Pgiam/iStock via Getty Images

Most sentiment indicators are signaling that we are at bear market lows. I have pointed this out in numerous articles over the last two months (Articles on Market Sentiment). However, one important sentiment indicator is not there yet. It’s the CBOE equity puts to calls ratio, which is one of the seven components in our Master Sentiment Index.

It is a highly important component since it measures what investors are “doing” not what they’re “saying” or “thinking,” like the AAII and Investors Intelligence surveys. It could mean we have another shoe to drop before this bear market is over, which ultimately brings up something that’s been worrying me for some time – global systemic risk.

But first, what is the equity puts and calls ratio and what does it measure?

The Puts to Calls Ratio

Put and calls are options with “calls” basically being bets stock prices will rise and “puts” being bets that stock prices will decline. There’s a lot more to options than this, but it will suffice for our purposes. Measuring how many puts versus calls investors are buying can tell us a lot about what they expect stock prices to do.

The puts to calls ratio was developed by market technician Martin Zweig and published in two Barron’s articles in 1971. This was three years before the CBOE was established, so the option statistics he used were over the counter. I remember the article causing quite a buzz, since it was a second way to measure investor expectations similar to the short-selling indicators.

The indicator is based on the theory of contrary opinion, i.e., that stock prices will bottom when too many people are bearish and there’s an excess amount of put buying. Plotting the P/C ratio over time gives us a basis to determine what is “a lot” and what is “a little.”

The Equity CBOE Puts to Calls Ratio (Michael McDonald)

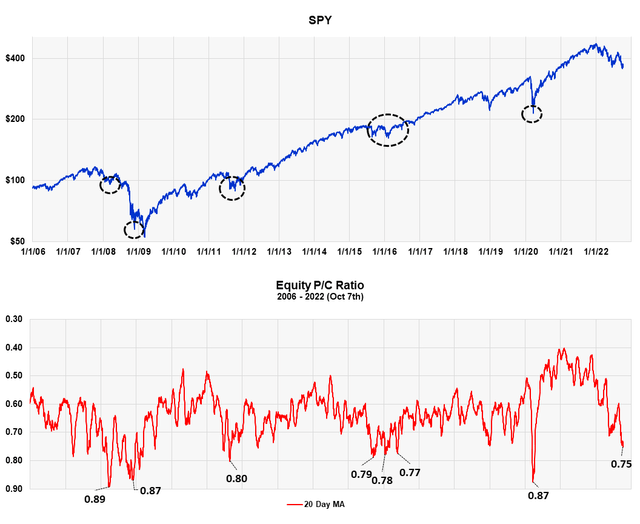

The red line in the chart is the ratio of puts to calls of all equities on the CBOE from 2006 to present. It does not include index options or exchange-traded funds (“ETFs”), so it’s like the original index introduced by Marty Zweig in 1971. We use a 20-day moving average of daily ratios. This smooths out random fluctuations and gives us a better long-term metric. The scale is inverted, meaning high ratios are at the bottom, low ratios at the top.

The ratio on October 7th of .75 is the highest ratio since this bear market started in January but it is still short of the ratios that occurred at other major lows. For example, it went to .87 at the bear market low in March 2020. It also registered .89 and .87 at two different times in the two-year, 2008-09 bear market. It is also less than the levels reached in the 2011 and 2016 market corrections.

This opens up the idea that, from the point of view of this indicator, further price declines would generate more put buying pushing the ratio higher generating a clean buy signal. I am now open to this idea. I normally wouldn’t be, but there is discernible risk today of something that I’ve been worried about for some time – the Fed triggering a global systemic event.

Global Systemic Risk

Systemic risk is the sudden collapse of the entire banking system of a country due to failures in interlocking financial agreements and obligations. The collapse can only really occur when these agreements and obligations have been structured using excessive borrowing and leverage.

The collapse usually occurs quickly – within a few days or a week – and few see it coming. The loss of $800 billion in bank capital and the bankruptcy of the American banking system in 2009 essentially occurred in just five days. It was the overnight emergency passing of TAARP, plus Fed liquidity measures, that halted the collapse and ultimately brought about recovery.

The risk today is having something like this happen to the global financial system. Here, however, there’s no world governing body or global Fed who has the power to rescue the system.

The scary part to me is that the independent actions of the major world Federal Reserve banks, acting in the very best interest of their own country or region, could trigger such a global collapse. Their well-intended actions to help their own economies could backfire in unintended way.

I intuitively know such a thing is coming at some point; in fact, I wrote a Seeking Alpha article in 2010 about it. Such a systemic collapse is almost inevitable with the creation of an interlocking global banking system with no one in charge. I’m just not sure if this is it.

Could an Overly Hawkish Fed Trigger a Global Instability?

The recent strong dollar and the Federal Reserve actions to raise rates are intimately connected. Nothing drives currencies higher or lower than changes in interest rates, and the dollar index is up 24% against other currencies over the last fifteen months. They’re not doing it for this reason, however. They are just following Congress’s mandate to control American inflation and maintain maximum employment. A higher dollar is just a side benefit. It actually helps lower inflation, since the price of imported things goes down a little.

But it can cause great problems for foreign economies. Since oil is traded in U.S. dollars, foreign countries not only have to pay the higher oil price but also the higher price to buy American dollars to purchase the oil. It’s a double whammy. What systemic effect this may have on the interlocking world economies is unknow.

But I don’t feel the Fed is thinking this way. If a hawkish Fed goes too fast and too far and creates a currency crisis that triggers a global event, the consequences to the American economy and financial system would be tremendous. They may save the American economy, but kill it in another, unexpected way.

Summary

History shows a bear market doesn’t usually end with an equity puts to calls ratio this low (.75). To get it higher further price declines are probably necessary.

What seems like a possibility today is a sudden unexpected global crisis triggered by a Federal Reserve focused only on the American economy and not the world scene.

Correct Federal Reserve actions from this point forward are critical. One should be on the lookout for any major country’s banking situation that could lead to a systemic global collapse. Especially watch for further rate increases by the Fed and the effect it has on the dollar and indirectly, other world economies.

I recommend staying hedged until the situation becomes clearer.

Be the first to comment