Muhammet Camdereli

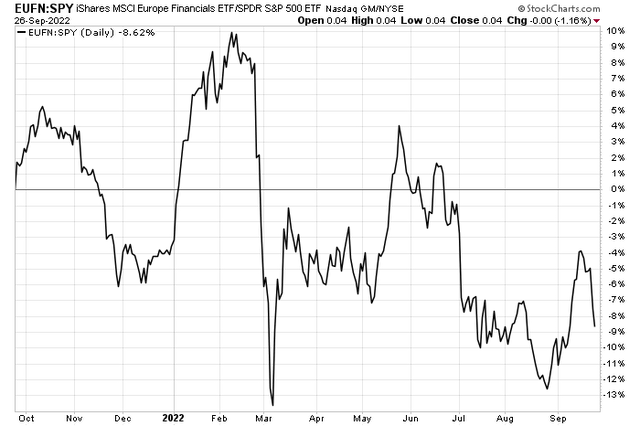

What if I told you that European Financials are beating the S&P 500 over the last month? True story. The notorious group, often mired in massive relative losses versus large-cap U.S. equities when global turmoil strikes, is holding its own this time.

One UK-based bank stands to benefit from higher foreign rates and features a compelling valuation with a good technical pullback setup.

European Financials Not Making New Relative Lows

According to Bank of America Global Research, NatWest (NYSE:NWG) is primarily a UK-focused retail and commercial banking business. It carries out similar activities in the Republic of Ireland and has a relatively small broader international presence. Investment banking activities have been scaled down substantially and are now primarily aimed at servicing the company’s corporate customers.

The bank is focused on growth despite the dire macro conditions across the global capital markets, particularly in the UK. NWG is working on cost cuts and improving its balance sheet and should benefit if and when the UK economy rebounds. Favorable Bank of England policy action could also benefit net interest margins.

The Scotland-based $25.5 billion Banks-industry company within the Financial sector trades at a low 6.2 trailing 12-month price-to-earnings ratio and pays a high 5.8% dividend yield, according to The Wall Street Journal.

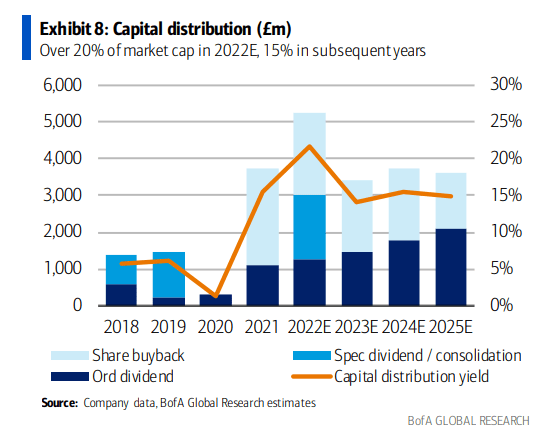

NatWest is also engaged in heavy shareholder accretive activities like buybacks and dividends. BofA reports that over 20% of the firm’s market cap is slated to be paid out this year and more than 15% in each of the following three fiscal years.

NatWest: A Big Dividend And Strong Share Repurchase Program

BofA Global Research

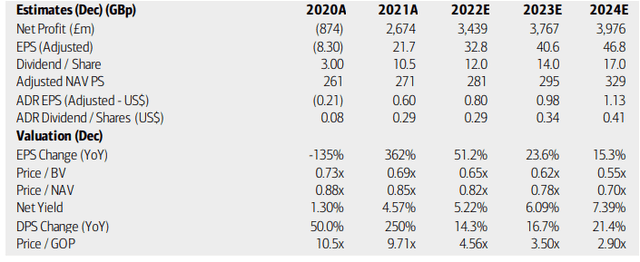

On valuation and earnings, BofA analysts expect NatWest’s earnings to grow sharply this year while maintaining a high EPS growth rate through 2024. Moreover, dividends are seen as rising at a clip north of 14% annually from 2022 through 2024. Its price-to-book ratio, key for banks, is exceptionally low near 0.65x, so the Financials company looks like an excellent value too.

NWG: Earnings, Valuation, Dividend Forecasts

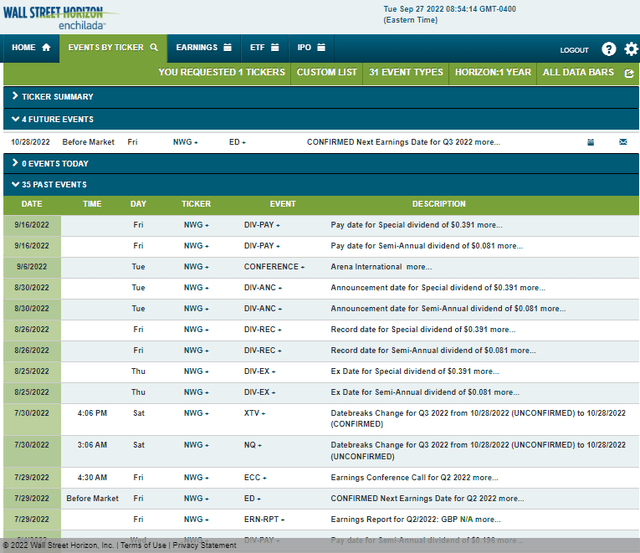

Looking ahead, NWG has a confirmed Q3 earnings date of Friday, Oct. 28, BMO, according to corporate event data provider Wall Street Horizon. The calendar is light until then, though.

Corporate Event Calendar

The Technical Take

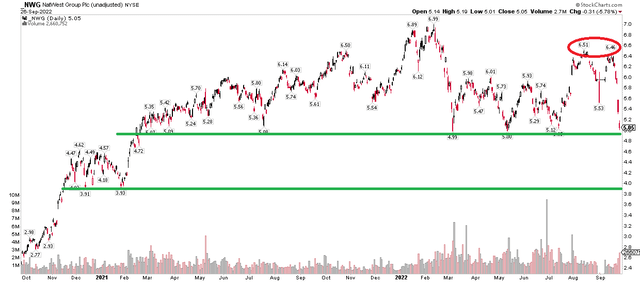

NWG shares have dropped back to key support around $5. This has been a key spot for NatWest over the past year-plus. The pullback offers investors an opportunity to buy shares at a favorable risk/reward setup. Going long in the low $5s with a stop under $5 on the ADR makes sense.

If shares break support, look for a move down to around $4 – that was the range-low from late 2020 into early last year. On the upside, I see resistance at $6.50 from a double top pattern that took place in August and September this year. Further resistance could be found at the year-to-date high of around $7.

NWG: Shares Retreat To Support After A Bearish Double Top

The Bottom Line

NatWest shares look cheap with a strong profitability outlook amid high interest rates in the UK. Moreover, shareholder accretive activities are bullish tailwinds. Finally, a solid risk/reward technical setup is something swing traders should like. Long-term, the value case is strong, so even if the stock breaks support, look to add to your position in NWG.

Be the first to comment