Olemedia

One thing is clear amid a hyper-volatile market: it’s not the right time to invest in low-quality stocks. Many high-growth tech names have been battered all year round, and there is plenty of value to be found in high-performing names. Smaller, more speculative plays, however, should be keenly avoided.

This is how I view Veritone (NASDAQ:NASDAQ:VERI), a small-cap software company with a market cap of just about a quarter billion dollars. The company describes itself as an AI platform in which companies can build and deploy AI applications – but in reality, while this product exists and contributes to a good chunk of revenue today, Veritone had its roots in ad-tech and also recently expanded into a recruiting software application.

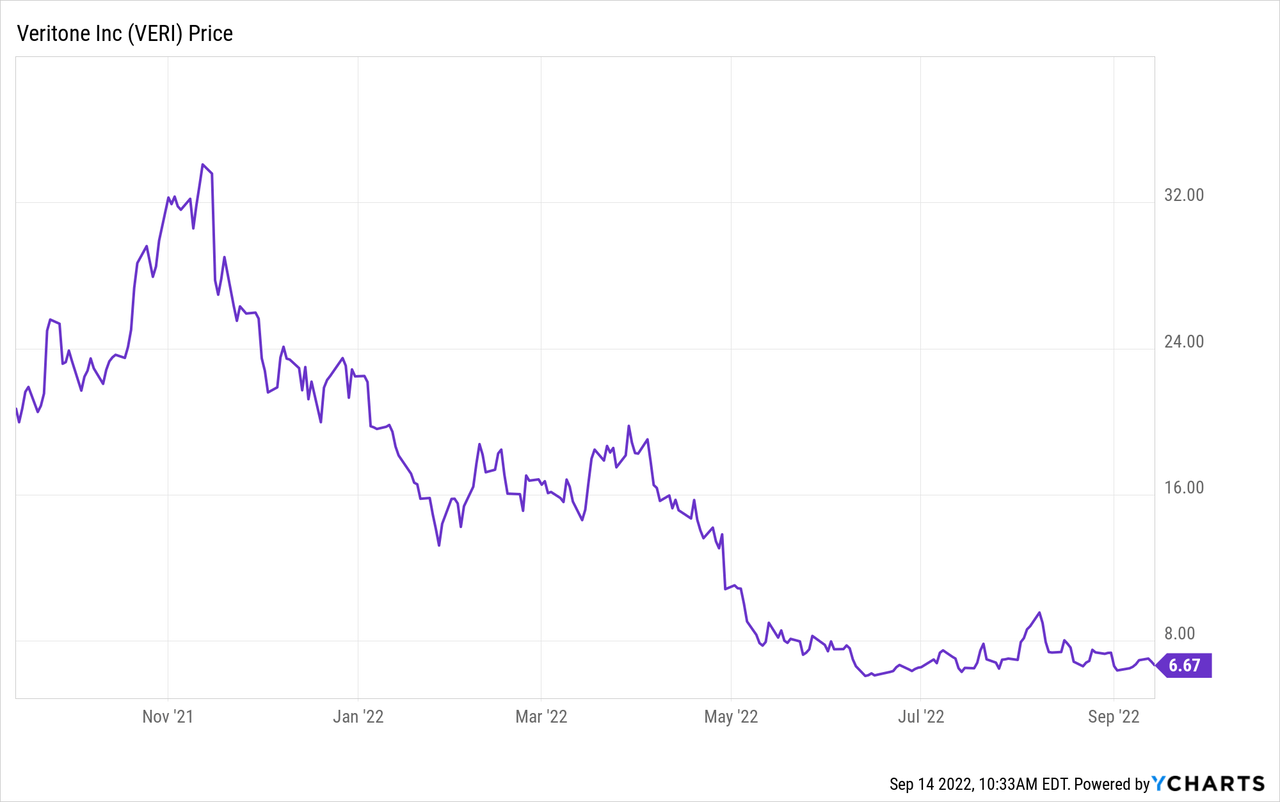

Year to date, Veritone has shed roughly 70% of its value – a reflection of investors’ loss of faith in its ability to execute. I have low confidence in the stock’s ability to rebound, especially when so many fellow SaaS peers have much stronger fundamentals and are trading at attractive valuations.

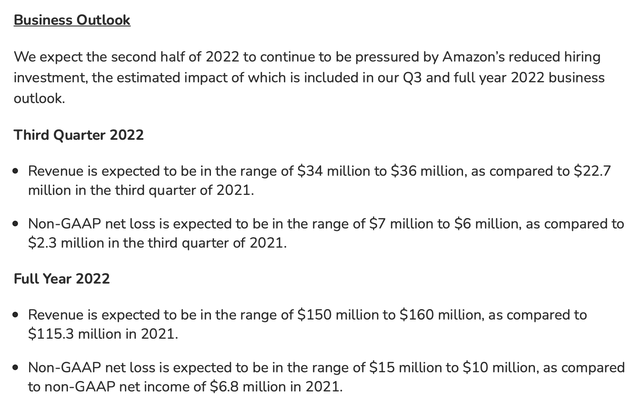

I remain bearish on Veritone. This is especially true after the company’s latest Q3 guidance update. The company noted that revenue growth will decelerate to +54% y/y (from 78% y/y in Q2) – note as well that this revenue growth is bolstered by the company’s acquisition of PandoLogic, and underlying organic growth is actually much weaker. The main driver for the downside guidance – with full-year revenue now expected at $150-$160 million (+34% y/y) versus Wall Street’s expectations of $179.1 million (+55% y/y) – is a dramatic slowdown in spend from PandoLogic’s largest customer, Amazon.

Veritone outlook (Veritone Q2 earnings release)

There are a number of key risks driving the bear case for this stock:

- Deep customer concentration. Veritone only has just shy of 600 total customers. A slowdown in spend from Amazon alone was enough to drop its full-year guidance by $30 million (the prior outlook for the year was $180-$190 million), and that was only with a half-year impact to the financials, with the slowdown occurring in mid-Q2.

- Confusing product portfolio. While Veritone rallies its brand around its aiWARE (“AI operating system”), the company’s newly acquired PandoLogic product is essentially a job advertising/recruiting tool. It also has another product, Veritone Voice, that helps create voice tracks for audio advertisements. In my view, Veritone has become an unwieldy portfolio of small products that is very confusing for an IT buyer to get behind.

- Debt-funded. Veritone has recently stressed the fact that it’s well capitalized, but that is only due to a recent massive convertible debt raise. Its $220.5 million of cash is counterbalanced by $195.7 million of debt, so its net cash profile is actually quite thin.

On paper, Veritone seems cheap. At current share prices near $7, Veritone trades at a market cap of $243.9 million. After netting off the $24.8 million of net cash on its books, the company’s resulting enterprise value is $219.1 million. This represents a 1.4x EV/FY22 revenue multiple against the $155 million midpoint of Veritone’s latest guidance. It appears cheap, but it’s cheap for a reason.

The bottom line here: Veritone remains a lower-tier software vendor that is far outclassed by more prominent names in AI, such as IBM (IBM), C3.ai (AI), and others. Now is not the right time to take a chance on a speculative, debt-laden play, especially as it is facing a demand slowdown from its most important customer. Steer clear here.

Q2 Download

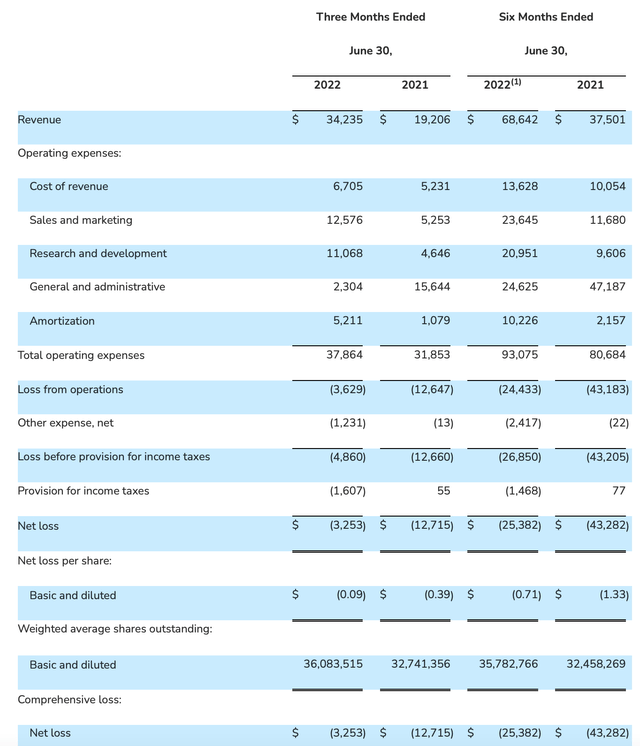

Let’s now go through Veritone’s latest quarterly results in greater detail. The Q2 earnings summary is shown below:

Veritone Q2 results (Veritone Q2 earnings release)

Revenue grew 78% y/y to $34.2 million, missing Wall Street’s expectations of $38.2 million (+99% y/y) by quite a wide margin. Again, most of this growth was fueled by PandoLogic, which closed in September 2021 and has no prior-year compare.

The main headwind to the quarter, as previously mentioned, was a slowdown from Amazon. Per CFO Mike Zemetra’s prepared remarks on the Q2 earnings call:

As mentioned, we did face some headwinds in Q2 with our largest customer, Amazon, which ran initiatives to reduce its hiring across its fulfillment business beyond the levels we had previously forecasted. Our updated second half 2022 guidance reflects the current estimated run rate of the Amazon hiring consumption. Also, we closed a small, but strategic acquisition at the end of the quarter that we believe will accelerate our synthetic voice strategy.”

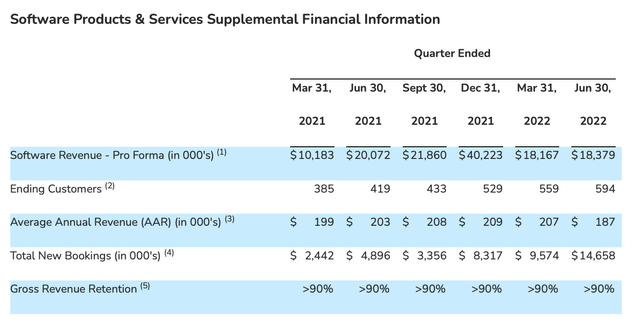

We note as well that the company’s software revenue declined year over year: software revenue of $18.4 million was down -8% y/y versus $20.1 million in the second quarter of last year.

Customer growth also was clipped, with Veritone adding only 35 net-new customers in the quarter. Average revenue per customer also fell -10% y/y to $187,000, as shown in the chart below:

Veritone key metrics (Veritone Q2 earnings release)

It’s worth pointing out that Veritone’s cash burn pace also quickened. In the first six months of FY22, the company burned through -$6.3 million of free cash flow versus just a -$1.3 million burn in the first half of FY21.

Key Takeaways

There’s too much to be wary of when it comes to Veritone and not enough to like. In my view, Veritone remains an unproven company with a second-tier, sprawling portfolio of smaller products. It is tethered to a few large spenders like Amazon, and it’s also saddled with substantial debt. Continue to avoid this stock.

Be the first to comment