The Good Brigade/DigitalVision via Getty Images

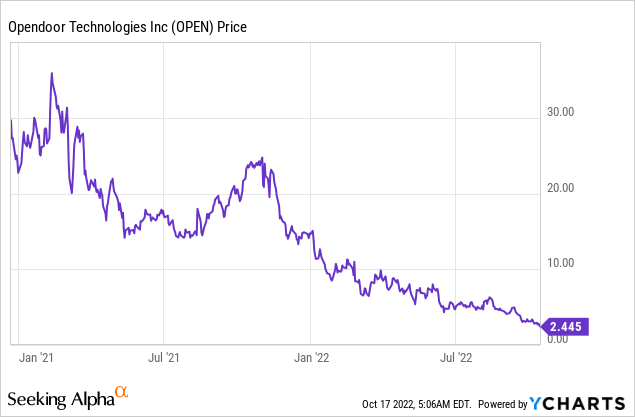

Opendoor (NASDAQ:OPEN) is an online platform that offers homeowners a way to sell their home fast and easily. The company was founded in 2014, 10 years after the number one real estate portal in the USA, Zillow (Z) (ZG). Since that point, the business has grown at a rapid pace with revenue popping by 254% year over year. Despite the progress, the rising interest rate environment has compressed the valuation of growth stocks. In addition, the recent forecasts of a decline in the housing market have further butchered the stock price. Opendoor’s stock is now down nearly 93% from its highs in February 2021. The good news is the stock is deeply undervalued if the company can increase its operating margin to 8% over the next 10 years. In this post I’m going to breakdown the company’s business model, financials, and valuation. Let’s dive in.

Business Model

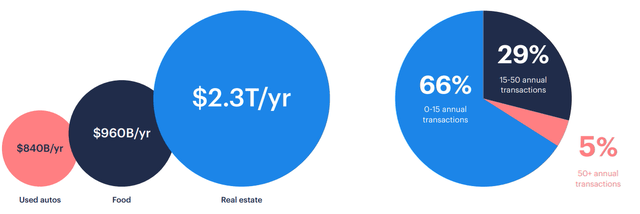

Opendoor’s business model is fully focused on automating the house-flipping process, which is commonly known as iBuying. 66% of US Citizens own a home and over 6 million homes are sold each year. To serve these homeowners and homebuyers, there are over 3 million real estate agents across the USA. This is a heavily fragmented market and thus it was not a surprise to discover that 25% of realtors have another occupation.

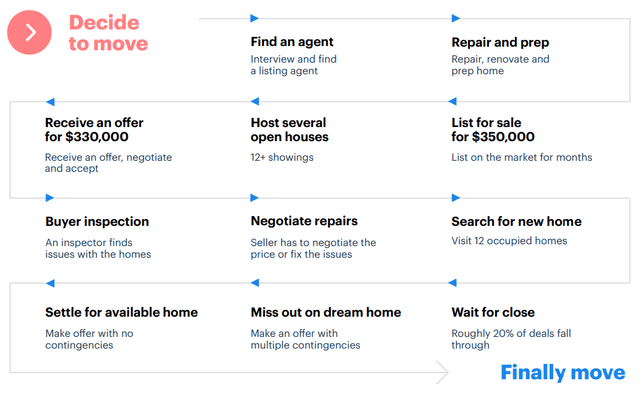

Traditionally selling a home can be a complex, costly and laborious process. You have to first find an agent, then potentially do repairs or renovate to get the property in good condition. After which, you will have to liaise with the agent and an average of 12 visitors per listing. Thus it’s no surprise that properties spend an average of 50 days on the market and ~20% of transactions fall through. It can also be difficult when you are in a “chain” and are trying to buy a home at the same time as selling yours. As the selling process has up to 6 different parties and lots of uncertainty if you try to buy a home before yours has sold you may be stuck.

Traditional Home Selling Process (investor presentation 2022)

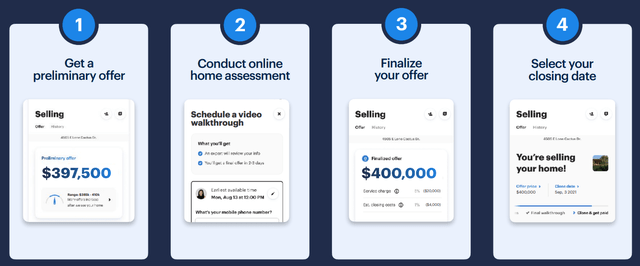

Opendoor solves these problems by digitizing the entire home-selling process. It has boiled down a complex process into a simple four-step solution. Step 1. you get a preliminary offer, step 2. you do a video walkthrough to get an idea of the property and its condition, after which an offer is finalized and the seller selects their closing date.

iBuying process Opendoor (Investor Presentation)

As a seller, this offers a fast, efficient and reliable process. Of course you will not get as much money for the property as you would if you sold it on the open market. Thus this is where Opendoor makes its profit, while also charging a 5% fee for its services. The company is really selling the ability to sell a home fast and easily.

I had an epiphany recently that Opendoor is effectively adding some liquidity to the real estate market. It is acting as a “market maker” for real estate, as a bank like JPMorgan would for stocks. If the company can do this at scale, that would be a huge revenue generator and change the real estate market as we know it.

Learning from Zillow’s Disaster

If you have read my previous posts on Zillow, the leading online real estate portal, you will know they had a disaster with iBuying. Zillow aimed to effectively do what Opendoor is doing, but this ended in a catastrophe. Its algorithms “failed to predict” the fluctuation in housing prices. Thus due to home flipping being a low-margin business, its portfolio went underwater pretty fast and the company had to shut down the entire business segment. As CEO Rich Barton stated, “we swung for the fences and missed”. Initially, when I heard about Zillow’s disaster I was reluctant to look at Opendoor as I believed they would be the next to fall. Zillow is a much larger and established company with strong core business and it failed at iBuying. Management figured out it was just an unprofitable endeavor; thus the question is what does Opendoor do differently?

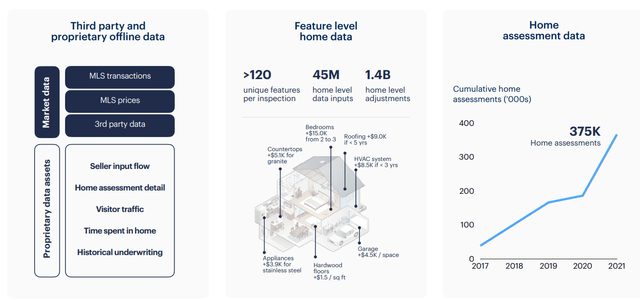

Well firstly, Opendoor is a specialist in this area and thus its tech stack and algorithms look a lot more extensive than Zillow’s. Its algorithms also seem to be predicting the best buy and sell prices so far, as they have been profitable on a GAAP basis since the first quarter of 2022. The business combines real estate market data with its proprietary databases to give an accurate prediction of the best prices. As Opendoor grows as does its home assessment data (right chart below), this could act as a moat against future competitors.

Opendoor tech (investor presentation)

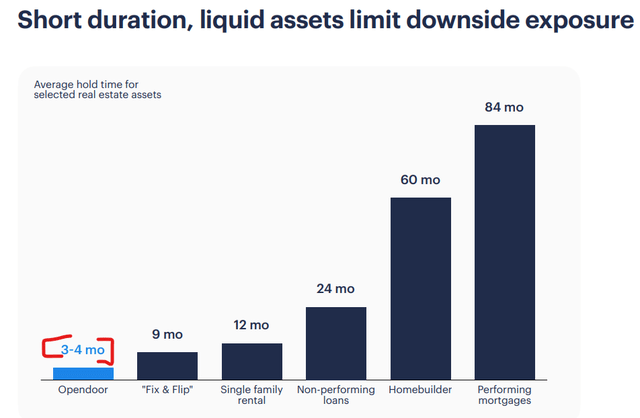

Opendoor has also learned from Zillow that the longer you hold a home the more difficult it is to predict price changes. Therefore the business has a low average hold time of 3 to 4 months. In addition, ~35% of its inventory is under resale contract at any given time which reduces its risk profile extensively. Opendoor has even shocked the world by announcing a multiyear partnership with Zillow which allows an offer to be requested on Opendoor right through the Zillow platform. This is a major game-changer as it effectively opens up Zillow’s market-leading audience to Opendoor and shows there is no bad blood between the rivals. Also, I believe if Zillow thought iBuying was impossible, they would not have partnered, therefore they may see something special in Opendoor’s technology.

Opendoor (Investor presentation 2022)

Financial Analysis

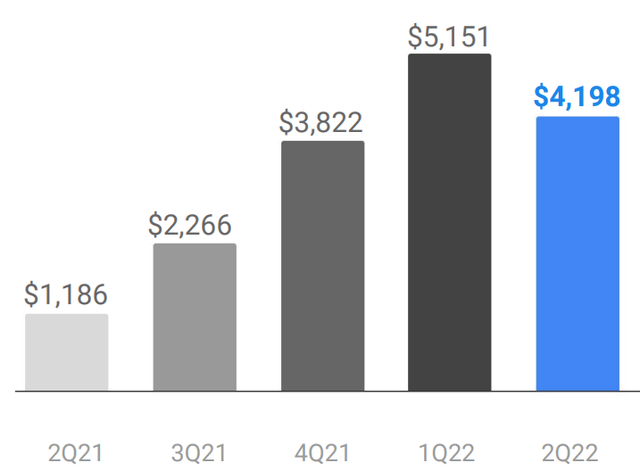

Opendoor generated solid financials in the second quarter of 2022. Revenue was $4.2 billion which popped by a blistering 254% year over year. The company sold a staggering 10,482 homes in the quarter up 201% from the first quarter of 2021.

Opendoor also acquired 14,135 homes in the second quarter up a rapid 66% year over year. The company is continually innovating and in June it announced its pre-approval financing app which can give users approval in as little as 60 seconds. In addition, the company launched “Opendoor Exclusives” which enables buyers to purchase homes via an e-commerce checkout experience, with a buy-it-now price.

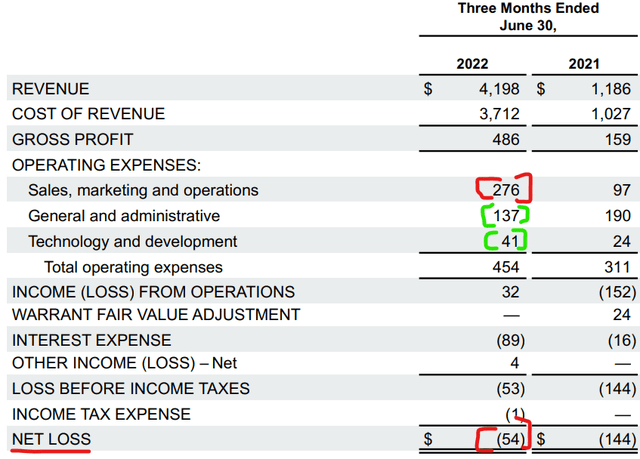

For a business like Opendoor, profitability must be the key focus. Gross profit was $486 million in the second quarter up a rapid 206% from the $159 million in Q1,22. Its Net loss has also reduced from negative $144 million in the first quarter of 2021, to negative $54 million by the second quarter of 2022. When I unpack the income statement (image below), I see that the majority of the business’s expenses ($276 million) are spend on “Sales, marketing and operations”. I personally don’t see an investment into Sales and Marketing as a bad sign, as this is part of a fast-growing company. However, I do not like that the business group’s “operations” expenses in with this as they are very different. The good news is the business reduced its G&A expenses from $190 million in Q2,21 to $137 in Q2,22. This indicates improving efficiency in the model and operating leverage which is a positive sign. I did notice a slight increase in Technology expenses which increased from $24 million to $41 million year over year. However, I believe this is a positive sign as the company has implemented many new features.

Adjusted Net Income was $122 million in Q2,22 up substantially from the $3 million in the first quarter of 2021. Its Contribution profit also increased to $422 million up from $128 million or a rapid 230% year over year. Adjusted EBITDA also expanded to $218 million in Q2,22 up from just $25 million in Q1,21. Its EBITDA Margin expanded to 5.2%, up from 2.2% in the prior year.

Opendoor has an inventory of 17,013 homes which have a value of ~$6.6 billion. It has expanded into new markets such as New York, Detroit, Boston, and Cincinnati and now operates in 51 markets.

Opendoor is in a strong liquidity position with $2.5 billion in cash and cash equivalents. In addition, the business has $4.1 billion in long-term debt, with $3.4 billion of this being current debt due within the next 2 years. This is fairly high but I do suspect some discrepancy in this as the real estate business is highly leveraged by nature.

Tepid Guidance

The company did notice a slowdown in momentum at the end of the second quarter, with sequential declines in its resale volumes. Thus management is expecting this trend to continue as the housing market tightens due to the rising interest rate environment. Revenue is forecasted to be between $2.2 billion and $2.6 billion in Q3,22 with Adjusted EBITDA in the range of ($175) million and ($125) million.

Advanced Valuation

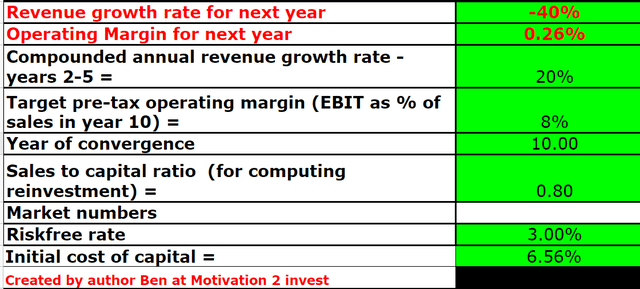

In order to value Opendoor I plugged the latest financials into my advanced valuation model which uses the discounted cash flow method of valuation. I have forecasted revenue to decline by a substantial 40% next year based up a slow down the housing market due to macroeconomic issues, after which I have forecasted a conservative 20% annual growth rate over the next 2 to 5 years. In comparison to past growth rates, this is more likely to be in the 30% to 40%+ growth range, but I believe its best to be prudent in valuation.

Valuation stock Opendoor (created by author Ben at Motivation 2 Invest)

I forecast Opendoor to generate a pre-tax operating margin of 8% over the next 10 years, as it benefits from economies of scale. In addition, I have capitalized R&D expenses to improve the accuracy of the model.

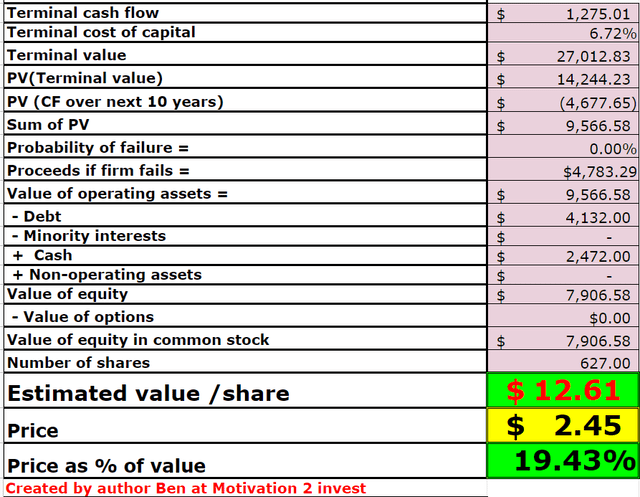

Valuation Opendoor (created by author Ben at Motivation 2 invest)

Given these factors I get a fair value of $12.61 per share, the stock is trading at just $2.45 at the time of writing and thus is over 80% undervalued. This means the upside is huge if the business can achieve high profitability long term which is something Zillow’s iBuying business failed to achieve.

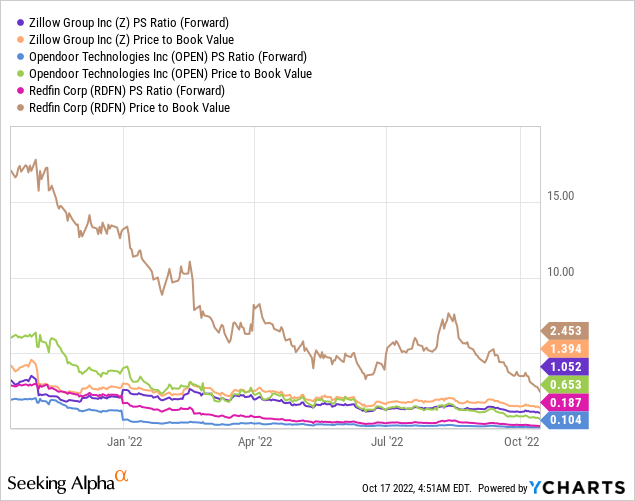

Comparing Opendoor to Zillow or Redfin is pretty challenging as now they operate with very different business models and margins. However, if you are curious Opendoor trades at the cheapest PS ratio = 0.104 (blue line) and the cheapest price to book value = 0.653 (green line).

Risks

Housing Market Slowdown

The high inflation environment has caused the fed to raise interest raises which is forecasted to decimate the housing market. A study by Morgan Stanley expects US home prices to end 2022, down 11% year over year. With a further 7% decline expected in 2023. High-interest rates mean higher mortgage servicing costs and macroeconomic issues are likely to cause homeowners to stay where they are until things resolve.

The Zillow Curse

Although I do believe Opendoor has a better system than Zillow, the fact that the company could fail needs to be taken into account. Zillow is run by founder and CEO Rich Barton who was also the founder of Expedia and one of the smartest guys in Silicon Valley. If Barton decided to get out of that business, then that is a major market signal. Thus Opendoor will need to continue to prove its model at scale in order to win the trust of investors.

Final Thoughts

Opendoor is the leading and possibly only iBuying platform on the market. The company has a huge opportunity to scale and is deeply undervalued if it can generate strong margins long-term. I do expect some volatility for at least the next 1 to 2 years, but long-term the company could be a great investment.

Be the first to comment