SDI Productions

Provident Financial Services (NYSE:PFS) thrives despite a quite pessimistic economic outlook. Its decent loan growth and improved efficiency remain the cornerstone of its top line, making it durable in a high-interest environment. But what hampers its growth is the large concentration of investments and savings and increased loan provisions. Nevertheless, its fundamental stability is evident, so it can withstand macroeconomic blows. It remains liquid, allowing it to cover borrowings and dividends. Likewise, the stock price is in an uptrend following its sharp dip last month. It remains undervalued and shows an enticing dividend yield for investors.

Company Performance

Banks, thrifts, and mortgage companies are susceptible to risks associated with economic volatility. But Provident Financial Services, Inc. continues to show how ready it is for market disruptions. Its sound fundamentals continue to generate stable returns despite the skyrocketing interest and mortgage rates. Growth is expected to slow down in the following quarters, but its potential to bounce back is still evident.

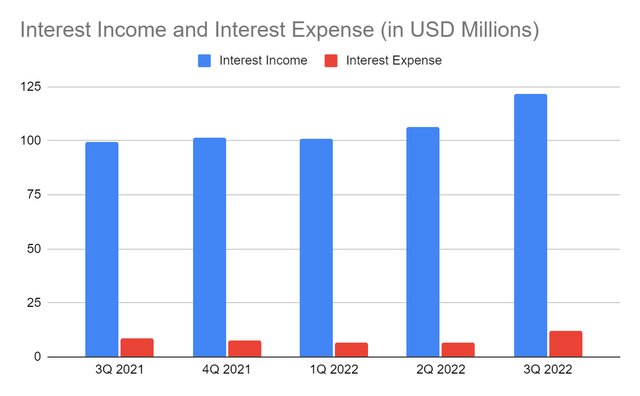

Its most recent interest income amounts to $121.73 million, a 22% year-over-year growth. It is a testament to how the company remains consistent with its goals and expectations this quarter. It continues to reflect and benefit from its repositioning in the last two years. Indeed, its increased concentration on risk management and strategic underwriting process amidst its repositioning continues to pay off. It served as a timely, prudent, and effective preparation for the stormy market environment. It continues to maneuver its operations with ease while satisfying the needs and preferences of its customers.

Interest Income and Interest Expense (MarketWatch)

Its moderately interest-sensitive but stellar Balance Sheet makes it a solid company. Its prudent portfolio diversification and good asset quality were the primary growth drivers. Its decent loan growth was in perfect timing with the interest rate hikes. As such, interest income on loans has steady increase. Meanwhile, its large concentration of investments derives higher dividends. But, their valuation is in a downtrend as interest rate hikes do not seem advantageous for its securities. Likewise, interest expense on deposits has a substantial increase despite having lower deposits. Its loan provisions must also increase for more conservative operations, reducing its interest income.

Meanwhile, its non-interest segment has a similar trend. Both non-interest income and expenses are on an uptrend. But their increases are almost the same, offsetting the change. Also, non-interest expenses this quarter is near the average amount in the last two years. It highlights efficiency as its expenses are manageable despite the elevated inflation. Somehow, it cooled down in 3Q after peaking at 9.1% at the end of 2Q. With that, its internal strength paid off this quarter.

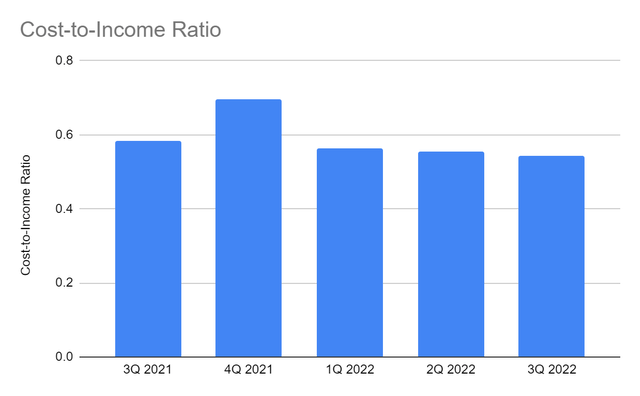

Of course, it has to expect a potential slowdown as these market disturbances persist. But overall, its top-line results are impeccable, allowing it to support and stabilize bottom-line income. Its efficiency is on track with its goal to reduce the cost-to-income ratio to 40% in 2024. Its efficiency ratio of 54% is proof of its commitment to its repositioning goals. It generates stable returns to increase its capacity to cater to more customers as a valuable and viable credit source.

Cost-to-Income Ratio (MarketWatch)

How Provident Financial Services, Inc. Can Withstand Market Risks

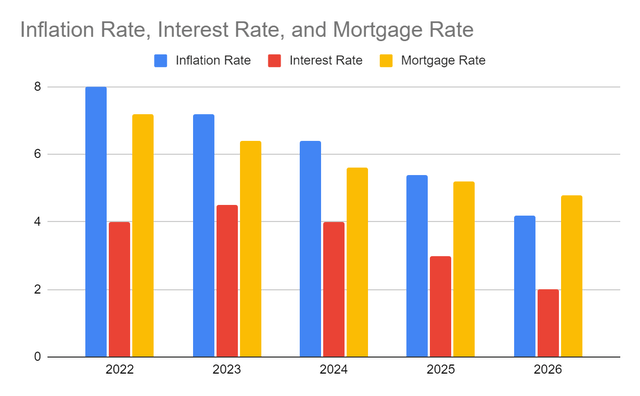

Inflation has cooled down in the last three months. But interest and mortgage rates have yet to peak. During the last meeting, the Fed raised interest rates by another 75 bps. Although increments may decrease next year, the actual rate may become as high as 4.5-5%. Likewise, mortgage rates are skyrocketing at about 7% and may reach 7.2-7.4%. The current estimates are far higher than the projections earlier this year. Indeed, inflation has moved further than expected, so policymakers have to stabilize it. Their efforts appear to pay off as it is now down to 7.7% this month.

Inflation Rate, Interest Rate, and Mortgage Rate (Author Estimation, Barron’s, and Forbes)

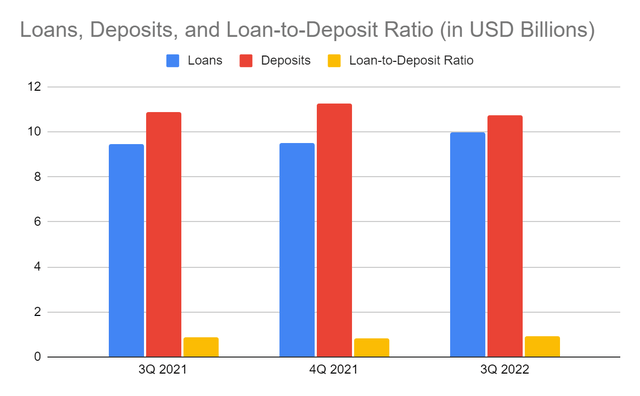

Meanwhile, PFS exudes stability and preparedness for these changes. Its repositioning in the last two years has been a preparation for unforeseen circumstances. For instance, its loans are 5% higher than the comparative quarter, driving its interest income. Meanwhile, deposits are 2% lower. Since these are mostly interest-bearing, expenses continue to increase. These can also become another growth obstruction. Even so, its liquidity may help it become flexible amidst the changes in deposit yields.

Loans, Deposits, and Loan-to-Deposit Ratio (MarketWatch)

Again, it must anticipate a slowdown as interest rates approach the maximum. Loan growth may be hampered, leading to lower interest income. It is a logical projection since its Balance Sheet has a low to moderate interest sensitivity. But, the company is still conservative as it raises its loan provisions to 0.89% from 0.84% in the previous year. Nevertheless, its loan-to-deposit ratio of 92% shows it still has enough capacity to cope with these drawbacks while covering deposits.

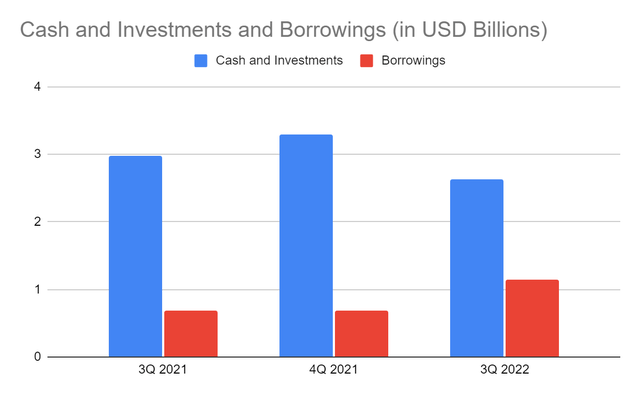

Cash and investments are way lower than in the comparative quarter. But they are enough to cover borrowings and other liabilities in a single payment. We can also see that cash decreased with the decrease in deposits. The company is better off with this change. With their combined amount, they compose 20% of the total assets. If loans are excluded, 72% of the remaining assets are cash and investments. Hence, the company is still liquid.

Cash and Investments and Borrowings (MarketWatch)

Moreover, we can also see that it is not overleveraged since borrowings remain reasonable compared to equity. So, its shareholders are secure in receiving consistent dividend payments.

Stock Price Assessment

The stock price of Provident Financial Services, Inc. has been rebounding after taking a sharp plunge last month. If we check the YTD trend, the stock price generally moves sideways, although the downtrend is more prominent. At $22.7, it is still 4% lower than the starting price.

Stock price metrics show that it is reasonable, being traded at a 10.9x earnings multiple. It is lower than the five-year average of 12-13x, making it attractive. If we use the average PE multiple to the current EPS YTD of $2.18, the stock price should be $26-28, a 20% upside from the current stock price. But given the potential risks and slowdowns, I estimate the annual EPS at $2.1 since the cumulative EPS for three quarters is already $1.69. I set a more conservative EPS of $0.41 for 4Q due to a potential decrease in income. Despite this, the stock price using the new values may still be higher at $25, a 9% upside. It is still acceptable due to the decent growth and returns of the company.

Meanwhile, dividend payments are consistent, although growth stopped temporarily in the last two years. The dividend increase resumed with an annualized value of $0.96, a 3% increase from 2021. Its dividend yield of 4.25% is impressive. Also, the company can sustain it, given the dividend payout ratio of 41%. It still has adequate means to increase dividends, so we can also estimate the stock price using the Dividend Discount Model.

Stock Price $22.7

Average Dividend Growth 0.054

Estimated Dividends Per Share $0.96

Cost of Capital Equity 0.09653571292

Derived Value $24.0021909 or $24.00

The derived value adheres to our initial supposition of undervaluation using the PE multiple. There may be a 5% upside in the next twelve months. So, investors must also watch this stock.

Bottomline

Provident Financial Services, Inc. remains on a solid footing despite market volatility. Revenues and margins are stable with decent growth. Its sound fundamentals help it cope with the drastic changes, although growth may be hampered. Also, it can sustain dividends with an attractive dividend yield, given the potential undervaluation of the stock price. The recommendation is that Provident Financial Services, Inc. is a buy.

Be the first to comment