R.M. Nunes

The last time we had a chance to cover Brandywine Realty Trust (NYSE:BDN) was all the way back in December of last year in an article titled: “The Future Remains Uncertain“. In that piece, we have expressed our appreciation for various qualities that the Office REIT possesses, but at the same time pointed out that the overall macroeconomic environment was not looking kind to BDN, and that secular social and economic changes represented a significant risk to the underlying business model.

Since then, the Philadelphia-based REIT has been hammered in the markets, with the share price declining by more than 53.8%. In our view, this creates an interesting value proposition with our previously noted negatives slowly already getting discounted into the share price. BDN is selling close to all-time lows, with the last time being priced similarly during the Financial Crisis. At the time of writing this article, shares of the REIT can be purchased for only $6.57. In fact, the current valuation looks immensely compelling and the potential downside appears to have become significantly limited.

BDN vs S&P500 1-Year Return (Seeking Alpha)

The real estate portfolio

Brandywine Realty Trust is one of the largest publicly traded office-oriented real estate companies in the United States, predominantly focused on markets such as Philadelphia, Pennsylvania, and Texas. It develops, leases, and manages an urban-oriented real estate portfolio.

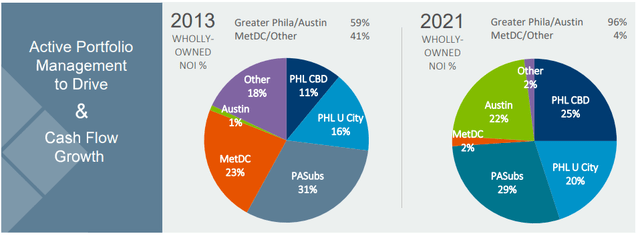

The Office REIT used to be more diversified back in the day, most notably owning a lot of real estate in the Metropolitan DC area, but has divested in recent years and placed its core focus on markets such as Philadelphia, developing projects such as Schuylkill Yards. In 2013, Brandywine Realty Trust operated 204 properties throughout the United States. That included real estate in Metropolitan Washington D.C., New Jersey, Delaware, Virginia, and California. The now excluded part of the portfolio used to take up 44% of total square feet and generated close to 42% of the BDN’s NOI.

Geographic Diversification (3Q 2021 Investor Update)

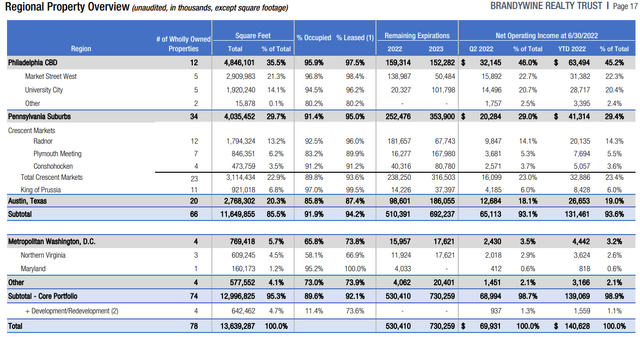

As per the latest quarterly filing, the Philadelphia-based REIT owns and operates 74 properties consisting of 12.99 million square feet. The portfolio is currently leased at 92.1%, while actual occupancy lags slightly behind at 89.6%.

Regional Property Overview (Q2 2022 Supplemental)

The effect of the strategic portfolio redeployment can be seen in the current regional diversification. Brandywine’s 12 properties in Philadelphia take up almost 35.5% of the portfolio and are currently leased at a very high 97.5%. Its 34 properties in Pennsylvania take up 29.7% of the portfolio and are leased at 95.0%, just as the 20 properties in Austin, which take up 20.3% of the real estate portfolio and are leased at a slightly smaller percentage of 87.4%. BDN is struggling to find new tenants for its 4 properties up in Washington D.C, but they take up only 5.7% of the portfolio.

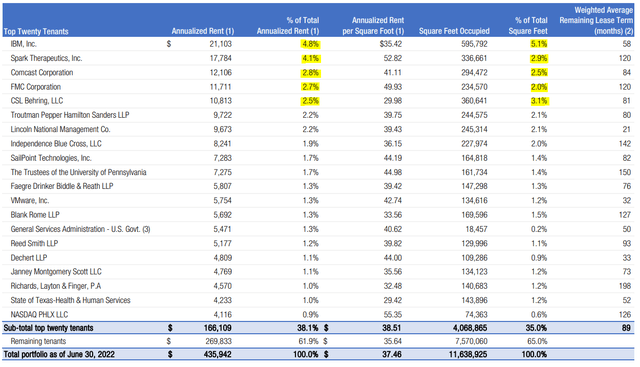

Tenants Overview (Q3 2022 Supplemental)

While the real estate portfolio remains heavily concerned in what they consider key markets, BDN remains well diversified, trying to avoid risk as much as possible in other regards. In terms of diversifying its tenant list, Brandywine has done a tremendous job.

Their top five clients take away only 16.9% of total annualized rent and 15.6% of total occupied square feet. Their top tenant is International Business Machines (IBM) which contributes only 4.8% of their ABR, closely followed by Spark Therapeutics (OTCQX:RHHBY) with 4.1% and Comcast Corporation (CMCSA) with 2.8% of their ABR. Jointly, the largest twenty tenants take up only 35.0% of occupied square feet and generate only 38.1% of annualized rent. Overall a very satisfactory composition.

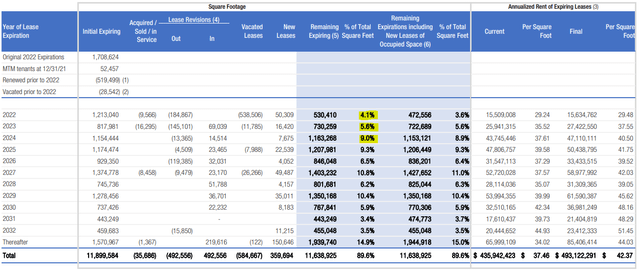

Lease Expiration Analysis (Q3 2022 Supplemental)

The lease expiration schedule is yet another positive in our books, at least for the short-mid term. In the third and fourth quarters of the year, only 4.1% of leases are set to expire. This is followed by 23.9% of leases expiring by the end of 2025. So roughly a third or fourth of the portfolio will “come under pressure” over the next 14 quarters. That is some 3.55 million square feet that BDN will attempt to renew at a time at which they achieve a 70.3% retention rate.

Historically, it has been far worse and hovered around 50% for a long time. Given the secular changes with the introduction of hybrid work and work-from-home, combined with the macroeconomic environment we find ourselves in, even if the leases get renewed, it would likely be from a weaker negotiating position. In essence, the combination will most likely result in some heavy pressure on FFO in the mid-term.

We have already witnessed a downgrade in guidance earlier this year due to the effect of rising interest rates. The management’s expectations for the full-year FFO range were downgraded from $1.37 to $1.45 per share to $1.36 to $1.40.

And looking at our 2022 guidance. Tom will articulate in greater detail, but the bottom line is our original 2022 business plan projected interest expense between $70 million and $72 million. We have met that assumption for the first half of the year. However, looking to the second half due to the rapid increase in short-term rates, our interest expense, including our share of joint ventures, will increase by about $0.03 per share. So while our operating plan remains fully on track based on the rise in interest rates, we are narrowing and adjusting our FFO range from $1.37 to $1.45 per share to $1.36 to $1.40 per share. And as I mentioned, Tom will articulate more detail on that in a few moments. Based on our 2022 leasing activity and development spend, we continue to project our debt-to-EBITDA range will be between 6.6 and 6.9x.

Jerry Sweeney, President and CEO – Q2 2022 Earnings

Attractive valuation

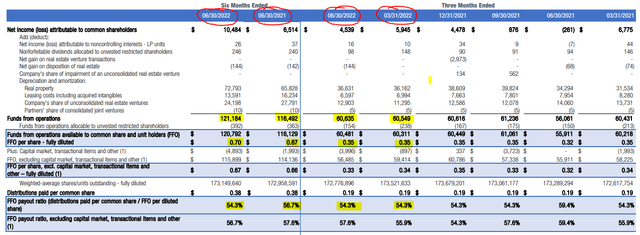

However, this leads us directly to the question of valuation, which remains the most appealing aspect of BDN. The REIT generated $60.53 million in FFO in the second quarter, in line with the previous. It amounts to $0.35 in FFO per share, which is also mostly in line with results from previous quarters.

The REIT distributes only $0.19 in dividends per quarter, with an FFO payout set at 54.28%. Brandywine is currently trading at $6.57 per share and is offering a very attractive 12% dividend yield.

Financial Performance (Q2 Supplemental)

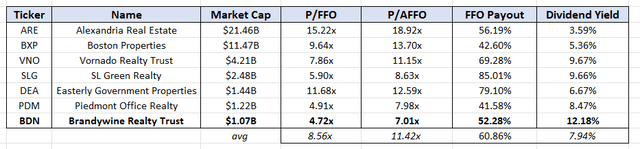

Brandywine Realty Trust currently is selling for an NTM P/FFO of 4.72x and an NTM P/AFFO of 7.01x. As we can see, this type of attractive value proposition is not unique within the Office REIT subspace. Other than a couple of the largest players in the space like Alexandria Real Estate (ARE) and Boston Properties (BXP), most O-REITs have gone through a rough couple of years in the market and are trading at relatively low valuations offering high yields.

For example, Piedmont Office Realty (PDM) generated a 46.17% year-to-date result and is currently selling for an NTM P/FFO of 4.91x and an NTM P/AFFO of 7.98x. The New York oriented SL Green Realty (SLG) generated a 48.43% year-to-date result and is currently selling for an NTM P/FFO of 5.90x and an NTM P/AFFO of 8.63x. All of these look quite attractive at their current valuations, especially when compared to some of the more mainstream options from other subsectors such as Realty Income Corporation (O), Rexford Industrial Realty (REXR), Digital Realty Trust (DLR), and others. Overall, while we believe the market is right to price in multiple headwinds Office REITs are facing, we are suggesting that it might be somewhat overdone at this point.

BDN Peer Valuation (Author Spreadsheet IQ Capital Data)

Risks still present

Secular changes in the nature of work that we expect to happen throughout the next couple of decades will apply significant pressure on the REIT and its ability to find new tenants after the leases expire. Even if successfully leasing out the properties, it is likely going to do so through a relatively weaker bargaining position leading to the top and bottom lines being pressured. Brandywine does not operate through a triple net-lease model and is not focusing on single tenants, making them even further vulnerable to changes that are taking place. The REIT’s overconcentration in the Philadelphia, Texas, and Pennsylvania markets might also prove as a double-edged knife, depending on how resilient the two markets prove to secular changes. Still, we feel comfortable with the level of risk associated with Brandywine Realty Trust at these price levels.

Final thoughts and conclusions

Brandywine Realty Trust does seem to be immensely attractively valued, providing the potential investor with a mesmerizing 12% dividend yield sold at just an x4.72 P/FFO multiple. In a previous article covering REIT, I pointed out that it is questionable if the discount is high enough given the issues the potential investor is facing. At the time, the REIT was offering “only” a 5.62% dividend yield accompanied by an x9.92 P/FFO multiple, and we did not like that risk/reward profile of the investment. However, the risk/reward profile has undoubtedly changed since the last time we covered Brandywine. BDN’s current valuation almost seems to indicate that economic activity is going to grind to a halt, with them losing their pricing power during releases and the REIT being forced to lower or completely cut its dividend distributions.

Even if something rather drastic happens with the dividend being cut in half, it would still mean a ~6% yield for investors willing to consider BDN at $6.57 per share, more than three times the current S&P 500 (SPY) dividend yield. It would in theory lead to a further decline in price, limiting the total return and leading to capital losses, but for strictly income-oriented investors, which happens to be the majority of those contemplating REITs, we see a somewhat limited potential downside. In fact, we are beginning to warm out to Office REITs at these discounts, and Brandywine Realty Trust in particular is starting to look very compelling.

Be the first to comment