B4LLS

Before Affirm (NASDAQ:AFRM) posted fourth-quarter results, the stock offered a double-digit return last month. Readers fared better if they sold AFRM stock in the rally above $40.00. In after-hours trade after the Q4 report, Affirm issued guidance for Q1/2023 and the full year of 2023. This disappointed investors.

What does the outlook mean for investors?

Affirm Q4 2022 Earnings Results

In the last quarter, Affirm posted revenue growing by 39.1% Y/Y to $365.13 million. It lost 65 cents a share on a GAAP EPS basis. Active consumers and gross merchandise volume both soared by 96% and 77% year-on-year, respectively.

For the first quarter, the revenue of $345 million to $365 million is below the consensus of $390.87 million. More worrisome is the adjusted operating margin forecast of negative 12% to negative 10%. Founder and CEO Max Levchin tried to allay investor fears by recognizing risks ahead. For example, he said the company would focus on scaling its network. It will maintain “attractive unit economics.”

This should result in addressable market share growth. As its merchant partners grow, it will grow, too.

Cost Growth Exceeded Revenue

Affirm reported total revenue of $364.1 million. It cited gross merchandise volume growth, in addition to benefiting from higher interest income and income related to its loan portfolio. Unfortunately, its operating loss was $277.2 million. Warrants granted to Amazon (AMZN) in November 2021 accounted for $108.0 million. Stock-based compensation rose by $10.7 million to $110.9 million.

The net loss increased from $123.4 million last year to $186.4 million. This weak result will deter investors. The bearish short interest is 20.23%. Short-sellers are ahead by 57% (before the post-market selling).

Seeking Alpha

What can Affirm do to deter the bears? The company’s mission statement is to deliver honest financial products that improve lives.

Opportunity

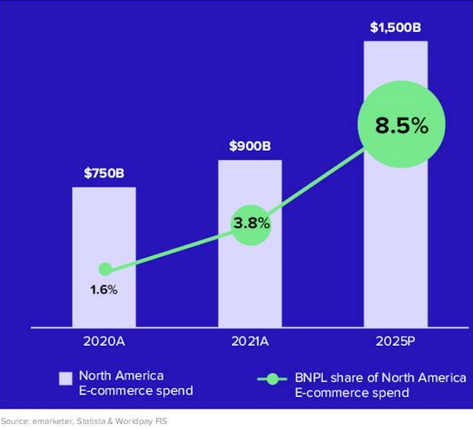

Affirm wants to win customer trust. This would help the firm capture a bigger portion of the e-commerce market. Stretched for disposable income, BNPL (buy now, pay later) will become a critical driver to stimulating spending online. Affirm could potentially double its revenue. BNPL will more than double from 3.8% of e-commerce spending in 2021 to 8.5% by 2025.

Affirm Q4/2022 Presentation

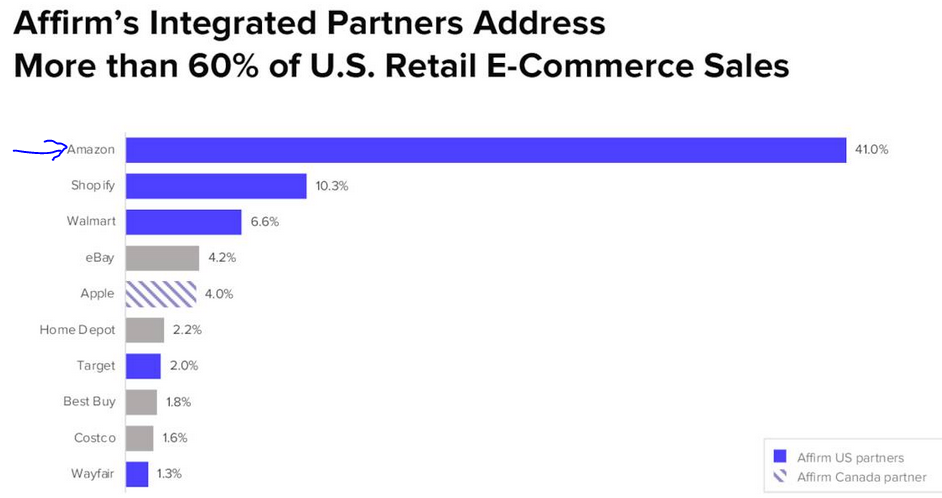

As shown in the bar chart below, Amazon is Affirm’s most important integrated partner. This partnership came at a cost. Already mentioned above, it cost Affirm over $100 million in warrants to earn this deal.

Affirm Q4/2022 Presentation

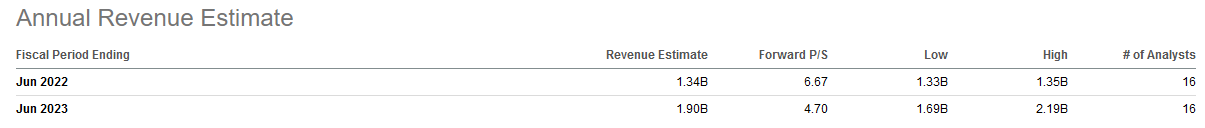

Affirm’s 2023 revenue growth outlook is not enough to satisfy shareholders. The company’s revenue forecast of $1.625 billion to $1.725 billion is below the consensus estimate of $1.9 billion. This estimate is based on data compiled by Seeking Alpha from 16 analysts.

Seeking Alpha

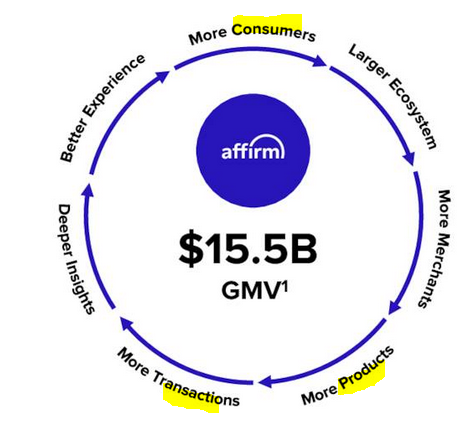

Affirm’s flywheel depends on a healthy economy. It needs more customers buying more products and generating more transactions. Contrary to the stock market rally that began in June 2022, the economy is not rebounding.

Affirm Q4/2022 Presentation

A steady schedule of Interest rate hikes will increase mortgage and debt costs. Unless consumers get a wage increase, their disposable income will fall. Even if inflation rates moderate, prices will hurt demand in 2023.

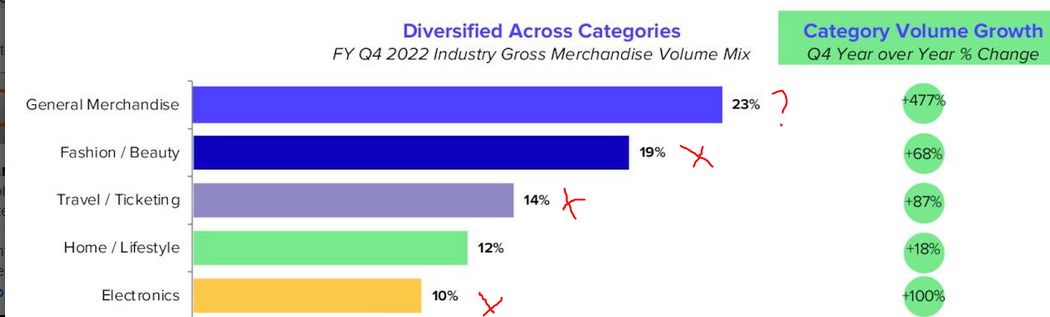

Affirm has a diversified GMV mix. However, consumers will cut back on goods that are “nice to have.” For example, I marked fashion/beauty, travel, and electronics as product categories consumers spend less on.

Affirm Q4/2022 Presentation

Fortunately, Affirm’s general merchandise volume grew nearly five-fold. It accounted for 23% of the volume mix in Q4/2022.

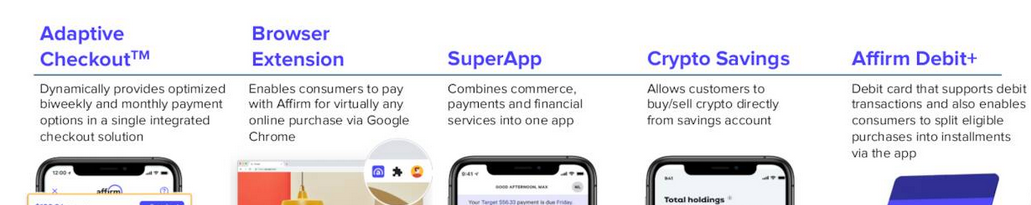

Product Roadmap

Affirm has two technological waves it will depend on to grow. First, it proved its virtual card, integrated checkout, split pay, and marketplace fueled its growth from 2013-2019. The company has multiple products ahead:

Affirm Q4/2022 Presentation

The skeptical investor will question the product’s uniqueness. Banks have a similar offering to Affirm’s SuperApp. They already integrate bill payments with financial services. Crypto Savings might compete with other platforms. Coinbase (COIN) is a widely-used crypto site that is struggling. This suggests that Affirm’s crypto offering will not gain traction.

The company’s flexible consumer offerings should differentiate its products from competitors. Affirm debit+ has 0% APR installment loans. It also offers split pay and four biweekly interest-free payments.

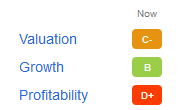

AFRM Stock Score

Affirm has a mixed scorecard. Its modest growth grade is typical for a high-flying software/fintech firm. The profitability score of D+ will deter conservative investors from considering AFFRM stock.

SA Premium

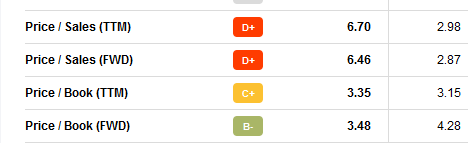

Valuations are poor. The company has no (‘E’)arnings in its price-to-earnings. A substitute metric is price/sales. Affirm scores a D+ in that category.

SA Premium

The price-to-book ratio is good enough. Still, the company started with $2.676 billion in cash and cash equivalents. It ended the quarter with $1.55 billion.

Your Takeaway

Affirm’s post-earnings sell-off is warranted. Markets will adjust for the weaker revenue outlook. The high cash burn rate increases the risk of the company raising cash.

In reflecting the opportunities against its near-term risks, I rate Affirm stock between a hold and a buy.

Be the first to comment