Scott Olson/Getty Images News

Price Drop

By now you probably know the news from the Wall Street Journal:

Sources indicated U.S. health officials will reject Juul’s application to sell tobacco- and menthol-flavored products after conducting a review period over two years.

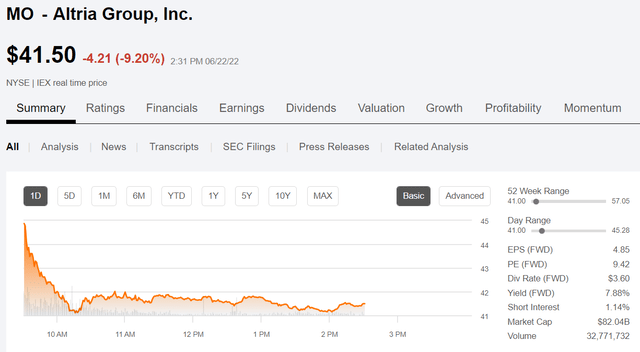

And, as a result, this happened to Altria (NYSE:MO):

Altria Price Drop (Seeking Alpha)

It’s been a bad day for MO shareholders. But, we must investigate if this is a fair response, or an overreaction. In this article, I’ll provide clarity, plus my opinion on valuation with an eye on the price.

Rough Four Years (Quick Personal View)

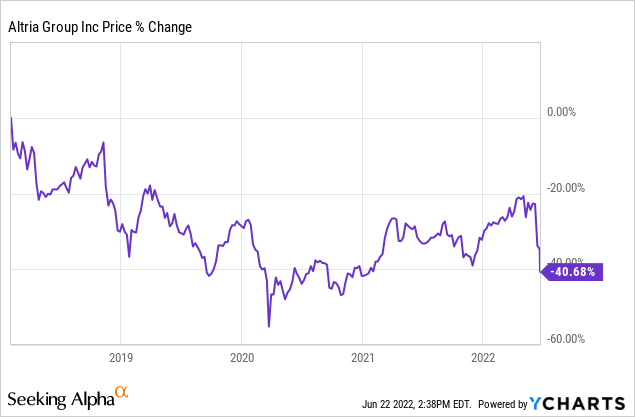

First, I want to make sure you know that I was wrong about MO. Back in 2018, I made the case that MO was compounding at 20%. I rated it a “BUY” although in my defense, and on a personal level, I said I was going to simply hold on to my shares. Here’s how that’s worked out since publication.

Since that time, MO is down 40%. However, that’s just price. Adding in dividends, MO is down about 15%, for a total annual rate of return of about negative 3.6%. That’s some context for what follows today.

Sales and Profits

On the one hand, Juul was very interesting to me because of the threat it posed to traditional cigarettes. Plus, the growth was astounding.

When MO first bought into Juul I was quite excited. But, not long after, I became quite unhappy because I found out that they invested $12.8 billion to grab 35% of the business. My gut told me that it was an outrageous amount. Juul certainly didn’t appear to be a $38 billion company, even with 75% of the e-cigarette market at the time. It pulled in $1.5 billion in revenue and the entire category was less than $3 billion in sales.

If we fast forward, here’s what we know about 2021:

Last year, Juul reported a net loss of $259 million and an 11% decline in sales to $1.3 billion, according to a disclosure the company made to employees.

Juul hasn’t exactly taken the world by storm since MO made their investment. The reasons don’t matter right now. All that matters, really, is the Juul isn’t making some tremendous contribution to MO at this time.

Two quick comments. First, MO has a market cap of about $82 billion. Second, total revenue for 2022 is expected to be around $21 billion. In other words, and speaking plainly, Juul contributes around 5-6% of all MO’s sales. The damning part is that it’s not dropping cash to the bottom line. Note the $259 million net loss in 2021.

Adding it all up, removing all Juul sales from MO will have zero impact on MO. In fact, the Juul net loss would go away, thereby increasing MO’s profits.

I admit I’m not doing some deep forensic analysis of Juul’s business. But, to paraphrase Warren Buffett, you know when a man is fat, even if you don’t know his exact weight. Here, we know Juul isn’t doing much for MO investors.

International Bliss?

The short answer here is that Juul sales outside of the United States are lackluster at best. Again, the Wall Street Journal helps us better understand:

The U.S. represents nearly all of Juul’s revenue, though its products are also available in Canada, the U.K., Italy, France and the Philippines.

If Juul is dead in the United States, it’s basically dead as a company. The point is that I don’t see some kind of renaissance or big shift, with Juul suddenly becoming a winning platform outside of the United States. If that was going to happen, it probably would have already happened.

Even if I’m wrong, finding its legs elsewhere will take time and money. Again, Juul’s not any good for MO investors because of sales that are being made outside of the United States.

Sensational News But Little Financial Impact

I want to stress again that Juul isn’t worth much to MO investors today. The business has already deflated but there has been hope there would be some kind of revival. It’s this “ideal future” and desire for growth that’s been shattered more than anything. Here it is again for absolute clarity:

An FDA order against Juul would be a blow for Marlboro maker Altria Group Inc., which in 2018 paid $12.8 billion for a 35% stake in Juul. The deal valued Juul at about $35 billion. Since then, Juul’s value has plummeted amid the regulatory crackdowns and declining sales. Altria valued its Juul stake at $1.6 billion as of March 31.

Sure, this hurts MO’s overall growth story and future potential. But, let’s face it, MO constantly faces terrible news, anger and frustration. This is a sin stock. Yet that’s also what drives down the stock price. Even as the hate piles on, the company relentlessly puffs out profits.

Yes, I am disappointed about Juul. But, it’s also kind of amusing because I’ve been disappointed about it for a long time. I think MO screwed up with Juul, mostly because of the exorbitant price they paid for the business. At the same time, it’s done very little for shareholders.

As a brief sidebar there are bigger problems for MO on the horizon. Here’s just one example of that:

The FDA is separately moving forward on a plan to mandate the elimination of nearly all nicotine in cigarettes, a policy that would upend the $95 billion U.S. cigarette industry and, health officials say, prompt millions of people to quit smoking or switch to alternatives such as e-cigarettes.

Quick Wrap Up

First, MO at just above $41 is a strong buy. This is a misguided price drop. While I’ve been wrong on MO before, I’m certainly not selling. And, in fact, I bought more today. In my opinion, it’s a smoking hot deal again.

Second, the yield is screaming at me. It’s an 8.6% yield and the P/E is below 10 right now. For income investors, this is a dream. Sure, the payout ratio is about 77%, based on some quick math. Seems a bit high, but it’s perfectly normal for MO, and other tobacco companies. No worries.

Third, there are some downsides. I’ve already mentioned the problem that comes with expectation violation. The market expected approval for Juul. The market hates uncertainty, but that’s what has been dished up. Personally, I don’t care too much about this. This kind of news is what makes Mr. Market go nuts, and then sell me shares at lower prices. Yippee!

Another downside, and perhaps a very important one, is that this impacts MO’s “reduced risk” aspirations. As Stifel analyst Chris Growe indicated:

“We contend this likely FDA announcement banning JUUL is a serious step back in the ability for Altria to participate in the vapor category,” he told clients.

I think it’s a step back, but perhaps not a serious step back. MO has other products, such as “ON!” which is a lower risk nicotine delivery mechanism. Ultimately, MO will navigate their way through this challenge, as always.

The last word, again, is that MO is a strong buy at $41.

Be the first to comment