Bet_Noire

Introduction

When the calendar rolled over earlier in 2022, Canadian Natural Resources (NYSE:CNQ) celebrated a very strong recovery during 2021 with their biggest dividend increase in history and as my previous article highlighted, it appeared there was plenty more coming. A mere six months later, this outlook was proven right with a special dividend coming as a surprise, thereby sitting atop their existing dividends that already provide a moderate yield of circa 4%, depending upon exchange rates. When looking ahead, this could see a new golden era for dividends as they take a greater role in their shareholder returns.

Executive Summary & Ratings

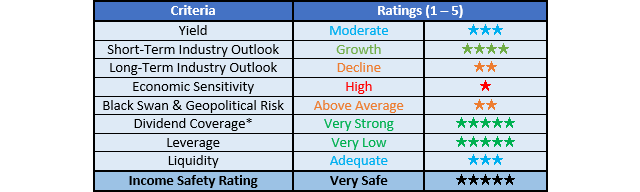

Since many readers are likely short on time, the table below provides a very brief executive summary and ratings for the primary criteria that were assessed. This Google Document provides a list of all my equivalent ratings as well as more information regarding my rating system. The following section provides a detailed analysis for those readers who are wishing to dig deeper into their situation.

Author

*Instead of simply assessing dividend coverage through earnings per share cash flow, I prefer to utilize free cash flow since it provides the toughest criteria and also best captures the true impact upon their financial position.

Detailed Analysis

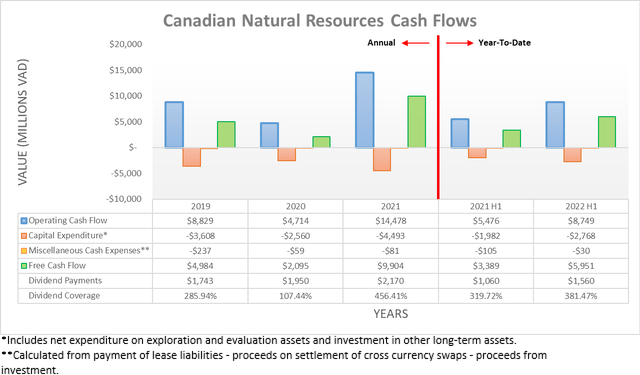

Following their very strong cash flow performance throughout 2021 on the back of the oil price recovery, unsurprisingly, the booming operating conditions during the first half of 2022 produced even stronger results. Thanks to the prevailing triple-digit oil prices, this saw their operating cash flow land at C$8.749b, which saw an extremely strong increase of 59.77% year-on-year versus their previous result of C$5.476b. Even more importantly, they translated C$5.951b into free cash flow, which is a massive sum for only half a year.

Whilst the first half of 2021 only saw an immaterially small working capital draw of C$87m, the first half of 2022 was very different with a sizeable working capital build of C$1.29b that significantly weighed down their already extremely strong results. If removed from their operating cash flow, it sees an underlying result of C$10.039b with their free cash flow obviously seeing the same sized increase, thereby lifting its underlying result to a massive C$7.241b, which annualizes to over C$14b and thus providing never-before-seen scope for shareholder returns.

Thankfully they did not disappoint on this front through their C$1.56b of dividend payments and further C$3.08b of share buybacks, which saw a very large total of C$4.64b returned to shareholders and thus slightly more than three-quarters of their free cash flow. Even more excitingly, they declared a special dividend of C$1.50 per share that is payable during the third quarter. Following this surprise development, it naturally begs the question of whether a pivotal change has occurred to their shareholder returns policy, which was asked during their second quarter of 2022 results conference call but alas, the answer was very generalized, as per the commentary from management included below.

“I think the best way to answer that is, we are committed to our balance allocation, as Tim and I talked about today on the free cash flow, and that that includes shareholder returns. And that’s shown in our track record. And as you mentioned, our free cash flow allocation policy. And our board will continue to review incremental returns to shareholders going forward as part of our quarterly process, and as part of our free cash flow allocation policy.”

-Canadian Natural Resources Q2 2022 Conference Call.

Even though I am supportive of their shareholder returns, I nevertheless must say that the lack of well-articulated guidance after declaring a surprise special dividend is disappointing, as it leaves the mix of their future shareholder returns uncertain. At least if nothing else, their special dividend is a very positive and tangible sign that strongly indicates dividends are likely to take a greater role in the future.

Whilst their massive circa C$6b of free cash flow during the first half of 2022 obviously provides scope for equally as massive shareholder returns, this is not surprising given the triple-digit oil prices that gave rise to this result. Whereas in the medium to long-term, the more important question is actually what can they provide to shareholders during business-as-usual operating conditions, which their 2021 results should provide a suitable basis to assess.

Thankfully even outside of these booming operating conditions, their results from 2021 show they can still generate immense free cash flow. Whilst the year saw a very strong end with oil prices north of $80 per barrel, it also saw a soft start with oil prices around a mere $50 per barrel, thereby making their full-year results a reasonable middle-of-the-road basis. As my previously linked article discussed in detail, their free cash flow landed at a massive C$9.904b during 2021 or more importantly, C$8.833b upon removing their C$1.071b working capital draw. Despite being well below their results from the first half of 2022, it would still provide a very high 10%+ free cash flow yield given their current market capitalization of approximately $65b, which equates to circa C$84b at the prevailing USD to CAD exchange rate. This means that if an investor were to buy their shares now but unfortunately see oil prices slide back to their levels from 2021, they could still provide a combination of share buybacks and dividends equating upwards of 10% on current cost.

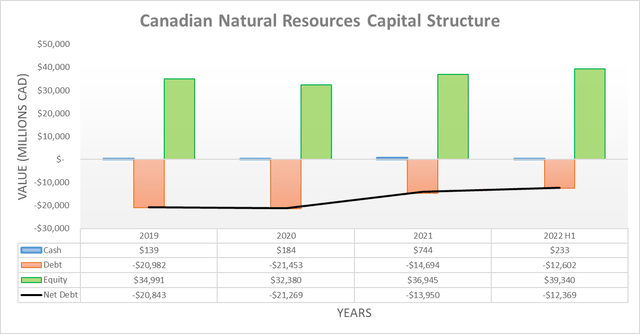

Despite their shareholder returns totaling a very large C$4.64b during the first half of 2022, they still reduced their net debt even further to C$12.369b and thus an impressive 11.33% lower than its previous level of C$13.95b where it ended 2021. If not for their sizeable working capital build, their net debt would actually be another C$1.29b lower, which would have seen an even more impressive 20.58% lower. When looking ahead, the extent that their net debt continues decreasing will depend upon not only oil prices as per usual but also, their yet-to-be-known shareholder returns.

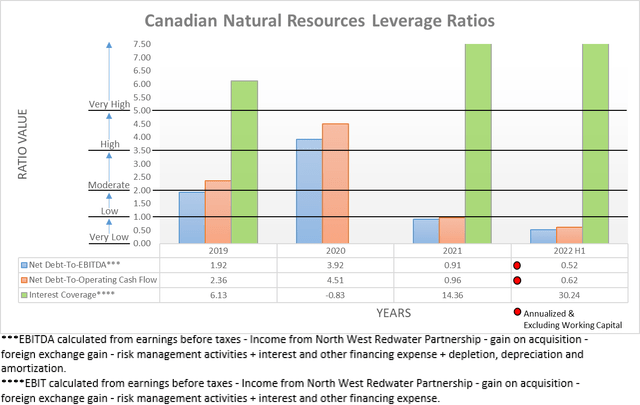

Thankfully the extent they reduce their net debt does not necessarily matter, regardless of whether taking a short-term or long-term view. In the former, their respective net debt-to-EBITDA and net debt-to-operating cash flow of 0.52 and 0.62 are down versus their previous respective results of 0.91 and 0.96 at the end of 2021, thereby sitting even further beneath the threshold of 1.00 for the very low territory. Whereas in the latter, even if operating conditions were to return to their terrible levels during 2020 and obviously dragged their financial performance down accordingly, their net debt-to-EBITDA and net debt-to-operating cash flow would only rise to 2.28 and 2.62, respectively, thanks to their now significantly lower net debt. Since these would remain comfortably within the moderate territory of between 2.01 and 3.50, it means that regardless of whether the future endures a downturn or not, their net debt should always be easily manageable.

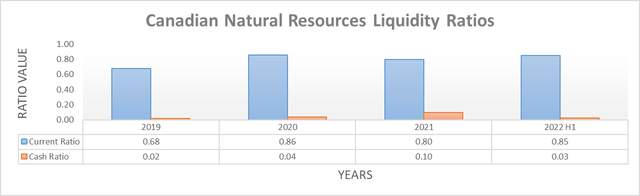

Even though their cash balance fell during the first half of 2021 to C$233m versus its previous level of C$744m at the end of 2021, thereby dragging down their cash ratio to 0.03 versus its previous result of 0.10, their liquidity is still adequate as their current ratio climbed to 0.85 versus its previous result of 0.80. Thanks to their large operational size, immense free cash flow and very low leverage, this should persist well into the future, along with their access to debt markets if required to help manage future refinancing, even if central banks further tighten monetary policy.

Conclusion

Following their surprise special dividend, we could be seeing a new golden era for dividends with their very healthy financial position providing ample support for management to continue returning vast sums of their immense free cash flow. It would have been preferable to see well-articulated guidance for their shareholder returns policy but nevertheless, their special dividend is a very positive and tangible sign that strongly indicates dividends are likely to take a greater role in the future. Since I prefer these over share buybacks and their shares are trading with a very high 10%+ free cash flow yield even based upon their far softer 2021 results, I believe that upgrading my rating to a strong buy is now appropriate.

Notes: Unless specified otherwise, all figures in this article were taken from Canadian Natural Resources’ SEC filings, all calculated figures were performed by the author.

Be the first to comment