courtneyk/E+ via Getty Images

I have a confession to make. I have been guilty of linear thinking.

The specific context is when to start drawing Social Security. I’ve seen and read articles about this for many years. You probably have too.

As best as I can recall, every single one of those articles treated a dollar received at age 80 as equivalent to a dollar received at age 62. And so did I in past thinking, if it could be called that.

It is true that there may continue to be inflation adjustments. But even an age-62 dollar delivered at age 80 is worth less than a dollar at age 62.

As investors we live in a world of compounding returns, and where the time value of money matters. These produce exponential changes, not linear ones.

By exponential I mean literally exponential. The word has tragically come to mean almost nothing in common use.

One sees today wildly fluctuating curves that are higher at the right end than the left described as “increasing exponentially.” This can end tragically for those many fools who have no clue about the literal meaning of an exponential function.

Albert Bartlett, a Harvard physics professor, famously lamented that “The greatest shortcoming of the human race is our inability to understand the exponential function.” In my view he was right about that, if wrong about the potential, since realized, for humans to make choices that would moderate their own population growth.

In this context, we would seem sensible to look at the question of when to begin drawing social security through the lens of discounted cash flows. I take this up below after a couple of preliminary items.

A challenge in writing this article is that “the year when you start drawing Social Security payments” is an awkward bunch of words. Going forward, to make the language simpler, this article will refer to that year as the year you “draw.”

The Future of Social Security

These days one sees a fair number of articles talking about how social security payments must be decreased when the accounting invention that is the “Trust Fund” is exhausted, according to current law. If you believe that is what will happen, you have not been paying attention or reading history.

Forty years ago, at age 27, I was certain that Social Security had no chance of lasting until I was 60. After all, it is nothing but a Ponzi scheme at root. Today at age 67 I expect it will long outlive me.

At that time, the future of Social Security also looked grim. Some fairly minor changes delayed the grim future for 40 years.

Social Security is welfare for the old, dressed up in complexity of the sort American government seems talented at producing. Details may change but it is not going away. All developed countries have some form of welfare for the old.

My guess is that we will again see a gradual increase in the various “retirement ages” and perhaps other changes. But time will tell.

Spouses and Security

Without getting deep in the weeds about spousal details, there is a big-picture point worth making. Social security payments based on the income of the higher-earning spouse will continue until the death of the second who dies.

So when “death age” is used below, please interpret it as “death of the latter spouse to die.” If the high earner in a couple is older, this can make a significant difference.

In particular, it can mean that the payments continue quite a few years until the latter spouse to die, usually the woman, finally does.

In my view, it is a really good idea to have some level of secure income. This is worth more than squeezing the last dollar out of notional investment gains. If for you that is to be social security, then factor that into your thinking about when to draw.

There is one detail not considered in the following. Individuals who have yet to pay into social security for 35 years by age 62, or who were far below the maximum payroll tax for most of those years, might significantly increase their indexed monthly earnings by delaying their draw. This, however, will not apply to most upper-middle-class earners.

Also, the details about payments are based on my own reading of the social security policy documents. The results are consistent with things I have read, but there is no guarantee that I got everything right.

The Linear Thinking About Retirement Age

The payment is related to the drawing age by linear thinking. Payments are decreased for earlier drawing so that the total amount of nominal dollars received by age 80 is nearly constant.

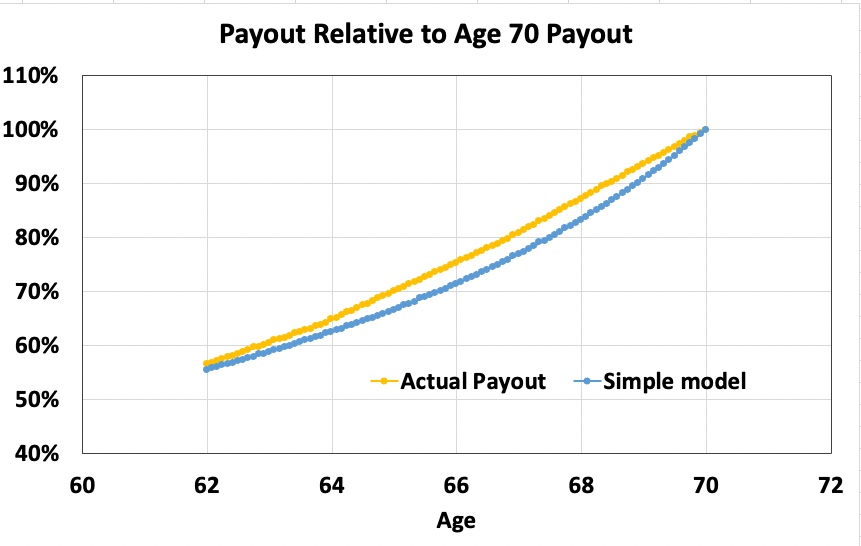

The details about the payments can be found here. Plotting the payments, as a fraction of their value at age 70, one gets this:

RP Drake

One gains a maximum of 5% relative to the model result by retiring close to the nominal “full retirement age.” We will ignore that below and use the simple model, which has easy math.

To concretize this, consider an individual who will bring in $40k per year if they retire at age 70. That individual will net $400k from then to when they turn 80. The annual payment from the simple model will be:

$400k/(80 minus drawing age).

The way people tend to think about this is that the breakeven age is 80. You will benefit from waiting until age 70 to draw, in the sense that you take the largest possible payment into the years after age 80.

In contrast, if your death age will be below 80, then you will net more total funds by drawing earlier. For most people, the earliest age they can draw is 62.

With the above numbers, the payout for someone drawing at age 62 is $22k while the payout for someone drawing at age 70 is $40k. The usual, linear-thinking calculation is that the 62-year old loses 45% by waiting, and not only until age 80 but until death.

This, however, is poor financial analysis. The 62-year old who waits will get payments of $40k per year starting in 8 years. Let’s look at the implications.

Deferred Lifetime Annuities

The closest investment option to social security is the deferred lifetime annuity. At more or less any age you can buy one of these.

What happens is you give the insurance company some funds to buy the annuity. They in turn guarantee some payment beginning at some future age.

I priced some of these a few years ago by looking at those payouts in a framework of discounted cash flows. My conclusion was that the net present value of the payments was not large enough to warrant the investment for me. But they might for you, I already have significant pension income.

What we have with social security is a sequence of payments starting at some drawing age equal to or later than your current age.

Discounting Cash Flows from Social Security

As in the case of those annuities, your social security cash flows, if thought of as a security, are strange. You get a regular payment for an unknown period of years with no terminal payment, as with the annuity.

But there are differences. That payment may increase with inflation, but also might lag. The amount of the payment and rules related to its taxation are subject to change without notice.

If there were a market for those payment strings, the market would establish a discount rate. It seems clear to me that the discount rate would be larger than that for top-rated bonds, but it is hard to know.

An individual, however, gets to make their own decision about the time value of that money. I will show some results for discount rates of 5% and 10%.

There are multiple possible reasons for applying a high discount rate. One may value having money available sooner much more than later.

This might be to have experiences while one is young enough to enjoy them. Or it might be to make capital investments that will decrease long-term costs.

Alternatively, one may plan to invest the funds received and believe that one will reap gains larger than those obtained by waiting. As a simple example, suppose one can draw some few years early and net $100k in payouts by age 70, at a long-term cost of $10k in annual income. These numbers are realistic.

If one invests these funds and makes returns above 10%, one will come out ahead. This would be pretty dangerous if you are investing in index funds, but might be a good choice if you had an established track record of making 15% returns.

Net Present Value vs Retirement Age

To evaluate the net present value of the payment string, one needs to specify the following quantities:

- Current age

- Drawing age

- Death age

- Discount rate

- Size of payment

One also could specify a rate of growth on the payment. I ignore that for now. On the assumption that payments will increase with inflation, the results here effectively represent the Net Present Value, or NPV, in 2022 dollars.

The uncertainty of lifetimes is real and can have consequences. My own father scrimped to get by and delay retiring until age 70, though he had shut down his law practice at age 65 for health reasons. Then he died at age 71 and my mother died three years later. In retrospect, he made an unlucky choice.

The calculations below will take the size of payment to be that of the above example, $400k divided by (80 minus drawing age). The NPV (done annually here) multiplies three pieces.

The first piece is the annual payment. The second piece is the discount that applies to all payments because they begin after the current age. This discount is the inverse of the following:

(1 plus discount rate) to the power of (drawing age minus current age).

The second piece can be significant. For a 10% discount rate, from age 62, payments beginning at age 70 are discounted by just over 50%.

The third piece that multiplies the first two that includes the discounted value of all payments from drawing until death. This is the sum over every year from drawing to death of the inverse of the following:

(1 plus discount rate) to the power of “years”.

Here “years” increases from one to (death age minus drawing age).

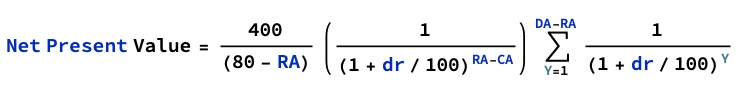

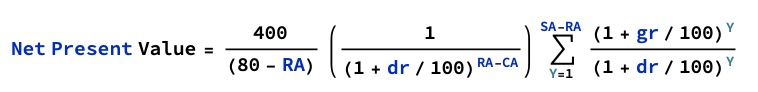

Here is the math, with current age, drawing age, and death age as CA, RA, and DA, respectively:

RP Drake

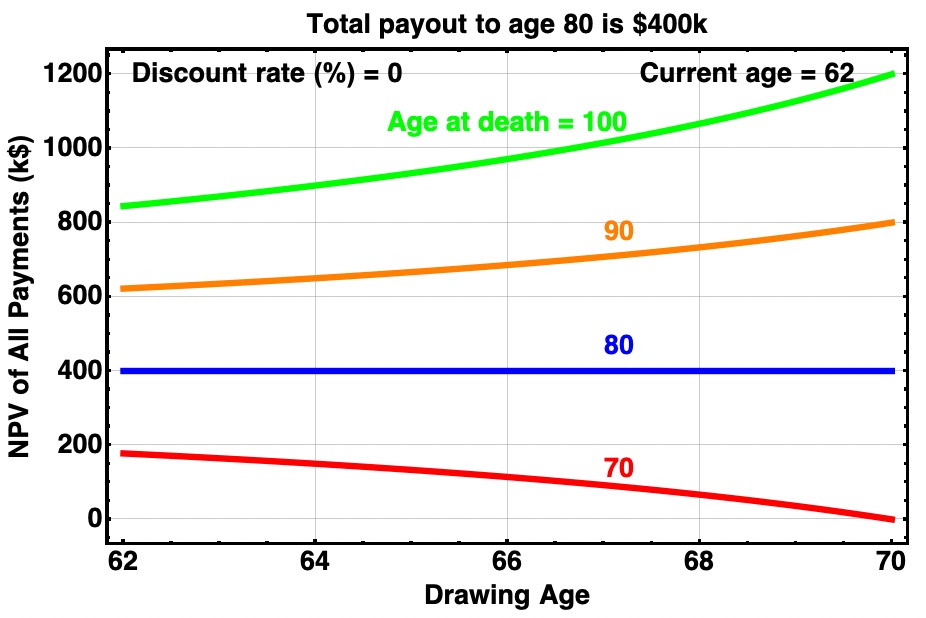

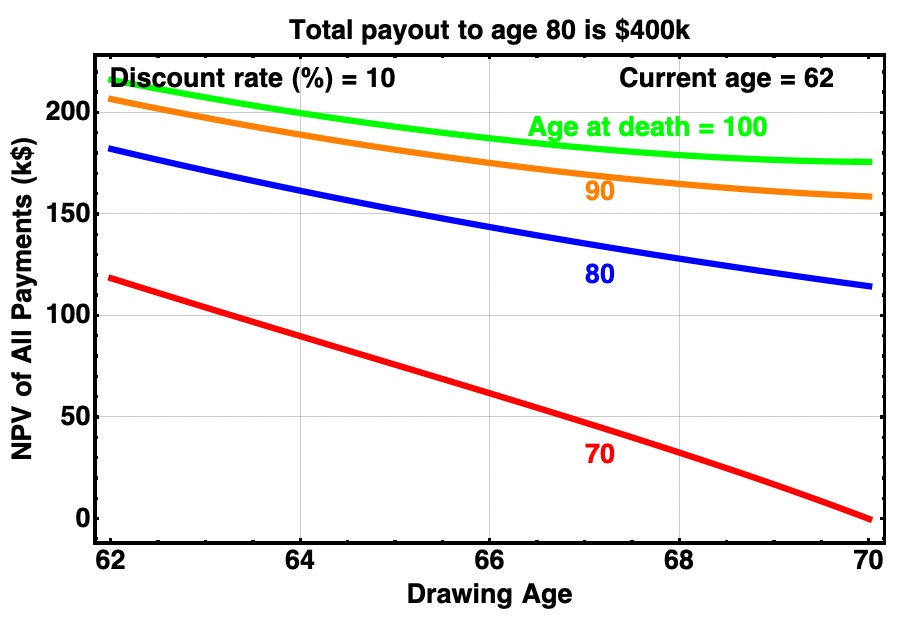

Having defined the calculation, let’s look at some results. First, the result for linear thinking. This is found by setting the discount rate to zero.

RP Drake

This will be the format for several subsequent plots. The discount rate and current age are shown within the frame. The curves are labeled by number and color and correspond to different ages at death. The plot shows NPV vs drawing age.

This plot just shows graphically what we discussed above. You win by retiring early if you will die after age 80 and you lose if you will die sooner.

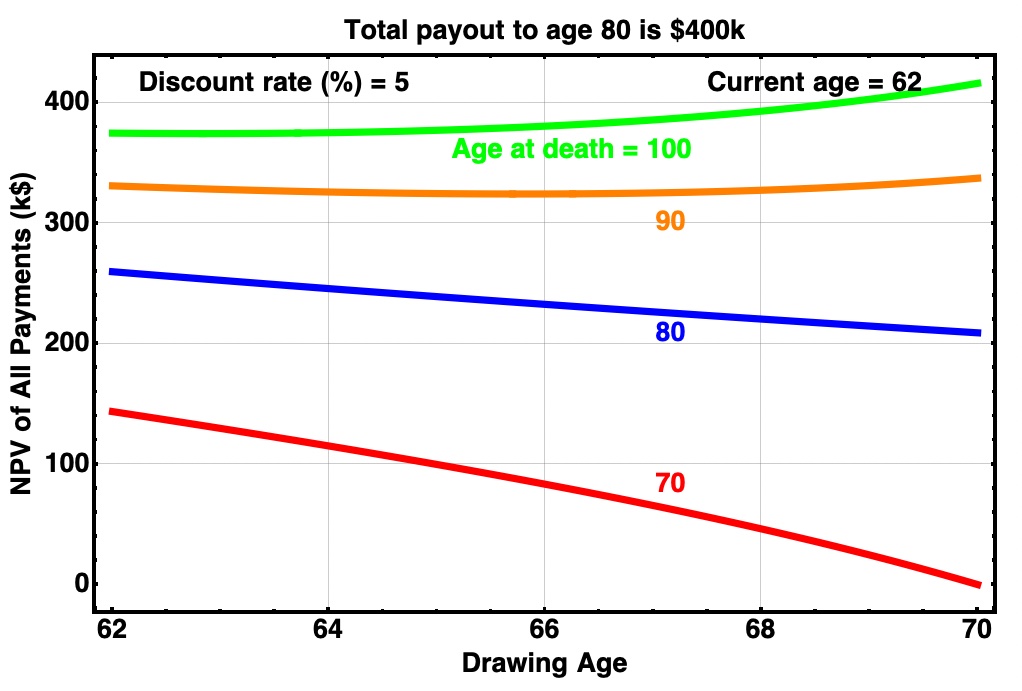

Now suppose one applies a 5% discount rate to the value of later payments. This implies that money to be delivered in a decade is worth 61% of money delivered today. Here is that plot, for a current age of 62.

RP Drake

Now only if your death age will be above 90 is there any point in waiting to draw, in the sense of starting social security. And even for a death age of 100, you only gain 10% in NPV by waiting 8 more years.

You may value money sooner more highly than this, for reasons discussed above. Doing the same calculation for a discount rate of 10% gives this.

RP Drake

On these assumptions, you gain 30% in NPV by retiring at age 62, for a death age of 90. You gain even more for younger death ages.

For larger current ages the gains are smaller but the trends are the same. For any discount rate of 5% or more, there is little benefit in waiting to draw, even if the death age will be 100. Instead, there is often a gain by retiring sooner.

Investing Favors Earlier Social Security

Many readers of SA may be in a place like my own. My desired spending is pretty much fixed. Any incremental income reduces my need to draw from investments, letting me compound the retained funds over time.

This suggests looking at the NPV of the social security payments if they then are compounded at some rate until an age is reached for spending or distribution. That “spending age” (“SA”) might be the death age or might be some earlier age.

In this case the math looks very similar, with growth of the payments (at rate gr) entering the final term on the right while DA is replaced by SA:

RP Drake

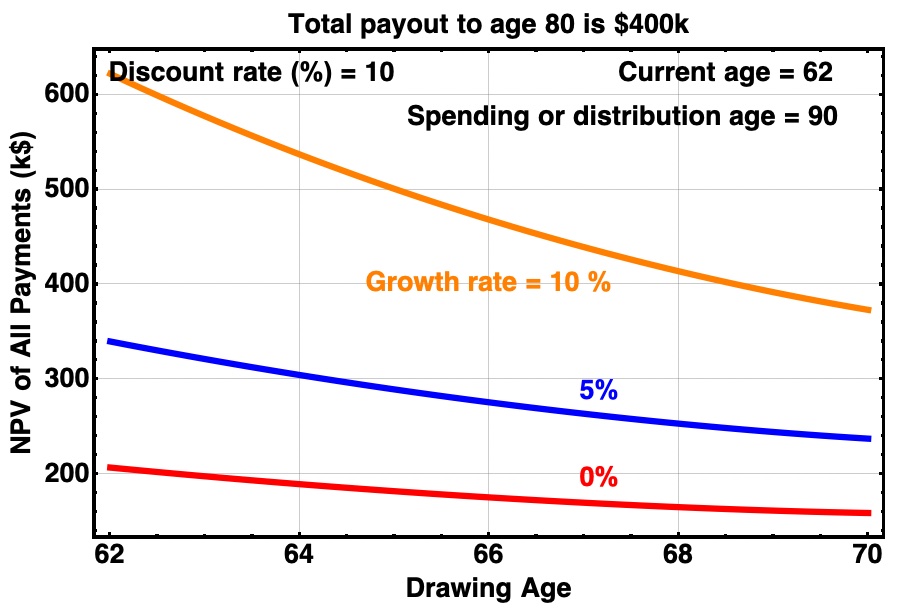

Here is what is implied for a 62-year-old, using a 10% discount rate and a spending age of 90.

RP Drake

Such a person gains significantly from an earlier draw even if their investment returns are quite modest. The qualitative story also does not change for lower discount rates.

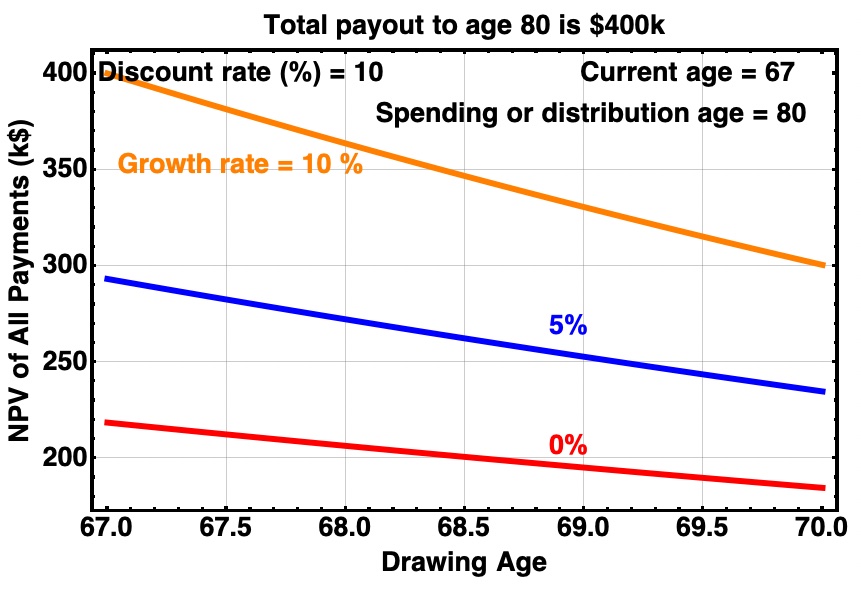

In my own case much of this opportunity has been missed. Here is what you get for a 67 year old. It uses a spending age of 80, since my worst case scenarios would correspond to needing to use those funds at about that age.

RP Drake

The gain from beginning to draw ASAP appears to be in the range of 25% to 33% for investment growth rates of 5% to 10%. This is a big difference compared to the conclusion one draws from linear thinking.

Conclusion

The role of social security in your overall retirement income plan matters. It may be that it represents your only source of secure income.

In that case, you might want to maximize the income even at a loss in Net Present Value. That is up to you.

Depending on your degree of self-control, you also may want to delay drawing social security as a form of forced savings.

We all suffer from the inability to comprehend exponentials intuitively. The idea that getting $100 in ten years is worth so much less than getting it today is not intuitive.

Many investors will prove unable to get over that hump. But the benefits are as real as the fact that you pay significantly more than the initial value of your home mortgage over its term.

As to me, we will see what I learn from reader responses to this article. But unless that causes me to change the analysis, I will start drawing social security very soon.

Be the first to comment