HJBC

At a market cap of $152.502 billion, French oil and gas company, TotalEnergies SE (NYSE:TTE), is ranked as the fifth largest energy company in the world. However, the stock trades well under its US-based peers. Most investors in the US only invest in US stocks, avoiding exchange rate risks, tedious tax admin and an additional market to study and keep track of.

Stock trend year to date (SeekingAlpha.com)

However, when a substantial undervalued opportunity arises, it may be the plunge-taking factor. TTE has strong earnings, back-to-back sales growth over consecutive quarters, attractive quarterly dividend yields and has rewarded investors with 18.21% in returns year-to-date. Furthermore, the company is actively taking on significant forward-looking investments to participate in the growing renewable energy market. Although alternative energy sources rub many oil and gas enthusiasts the wrong way, TTE is growing its energy pie rather than reducing its oil production. While alternative energies are crucial to growth, the development and maintenance of oil are equally critical to the company, such as the significant oil discovery off the coast of Namibia earlier this year. With a finger in every pie, I think this stock has a lot more upside potential, and therefore, investors may want to take a bullish stance.

Overview

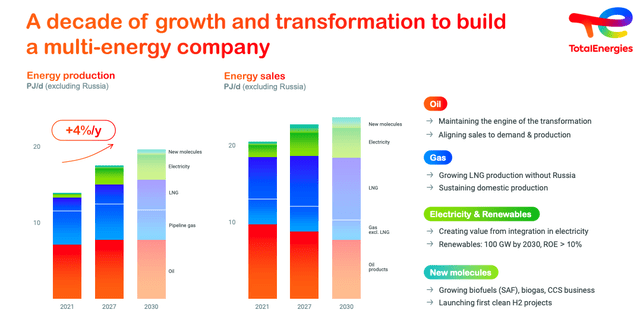

TTE was founded in 1924 as a French government initiative to engage in oil exploration. Today the government has no stake in the company. TTE has made significant changes over the last eight years, moving towards becoming a multi-energy company. Traditionally more than 66% of the company’s sales came from oil products, 33% from gas and a tiny percentage from electricity. The goal by 2030 is for oil to account for 30% of revenue, natural gas at 50%, electricity at 15%, and biomass and hydrogen at 5%.

Move towards a multi-energy company (Investor Presentation 2022)

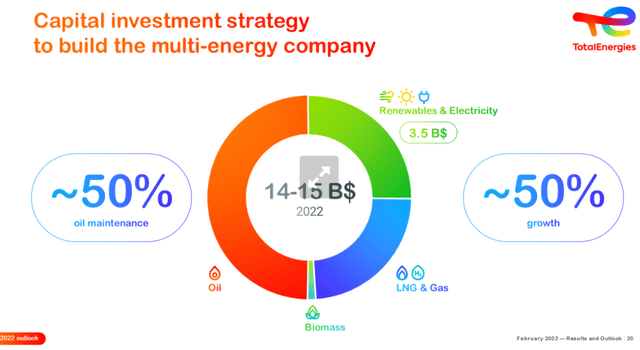

Due to record-breaking cash generation from its traditional oil business, the company is making substantial growth moves organically and through strategic acquisitions. As seen in the chart below, it is investing CAPEX in the maintenance of oil production and new energy sources.

Balanced Energy Growth Plans (Investor Presentation 2022)

Earlier this year, TTE bought 50% of Clearway Energy (CWEN) for $1.6 billion via Global Infrastructure Partners (GIP), increasing its renewable energy portfolio in the USA to 25 GW. Below we can see an equal emphasis on continuing to develop new oil projects for which global demand is expected to grow by 20% between now and 2040.

Developing new oil projects (Investor Presentation)

Financials and valuation

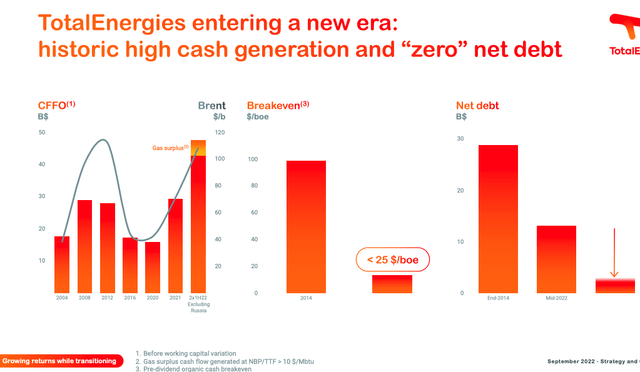

TTE has had a brilliant financial few years. It has generated historically high cash flow and has very little net debt. This past third quarter, it doubled its profits on a year-on-year basis to $9.9 billion, primarily due to the increase in gas prices and the growth of its LNG business.

Cash generation and debt (Investor Presentation 2022)

TTE has a very healthy balance sheet. It has been reducing its net debt from almost $30 billion at the end of 2014 to $5 billion this past quarter. It had a net debt position of $24.3 billion. At the end of the third quarter of the current year, that net debt position has shrunken to just $5.0 billion. TTE increased its cash flow year on year by $1.5 billion to $17.8 billion in the third quarter. Cash flow from operations The LNG project in Qatar has had a significant impact on the company’s growth. This cash can be used in many ways, as seen below.

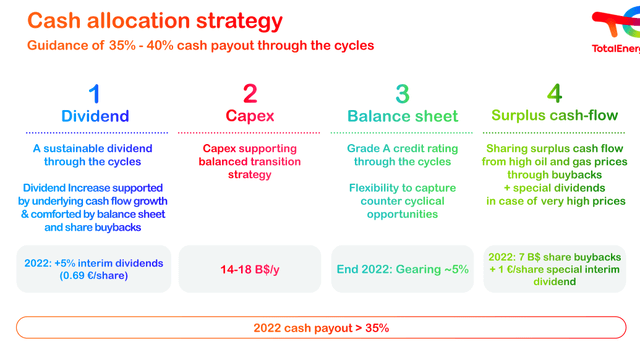

Cash allocation (Investor Presentation)

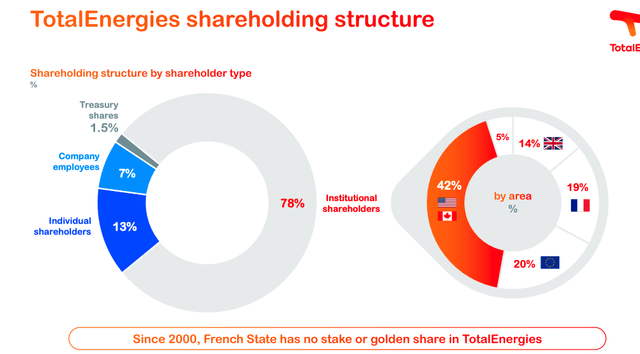

The company is in an excellent financial position to share additional value with its shareholders. In addition to the third quarter dividend of $0.69 per share, which increased by 5% from the prior year, the company has decided to set a special dividend of $1 this month. Below we can see the breakdown of the shareholder structure for TTE.

Shareholding Structure (Investor Presentation 2022)

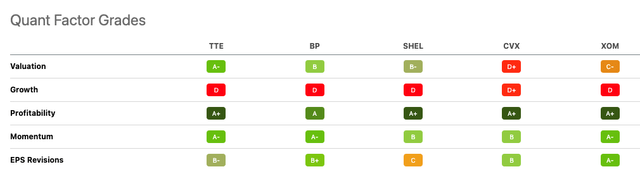

Using SeekingAlpha’s Quant factor grades, I have compared TTE to BP p.l.c (BP), Shell Plc (SHEL), Chevron Corporation (CVX) and Exxon Mobil Corporation (XOM). Below we can see that TTE has the highest-rated valuation grade of A- and an impressively high A+ quality for profitability. Across the five peers, we see a less attractive D grade for growth.

Quant Peer Valuation (SeekingAlpha.com)

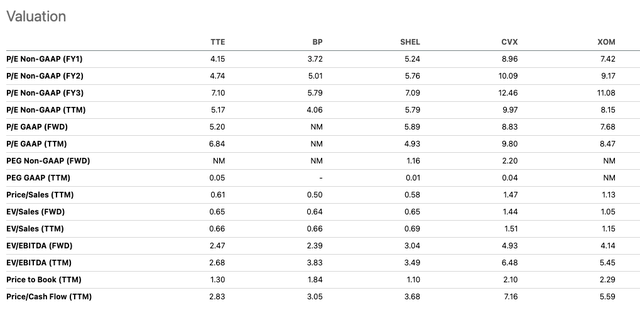

If we zoom into the valuation Factor grade, TTE has an attractive price-to-cash flow ratio of 2.83, indicating the company may be undervalued as the cash flow could not yet be fully considered in its current stock price. TTE is undervalued on almost every ratio compared to its US-located peers.

Relative Peer Valuation (SeekingAlpha.com)

Risks

Due to the volatile nature of the market, investing in oil companies can be risky. It is a favorable market for oil companies benefiting from high oil and gas prices. The market is heavily influenced by geopolitical factors such as the EU decision to ban Russian oil effective this month and oil production quotas by OPEC+. TTE has global production plants, which also have risks, such as unforeseen closures due to unrest, which the company experienced with its operations in Kashagan, Russia. These unexpected occurrences could hinder the healthy level of free cash flow. Furthermore, taxes, such as the recently introduced windfall tax in the North Sea region, can impact operations, as we can see with TTE’s decision to reduce its investments in the area by 25%.

Final Thoughts

TTE is ambitiously taking on the energy market through a more-is-more approach, generating vast amounts of cash from its traditional oil business and investing it back in maintaining its oil production while acquiring significant renewable energy assets around the globe. The company is still undervalued compared to its US peers in the oil industry. With a healthy balance sheet, strong cash flow and doubling its net income year on year this previous quarter, I think there is a lot more upside potential for this attractive stock and therefore also think investors may want to take a bullish stance on this stock.

Be the first to comment