Kar-Tr/iStock via Getty Images

A Quick Take On MusclePharm Corporation

MusclePharm Corporation (OTCPK:MSLP) has filed to raise an undisclosed amount in an IPO of its common stock, according to an S-1 registration statement.

The firm sells sports nutrition and functional energy products.

MSLP has produced contracting topline revenue, although its most recent period was essentially flat.

I’ll provide an update when we learn more IPO details from management.

MusclePharm Overview

Las Vegas, Nevada-based MusclePharm was founded to develop a family of sports nutrition and energy products for sale to consumers.

Management is headed by Chairman and CEO Ryan Drexler, who has been with the firm since 2015 and was previously president of Country Life Vitamins.

The company’s primary offerings include:

-

Sports Series

-

Essential Series

-

FitMiss

-

On-The-Go

-

Combat Energy

-

FitMiss Energy

MusclePharm has booked fair market value investment of $205 million as of March 31, 2022.

MusclePharm – Customer Acquisition

The company distributes its products through major global retail channels such as food & drug merchandise retailers, specialty retail, ecommerce and international.

Management intends to expand its distribution through grocery and convenience store channels.

Selling and Promotion expenses as a percentage of total revenue have risen slightly as revenues have decreased, as the figures below indicate:

|

Selling and Promotion |

Expenses vs. Revenue |

|

Period |

Percentage |

|

Three Mos. Ended March 31, 2022 |

8.9% |

|

2021 |

8.8% |

|

2020 |

6.0% |

(Source)

The Selling and Promotion efficiency multiple, defined as how many dollars of additional new revenue are generated by each dollar of Selling and Promotion spend, was 0x in the most recent reporting period, as shown in the table below:

|

Selling and Promotion |

Efficiency Rate |

|

Period |

Multiple |

|

Three Mos. Ended March 31, 2022 |

0.0 |

|

2021 |

-3.3 |

(Source – SEC)

MusclePharm’s Market & Competition

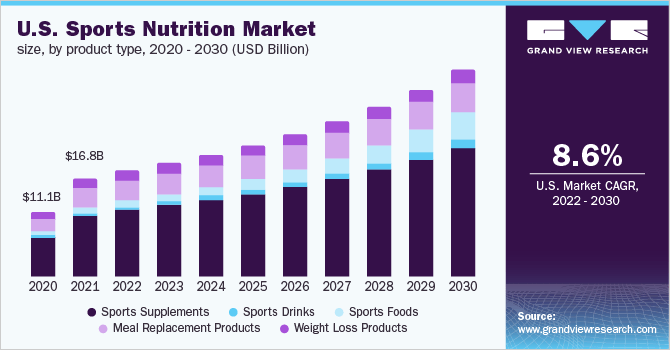

According to a 2022 market research report by Grand View Research, the global market for sport nutrition products was an estimated $40 billion in 2021 and is forecast to reach $83 billion by 2030.

This represents a forecast CAGR of 8.5% from 2022 to 2030.

The main drivers for this expected growth are an increase in consumption of sports nutrition products by fitness enthusiasts and people maintaining an active lifestyle for health reasons and enjoyment.

Also, below is a chart showing the historical and projected future trajectory of the U.S. sports nutrition market:

U.S. Sports Nutrition Market (Grand View Research)

Major competitive or other industry participants include:

-

Iovate Health Sciences

-

Abbott

-

Quest Nutrition

-

PepsiCo

-

Cliff Bar

-

The Coca-Cola Company

-

The Bountiful Company

-

Post Holdings

-

BA Sports Nutrition

-

Cardiff Sports Nutrition

MusclePharm Corporation Financial Performance

The company’s recent financial results can be summarized as follows:

-

Contracting topline revenue

-

Reduced gross profit and lower gross margin

-

Increasing operating and net losses

-

Growing cash used in operations

Below are relevant financial results derived from the firm’s registration statement:

|

Total Revenue |

||

|

Period |

Total Revenue |

% Variance vs. Prior |

|

Three Mos. Ended March 31, 2022 |

$ 13,101,000 |

-0.2% |

|

2021 |

$ 50,042,000 |

-22.3% |

|

2020 |

$ 64,440,000 |

|

|

Gross Profit (Loss) |

||

|

Period |

Gross Profit (Loss) |

% Variance vs. Prior |

|

Three Mos. Ended March 31, 2022 |

$ 1,509,000 |

-59.1% |

|

2021 |

$ 5,371,000 |

-72.6% |

|

2020 |

$ 19,609,000 |

|

|

Gross Margin |

||

|

Period |

Gross Margin |

|

|

Three Mos. Ended March 31, 2022 |

11.52% |

|

|

2021 |

10.73% |

|

|

2020 |

30.43% |

|

|

Operating Profit (Loss) |

||

|

Period |

Operating Profit (Loss) |

Operating Margin |

|

Three Mos. Ended March 31, 2022 |

$ (2,480,000) |

-18.9% |

|

2021 |

$ (8,913,000) |

-17.8% |

|

2020 |

$ 2,602,000 |

4.0% |

|

Net Income (Loss) |

||

|

Period |

Net Income (Loss) |

Net Margin |

|

Three Mos. Ended March 31, 2022 |

$ (6,301,000) |

-48.1% |

|

2021 |

$ (12,866,000) |

-98.2% |

|

2020 |

$ 3,185,000 |

24.3% |

|

Cash Flow From Operations |

||

|

Period |

Cash Flow From Operations |

|

|

Three Mos. Ended March 31, 2022 |

$ (3,582,000) |

|

|

2021 |

$ (8,042,000) |

|

|

2020 |

$ (868,000) |

|

(Source – SEC)

As of March 31, 2022, MusclePharm had $534,000 in cash and $50.0 million in total liabilities.

Free cash flow during the twelve months ended March 31, 2022, was negative ($11.7 million).

MusclePharm Corporation IPO Details

MusclePharm intends to raise an undisclosed amount in gross proceeds from an IPO of its common stock.

No existing shareholders have indicated an interest to purchase shares at the IPO price.

Management says it will use the net proceeds from the IPO as follows:

for working capital, general corporate purposes and marketing and advertising our new energy line.

(Source – SEC)

Management’s presentation of the company roadshow is not available.

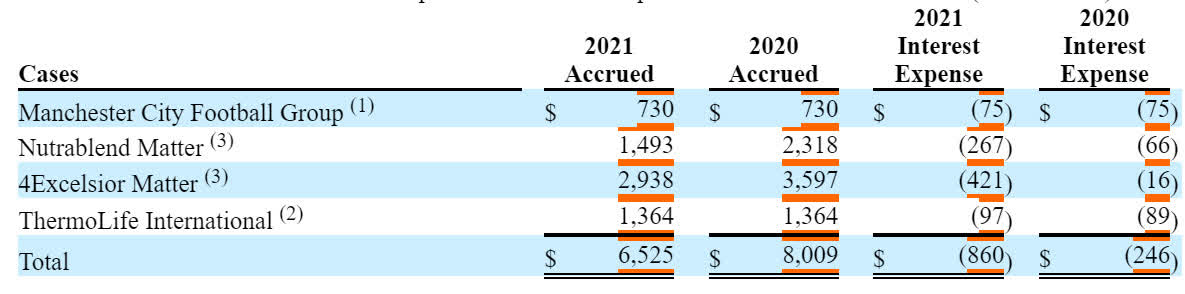

Regarding outstanding legal proceedings, the firm has been subject to several legal claims and the table below represents 2020 – 2021 legal claim accrued expenses and interest:

Legal Accruals (SEC EDGAR)

The sole listed bookrunner of the IPO is Roth Capital Partners.

Commentary About MusclePharm’s IPO

MSLP’s financials have produced contracting topline revenue, lowered gross profit and lower gross margin, higher operating losses and net losses, and increasing cash used in operations.

Free cash flow for the twelve months ended March 31, 2022, was negative ($11.7 million).

Selling and Promotion expenses as a percentage of total revenue have risen as revenues have decreased; its Selling and Promotion efficiency multiple was 0x in the most recent reporting period.

The firm currently plans to pay no dividends on its common stock for the foreseeable future.

The firm’s CapEx Ratio is high, which indicates it is spending very lightly on capital expenditures as a percentage of its operating cash flow.

The market opportunity for the sports nutrition market is large and expected to grow at a CAGR of 8.5% from 2022 to 2030, but the firm faces strong competition from major industry players.

Roth Capital Partners is the sole underwriter, and IPOs led by the firm over the last 12-month period have generated an average return of negative (37.3%) since their IPO. This is a lower-tier performance for all major underwriters during the period.

The primary concern I have is the firm’s contracting revenue history, although it appears to be stabilizing in the most recent reporting period. Another concern is its increasing operating losses and cash burn.

When we learn more information about the IPO, I’ll provide a final opinion.

Expected IPO Pricing Date: To be announced.

Be the first to comment