Drew Angerer

Investment thesis

Overall, there are many positive things to say about Snap (NYSE:SNAP). User numbers are still growing and are very young. The company benefits from several tailwinds, such as advertising spending on mobile and pre-video. Although the stock has fallen 80% since its high, I think you should still wait to invest. In a recession, many companies cut their ad spending, and I believe Snap might suffer more here because their young users tend to have less spending power. Overall, the valuation is still too high for my taste, or in other words, the risk-reward ratio not good enough.

Analysis of the market environment

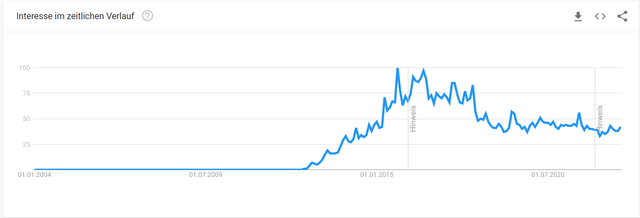

Let’s start with a broad picture. According to Google Trends, Snapchat peaked in 2016 and has since been on a downward trend. However, the trend is the same for Facebook and YouTube. TikTok and Reddit, on the other hand, have had a strong upswing in recent years. Instagram is relatively constant and still near its peak.

However, Google Trends is somewhat of a mystery. I don’t know exactly how their data is calculated. At least this data clashes with other data regarding daily active users, which according to the company and other sources, are still increasing.

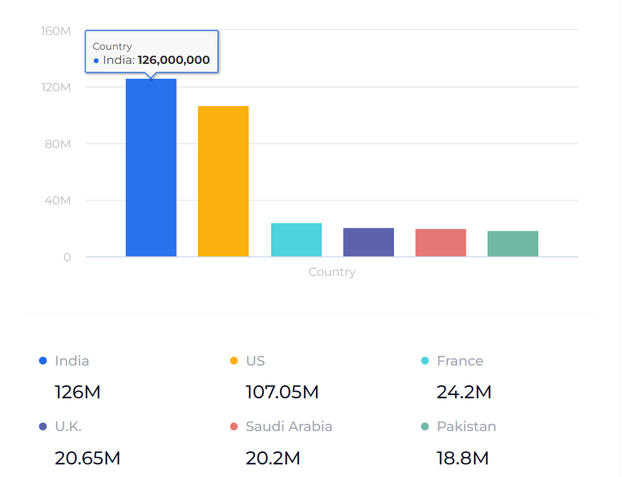

India is the country providing the most users, followed by the USA. They are by far the top countries.

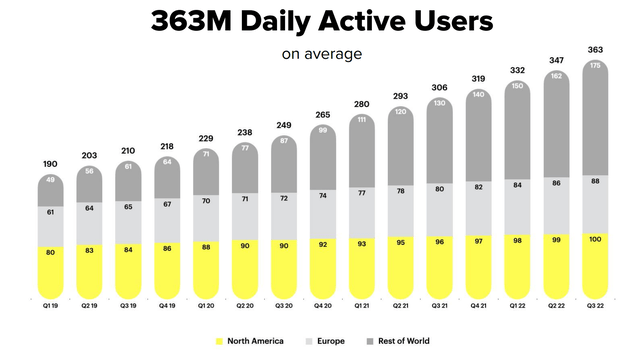

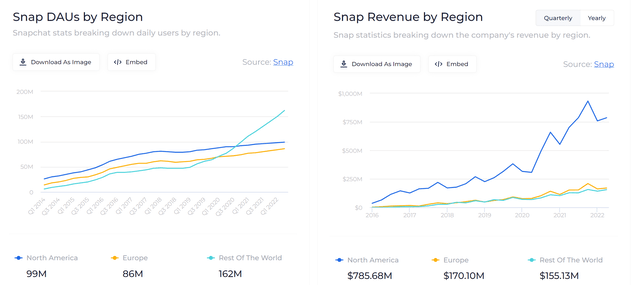

This proportion has also changed rapidly over the years towards the rest of the world. But until 2021, North America and Europe have also grown steadily. The table below shows the trend in user numbers for different geographies in millions.

| Year | North America | Europe | Rest of the world |

| 2014 | 30 | 18 | 9 |

| 2016 | 61 | 46 | 36 |

| 2018 | 80 | 61 | 47 |

| 2020 | 90 | 71 | 77 |

| 2021 | 95 | 78 | 120 |

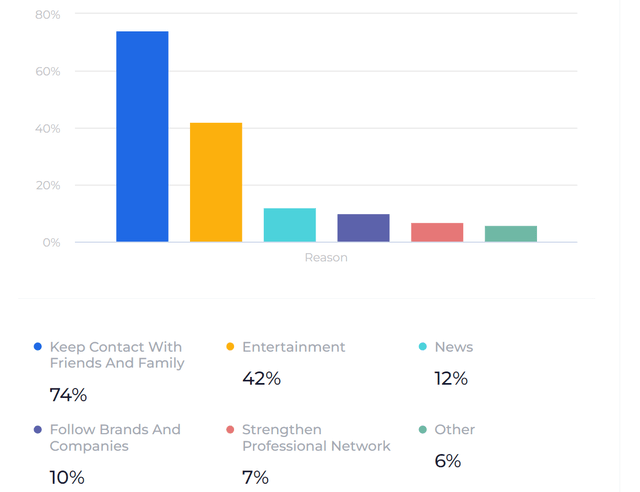

And yet the rest of the world still has the most significant growth potential simply because it has the most people. According to the investor presentation, the market penetration in North America is 25%, in Europe 16%, and in the rest of the world 7%. Overall, Snapchat users are very young, 60% are up to 24 years old, and more than 80% are up to 34. The two main reasons US users engage with the app are to keep in touch with friends and family and for entertainment.

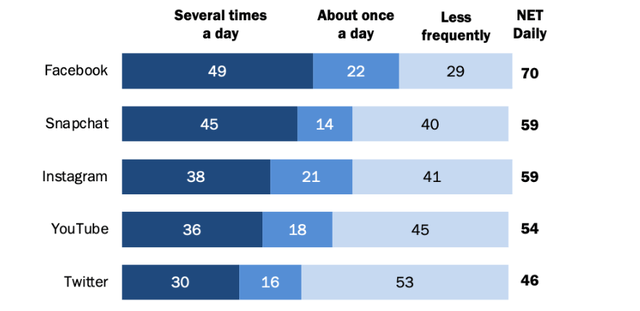

According to pewresearch.org, Snapchat has excellent scores compared to its competitors in the frequency of use. 45% of respondents said they use Snapchat several times a day game.

Market environment conclusion

There are several positive factors for Snapchat. The users are young and use the app frequently. Overall, Snapchat is still growing in terms of daily active users. This is not a given since the stay-at-home mentality is over. Moreover, they have managed to grow strongly in many developing countries. It remains to be seen whether Snapchat is a gimmick for very young users and whether they will still use the app when they get older.

Financials

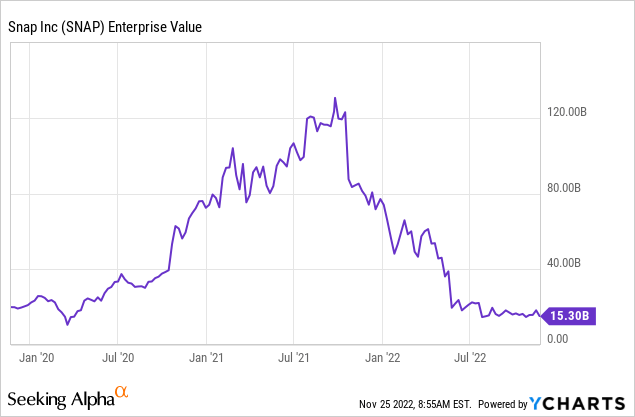

According to Seeking Alpha, Snap has an enterprise value of $16.40B, down sharply from absurdly high valuations in 2021. Moreover, it has more cash than debt, so debt or rising interest rates should not affect the company too much.

Revenue by region

Although the rest of the world now accounts for the largest number of users, most revenue comes from North America. The large gap between the USA and Europe in terms of revenue is surprising.

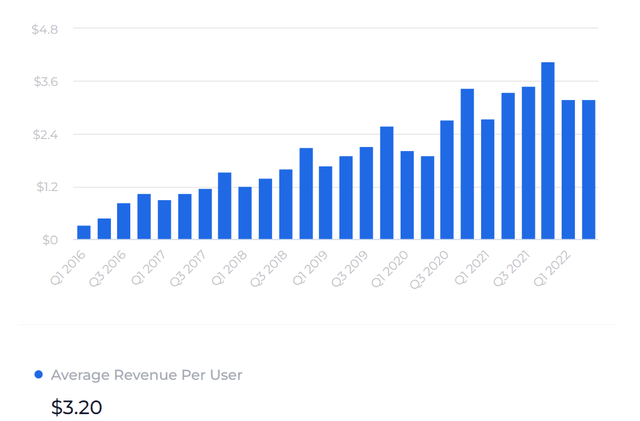

The average revenue per user is $3.20 and has been roughly at this level since Q4 2020. That’s also easy to explain when you look at the picture above. Since 2020, user numbers from the rest of the world have been growing much faster than those in North America and Europe. According to Statista, Snap’s average quarterly revenue per user and region in Q3 2022 is:

- North America $8.13

- Europe $1.83

- Rest of the world $0.89

These figures can be interpreted in different ways. Pessimistically, one could say that in the area where the users are most valuable, the growth is no longer as fast because market penetration is already highest. Optimistically, however, one could say that the revenue per user in the areas where Snapchat is still growing fast still has a lot of potential. Europe should also have a lot of room to grow – I wonder why Europe generates so much less revenue per user than North America. I’m more of an optimist at this point. I think that Snapchat, like many other companies, will benefit in the long run because the middle classes in many countries are growing, and there is more money for consumption.

Valuation

I think it is difficult to determine fair valuations in the current market phase. We don’t know precisely how consumer behavior will change over the next year, given that broad population segments will be forced to save due to rising prices. How severe a possible recession will be. But okay, let’s try to approach the valuation question from different angles.

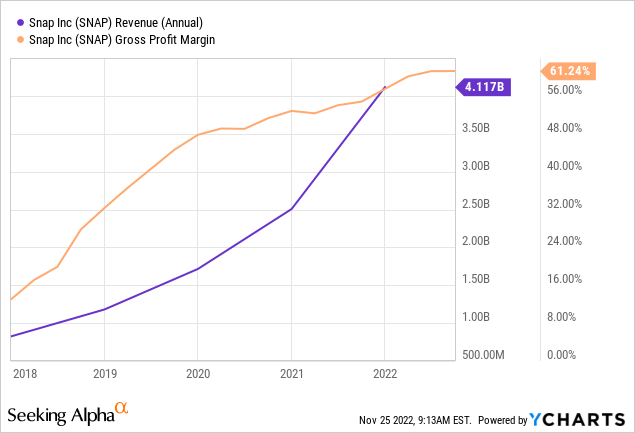

Historically, Snap’s development has been quite impressive. From 2017 – 2021, they increased revenue fivefold. Meanwhile, the gross margin improved from 23% to 58% (according to the company).

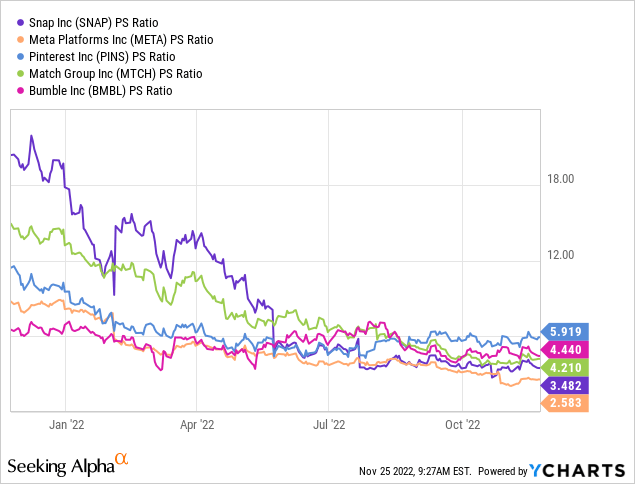

According to Seeking Alpha, the price-to-sales ratio is currently 3.5. Compared to some competitors, this valuation is not excessively high. Of my chosen peer group, only Meta is valued more favorably.

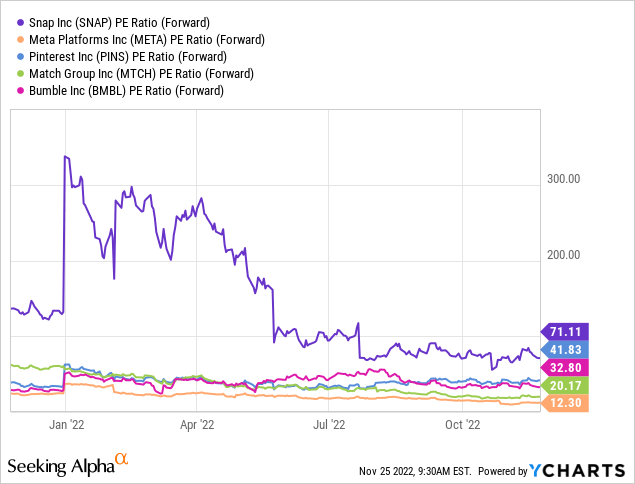

But the picture changes if we compare the forward P/E ratio. Snap is the most highly valued here, and Meta is still the cheapest.

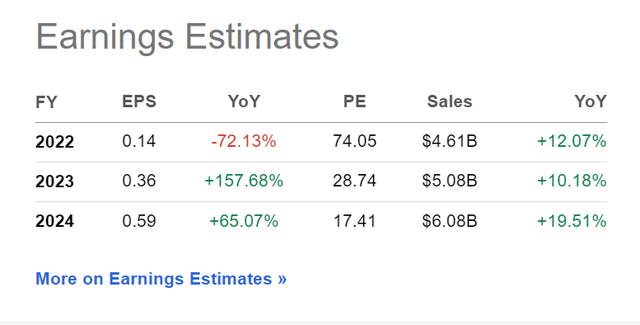

However, this is the 2022 P/E and not yet the estimates for 2023. According to the analyst numbers here at Seeking Alpha, EPS estimates are $0.36 for 2023 and $0.59 for 2024. Snap would probably be a very profitable buy if the numbers were accurate. However, one has to be very careful here. Analyst estimates are just that, estimates and not certain.

I have heard in recent weeks from numerous market experts who say that a recession still needs to be sufficiently priced into the markets and, therefore, the overall average valuation level still needs to be lowered. But they could be wrong as well. That’s why I initially said that the valuation question is challenging to answer. If Snap disappoints on the earnings front, the market will punish it severely. This year, we have seen countless times how stocks plummet by 20% or more after the release of their quarterly results.

Overall, I also doubt whether these figures will materialize. Given the valuation, the share price could still have further downside potential. All that needs to happen is a signal that growth is slowing down. Because in the current valuation, the expectations of further rapid growth, especially on an EPS basis, are priced in. If the valuation question is difficult and you are uncertain, that is already a reason not to invest. Investing is much more comfortable when you are relatively sure about your assumptions. In the high-speed social media world, long-term assumptions are impossible anyway.

Potential

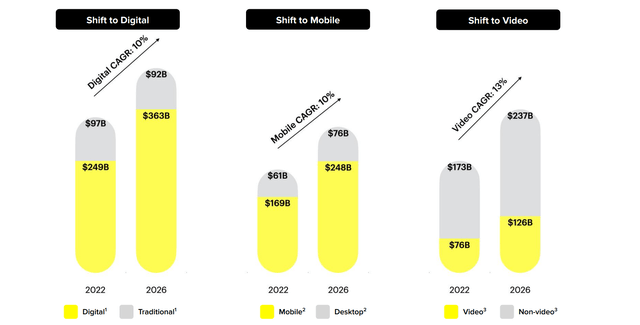

The company is right to point out that the advertising industry is turning in the direction where Snapchat is particularly strong: digital, mobile, and video. Other trends I would like to add here are short videos and augmented reality.

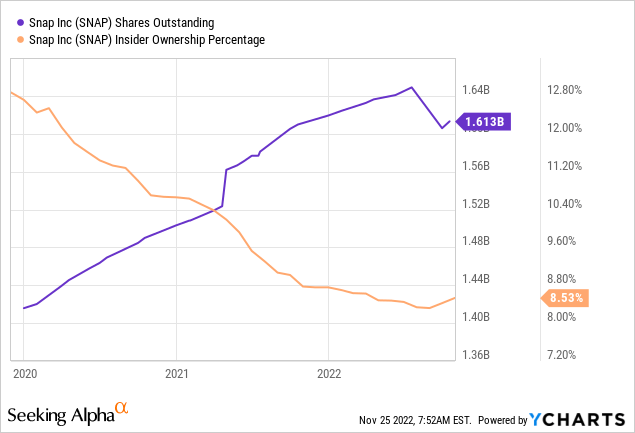

In addition, for the first time, the company has launched a share buyback program with a volume of $500M. The effect can be seen in the graph below.

Completed our first $500 million stock repurchase program, with 3.1% of outstanding shares repurchased at an average price of $9.75 We announced an additional stock repurchase program of up to $500 million to help offset the impact of anticipated future dilution related to stock-based compensation.

Share dilution and insider selling

I always want to look at stock dilution and whether there is insider selling. Here we can see that the outstanding shares have increased by about 15% since 2020. In addition, insiders have sold more and more of their shares.

This is an excerpt of the insider sales. Together, this amounts to approximately $13.9M since the beginning of August alone. That’s a lot, but only 0.01% of the market capitalization. Still, I find it worrisome when many insiders sell, especially at prices that seem low. After all, the stock is down 78% YTD.

Risks

This section can be concise as the main risks have already been mentioned: user numbers are growing slower than they used to. Especially in North America, where the revenue per user is the highest. Social media companies have a higher risk than most other companies. It’s tough to build something like a moat; the next exciting app is just a click away. There are no switching costs and no subscription you have ever bought. In case of success, the scalability is, of course, also very high.

Conclusion

Overall, the company has the potential to generate a lot of revenue and positive cash flow within the next few years. But we are not quite at that point yet, and for my taste, the valuation is still a bit too high. I also have doubts about whether the analysts’ estimates will come true. In a recession, companies cut back on their ad spending, and Snap’s very young users don’t have the same spending power as people between 30 and 50.

And even if the analyst estimates come true, the company would be at a P/E of 17 in 2024. So not even extremely cheap but rather average. I think we will not see extremely high valuations again so quickly after the 2021 super-bubble. Overall, I think the risk-reward ratio is rather poor, as the stock still has downside potential at the current level. If the shares fall another 30% or 40%, things may look different. But at the moment there are better opportunities in the market from my point of view.

Be the first to comment