gk-6mt

In past cycles, Boeing (NYSE:BA) was a great bet on growing travel demand. The airplane manufacturer had a massive order book and provided a very profitable opportunity with volatile airlines less attractive to own. Now the stock has already surged, yet Boeing is still struggling to return to profits due to production issues. My investment thesis is more Neutral on the stock after the rally back to $190.

Slow Delivery Recovery

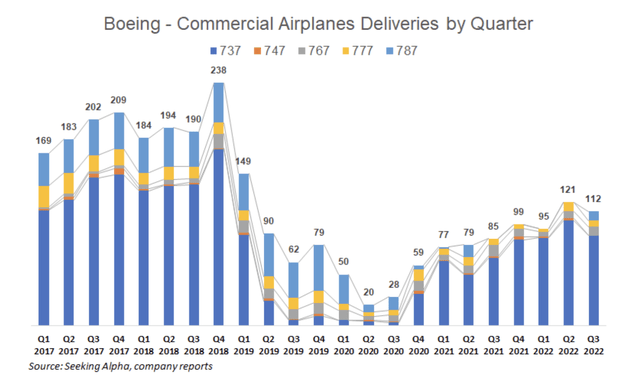

Between global airlines crushed by the Covid crisis and regulatory issues with the once grounded 737 Max, Boeing is still in recovery mode. The company is only still working on recovering the prior delivery schedule of reaching 200 airplanes per quarter despite a large inventory of near finished planes.

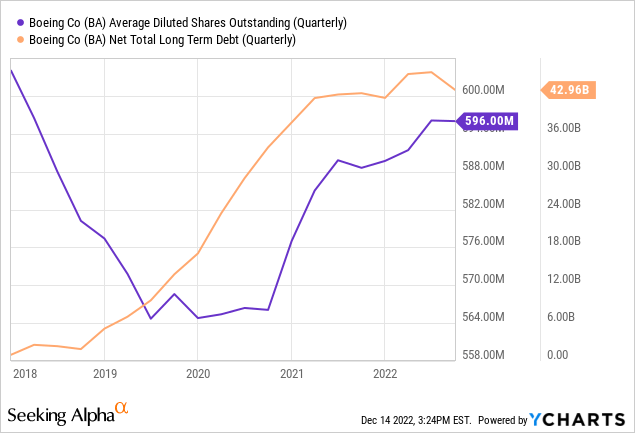

Boeing just announced the delivery of 48 jetliners in November. The problem here is that the stock has already rallied to about half of the prior peaks in 2019, yet the airplane manufacturer has more shares outstanding now and net debt has soared to $43 billion.

The debt load has soared due to the combination of the 737 Max groundings following fatal crashes along with the Covid lockdowns. Boeing saw debt explode to nearly $18 billion in 2019 before Covid was even a problem with a total reaching $43 billion now.

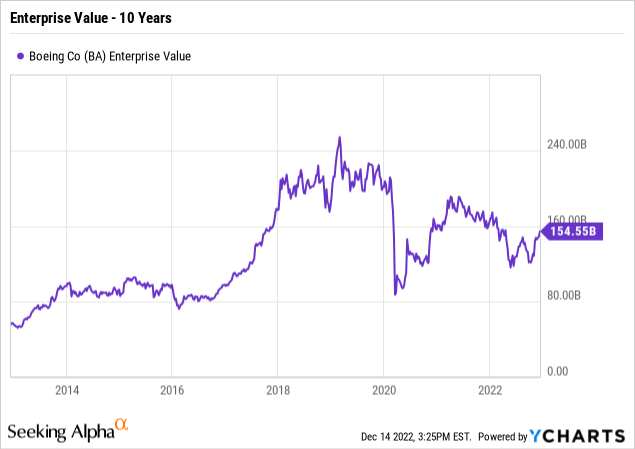

Back when Boeing traded at nearly $400, the EV sat at $220 billion and reached a peak around $250 billion. The current EV is back to $155 billion and the company is not the respected leader these days due to the 737 MAX manufacturing flaws, but Boeing still has a near duopoly with Airbus (OTCPK:EADSF).

Not Ready For Prime Time

The United Airlines (UAL) order is a big step towards the domestic sector signaling a full recovery from the covid crisis and a move beyond the distrust of Boeing manufacturing. United Airlines ordered 100 787 Dreamliners with an option for another 100 airplanes along with the exercise of an option for 44 737 MAX planes plus another order for 56 737 MAX.

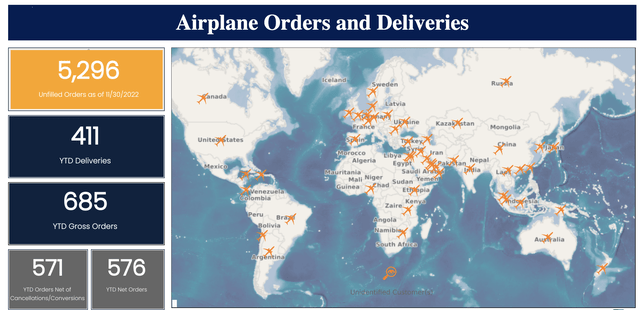

The massive order helps Boeing return to where the company has orders vastly in excess of current production capacity. The stock was appealing years ago when the major risk to the investment story was the ability of the company to profitably increase production.

While Boeing currently lists 5,296 unfilled orders, the market was somewhat skeptical of the desire for airlines to actually fulfill these orders, especially the Chinese. The United Airlines order now confirms stronger airlines are more than willing to take the delivery slots over the next few years solidifying the veracity of the order book.

Source: Boeing Orders/Deliveries Report

The problem with the stock is that production isn’t up to snuff anymore reducing the profit picture. The CEO even confirmed supply chain bottlenecks are forecast to remain in place through most of 2023.

As highlighted back on the Q3’22 earnings call, the 737 lacks engines in order to increase deliveries. The multiple crisis at Boeing have left some external suppliers producing far below desired production rates.

As a prime example of the current issues facing Boeing, the company anticipates $2 billion in abnormal costs for the 787 program due to rework of airplanes in inventory and below normal production levels. The company only forecasts a 737 delivery rate of low-30s per month in 2023 despite the company having 270 MAX still stuck in inventory.

The cluster facing Boeing is why the airline manufacturer is only forecast to finally top a $10 EPS in 2025. At $190, the stock already factors in the eventual recovery of the next 2 to 4 years.

The problem for investors is the lack of upside while another disastrous crash would have dramatic consequences for the airplane manufacturer. China could even further delay the 737 MAX certification and push domestic airlines towards the Chinese produced C919 jet recently delivered to China Eastern Airlines (CEA). COMAC already has over 1,115 orders for the new airplane, but production levels will be very low for years.

Takeaway

The key investor takeaway is that the market is already pricing in perfection for the next few years for a company operating at far below suboptimal levels. Boeing is still trying to recover from the 737 MAX crashes and the Covid crisis, yet the stock is already pricing in a near full recovery.

Investors shouldn’t expect any upside for the shares of Boeing over the next couple of years.

Be the first to comment