HT Ganzo

Dear readers/followers,

In my last article, I clarified my thesis on Norsk Hydro (OTCQX:NHYDY), believing it to be buyable after falling double digits. Despite positives, there are plenty of risks to still be considered here.

However, the new macro brings with it all kinds of new situational considerations – including what sort of commodity availability we’ll see from Russia and what this will result in, as well as previously mentioned headwinds, such as macro, costs, energy pressure, and the raw cyclicality of the business, as well as massive slowdowns in China.

Let’s dig in.

Updating on Norsk Hydro

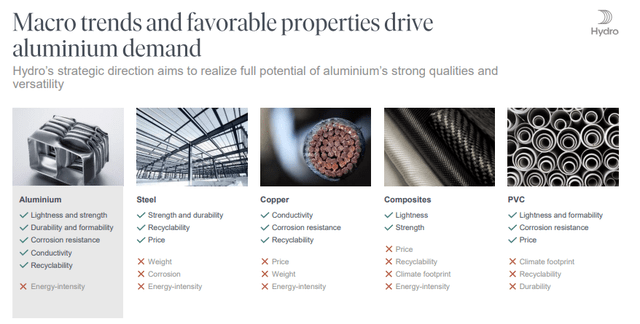

First off, Hydro has a massive advantage going into this sort of environment that it’s clear that we’re currently having. The company is a commodity business in many commodity segments and sub-segments, including recycling of their own product, and with an international production basis. This means that they are theoretically in the best possible situation for taking advantage of whatever weakness this market presents.

While macro and energy pressures are getting “real”, and of course, Ukraine doesn’t make it any easier either, there are significant advantages to Hydro’s current set of operations.

Norsk Hydro is one of the better companies prepared for these ongoing pressures. We’ve seen this very clearly. The company also has its own electricity generation in its portfolio, which in some parts insulates its Aluminum production from the issues faced by other companies.

Also, a lot of company capacity is also located in South America, which further separates the company from Europe and the potential issues we currently see here.

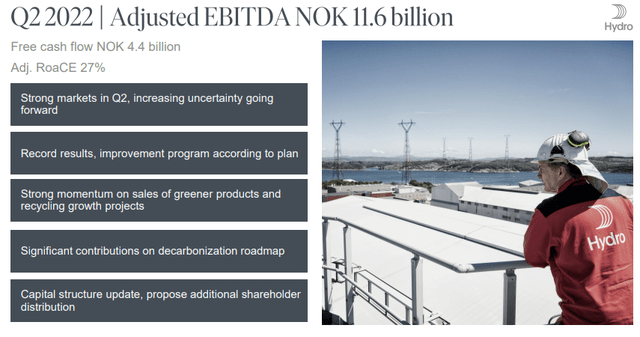

We do not yet have 3Q22 results – though these are forthcoming, and I may provide an update at that time. Adjusted 2Q22 EBITDA was significantly up YoY, together with return metrics. In fact, the company recorded record results in both core segments of Aluminum metal and Extrusions, owing to the strong 1H22 market, but with a lot of ongoing uncertainty as we move forward.

What I want to focus on here is the foundational strength of the company which makes it a great long-term investment no matter which way things go. Because let me be very clear here – I consider Hydro to be an appealing “BUY”, even if the last time I really pounded the drum for the company was when it traded closer to around 25-30 NOK/share, which is around half the current share price.

However – markets were in one position at the time, and they’re in another position now.

There are key trends that push Hydro upward from here, including things like:

- Superb results from the improvement program coupled with record quarterly results (Hydro’s 2025 improvement program is estimated to deliver on its 2022 target of ~$700M).

- Strong momentum from EU-supported greener products/commodities, coupled with ongoing recycling projects and EU plans to introduce tariffs and punitive measures toward imported metal, puts Hydro at a distinct advantage.

- Strong ESG trends – the reason I mention this is because these trends are important to how the company is taxed going forward.

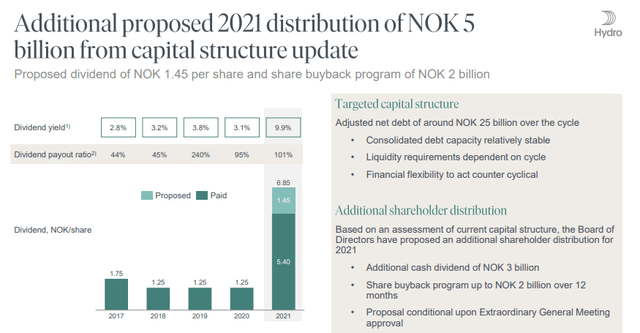

- Superbly appealing capital structure with a recently proposed additional dividend, showcasing how the company currently, and intends to distribute future excessive proceeds from the current macro.

Pricing for metal/alumina is up, and the stronger margins the company is presenting are despite any and all input increases, including power and upstream costs.

While the company expects this strong trend to not necessarily last, it’s clear to me that the current trends are very good, and provide an excellent backing against future volatility.

China remains one of the major deciding factors for exactly how the company “does”, on a high level. The ongoing fears of recession and weak demand in China led to a large drop in base metal prices for the past quarter, and the outlook for some aluminum production capacity remains uncertain as high global energy prices put pressure on smelter margins, resulting in producers in Europe and the US curtailing parts of their production. The same is true for Hydro.

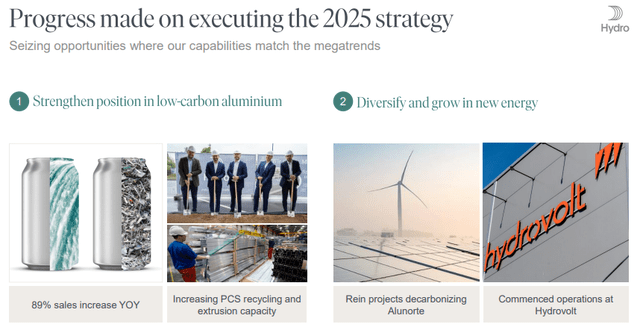

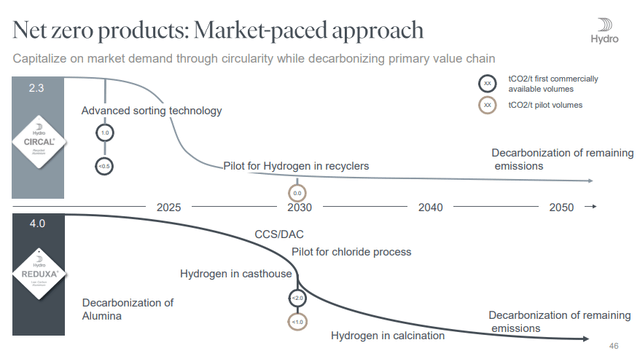

So a large part of Hydro’s current strategy is risk management. Part of this, of course, is the low-carbon aluminum pushes and moving into new energy as the current market is growing ever shorter of renewable capacity. Greener aluminum with a lower carbon footprint is still seen as a key enabler for the green transition. 2Q22 saw increased demand for greener products, Hydro CIRCAL and Hydro REDUXA. These were up nearly 90% YoY, and this supports the company’s expectation of reaching sales doubling by 2025.

Straight recycling is also going forward. In July of 2022, construction started for the expansion of the aluminum recycling plant in Rackwitz, Germany, enabling the plant to produce 25,000 tonnes of HyForge per year, and increasing the recycling capacity of post-consumer scrap. The company also pushed more capacity into Årdal in Norway, increasing the capacity here by 25,000 tonnes per year, which puts a potential 50,000+ tonnes of annual capacity within the company’s reach. This also includes the recent buy of Alumetal S.A. Following the launch of a tender offer for 100 percent of the shares of the company at the start of the second quarter, Hydro announced in July that it will extend the subscription period to October 10, 2022, in order to provide additional information requested by the European Commission. This is today, the day I’m writing the article. No new information has been published yet, but I’m expecting this to go forward as well, as there are a few issues conceivable that would completely halt this process.

Hydro is essentially a play on the current energy trends going on, as well as the volatile supply/demand situation. Visibility, I argue, has very rarely been lower for the past 15 years that I have had Hydro in my sights. The company has slightly updated its capital structure, retaining focus on a BBB or above-rating from major credit institutes, and working with adjusted net debt to EBITDA of less than 2X, reflecting the current interest rate situation we’re going into. However, Hydro has probably one of the best liquidities in the entire sector, with a solid dividend floor that’s well-covered by recurring earnings – and with a company willing even to take on debt to fund this.

As such, NHYDY shareholders are well-covered in their investment if they buy the company at a good price. While NA growth rates for demand in extrusion remain on par, Europe has been updated and now expects negative growth for the coming quarters, as well as negative growth for the full year of 2022. But the underlying trends for this company are so positive, that I see a sub-60 NOK share price as much more appealing than I did a few months back. Remember, my initial position in Hydro had a cost basis of less than 24 NOK/share and was an incredible overall investment seeing the returns I was able to get.

I’m still very eager to get back fully into Norsk Hydro, and make it a 3-5% portfolio position once again – but I will not do so at a price that could derail my returns for the coming few years if the cycles invert and we look at years of substandard performance.

Updating Company Valuation

We’re down from highs of over 80 NOK and are currently hovering around the 60 NOK mark. Catalysts to bring about significant changes are likely to be pricing trends in 2H22, but even in the case of significant changes in conjunction with the next quarterly, at worst this will be a long-term oriented “BUY” opportunity for Hydro.

There is volatility to Hydro – that is not in question. The volatility in forecasting Hydro is very evident when you look at the analysts’ accuracy here – because analysts usually (50%+) miss negatively on their forecasts for the company. It doesn’t help that current forecasts call for a 3-year EPS growth rate of essentially 0% on average.

But Hydro is in the enviable position of being among the world’s foremost Aluminum businesses with exposure to renewables, and recycling, while being part-owned by the Norwegian state and paying out a pretty good dividend. There is very little “real” long-term risk here.

Remember, analysts, even many of my colleagues, did not like this stock when it was priced at 25-35 NOK/share. That’s when I bought it, knowing the fundamentals and the substance of this company and going against the grain. Yet now, when it’s still priced at more than twice the price I paid, analysts suddenly love the company with 8 out of 13 analysts still considering it either a “BUY” or an “outperform” here.

Today, I’m more willing than before to agree with such an assessment for Hydro. But remember, less than 6 months ago, this company still had an average PT of 93 NOK, owing to arrange from 67 NOK to 120 NOK. Laughable, truly, compared to when the average target was below 30 NOK, less than 2 years ago.

I lower my targets slowly – and I raise them slowly. As of this article, we have an average range starting at 50 NOK and going to triple-digit 100 NOK numbers. I would consider anywhere from a 60-65 NOK to be a decent price, and below 60 NOK to be a “good” price for what this company offers you. The average price we’re looking at from S&P Global here is 74 NOK. I consider this to still be somewhat on the high side and would argue that you don’t want to go above 65-68 NOK, 68 if you want me to give you the “last” price that I would personally buy the company at.

I like how much the company has fallen, and how quickly it has done so. My previous target for Hydro was 68 NOK – and I’m still sticking to this PT here. That makes the company a “BUY” for me, but a volatile one, and I’m not going back in just yet.

Thesis

My current stance on Norsk Hydro is the following:

- Norsk Hydro is currently fairly valued to normalized future earnings going into 3Q22. While current trends are cyclical and will turn around eventually, there is enough value in the company to become positive here.

- The potential returns from today’s levels are now acceptable compared to what other investment alternatives in the market offer us.

- At its current valuation, Norsk Hydro is a “BUY” with at least the beginnings of what I consider to be an attractive upside.

Remember, I’m all about:

- Buying undervalued – even if that undervaluation is slight and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

- If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

- If the company doesn’t go into overvaluation but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

- I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (italicized).

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has a realistic upside based on earnings growth or multiple expansion/reversion.

Be the first to comment