Justin Sullivan

Oracle Corporation (NYSE:ORCL) is a remarkably resilient company, especially during recessionary times, and its products are often considered mission critical by its customers. Over the last twelve months, Oracle began seeing revenue acceleration, driven by Cloud and the best database performance over five years. Oracle’s database customers are on the path to upgrading their existing database software with the newer Autonomous Database version, driving revenue and EPS.

Oracle’s revenue base is sticky and has a large recurring revenue stream. More than 70% of its revenue is recurring/renewable. Organic revenue growth will likely accelerate over the next 12-24 months, driven by cloud revenue and the upgrade of the database across the install base. Revenue could reach high-single digits from the current mid-single digits, led mostly by the database upgrade cycle as well as the performance of OCI (Oracle Cloud Infrastructure). Many customers who previously bought infrastructure from the likes of Dell, HP, IBM, and Hitachi now use OCI or Cloud@customer to deploy their database infrastructure.

Oracle shares have declined 27% YTD and have hit a fresh 52-week low of about $63. Oracle is down about 40% from its recent high of $106. Oracle stock is cheap, trading at around 11.9x on C2023 EPS versus the peer group that is trading close to 19.8x. Given our confidence and the durability of Oracle’s business, we recommend buying shares here.

Database to drive growth

Oracle remains the market leader and is considered a gold standard in relational databases. Millions of applications are built on top of the Oracle database and are considered many organizations’ core infrastructure. Most of Oracle’s customers are running an older database version and are now due for an upgrade. Oracle database contributes about 50% of revenue. The latest version of the core database product, dubbed the Autonomous Database, was launched four years ago, followed by version 2, which was launched a year later. The Autonomous database is a mixture of traditional database and machine learning, built to automate the whole swathe of operations.

Since the Oracle database remains mission-critical in most organizations, customers upgrade to the newer version after most of the bugs within the software have been ironed out. With the newer database now much more stable, we believe many organizations will upgrade their existing installations over the coming years, driving growth for the company. We believe the newer version is much more efficient and easy to maintain, and the TCO (total cost of ownership) is lower, given that it can self-tune and self-repair without needing the help of a database administrator. The database uses “adaptive machine learning to automatically upgrade, patch, and tune itself ” without an administrator’s help. In addition, the software runs in the Cloud, either the public or private Cloud, making it much more cost-effective.

Oracle Cloud Infrastructure is another driver

Oracle Cloud Infrastructure (OCI) service offers servers, storage, network, and application services via a global network of data centers. OCI is designed to provide mission-critical workloads an easy path to migrate from on-premises deployment to the public Cloud. We expect OCI to grow rapidly as on-premises database deployments are slowly moved over to OCI in the coming years. Oracle’s public cloud business reached a $3.2 billion run rate in F4Q22. Customer can deploy their Oracle instances on the public OCI or deploy them on Cloud@Customer formats.

Requirements for low latency and performance, regulatory compliance, and data sovereignty issues prevent companies from using the public Cloud. In those instances, Oracle provides a solution called Cloud@Customer to deploy applications within their data centers. Cloud@Customer is a solution that is deployed within the customer data center. Over the next three to five years, we expect OCI and Cloud@Customer to drive growth for the company, driven by an upgrade to the Autonomous Database. In addition, we expect Oracle to move recently acquired Cerner customers to OCI.

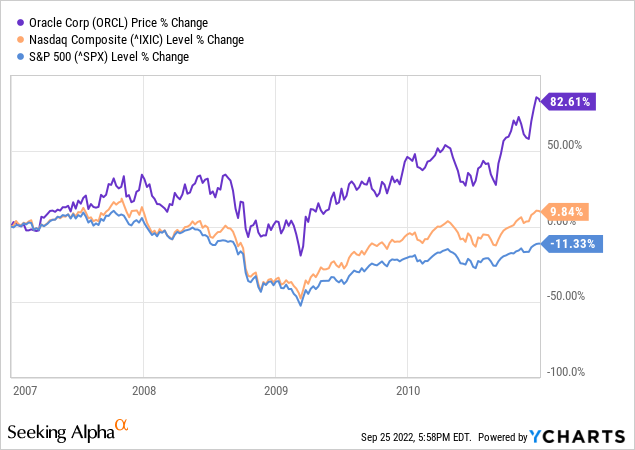

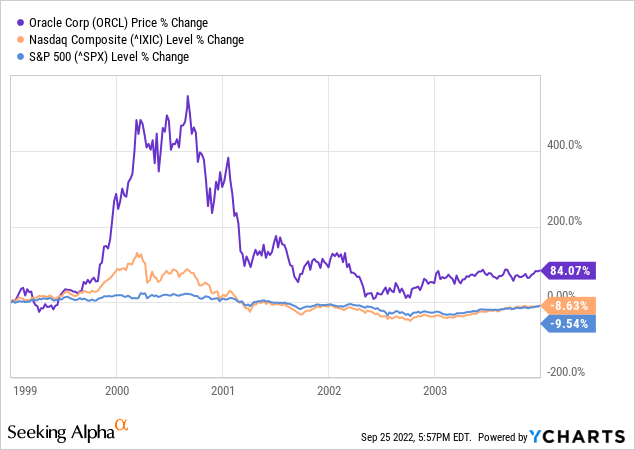

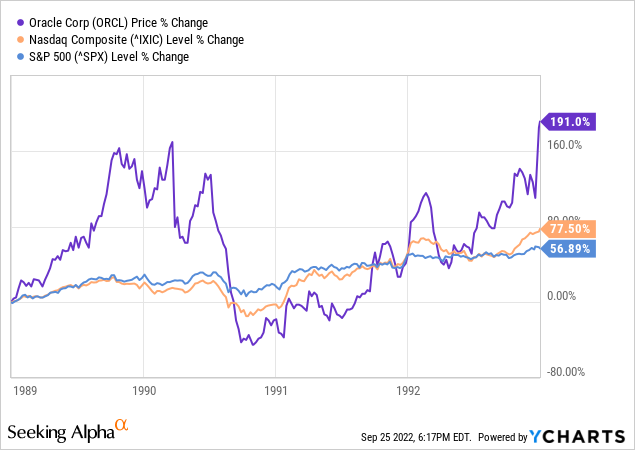

Oracle outperformed the indices during the past three recessions

During the past recessions/market downturns, Oracle outperformed the Nasdaq and S&P500 by a wide margin. During the recession of the great financial crisis, Oracle appreciated almost 83%, Nasdaq appreciated almost 10%, while S&P declined 11%. During the Internet bubble recession between 1999 and the end of 2003, Oracle stock appreciated 84%, while Nasdaq declined almost 9%, and S&P declined almost 10%. Similarly, Oracle stock outperformed S&P and Nasdaq indices during the Gulf War and the accompanying recession.

We believe Oracle is a safer stock to own during market turbulence since its products are considered mission-critical by most of its customer base. Oracle revenues are stable with predictable revenue and earnings even during tough economic times. The following charts illustrate Oracle’s performance during the last three recessions.

Ycharts Ycharts Ycharts

Valuation

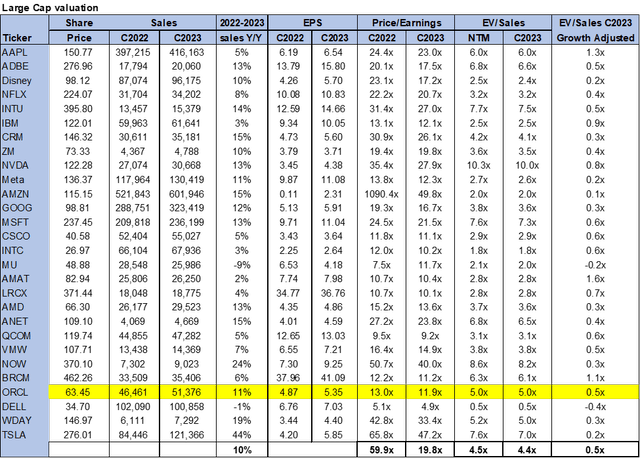

Oracle is a cheap stock when compared to our large-cap peer. On a P/E basis, Oracle is currently trading around 12x C2023 EPS of $5.35 compared to the peer group trading at 19.8x. On an EV/Sales basis, Oracle is slightly more expensive than the peer group of 4.4x. And on a growth-adjusted basis, Oracle is trading in line with its peer group and is trading at 0.5x. We recommend investors buy the stock at current prices as we expect it to outperform the peer group.

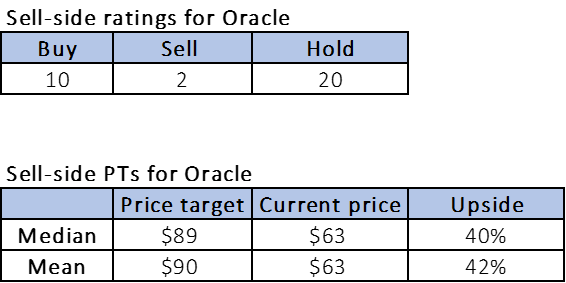

Word on Wall Street:

The sentiment on Oracle from the sell-side analysts is mainly neutral. Out of the 32 analysts covering the stock, ten analysts are buy-rated, twenty analysts are hold-rated, and two analysts are sell-rated. The median price target is $89, and the mean is about $90. The stock is currently trading around $63, for an upside from 40% to 42%. The following chart illustrates sell-side ratings and price targets.

Refinitiv & Techstockpros

Risks to our buy thesis

Risks to our buy rating include slowing cloud revenue growth and slowing growth of its primary flagship database offering – the Autonomous DB. The Autonomous DB is expected to drive database growth, and if the anticipated growth fails to materialize for any reason, we believe earnings will be at risk. Many new applications are being architected with newer database offerings, such as MongoDB (MDB), which are flexible and much easier to work with. Newer applications that use unstructured or semi-structured data are being deployed to store this data efficiently. Oracle currently does not have a product that could compete with MongoDB. If Oracle’s other databases, such as MySQL, do not participate in the market with newer workloads, Oracle’s revenue could decline over time.

What to do with the stock

We are buy-rated on Oracle and believe the company’s stock should outperform during the upcoming recession. During the last three major recessions in the early 1990s, early 2000’s and during the great financial crisis, Oracle outperformed both S&P and Nasdaq indices by a wide margin. We think Oracle is well positioned for the upcoming recession, as some speculate it is possible in 2023.

We recommend investors buy shares here, given that Oracle’s revenue is highly resilient and many customers are in the early stages of upgrading their existing software. The sentiment on the stock should improve as more analysts upgrade their views on Oracle, as the company continues to beat and raise estimates. Therefore, we would be buying shares here.

Be the first to comment