Ryland Zweifel/iStock via Getty Images

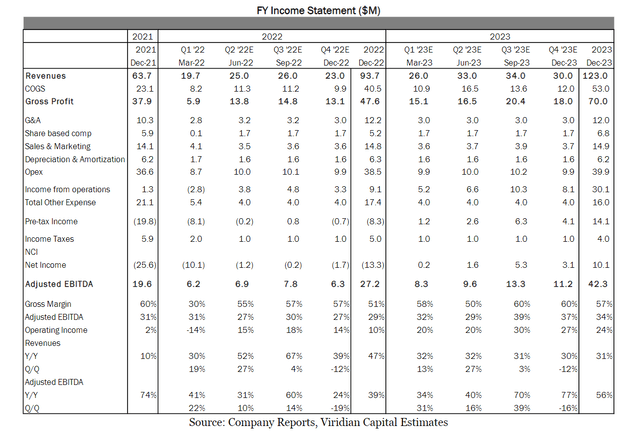

Cansortium (OTCQX:CNTMF) reported Q1/22 un-audited results of $19.7M in revenues and $6.2M adjusted EBITDA. Revenues were in line with expectations while adjusted EBITDA exceeded our estimate of $4.9M. Management also reiterated full-year 2022 guidance of between $90M and $95M in revenues and adjusted EBITDA in the range of $25M to $28M. We continue to believe guidance reflects extreme conservatism as it does not include any contributions from new dispensaries (management expects to open between four and six new Florida stores before yearend) and we are confident that over the past three months Cansortium has at times generated revenues at closer to a $120M annualized run rate in Florida. We believe the run rate will increase further in the coming months particularly as enhanced production capabilities come online. Official results remain delayed by auditors however we believe any further issue with actual reports is unlikely and anticipate a resolution on the audit delay will come in the coming weeks.

In addition to earnings, we hosted Cansortium’s CEO Robert Beasley and CFO Patricia Fonseca for a series of investor meetings this week. Meetings furthered our view of Cansortium as an underappreciated growth story in the space and specifically highlighted the successful turnaround for Cansortium and the company’s favorable position in Florida. According to OMMU data, Cansortium’s flower sales are up more than 100% since enhanced cultivation capacity came online this winter and the company is gaining meaningful share in the state. The latest weekly sales data reflects a roughly 4% share in Florida which positions Cansortium as the sixth biggest operator in the state. We expect further growth and share gains will come in the coming weeks and months on further production enhancements, repeat customer interest now that the company can offer a greater and more consistent breadth of inventory and the opening of additional retail stores. At the investor meetings, Mr. Beasley highlighted a long-term target of roughly 45 dispensaries in Florida (vs. 27 today) which would put the company roughly in line with other top operators in the state (aside from Trulieve). We believe this store opening goal and the requisite cultivation expansion is fully feasible particularly if the company sells its Texas license in the near term with proceeds being used to pay off what has to-date been restrictive debt.

Meanwhile, the story looks attractive even without further expansion. Cansortium is growing in Pennsylvania, having recently opened its third dispensary, generated initial cash during Q1/22, and was one of the most profitable companies within our coverage during the quarter. Despite positive momentum, Cansortium’s stock continues to underperform making the company one of the cheapest plays in US cannabis. Cansortium now trades at an EV/EBITDA multiple of just 4.1x our 2022 estimates and 2.6x 2023. Valuing Cansortium’s market cap based on licenses alone in either Florida or Texas (estimated at roughly $50M and $70M respectively) puts the price well above current levels before even considering operations. We are confident that further execution will bring enhanced awareness and greater interest while the resolution of the audit issue or any M&A activity in the near term can provide a more immediate catalyst. We adjust our model to reflect the preliminary results while our rating and price target Buy and $1.50 respectively.

Takeout or Partnership in Play

We continue to view Cansortium as an attractive takeout partner for any MSO that is either looking for an entry into Florida at an immediate scale or for an existing operator in the state to quickly expand and make a viable challenge at Trulieve’s position in the state. This is true particularly if Cansortium’s valuation remains depressed.

Cansortium is currently trading on a market cap basis of less than the $55M cash paid by Planet 13 to acquire Harvest’s Florida. Meanwhile, while Cansortium’s $67M debt position is not insignificant, the terms are not particularly onerous for any operator aside from Cansortium (it limits the company’s additional financing capabilities in the near term), as the 13% rate could soon be attractive and the 2025 maturity is likely to be funded by Florida operation cash flows at that time. As previously stated, we believe a likely resolution for Cansortium in the near term is to sell its Texas license to pay off debt and then turn around and take on less onerous debt to fund expansion initiatives.

Along with a traditional exit via acquisition, a new takeaway from investor meetings was that, given improved fundamentals and operations, Cansortium could be in play for a merger of equals inclusive of other limited state operators that would benefit from enhanced consolidated scale in the form of capital and investor access. We have highlighted a likely increase in these types of transactions in US cannabis particularly if/when SAFE does not pass this year and if interest rates again become prohibitive for smaller operators as rates across the economy increase. For Cansortium, a merger of this form could help with funding growth initiatives and position the company for greater investor interest when greater institutional investment does enter the market.

Company Reports, Viridian Capital Estimates

Required Research Disclosures

|

Distribution of Ratings/IB Services |

||||

|

IB Services in Past 12 months |

||||

|

Rating |

Count |

Percent |

Count |

Percent |

|

Buy (Buy) |

15 |

100% |

0 |

0% |

|

Hold (Hold) |

0 |

0% |

0 |

0% |

|

Sell (Sell) |

0 |

0% |

0 |

0% |

|

Not Rated (NR) |

0 |

0% |

0 |

0% |

Analyst Certification

The research analyst responsible for the content of this research report, in whole or in part, certifies that with respect to each security or issuer that the analyst covered in this report: (1) all of the views expressed accurately reflect his or her personal views about those securities or issuers and were prepared in an independent manner, including with respect to Bradley Woods & Co. Ltd.; and (2) no part of his or her compensation was, is, or will be, directly or indirectly, related to the specific recommendations or views expressed by the research analyst in this report.

Meaning of Ratings

Bradley Woods & Co. Ltd.’s rating system of Buy, Hold, Sell, Not Rated reflects the analyst’s best judgment of risk-adjusted assessment of a security’s 24-month performance.

Buy: A Buy recommendation is assigned to stocks with low risk and approximately 10% expected return or stocks with high risk and approximately 25% expected return. The analyst recommends investors add to their position.

Hold: A Hold recommendation is assigned to stocks with low risk and less than 10% upside or less than 15% downside or to stock with high risk and less than 25% upside or less than 15% downside.

Sell: A Sell recommendation is assigned to stocks with an expected negative return of approximately 15%. The analyst recommends investors reduce their position.

Not Rated: A Not Rated recommendation makes no specific Buy, Hold or Sell recommendation.

Compensation or Securities Ownership

The analyst(s) responsible for covering the securities in this report receives compensation based upon, among other factors, the overall profitability of Bradley Woods & Co. Ltd. including profits derived from investment banking revenue and securities trading and market making revenue. Unless noted in the Company Specific Disclosuressection above, the analyst(s) that prepared the research report did not receive any compensation from the Company or any other companies mentioned in this report in the previous 12 months, or in connection with the preparation of this report. Unless noted in the Company Specific Disclosuressection above, neither the analyst(s) responsible for covering the securities in this report, nor members of the analyst(s’) household, has a financial interest in the Company, but in the future may from time to time engage in transactions with respect to the Company or other companies mentioned in the report.

For compendium reports (a research report covering six or more subject companies) please see the latest published research to view company-specific disclosures.

Other Important Disclosures

This report is provided for informational purposes only. It is not to be construed as an offer to buy or sell a solicitation of an offer to buy or sell any financial instruments or to particular trading strategy in any jurisdiction. The information and opinions in this report were prepared by registered employees of Bradley Woods & Co. Ltd. The information herein is believed by Bradley Woods & Co. Ltd. to be reliable and has been obtained from public sources believed to be reliable, but Bradley Woods & Co. Ltd. makes no representation as to the accuracy or completeness of such information.

Bradley Woods & Co. Ltd. is regulated by the United States Securities and Exchange Commission, FINRA, and various other self-regulatory organizations. This report has been prepared in accordance with the laws and regulations governing United States broker-dealers.

Opinions, estimates, and projections in this report constitute the current judgment of the author as of the date of this report. They do not necessarily reflect the opinions of Bradley Woods & Co. Ltd. and are subject to change without notice. In addition, opinions, estimates and projections in this report may differ from or be contrary to those expressed by other business areas or group of Bradley Woods & Co. Ltd. and its affiliates. Bradley Woods & Co. Ltd. has no obligation to update, modify or amend this report or to otherwise notify a reader thereof in the event that any matter stated herein, or any opinion, projection, forecast or estimate set forth herein, changes or subsequently becomes inaccurate.

Bradley Woods & Co. Ltd. does not provide individually tailored investment advice in research reports. This report has been prepared without regard to the particular investments and circumstances of the recipient. The securities discussed in this report may not suitable for all investors and investors must make their own investment decisions using their own independent advisors as they believe necessary and based upon their specific financial situations and investment objectives. Estimates of future performance are based on assumptions that may not be realized. Furthermore, past performance is not necessarily indicative of future performance. Investment involves risk. You are advised to exercise caution in relation to the research report. If you are in any doubt about any of the contents of this document, you should obtain independent professional advice.

Bradley Woods & Co. Ltd. salespeople, traders and other professionals may provide oral or written market commentary or trading strategies to our clients that reflect opinions that are contrary to the opinions expressed in this research. Bradley Woods & Co. Ltd. may seek to offer investment banking services to all companies under research coverage. Bradley Woods & Co. Ltd. and/or its affiliates expect to receive or intend to seek investment-banking related compensation from the company or companies mentioned in this report within the next three months.

This research report (the “Report”) is investment research, which has been prepared on an independent basis by Bradley

Woods & Co. Ltd., a member of FINRA and SIPC, with offices at 805 Third Avenue, 18th Floor, New York, NY USA, 10022. Electronic research is simultaneously available to all clients. This research report is provided to Bradley Woods & Co. Ltd. clients and may not be redistributed, retransmitted, disclosed, copied, photocopied, or duplicated, in whole or in part, or in any form or manner, without the express written consent of Bradley Woods & Co. Ltd. Receipt and review of this research report constituted your agreement not to redistribute, retransmit, or disclose to others the contents, opinions, conclusion or information contained in this report (including any investment recommendations, estimates, or target prices) without first obtaining express permission from Bradley Woods & Co. Ltd. In the event that this research report is sent to you by a party other than Bradley Woods & Co. Ltd., please note that the contents may have been altered from the original, or comments may have been added, which may not be the opinions of Bradley Woods & Co. Ltd. In such case, neither Bradley Woods & Co. Ltd., nor its affiliates or associated persons, are responsible for the altered research report.

This report and any recommendation contained herein speak only as of the date of this report and are subject to change without notice. Bradley Woods & Co. Ltd. and its affiliated companies and employees shall have no obligation to update or amend any information or opinion contained in this report, and the frequency of subsequent reports, if any, remain in the discretion of the author and Bradley Woods & Co. Ltd.

Bradley Woods & Co. Ltd. may effect transactions in the securities of companies discussed in this research report on a riskless principal or agency basis. Bradley Woods & Co. Ltd.’s affiliated entities may, at any time, hold a trading position (long or short) in the securities of the companies discussed in this report. Bradley Woods & Co. Ltd. and its affiliates may engage in such trading in a manner inconsistent with this research report. All intellectual property rights in the research report belong to Bradley Woods & Co. Ltd. Any and all matters related to this research report shall be governed by and construed in accordance with the laws of the State of New York.

This report is not directed at, or intended for distribution to or use by, any person or entity who is a citizen or resident of, or located in any locality, state, country, or other jurisdiction where such distribution, publication, availability, or use would be contrary to law or regulation or which would subject Bradley Woods & Co. Ltd. and its affiliates to any registration or licensing requirements within such jurisdictions.

The Bradley Woods Form CRS, Client Relationship Summary, can be accessed here.

Be the first to comment