The Good Brigade

Co-produced with Treading Softly

You’re a busy person. I get it. We all feel extra busy and extra stressed.

According to studies by the American Psychological Association, 77% of American adults felt stressed in 2020, this was up from 66% in 2019. A full 71% of Americans felt in 2020 that the United States had hit its lowest point – with COVID-19 being a major stressor.

So even before COVID, over half of Americans felt stressed out.

Little did those individuals in 2020 know that stress was only going to pile on. In a 2022 survey, a full 84% felt stressed, up from 78% in 2021.

This is the kind of chart that chartists would love to invest in: it’s constantly climbing!

We just want to shed the stress, frustration, worry, and burden of all we’re carrying around. Yet, we’re getting more stressed, not less. Even as the economy recovers from COVID-19, we must deal with the aftermath of the global economic policies pursued by governments. The cost of mountains of stimulus is waking the sleeping beast of inflation.

One thing that we should have learned from history is that this, too, shall pass. In the long run, the economy is a powerful force for wealth generation. Those who have more exposure to it become wealthier. Those who panic over the issues of today don’t.

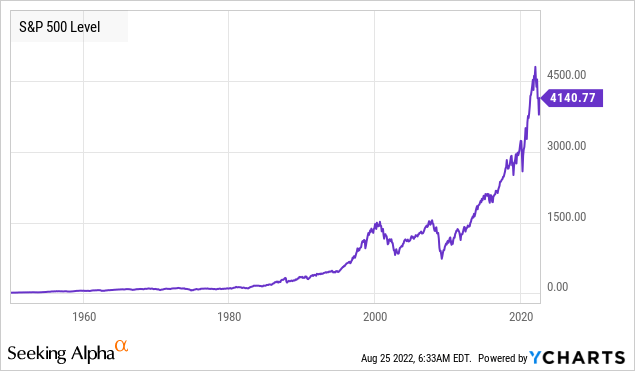

The stock market has frequently dipped. Each time it felt like “the end of the world” and investors panicked. Every time, the market recovered and went on to reach new heights.

So today, I want to look at two “market” funds that invest in a wide swath of the market while also looking to provide their holders with strong income. These funds have a variable distribution policy based on the value of their assets. As such, they generally track the market up and down but provide larger sums of income than many of the boring passive market ETFs.

I like the income, and I also like their focus on value over growth. Let’s dive in!

Pick #1: USA – Yield 10.4%

2022 has been a rough year for the market indexes. The first half was the worst first half in 50 years for the S&P 500. Think about that, the worst first half in 50 years where a lot of negative stuff has happened. Bankruptcies, foreclosures, wars, terrorism, pandemics, rate hikes, rate cuts, and recessions have all happened in the past 50 years. Yet the first half of 2022 was the worst start for the S&P 500.

One thing investors should know about the S&P 500 by now is that it bounces back. Yet every time stocks are selling off, there is a crowd of bears assuring you that there is worse to come. Investors act like capital losses are permanent. They panic. They sell, and that is why most investors don’t beat the market. They are impatient.

The Stock Market is a device to transfer money from the impatient to the patient. – Warren Buffett

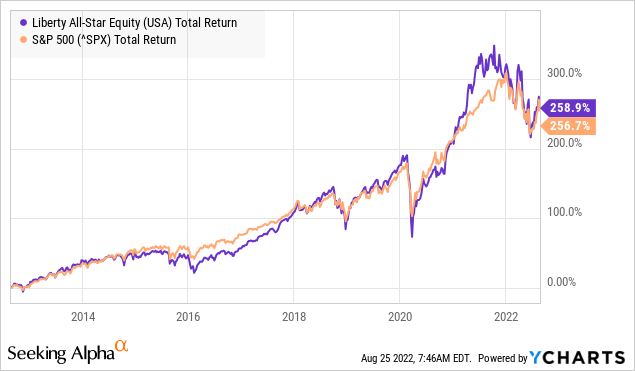

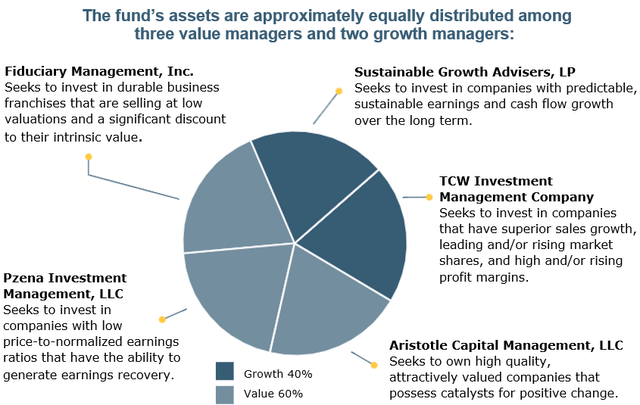

The S&P 500 will recover. It is a question of “when”, not “if”. We can take advantage of this reality through the Liberty All-Star Equity Fund (USA). USA is a diversified fund that splits its capital among five managers with different strategies. (Source: Liberty All-Star Funds.)

As a result, USA is highly diversified, with a slight bias towards “Value” stocks. It has a high correlation with the S&P 500 and, over the past 10 years has had a nearly identical total return.

The S&P 500 will recover. It will go on to hit new heights, so having broad diversified exposure is a great bet. Why not just invest in an S&P 500-based ETF like SPY? The income.

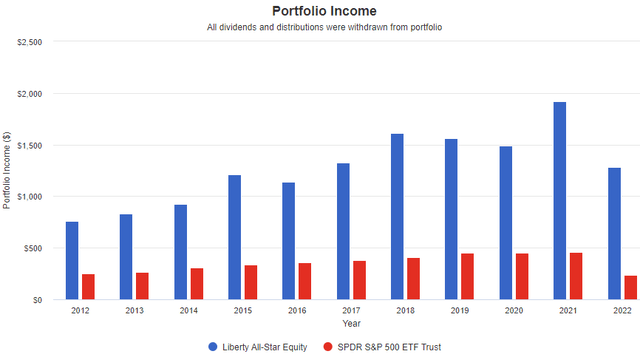

Here is a look comparing the income from USA to SPY on a $10,000 investment with no reinvestment. (Source: Portfolio Visualizer.)

USA has a variable distribution policy. It pays out 2.5% of its NAV (net asset value) each quarter. As NAV rises, USA pays a higher dividend. If NAV declines, it pays a lower dividend. In this way, USA is paying out the bulk of its total return in dividends. That is cold hard cash in your pocket that you can spend as you please. Reinvest in USA, reinvest in something else, or go spend it on something you want or need, the choice is yours. After all, isn’t that freedom what the USA is all about?

The market has been steadily recovering from its bottom for the past two months. With inflation easing, calming fears that the Fed might hike more than is already priced in, the market is likely to continue drifting up. USA is one of my favorite ways to benefit from that rise while collecting a fantastic income.

Pick #2: RVT – Yield 8.3%

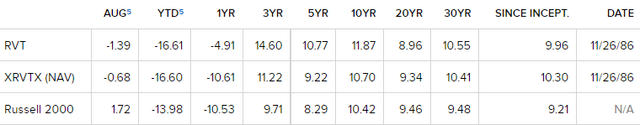

Royce Value Trust (RVT) has achieved something very few funds have: It has outperformed its benchmark for 36 years. (Source: royceinvest.com.)

We see it all the time. Some fund manager goes on a winning spree and has great results over a 5-10 year period. They are adored by the media, and their opinion on everything makes the headlines of financial news outlets. Inevitably, their winning spree ends, and they fade away.

You probably won’t see headlines about what Chuck Royce is saying about this or that. You might look at the performance above and see 10.3% CAGR on NAV, compared to 9.21% CAGR, and think that is only minor outperformance. Over one or two years, you would be right. Over 36 years? RVT turned $1,000 invested into $35,113 while the Russell 2000 turned $1,000 into $24,646.

RVT is proof that slow and steady wins the race. With RVT, you aren’t going to see 100%+ returns in a single year. RVT isn’t speculating, making huge bets, or gambling to try to beat the market. RVT specializes in small-cap “Value” stocks. In the words of Chuck Royce:

Our task is to scour the large and diverse universe of small-cap companies for businesses that look mispriced and underappreciated, with the caveat being that they must also have a discernible margin of safety. We are looking for stocks trading at a discount to our estimate of their worth as businesses.

RVT is analyzing businesses, valuing them, and then buying them when the share price is lower than their estimation of the value. It’s a lot of hard work and is an approach that will find long-term winners.

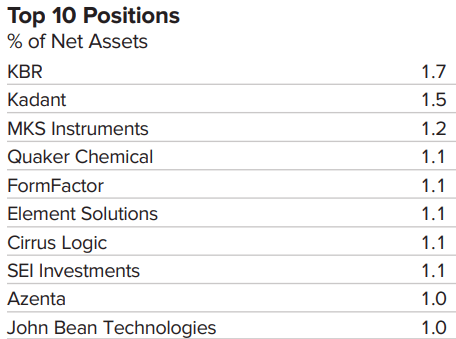

RVT is very well diversified, with its top 10 companies making up less than 12% of its portfolio. (Source: RVT FactSheet.)

RVT FactSheet

Closed-end fund (“CEF”) managers aren’t working for free, this is their career. RVT is unique among any funds, as far as we know, with a provision that could cause the management fee to be 0%. No fee will be taken for any month in which the Fund’s performance (rounded to the nearest whole number) over the trailing 36-month period is negative. Additionally, the fee structure is adjusted based on actual performance versus their benchmark. In short, management’s interests are very strongly aligned with maintaining high performance over the long term.

RVT pays a variable distribution. The quarterly distributions are calculated at an annual rate of 7% of the average of the prior four quarter-end NAVs. In the fourth quarter, RVT will pay out extra if it is required by IRS regulations as a year-end special distribution. These are most common in years following a crash as RVT has excess gains during the recovery.

RVT is an ideal CEF for sustainable distributions through NAV preservation over time. When NAV is high, shareholders are rewarded immediately. When NAV declines, the distribution will reduce, ensuring that RVT is not forced to sell shares in a down market, protecting NAV, so they benefit the most from the rebound. At the same time, the strategy of using an average of the past four quarters means that there is reasonable stability. The dividend doesn’t simply collapse because of one bad quarter, it will drift down, and when NAV recovers, it will start drifting back up. The HDO Model Portfolio is proactive at projecting the next dividend to provide you with the best estimate of RVT’s current yield.

Shutterstock

Conclusion

With RVT and USA, you can invest in two excellently run funds with long histories of beating the market for income, or for RVT’s case, a long history of outperforming its index.

For many, they are too stressed and too busy to want to manage a larger portfolio of holdings. These CEFs cover hundreds of holdings, providing you with diversified exposure to the market.

In the end, if you are a stressed-out, hard-working individual who wants to invest for income but cannot yet bring your attention to focus on the market. You may want to consider buying these CEFs and get the ball rolling. Combining these CEFs with a selection of CEFs that focus on bonds, preferred equity, and hot sectors allows you to benefit from the market and collect a large income.

Today, we wanted to give you two easy-to-invest-in funds that can provide high levels of income and help you maintain a wide-ranging exposure to the market. These funds are an excellent way to lay a foundation for your income portfolio to grow and blossom over the years to come.

Be the first to comment