John Penney

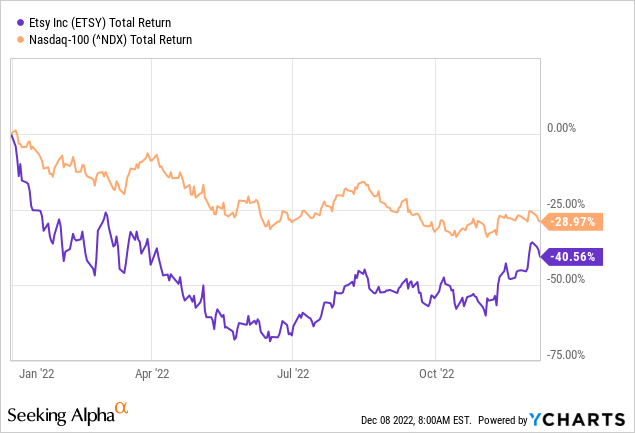

Etsy stock (NASDAQ:ETSY) has been beaten hard over the last 12 months by the broader Tech-market. However, it has recovered slightly since, with the stock climbing 35% in the last 30. Investing in Etsy provides promising upside potential. Arguments in favor of investing in Etsy include the ongoing E-Commerce transition towards Marketplaces, Etsy’s ability to operate its business at attractive unit economics, presenting an exception to the broader industry, and lastly, having positioned itself as the industry leader for creative goods. On the contrary, however, E-Commerce is and probably will remain a highly competitive space, which will impact their operating margins. Further, the times of massive growth for the space appear to be over, and it remains highly speculative if there will be another substantial shift in consumer buying behaviour towards creative goods.

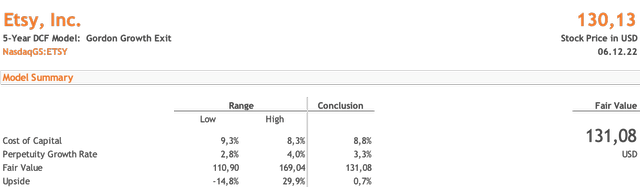

Overall, it seems that Etsy is currently priced fairly, given the current market conditions and the company’s performance, which is why at the current price of $136, I rate Etsy stock as “Hold.”

Market Potential & USP

Etsy is a unique online marketplace specializing in handmade, vintage, and customized goods. This focus sets it apart from other e-commerce platforms like Amazon (AMZN) or eBay (EBAY) and allows it to tap into a niche market with a strong demand for unique, personalized items. Additionally, the fact that Etsy is a platform specifically designed for creative entrepreneurs means it has a built-in community of sellers and buyers passionate about handmade and vintage goods. This can drive traffic and sales for sellers on the platform.

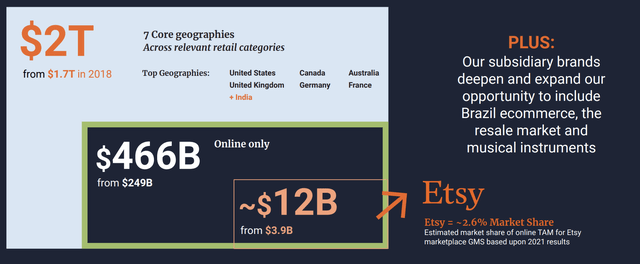

Furthermore, the market for handmade and vintage items is growing as more and more consumers are looking for unique, one-of-a-kind items that are not available in mass-market retailers. The increasing popularity of sustainable and eco-friendly products and a growing preference for personalized, individualized items fuel this trend. All of these factors point to a strong market potential for Etsy.

Another key advantage of Etsy is its commitment to supporting small businesses and promoting sustainable, ethical practices. This aligns with the values of many consumers, who are increasingly looking to support small, independent businesses and avoid buying from large, faceless corporations. Etsy can offer a valuable service and differentiate itself from other e-commerce platforms by providing a platform that connects these consumers with small business owners.

In conclusion, the market potential for Etsy is vital due to its focus on handmade, vintage, and customized goods, the growing demand for unique and personalized items, and its commitment to supporting small businesses and sustainable practices. These factors make it well-positioned to capitalize on the current trends in e-commerce and continue to grow and thrive in the future.

Etsy TAM (Etsy Investor Presentation)

Operating margin

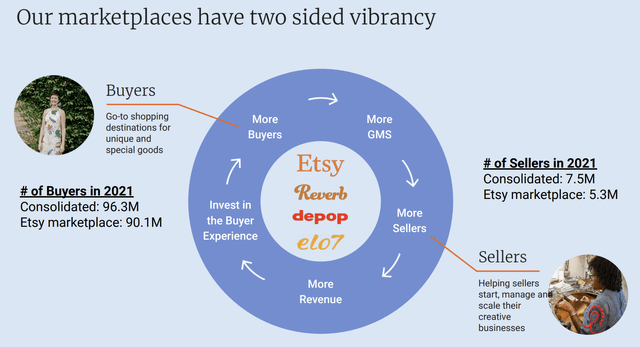

Etsy, one of the most prominent digital marketplaces for handmade and vintage goods, has an operating margin of 16%, significantly higher than many of its competitors. This higher margin is due in part to Etsy’s success in leveraging its technology and marketplace to offer a unique shopping experience to its customers. Furthermore, Etsy’s marketplace has a significant competitive advantage over other online retailers due to its focus on creating a customer-centric experience. This has allowed them to generate a higher operating margin than many of its competitors. Etsy’s ability to offer a wide variety of products and services to its customers has also helped drive its higher operating margin.

Etsy Marketplace (Etsy Investor Presentation)

Competition

Competition is a sizeable threat to Etsy’s long-term success because it limits its ability to attract and retain sellers and buyers on its platform. In the e-commerce industry, many other online marketplaces offer similar services to Etsy, like Amazon Handmade, eBay, and Bonanza. These competitors can lure away sellers and buyers with lower fees, more attractive features, or a more comprehensive selection of goods. This would ultimately reduce the traffic and sales on Etsy’s platform, negatively impacting the company’s profitability and long-term viability. Additionally, competition will drive down the prices that sellers can charge for their goods on Etsy’s platform. If many other platforms offer similar goods at lower prices, buyers may be less willing to pay a premium for the unique, handmade, and vintage items that are Etsy’s specialty. This can reduce the overall profitability of the platform and make it less attractive to sellers.

Etsy Competitors (LitCommerce)

Fading Growth

Etsy’s growth is slowing because the company is facing increasing competition from other e-commerce platforms, as mentioned above, which has led to a reduction in traffic and sales on Etsy’s platform, which can slow the company’s growth. Etsy’s growth may also be slowing because the market for handmade, vintage, and customized goods are becoming more saturated. As more and more consumers turn to online marketplaces for these items, the competition for buyers’ attention and spending is increasing. This can make it more difficult for Etsy to differentiate itself from its competitors and drive sales on its platform.

Looking to the future, it is difficult to predict precisely how Etsy’s growth will evolve. However, the company will likely continue to face competition from other e-commerce platforms and a more saturated market for handmade, vintage, and customized goods. To continue to grow and thrive, Etsy will need to continuously innovate and differentiate itself from its competitors to maintain its market position and appeal to sellers and buyers.

Valuation

Etsy’s fair valuation is at $131.08, with an upside to today’s price of 0.7%. Etsy has seen plateauing growth in recent quarters, driven by the stark rise of demand in e-commerce during the pandemic. Hence, with much-advanced change over the last two years, Etsy’s revenue will account for approximately 12% p.a. for the next five years. Further, increased competition will pressurize their currently strong margin profile, and as a result, I do not expect massive improvements on this side. Not to mention that the stock has been well received by the market and is currently trading at a premium to its peers. On the more positive side, there could be fundamental upside for Etsy as they are well positioned to benefit from the ongoing digital transformation of retail. Therefore, the stock looks fairly valued at its current price of $131.08.

Conclusion

Etsy is the most prominent marketplace for creative goods and benefits from the ongoing market transition towards marketplaces. Etsy has positioned itself as the industry leader for creative goods and has consistently performed well. Etsy’s ability to operate its business at attractive unit economics is rarely seen in the E-Commerce space and speaks in favor of the company. However, times of massive growth for the company appear to be over. While the company is set to continue growing, there is a risk that growth will slow down further. It is highly speculative if there is another substantial shift in consumer buying behaviour towards creative goods.

Be the first to comment