memoriesarecaptured

Shares of The Scotts Miracle-Gro Company (NYSE:SMG) have been anything but miraculous over the past year. The company enjoyed strong performance in the immediate aftermath of COVID as countless households spent time beautifying their gardens and yards with so many other activities closed. As that demand has proven to be a one-time burst and operation missteps around the marijuana business have mounted, shares have plunged. At this price though, they may be worth consideration for investors with high-risk tolerance.

Fiscal third quarter results were terrible. Overall sales were down 26% to $1.19 billion. The U.S. consumer business fell 14% to $905 million, and its Hawthorne cannabis business reported a 63% fall to $155 million. Hawthorne provides equipment and supplies to the legal cannabis industry, hoping to profit from its growth, but results have been terrible. Too many cannabis cultivators were licensed by many states, creating supply gluts and feeding the illicit market to avoid taxes.

Hawthorne was built assuming a $1-1.5 billion run-rate in revenue, but it’s down to a $600 million run-rate. As a result, management estimates the unit carries $65 million in excess cost. While at one point they hoped to separate the business, on the third quarter call, management conceded it is not feasible with the unit performing this poorly. The hope is to get operating margins back to 15% in two years as part of Project Springboard, which aims to cut costs and stabilize the balance sheet. Right now, the unit is essentially running at breakeven.

While Hawthorne’s results are disastrous, the Consumer unit is still ugly. Consumer volumes are down 20%, with price up 6%. One challenge has been that retailers have reduced orders to normalize their inventory. Retail inventories are down 12% from a year ago, and expected to fall a few percentage points further this quarter before rebounding next year. The worst of the inventory drag should be passing.

At the same time, the company may have pushed too hard on price. Sold-through dollars fell 6% as volumes fell 8%. That implies a 2% pricing benefit. However, the company has raised product prices by 18%. This has caused consumers to trade down to cheaper products, essentially wiping out 90% of the benefits. Essentially, I think management had priced its products assuming the unwavering post-COVID demand would continue, and instead it normalized. That left prices too high and retailers cutting inventory. Fortunately, customer volumes did improve sequentially during the quarter, suggesting we are nearing the nadir in this unit.

Due to the loss of operating leverage, the consumer business reported a 32% drop in segment profits. Management’s goal is to restore this unit to high-20% operating margins from the high teens. This will likely take a couple of years to achieve.

One thing I view favorably is when management admits they made a mistake. On the third quarter call, CEO Jim Hagedorn did just that, saying:

“There were some challenges that emerged this year, several of them actually that we could not have anticipated. In other cases, especially with Hawthorne, we misread the market which drove investment decisions that I’d reverse if I could but I can’t. What I can do and will do is focus on the proactive steps we can take to get this business back to an acceptable level of profitability.”

Now, talk is cheap. On top of this, Hagedorn announced there would be no bonuses for management this year, saving $60 million. Actions like that build trust – management gets the severity of the problem. Then, at the end of August, SMG announced its CFO, Cory Miller, would be leaving the company, sparking a search for a new CFO. Rarely is a surprise senior management change good news, and sure enough, alongside this news, the company cut its free cash flow guidance to a negative $275-325 from -$150 million previously, which had been given just four weeks earlier, due to a reduction in accounts payable. All other aspects of guidance were reiterated. SMG seems to be clearing the deck and beginning to take action to address operating and strategic failures.

The difficulty is that the company carries $3.5 billion of debt against just $400 million book equity and a $2.3 billion market capitalization. Frankly, at the start of the year, the company should have issued equity to pay down debt and strengthen its balance sheet. This high debt total greatly restricts management’s flexibility. This elevated debt load combined with falling profits is pushing Debt-to-EBITDA leverage to over 6x. Management has a long-term target of 3.5x, but this will take at least two years to achieve.

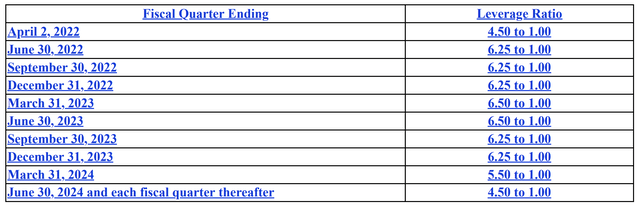

This forced the company to amend its credit facility to maintain access to its revolver, permitting leverage to peak at 6.5x. In exchange, its interest rate on its revolving facility increased by 0.35% and term loan by 0.50%. The company is also restricted to paying an annual dividend of $225 million. Its current dividend costs about $150 million, so it can be maintained as part of the credit agreement. Frankly, I would like to see the company suspend its dividend and use that cash to accelerate debt paydowns. Restoring balance sheet health should be the primary priority to give management operating breathing room, but I do not view this action as likely. All buybacks and M&A are paused.

Now, management plans to reduce debt by generating $1 billion in free cash flow over the next two years. This is based on an ongoing free cash flow run rate of $300 million, and $400 million of one-time inventory unwind. Importantly, about 2/3 of that inventory reduction comes from the consumer unit, where trends seem to have stabilized, and just 1/3 from Hawthorne, where inventory reductions may be harder to come by. While that poses up to $100 million of downside risk, this plan should be broadly achievable.

So where does that leave the stock? Essentially, Scotts operates two business: traditional garden care and cannabis supply. If we do a sum of the parts analysis, segment profits for the U.S. consumer unit have been $621 million YTD. This should translate to $700 million of full-year profits. Assuming they can recoup 5% of the lost 10% in margins (i.e., half of the goal), that’s $850 million of potential profits. Subtracting out unallocated corporate expenses and taxes makes this a $600 million run rate business. If we value Hawthorne at $0, the consumer unit is trading with an enterprise value to run-rate income of 9.7x. At 12x, recognizing management missteps will keep it with a discount valuation, it is a $66 stock, or 60% upside from here. That may seem wildly optimistic, but the stock was there on August 31st.

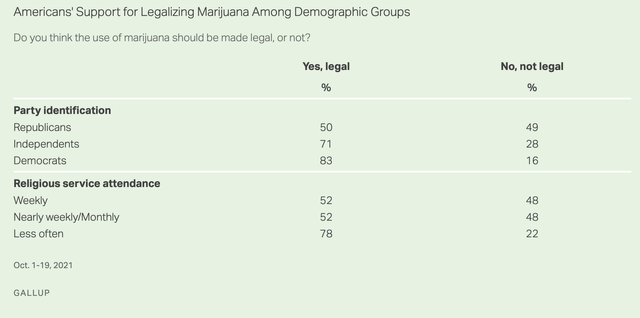

Given the Hawthorne unit is running around breakeven, I think it is hard to argue the business should have a negative valuation. On the positive side, last week President Joe Biden announced he would pardon anyone solely convicted for a marijuana possession charge while urging governors to do the same. Polling has moved considerably on marijuana legalization, with even a majority of Republicans in favor. If next year there is federal legalization, that could open more markets and solve some of the oversupply issue plaguing the industry.

For now, though, after management overbuilt it so dramatically, Hawthorne is a “show-me” story, and I expect investors will be hesitant to assign much value to the unit until we see positive catalysts materialize and help results. I think investors in SMG should view the core business as worth $66 and view Hathorne as akin to a call option, worth zero for now, but potentially adding further upside to the stock.

Over the next 12-18 months, SMG will be working primarily to fixing its balance sheet, improving working capital, taking out cost, and restoring margin. As the company executes on this, even using my assumption they achieve just half of their margin target, I believe markets can move SMG shares meaningfully higher. While the stock won’t return to $100 absent some cannabis recovery, they can rally 60% from here based on the consumer business.

Be the first to comment