Justin Sullivan/Getty Images News

Investment Thesis

Costco Wholesale Corporation (NASDAQ:COST) delivers a middle-of-the-road fiscal Q1 2023 earnings report. For long-term shareholders, there wasn’t any substantially negative news here. After all, Costco prides itself in positioning itself for a win-win alongside its loyal customers.

In fact, this is Costco’s goal, not only to position itself to win with new customers but retain existing customers and grow mindshare amongst consumers.

With this in mind, the focus for this quarter’s results and the near term isn’t about rapidly growing on its topline. Instead, Costco’s strategy is about remaining extremely disciplined over its cost structure. And on this front, Costco delivered, as expected.

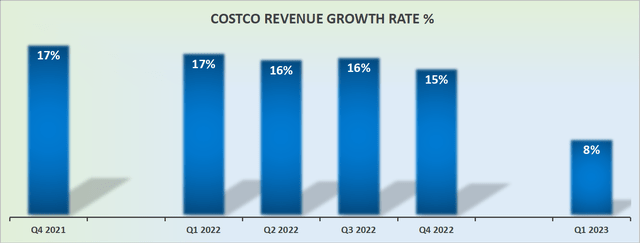

Revenue Growth Rates Remain Attractive

The graphic above reflects the inevitable slowdown in revenue growth rates that investors had expected going into this Q1 2023 earnings report.

On the one hand, these revenues were largely known beforehand, given Costco’s monthly sales reports.

On the other hand, it was yet another bearish consideration that Costco’s topline growth rates are struggling to match last year’s performance. That being said, this is Costco’s playbook.

That is, not to take advantage of its loyal customers in the downturn, so that it can gain market share and come out stronger once the macro factors, including inflation pressures, ease up.

The Focus Is Always On Margins

In last year’s Q1 2022 report, GAAP operating margins were 3.4%, while in this year’s quarter, operating margins were slightly compressed to 3.2%. Again, as noted in the introduction, Costco’s game is a long game. It’s not about winning on the quarter and losing sight of growing goodwill amongst its customers.

Meanwhile, lower down the income statement, Costco’s GAAP EPS was up just 3.0% y/y. That being said, both periods did have a few adjustments.

Consequently, on an adjusted basis, this year’s non-GAAP EPS was $3.10 up 4.4% from last year’s non-GAAP EPS of $2.97.

At the time of writing, we don’t have an update on the latest membership count. What we do know is that deferred membership fees are up 6.0% y/y, which is indicative of a solid increase in membership figures.

COST Stock Valuation — Too Rude To Ask

As an investor, I’ve never understood what’s a fair multiple for a high-quality business. If the business is growing its EPS at 10% CAGR, is one justified to pay more than +25x that EPS? And what about +30x EPS? Perhaps +40x EPS is the correct multiple?

Or perhaps, this line of thinking is nonsensical and redundant? Could it be that the mere act of thinking about valuation is to over-internalize this investment?

After all, Costco is a strong free cash flow generating company, with +30% ROE. Therefore, to bring up the question of valuation is heresy? It just misses the point!

Therefore, in an effort to avoid being a heretic, allow me to invert this question.

Does it make sense to postulate that Walmart (WMT) is growing its EPS at a very similar CAGR and is priced very approximately 23x forward EPS after adjusting for the different fiscal years? Nearly 10 turns cheaper than Costco at approximately 32x forward earnings?

The Bottom Line

When investing, absolutely nothing matters until the time it matters. The market latches onto an idea, and it becomes so ingrained that it becomes a self-fulling prophecy. And we all become believers.

Consequently, this is the only point that I believe it’s safe to declare, the majority of Costco’s shareholders are not in the name for quick gains.

They are in this name for wealth preservation. And therein lies Costco’s true bull case: knowing that investors can continue to dollar cost average into their holding and know that they are not going to get any rude selloff.

Be the first to comment