Alvin Man/iStock Editorial via Getty Images

Recently, IATA estimated that 2022 losses would narrow to $9.7 billion which is a $2 billion improvement from the estimate provided in October 2021. North American airlines are expected to lead the pack being the positive outlier with an estimated $8.8 billion in profits. Air Canada (OTCQX:ACDVF) could be one of those airlines benefiting from strong pent-up demand being released to the market. In this report, I have a look at Air Canada’s first quarter results.

Values in this report are denoted in Canadian dollars unless mentioned otherwise.

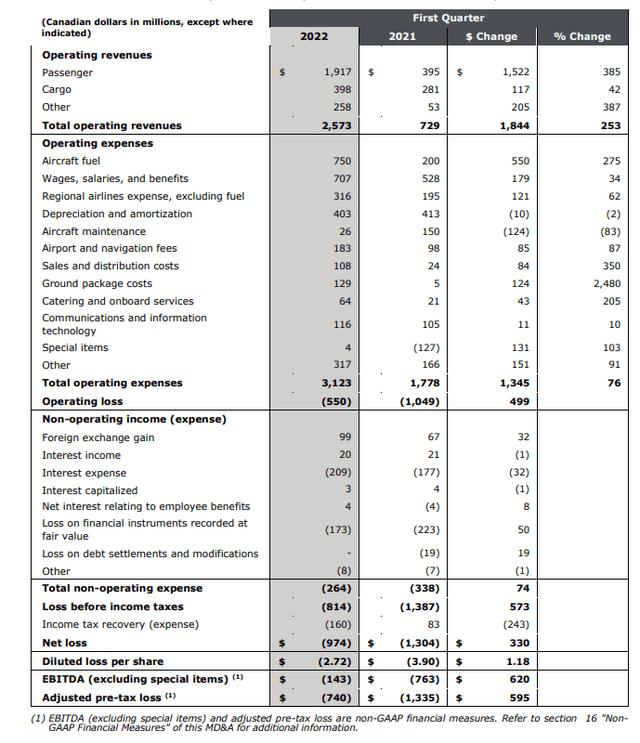

Air Canada Loss Tapers

Air Canada Q1 2022 results (Air Canada)

During the first quarter, revenues increased by $1.8 billion which was primarily driven by a 385% surge in passenger revenues. This was clearly the result of pent-up demand being released to the market offset by Omicron pressures while cargo revenues grew as Air Canada has been expanding its cargo capacity and cargo rates remained strong. On the cost end, Air Canada saw a 76% increase or $1.35 billion. So, despite a 55% surge in fuel prices and flight volume related cost increases Air Canada narrowed its operating loss helped by a 6.6% sequential decrease in adjusted unit costs and a 43% year-over-year increase in unit revenue.

Year-over-year figures provide some insight in how things did develop, but it’s hard to get a good view of the recovery because we’re comparing two different market environments and the 2021 numbers provide a low comparison basis. A comparison with Q1 2019, provides better insights into the recovery. In Q1 2022, revenues were 58% recovered. Passenger capacity was 55% recovered with revenues down 50% and traffic down 55%. This suggests that there still is a lot of space to increase capacity to benefit from pent-up demand and drive down unit costs excluding fuel.

In March, bookings were already 90% recovered from 2019 levels while advance tickets sales were exceeding the March 2019 levels by $200 million. This shows a strong base to increase capacity going forward.

Air Canada: Path of Prudent Capacity Expansion

Air Canada Boeing 737 MAX (Boeing)

What I particularly like about Air Canada is their awareness of being in a pent-up demand environment, which means that the company is not throwing capacity on the market at the fastest rate as the airline keeps in mind that the pent-up demand might cool in which case capacity is being brought to the market enabling some unit costs advantages but overall bring higher total costs that might not be offset by the topline growth. Air Canada expects to recover 73% of its 2019 capacity in the second quarter and have summer capacity of 80% of pre-pandemic levels. In North America where pent-up demand likely is strongest, the capacity will already be 90% recovered in summer and 70% recovered by September/October and 90% recovered for Atlantic in the second half of the year. So, there’s a lot of strength in North America and the Atlantic bringing capacity very close to pre-pandemic levels and Air Canada expects to be fully recovered by 2024 which is in line with the industry outlook.

Corporate demand is evolving in positive direction almost weekly and Air Canada also is seeing higher demand for premium products from its leisure travelers.

So, overall there’s a lot of improvement going to materialize in the second quarter partially offset by a high jet fuel price environment. Nevertheless, the Canadian carrier does expect that EBITDA margin will reach 8 to 11 percent in 2022 with adjusted CASM being 13 to 15 percent higher compared to 2019. Air Canada also pointed out that it sees strong demand this year, but its passenger revenues would not exceed pre-pandemic levels until somewhere next year.

Overall, from the Air Canada plans we see that the company is extremely prudent about providing step ups in capacity and driving down the unit costs in the process but also not overdoing that as pent-up demand could dry up providing a significant cost overhang. Another strong point is that while staff shortages have been major talking points with other airlines, Air Canada sees absolutely no issues on that end meaning that the airline can match its capacity with demand levels without seeing other constraints. At this point, that’s a very comfortable position to be in.

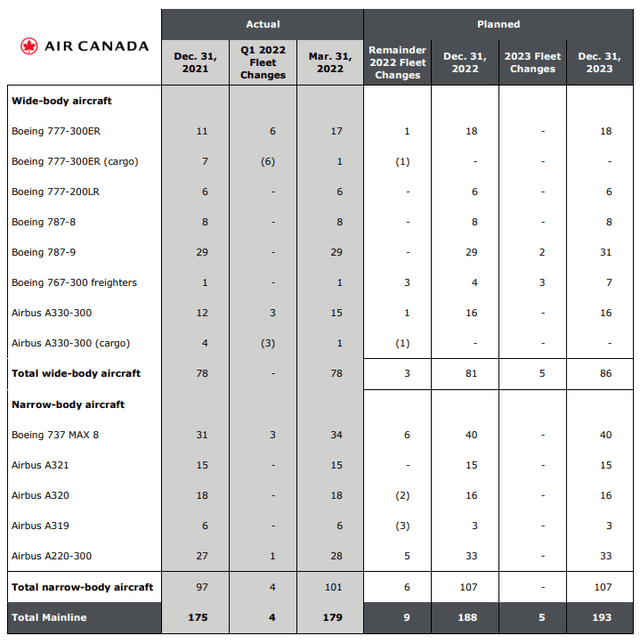

Fleet planning

Air Canada expects a strong recovery this year, but also is positioning itself for the longer term as becomes apparent from its fleet.

Air Canada fleet plan (Air Canada )

As Atlantic capacity will recover to 90% during the second half of the year, Air Canada is bringing back some passenger aircraft used for cargo services to passenger services. During Q1, six Boeing 777-300ERS and three Airbus A330-300s were brought back to passenger service. To offset the capacity loss, Air Canada has taken delivery of one Boeing 767-300 Freighter this year and expects another later this year. Also interesting to note is that Air Canada has no Boeing 787 deliveries planned this year even though deliveries are expected to recommence soon.

Air Canada Airbus A321XLR (Air Canada )

During the quarter, three Boeing 737 MAX aircraft were added to the fleet and another three are expected in the second quarter with the remaining three expected by year-end. Air Canada announced in March 2022, that it would acquire 26 Airbus A32XLRs. Twenty will be obtained via lessors while six had been previously ordered by Air Canada but were not disclosed and four were ordered in April 2022 by Air Canada according to data analytics tools from The Aerospace Forum. First deliveries are scheduled for 2024 and the airline has options for 15 more aircraft scheduled for delivery between 2027 and 2030.

During the pandemic, Air Canada backed off from the purchase of 12 Airbus A220-300s but decided earlier this year to take delivery of all of the jets. So, Air Canada is not fully recovered yet but it already has a strong fleet plan in place to position itself for growth compared to pre-pandemic levels and that’s nice to see.

Conclusion

Air Canada revenues tapered in the first quarter of the year compared to the previous quarter partially due to Omicron. However, the company has seen year-over-year costs losses taper and demand driven capacity expansion will drive up revenues and reduce unit costs. Air Canada is being prudent on their capacity expansion keeping in mind the pent-up demand environment. Simultaneously, the airline is assessing how it can efficiently absorb increased fuel prices through its revenue drivers. I would say that the airline is being very prudent in the cost and capacity management while staff shortages don’t seem to be a watch item for Air Canada at the moment allowing the airline to grow back to 90% in some areas this year already and be close to fully recovered in 2024 and have passenger revenue exceed pre-pandemic levels in the first half of next year.

I would say that Air Canada is the template airline of the recovery trajectory as expected by Boeing and various aerospace intelligence companies. What’s also compelling is that the airline is looking beyond 2024 and has fleet plans in place that allow the airline to grow in a cost efficient way and exceed pre-pandemic results. My only concern is Air Canada’s cargo segment. With high expectations of e-commerce having a cargo segment seems like a no-brainer, but we’re still in a cargo rate environment with very strong unit revenues and that has not always been the case. So, we need to see whether the Air Canada can manage its cargo business such that it remains an asset rather than a liability.

Be the first to comment