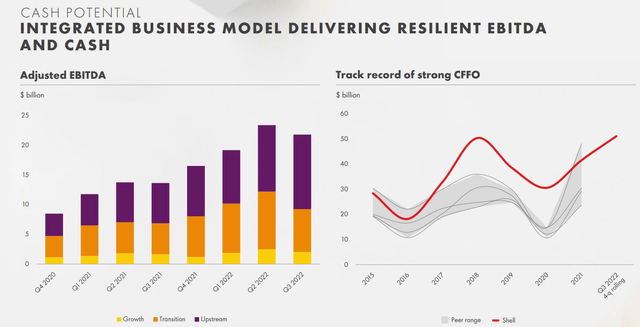

The company reported a free cash flow of $7.5 billion which consists of divestment proceeds of $0.3 billion. The company has generated strong cash flow from operations over the years.

Shell

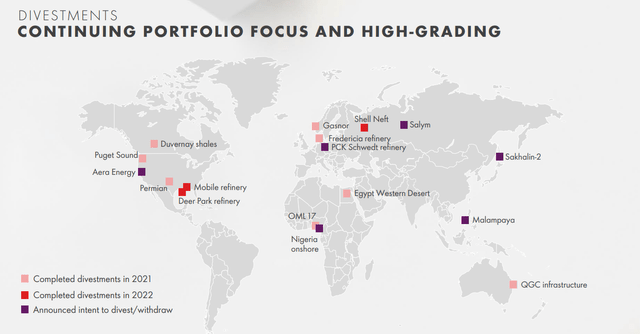

Divesting non-core assets while investing in attractive projects

The company has strengthened its portfolio with various acquisitions and divestments which include the acquisition of a renewable energy platform Sprng Energy Group, selling of interest in Aera Energy LLC to IKAV (International Asset Management Group) for $2 billion in cash, and development of the Rosmari-Marjoram gas project aiding to reliable supply of energy.

The following image gives an overview of the company’s planned divestments which are completed so far as well as the intended divestments or withdrawals –

Shell

Shell PLC also expects a disciplined cash capex between $23 billion to $27 billion for 2022 which will be split between growth, transition, and upstream activities. The company has commenced operations of its Pennsylvania chemical project. Being the first major polyethylene manufacturing complex in Northeastern U.S., the Pennsylvania facility bears an annual output of 1.6 million tonnes.

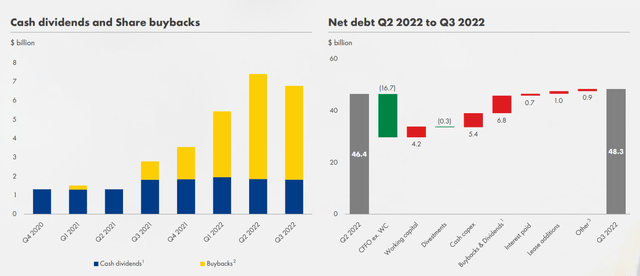

Returning value to shareholders

In Q3, Shell completed $6 billion of share buybacks and has announced a new $4 billion share buyback program expected to be completed by the end of 2022. With this, the total announced shareholder distributions for 2022 are expected to be $26 billion.

Shell

The company’s net debt has reached around $48 billion, which is slightly higher than the previous quarter. An increase in net debt includes the absorption of Sprng Energy’s debt. Overall, Shell has managed to reduce debt significantly in the last couple of years. Net debt was reduced from $75.4 billion in 2020 to $52.6 billion at the end of 2021 with which the company was able to slide below the $65 billion milestone.

Along with the announcement of a new share buyback program, resulting in an additional $4 billion of distributions, the company has also planned to increase its dividend per share by around 15% for the fourth quarter of 2022.

Attractive Valuation compared to peers

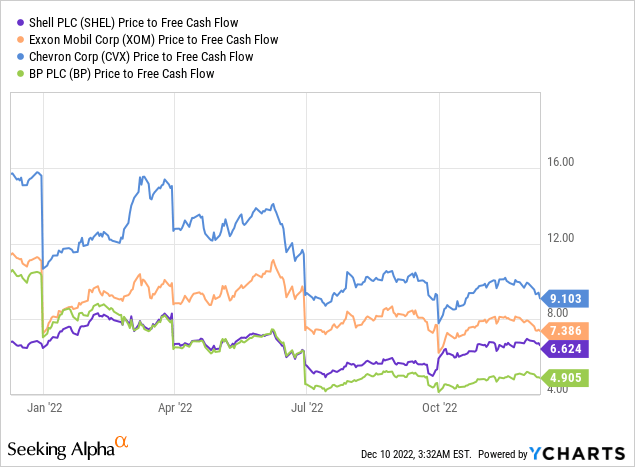

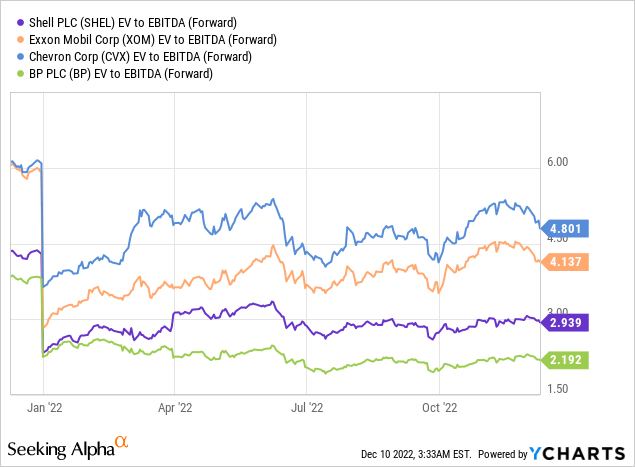

In terms of valuation, Shell stock looks attractive compared to Exxon Mobil (XOM) and Chevron (CVX) based on price to free cash flow and forward EV to EBITDA ratios.

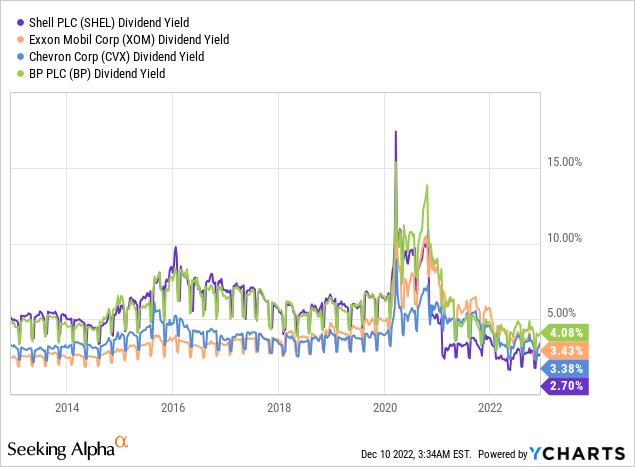

The stock currently offers a lower yield than its peers, thanks to its dividend cut in 2020. However, with significant debt reduction and favorable commodity prices and demand, investors can expect growing dividends in the coming years.

Seeking Alpha’s proprietary quant ratings rate Shell as “hold.” The stock is rated high on profitability and momentum factors but low on growth factor.

Risks

Shell is investing heavily to transition to clean energy. That looks like a solid approach for the long-term. However, the company runs the risk of underperforming its peers should the demand for oil and gas remain stronger than expected in the years to come. Shell recently acquired Nature Energy Biogas, the largest RNG producer in Europe, for $2 billion. The kind of returns that Shell can generate in the long term in its clean energy businesses remain to be seen.

Conclusion

As a top integrated oil company, Shell is committed to deliver value to its shareholders. The company has done a good job in debt-reduction, and is focusing on clean energy, keeping into consideration the long-term energy market trends. Although the dividend yield is lower than its peers, investors can expect steady dividend growth in the coming years.

Be the first to comment