Blue Planet Studio/iStock via Getty Images

Introduction

There are two categories of investors. One category, an overwhelming majority of investors, has never heard of or really investigated Constellation Software (OTCPK:CNSWF), a Canadian software company. The other group, a small minority, has thoroughly studied the company, its structure and unique characteristics and loves it. Now, I am fully aware that this sounds promotional but that’s not my intention. It’s just how I have seen it in my circle of investors. But don’t worry, we will also consider some risks in this article.

If you are in that small minority, you’ll love reading this article, as it’s from someone of your group, as I have been very impressed by what the company has achieved and how it’s operated. If you don’t know the company (and its stock) yet, I think this article might give you the most relevant aspects of the company to start digging deeper on your own.

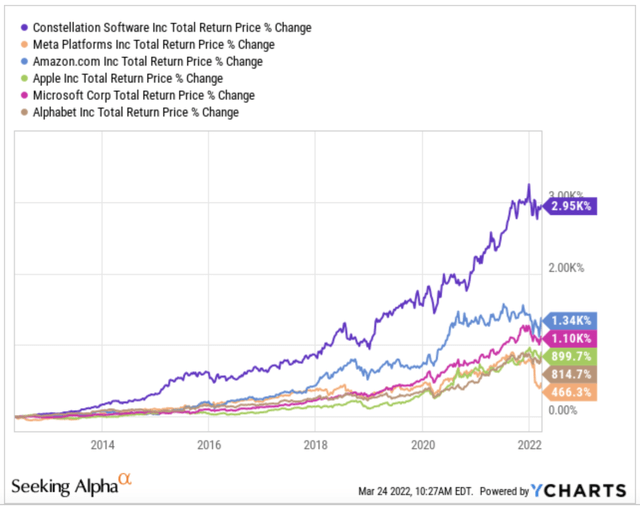

If Constellation Software has flown under the radar of the individual investor for many years, that’s no coincidence but due to its CEO’s obsession to keep the company out of the spotlight. However, despite flying under the radar, it is one of the best performing stocks of the last 10 years, comfortably beating FAAMG:

If you look back for the last 15 years, the stock has compounded at 35% per year. It still amazes us that the company is not given more credit in public markets, especially since it’s one of a kind. Let’s see what makes it so special.

Basic info about the company

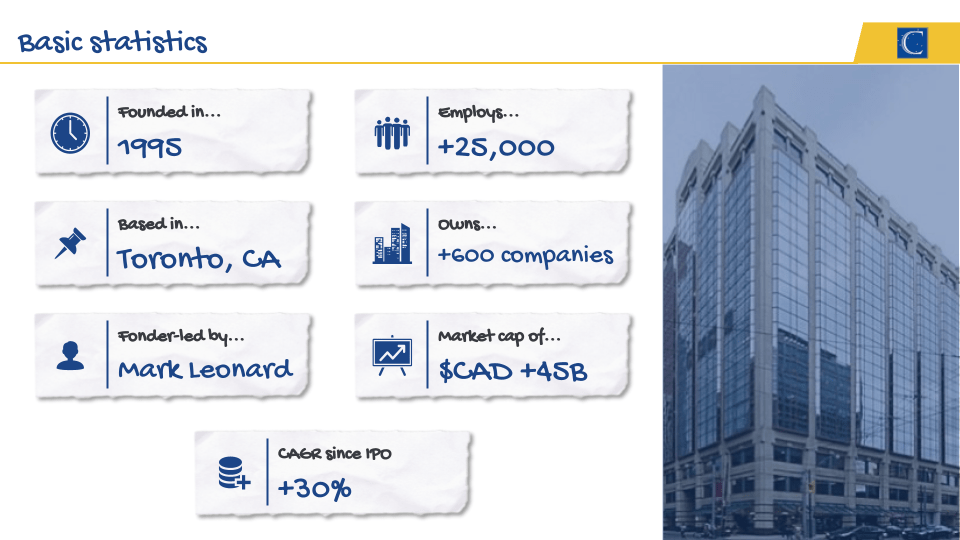

Company name: Constellation Software

Ticker: CNSWF in OTC markets in the US (unsponsored ADR) and (CSU.TO) on the Toronto Stock Exchange.

Made by Best Anchor Stocks

Company overview

Constellation Software is a serial acquirer of VMS businesses. VMS or Vertical Market Software is software that is used in niche markets. Think of the reservation software of your gym, employee benefits administration, property insurance, software for banks in Ecuador or education software in schools worldwide. And these are just a few of the thousands of VMS markets.

A company acquiring other companies, that doesn’t sound thrilling, of course. Immediately, we think of high leverage and a risky investment. I use ‘we’, dear reader, because I was the same when I initially heard what this company does and it almost was enough to not look deeper. But Constellation Software is different from other serial acquirers.

It enjoys a solid financial position, as Mark Leonard, the founder and CEO, has never been a fan of leverage to fund acquisitions. As a result, almost all of the company’s acquisitions are made with cash on hand and/or operating cash flow. Constellation’s entire debt outstanding could be paid with one year of operating cash flow, and it enjoys a healthy EBIT/Interest coverage ratio of 6.5x.

The company acquires many VMS businesses, always intending to hold them for the long-term and achieve a high IRR (Internal Rate of Return). That makes them stand out. We’ll come back to this later in this article.

The goal is to buy VMS companies cheap when their growth is low or even negative and turn them around thanks to Constellation’s know-how and scale in these industries. Price is management’s obsession, so they can also buy declining businesses and make a fair return on them if and only if the price is right.

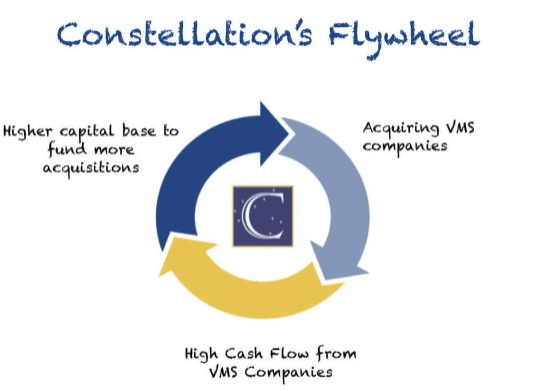

VMS companies are very appealing for Constellation because they satisfy very specific and critical software needs in vertical markets. Customers need the software and it’s just a small part of their budget, so it’s very sticky. This means that VMS companies bring predictable and resilient cash flows to Constellation, which can later be deployed in other acquisitions to get the flywheel spinning.

Made by Best Anchor Stocks

How does the company make money?

Constellation makes money through 4 different sources: professional fees, license fees, hardware and maintenance and other recurring fees. All the companies included in Constellation’s portfolio charge these fees to customers.

The company’s revenue is highly weighted towards maintenance and other recurring revenue (71% of total revenue in 2021), and what is recurring is predictable. The percentage of this revenue over total revenue has increased gradually over the last decade, as management knows this revenue is of utmost importance to spin the flywheel.

Sources of revenue growth

Constellation has two primary sources of growth: inorganic and organic. Almost all current growth is fueled by acquisitions (i.e., inorganic) of additional VMS companies. However, the company is working hard to boost organic growth too, although this is a challenge due to the nature of vertical markets, which tend to “suffer” from capped TAMs (total addressable markets).

Organizational structure

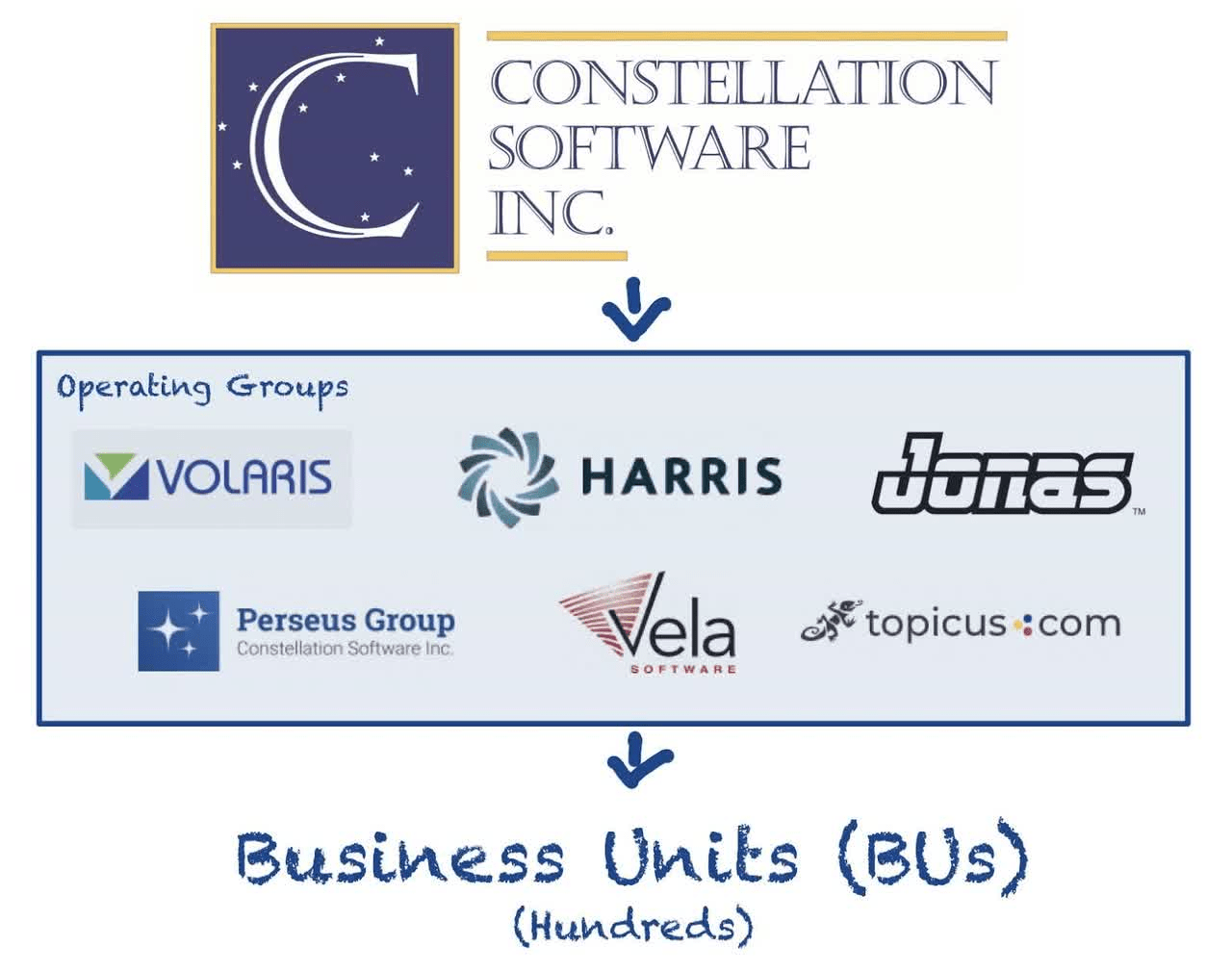

Constellation has a unique decentralized organizational structure, which is a key component of its moat. The company operates through 6 different operating groups: Vela, Harris, Volaris, Perseus, Jonas, and Topicus.com (OTCPK:TOITF). These operating groups decentralized further into sub-operating groups and Business Units:

Made by Best Anchor Stocks

The objective of this decentralized organizational structure is to push capital allocation decisions down the hierarchy to allow for the deployment of an ever-increasing capital base at high rates of return.

Operating Groups operate as “mini-Constellations” in deploying capital, being fully autonomous. As a result, Constellation’s task is limited to decisions around large acquisitions and other strategic decisions. For almost all other companies that are serial acquirers, there is a bottleneck at the management level. As that management wants to decide on all acquisitions, most companies struggle to get to more than 10 acquisitions per year. Constellation does dozens per year.

Management

Mark Leonard founded Constellation Software in 1995, and he still runs the company. He has managed to build a very experienced and aligned management team. The team consists of 4 managers (plus Mark Leonard) at the “parent company” level and 6 operating group managers.

- Experienced: the average management tenure is 24 years at the parent company level and 19 years at the operating group level. Managers clearly know how the company operates because they have been at the core of its successes.

- Aligned: Constellation Software requires all managers with a certain paycheck to invest their bonus in the company’s stock. This is done through open-market buys, as Constellation has not issued a single share since IPO (so no dilution). That’s also why Constellation doesn’t want to be in the news. If its stock would be hyped up, insiders would have to buy shares that are overvalued. As a result of the system, more than 50 employees have become millionaires by investing in Constellation’s stock.

Financials and KPIs

Constellation’s fundamental metrics have all been trending in the right direction. Over the last 5 years, revenue is up 137%, and Operating Cash Flow is up 99%. The company is perfectly capable of continuing to grow these metrics by double digits by scaling its M&A strategy and investing in ventures to boost organic growth.

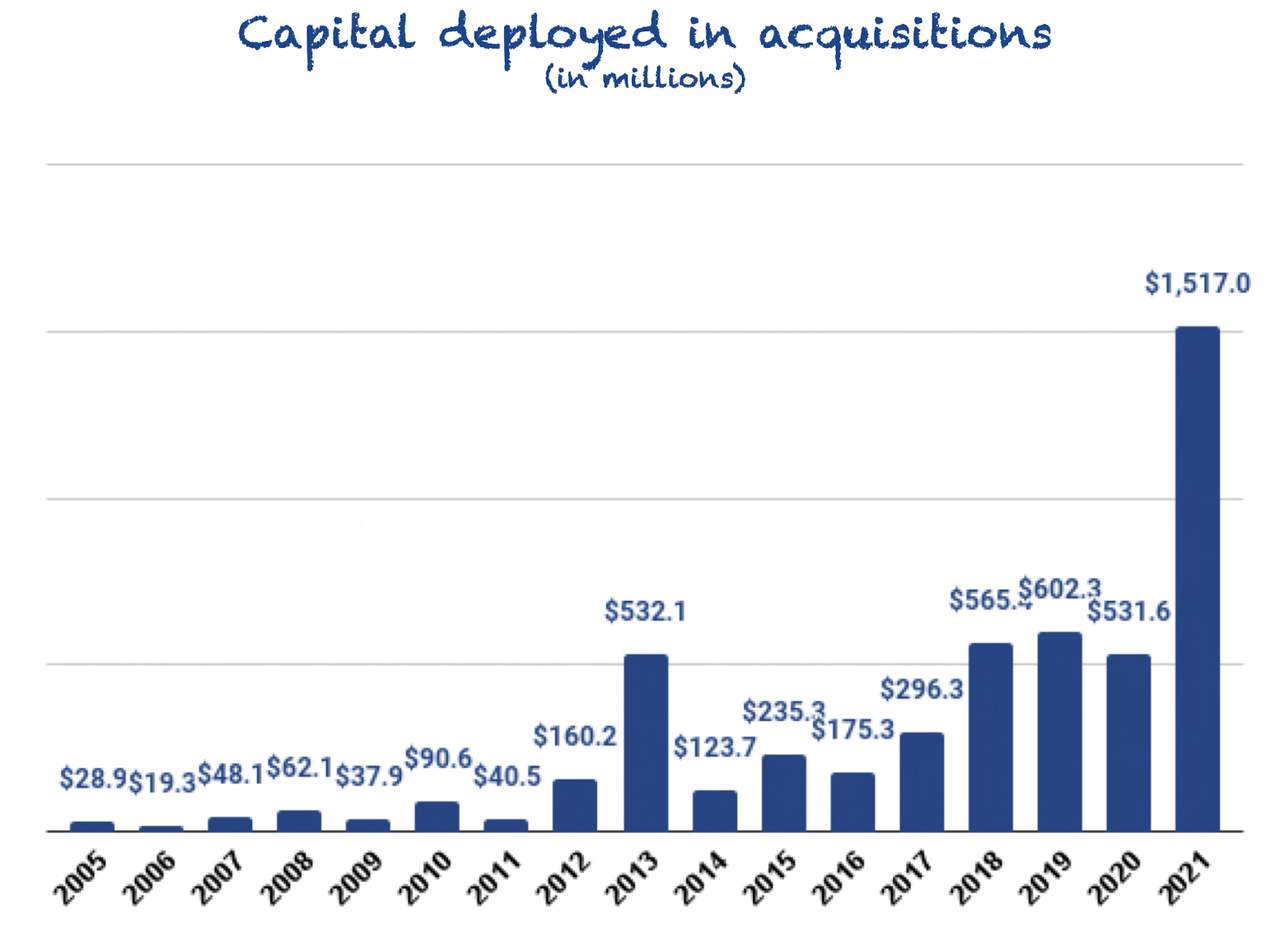

There’s much more to Constellation than what can be found in the income statement and the balance sheet. To measure if the company is being able to scale its M&A strategy, we must look at capital deployed, the number of acquisitions, and ROIC (Return on Invested Capital).

Constellation deployed a record $1.5 billion of capital into acquisitions in 2021. This is approximately 25% of total capital deployed since 2005 and more than double the previous record. 2022 is expected to bring a record capital deployment once again.

Made by Best Anchor Stocks

A big part of the company’s success depends on deploying this large capital base across acquisitions of small and medium-sized businesses. This segment is where Constellation manages to find more mispriced companies and earn higher rates of return. In 2021, the company acquired 95 VMS companies (a record) at an average price of $16 million.

As said before, other serial acquirers typically find bottlenecks at 10 acquisitions per year and automatically look for larger acquisitions that can move the needle. This said, Constellation has now started to also look at larger acquisitions, as the capital base has become increasingly challenging to deploy.

Deploying a large capital base is essential, but Constellation must do so without significantly impacting the returns it expects to make on these acquisitions. ROIC has been trending down, which is normal due to the large amount of capital that the company has recently deployed. Investments take time to play out.

Competition

Competition comes from two different industries. On the one hand, the company’s VMS companies compete against a wide variety of players in vertical industries. On the other hand, Constellation competes against other serial acquirers that target the VMS industry.

Competitors in Constellation’s M&A ventures come in many shapes and forms. We can think of 4 main players: Venture Capital, Private Equity, small serial acquirers, and large serial acquirers. The company competes favorably against all of these.

Venture Capitalists typically focus on building a diversified portfolio of risky and growth-oriented companies, some of which will have a huge payoff. This is not Constellation’s playing field because it looks for resilient and predictable cash flows.

Private Equity firms do fish in the same pond as Constellation, but the next part of this article (The Moat) should show why Constellation software can often outcompete PE firms.

Small serial VMS acquirers lack Constellation’s scale and know-how, whereas large VMS serial acquirers suffer bottlenecks as they grow, moving to larger acquisitions and leaving Constellation’s playing field.

The moat

Constellation’s moat comes from two sources: its decentralized structure and its reputation as a VMS acquirer.

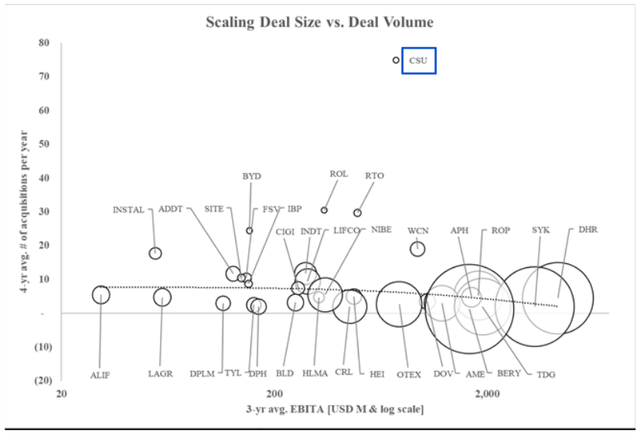

Decentralized organizational structure: most serial acquirers end up suffering bottlenecks around 10 to 12 annual acquisitions because most of the decisions end up on the CEO’s desk. However, Constellation has built a structure where capital allocation decisions go down to the Business Unit level. This way, the company can bypass these bottlenecks and deploy large amounts of capital in small and medium-sized acquisitions. The company is a clear outlier from the pack:

Canuck Analysts

Reputation as a VMS acquirer: Constellation has acquired VMS companies for more than two decades now, and it has cultivated relationships with potential targets for years. Potential acquirees know that Constellation is a great home as they get access to financing, know-how, and the ability to run their company independently. And Constellation doesn’t sell. In all those years, it has only sold one company and Mark Leonard still regrets it. This is important for a lot of companies. They don’t want to be ‘optimized’ for selling, like private equity does. Often these VMS companies are family businesses and it’s important for them to leave their legacy in good hands. This is one of the main competitive advantages that the company has against PE firms.

Tailwinds and Optionality

With almost every industry worldwide inevitably gaining software exposure, VMS companies should proliferate. Constellation argues that there are around 40,000 potential targets. Penetration of the current TAM is low, and TAM is expected to increase over the coming years.

Optionality can be understood in two ways: from a business perspective and a shareholder perspective. From a business perspective, the company can look for targets outside the VMS industry that satisfy its needs, or it can look at larger acquisitions to deploy the increasing capital base. Although management is looking at the former, they are already doing the latter.

From a shareholder perspective, there is also optionality in the large cash-generating capacity of the company. Constellation owns lots of VMS companies with resilient and predictable cash flows, so shareholders might reap dividend returns or buybacks if the company would not be able to allocate this capital at high rates of return anymore. This should help to protect the downside to a certain extent.

Risks

Even though Constellation is a very strong company, all investments have risks.

Constellation’s M&A strategy might no longer scale: the company’s main strength is its ability to continue scaling M&A to deploy an increasing capital base. We all know that as capital bases get larger, deploying all this capital at high rates of return becomes a challenge. There is no evidence of a deterioration of the M&A strategy currently, but it’s something that we should monitor going forward.

Competition: Mark Leonard was one of the first to understand the “beauty” of VMS companies, but Constellation is not alone in the playing field anymore. Despite the company’s competitive advantages, competition is intensifying. This could lead to lower hurdle rates or ventures outside of VMS, which would be outside of Constellation’s expertise.

Key man risk? An argument can be made around key man risk. Mark Leonard founded the company and has been responsible for the vision. He is close to 70, and he might retire over the next years. Giving up his salary was maybe the first step. However, we should not consider this a risk because Constellation has been working in a decentralized manner since the beginning. Operating Group Managers have been mostly responsible for everything that has happened to the company, and they still have a long runway ahead of them.

Conclusion

Constellation Software is a high-quality company that still flies mostly under the radar. The company has performed great in the past, and everything indicates that it’s capable of doing so in the future as well. Building a decentralized structure has been key for the company’s performance and it’s not something that is easy to replicate for competitors.

In the meantime, keep growing!

Be the first to comment