Tim Boyle/Getty Images News

Thesis

In August I have argued that AT&T (NYSE:T) stock is a value trap and that the company does not provide investors with an attractive risk/reward opportunity. Since my article, T stock is down approximately 20%. But I do not change my thesis — In fact, today I downgrade AT&T stock to ‘Sell’.

While AT&T competitive challenges persist, rising interest rates should be the company’s biggest concern. In this article I discuss what you need to know about the AT&T’s crushing debt position; and why I believe the stock could go as low as $7.47/share.

Seeking Alpha

AT&T Has Too Much Debt

For a long time, given a zero/low-cost interest rate environment, firms could expand their debt position with no major impact on business fundamentals. But conditions have changed rapidly in 2022, as the yield on US treasuries (10-year reference) surged from about 1.66% in January to 3.88% as of October 2022. Moreover, it remains yet to be seen if the current yield has touched a ceiling. In my opinion, it could very likely be that yields push higher for another one to 2 percent.

Higher interest rates will be a major headwind for AT&T, which is one of the U.S. most indebted companies. From 2012 to 2022 (TTM reference), AT&T net debt position exploded from $65.6 billion to $158.2 billion. Over the same period, AT&T interest expenses only increased from about $3.2 billion to $6.5 billion. Dividing $6.5 billion of interest expenses by $158.2 billion of net debt, the company’s current cost of debt is calculated at about 4%.

However, now that investors can get a 4% yield even on ‘riskless’ US treasuries, investors will likely demand a much higher yield for lending money to AT&T. That said, the past risk premium for AT&T debt versus treasuries has been somewhere between 3 to 4 percent. And I see no reasons why this should be lower in the future. (In fact, technically the risk premium should be higher, given that the combination of high debt plus high interest rates makes AT&T debt riskier as compared to high debt and low interest rates previously)

The Impact Of Higher Interest Costs …

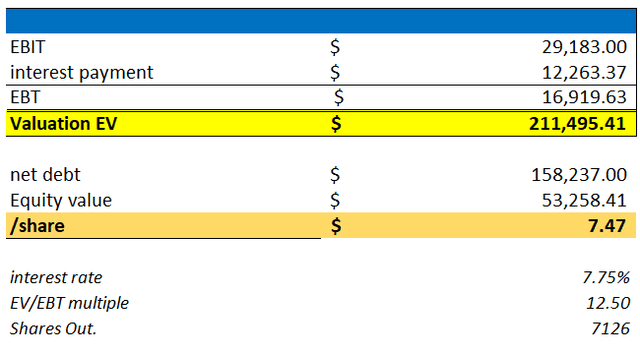

So, what will happen to AT&T’s business profitability when the cost of debt rises? The answer can be found through the application of a simple but effective thought exercise: (1), find AT&T’s cyclical adjusted operating profitability (pre-interest expenses); (2), estimate a fair implied cost of debt; (3), multiple the cost of debt by the company’s net debt position to estimate the annual interest payment, and; (4), deduct the annual interest payment from the company’s cyclical adjusted operating profitability in order to calculate the earnings capacity available for the amortization of outstanding debt and shareholder’s equity.

(1) To find AT&T’s cyclical adjusted operating profitability, I argue it is fair to take the average of the past 5-year’s operating income, which I calculate is $23.995 billion.

(2) Personally, I believe that AT&T’s cost of debt will rise to 7.75%, given the arguments presented in the previous sections. But please note that later when I structure a valuation, I will also present a sensitivity table that varies the cost of debt.

(3) Based on a 7.75% cost of debt and a $158.237 million net debt position as of June 30, 2022, I calculate the annual cost of debt for AT&T at $12.263 million.

(4) Now, if we deduct the annual cost of debt from AT&T’s cyclical adjusted operating income, AT&T’s estimated earnings capacity (earnings before tax) is $16.919 million. For reference, in 2021 AT&T generated earnings from continuous operations of $21.479 million, and for the trailing twelve months, the respective metric is $17.824 million.

… On Valuation

Based on the previous exercise an investor could calculate a fair implied share price for T stock.

In theory, an investor’s expected annual return from investing in a company is the ratio of 1 divided by the EV/EBT multiple (assuming no growth). For example, if an investor requires a return of 10%, then the EV/EBT multiple must be x10.

Following this train of thought, what is a fair return for investing in AT&T? Well, I have argued that debt holders will soon require 7.75%. I argue that equity holders would like more — in order to be compensated for the higher risk. So, 8.0% would be acceptable? We also know that the headline dividend yield on T stock is 7.4%. So, in my opinion 8.0% would indeed be a reasonable anchor.

In order to get an 8.0% annual return, AT&T’s EV/EBT multiple should be x12.5 (calculation: 1/0.008)

Previously we have calculated AT&T’s sustainable EBT at $16.919 million. Given a x12.5 EV/EBT multiple, the firm’s enterprise value is $211.595 million, which after net debt of $158.237 million implies an equity value of $53.258 million, or $7.47/share.

Thus, if AT&T’s cost of debt indeed rises to 7.75%, and investors require an 8% annual return, then T stock would need to fall an additional 50% from current levels of $14.90 share to make the risk/reward acceptable. (I am sorry, this is just mathematics.)

AT&T financial statements; author’s calculation

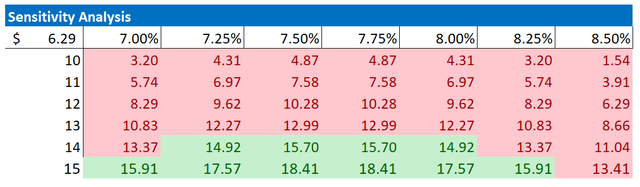

I understand that an investor might want to assume a different cost of debt for AT&T’s net debt, and/or require another EV/EBT multiple. So, I would also like to provide readers a sensitivity table. For reference, red-cells imply an overvaluation as compared to the current market price, and green-cells imply an undervaluation.

AT&T financial statements; author’s calculation

Risks To My Thesis

My argument for why T stock could fall another 50% from current levels assumes that the company’s cost of debt pushes to 7.75%. This is not unreasonable, in my opinion. But investors should consider that the thesis is made and broken by the actions of the federal reserves. Specifically, how high will the fed funds rate go?

Accordingly, investors interested in T stock should closely follow monetary policy in the U.S, which is strongly influenced by inflation (so also watch inflation). If the interest rate environment would return to 2020/2021 levels, then AT&T stock’s implied fair valuation would quickly jump to $25/share – $30/share.

Investors should consider that it will be very difficult for AT&T stock to sell assets in order to repay outstanding debt. After AT&T has spun out Warner Bros. (well done), most of AT&T’s asset base is composed of goodwill ($92.7 billion) and other intangibles ($128.9 billion). Moreover, as asset prices are falling across markets, and capital markets start to freeze, any sale would likely need to be made at distressed valuations.

Conclusion

AT&T stock looks attractive with a greater than 7% headline dividend yield. But the more I think about AT&T’s unsustainably high net-debt position, and also reflect on rapidly rising interest rates, the more bearish I get.

I have previously argued that AT&T stock is a value trap, and initiated coverage with a ‘Hold’ recommendation: AT&T Stock: No Growth, High Debt, A Value Trap. But today, I do not feel a ‘Hold’ recommendation adequately reflects the company’s challenges due to a crushing net debt position. If AT&T’s cost of debt rises to 7.75%, which I think it will, AT&T stock could fall as low as $7.47/share.

Be the first to comment