Marje/E+ via Getty Images

Thesis: Discount To Peers May Not Persist

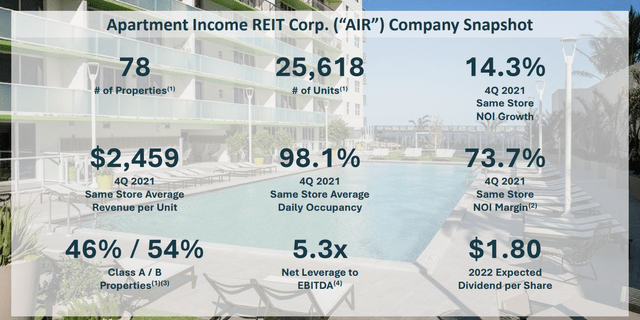

Apartment Income REIT (NYSE:AIRC) is a multifamily/apartment real estate investment trust (“REIT”) that has been around for quite a while but may still be unfamiliar to many investors.

That is because AIRC was spun off from parent company Apartment Investment and Management Company (AIV). Today, the former only owns and operates stabilized apartment communities, while the latter develops and redevelops them.

Since the separation was finalized in late 2020, AIRC has proven itself as a standalone multifamily REIT. Leverage has come down (as around $1.5 billion of properties were sold), operating costs have remained low, the portfolio has been refreshed with high-upside properties, and general & administrative costs have been kept below 15 basis points of gross asset value. The CEO was so committed to this last policy, in fact, that he reduced his compensation by $2.5 million in order to stay within that target.

Management has issued 2022 FFO per share guidance of $2.40 at the midpoint, which would represent 12% year-over-year growth. At the current stock price of around $55, AIRC is trading at a price-to-FFO of ~23x. While that may sound high, it is actually a 10-15% discount to both coastal multifamily REIT peer valuations and AIRC’s net asset value.

If AIRC continues operating efficiently and generates the kind of growth it expects, I believe this discount will narrow over time. That makes AIRC an interesting buy prospect even after its recent stock price rally.

The valuation discount to peers, which will be discussed below, may not persist forever. However, that could mean that AIRC’s valuation will rise to a level commensurate with peers. Or, if inflation and rent growth cools down, it could mean less downside for AIRC than for its higher valued peers.

Picture Of A Well-Run Multifamily REIT

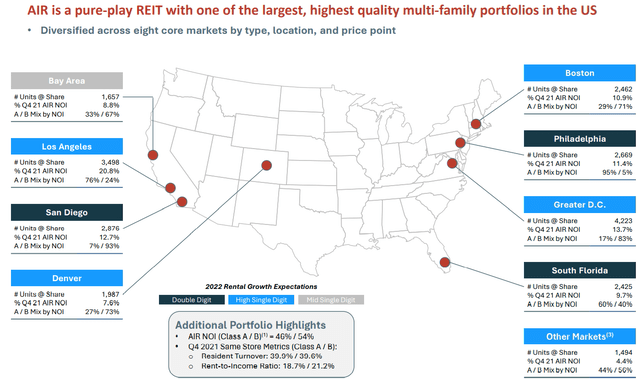

At the end of 2021, AIRC owned 78 properties spread across eight core markets, most of which are concentrated on the East and West Coasts.

AIRC March Presentation

AIRC ended the year with high occupancy above 98% and same-property net operating income growth registering in the mid-teens.

Of AIRC’s eight core markets, only Denver is not located on the coasts. And though the REIT does have exposure to the Bay Area in California, which suffered mightily from the pandemic as thousands of residents left the city for good, AIRC’s exposure to this market is smaller than for many of its coastal peers.

AIRC March Presentation

As for price point, AIRC’s portfolio is split roughly evenly between Class A and Class B apartments, with a slight tilt toward Class B.

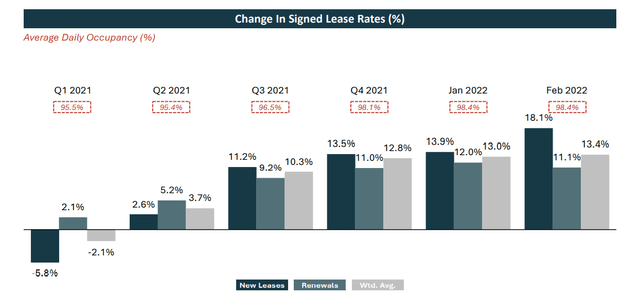

Leasing activity has been strong. In January 2022, AIRC reported average occupancy of 98.4%, a record high for the company and one of the highest occupancy rates among peers. In February 2022, average occupancy remained near its record high at 98.3%.

Meanwhile, contributing to this high occupancy has been AIRC’s high resident retention rate, which averaged slightly over 60% in 2021. This is a sign that residents generally like living in AIRC’s communities and will stay longer than for the average apartment complex.

Also, AIRC has been raising rents as demand has returned. In fact, rent rates are higher in seven of the REIT’s eight core markets than they were before COVID-19. In February of this year, blended (new and renewal) rent growth came in at 13.4%, a level of rent growth recently seen only by exclusively Sun Belt multifamily REITs.

Since the beginning of 2021, blended rent growth has risen quarter after quarter:

AIRC March Presentation

For 2022, management expects same-property NOI growth to fall in a range of 11% to 13%.

Finally, note that management has made significant progress on deleveraging. They expect net debt to EBITDA to be 5.5x by the end of this year, putting it in the same general neighborhood as its closest peers as far as leverage goes. Already at the end of 2021, pro forma net debt to EBITDA (after the closing of certain properties under contract to sell) sat at 5.3x. So, in short, management pretty much has debt levels where they want them going forward.

Comparison To Peers

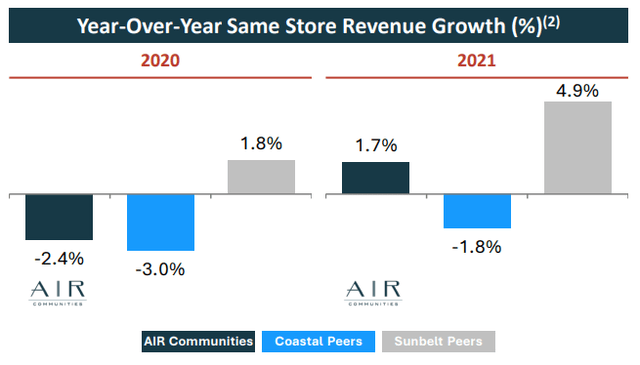

Though AIRC produced solid results in 2021, it continues to be treated as the lowest quality coastal multifamily REIT. That would draw one to conclude that AIRC’s operational performance was worse than its peers during this period. Not so.

Rather, AIRC was the only REIT among its coastal peer group to produce positive same-property revenue growth in 2021, resulting in 1.6% same-property NOI growth versus the peer average of -0.8%.

AIRC March Presentation

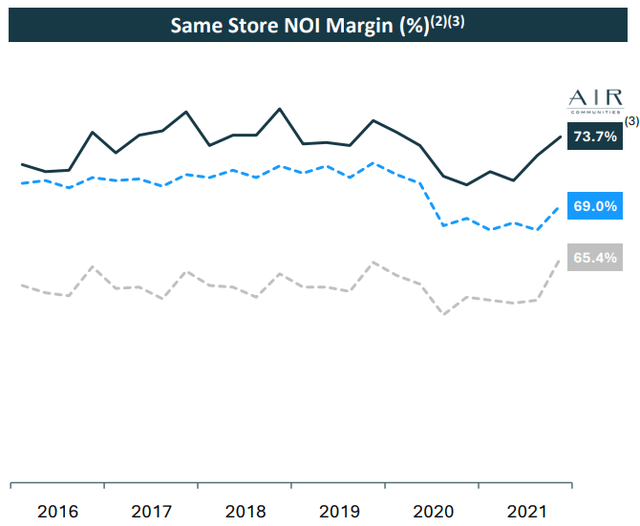

Moreover, AIRC also consistently generates higher same-property (or same-store) NOI margins than its peers, both coastal and Sun Belt.

AIRC March Presentation

It does so primarily by keeping controllable operational expenses low and operating its properties with extreme efficiency using its proprietary program called “AIR Edge.” Since 2008, AIRC has lowered controllable operating expenses by an average annual rate of 0.1%.

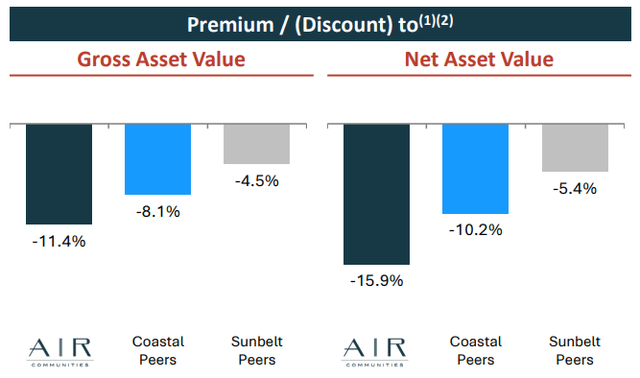

Also consider that AIRC’s discount to gross and net asset value is the largest in its peer group by a significant margin. This chart shows the discount as of March 3rd:

AIRC March Presentation

The stock price has gained around 5% since this chart was created, but other multifamily REITs have gained as well. The discount remains.

Let’s look at an up-to-date metric price-to-FFO for AIRC as well as its closest peers that own and operate apartment communities in coastal areas. These peers are:

- AvalonBay Communities (AVB)

- Equity Residential Trust (EQR)

- Essex Property Trust (ESS)

- UDR Inc. (UDR)

Here are the price-to-FFO multiples for each coastal multifamily REIT:

- AIRC: 23.0x

- AVB: 26.7x

- EQR: 27.1x

- ESS: 26.0x

- UDR: 26.2x

The average valuation of the other four coastal apartment REITs is 26.5x, which is about a 15% premium to AIRC’s valuation.

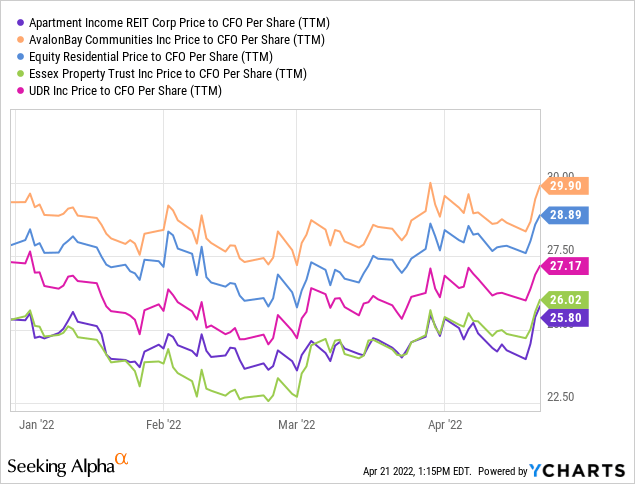

We can visualize this in a much rougher way using price to cash from operations (“CFO”) per share:

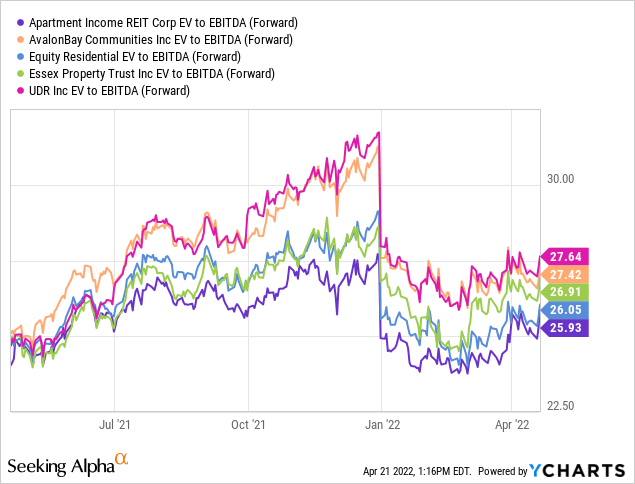

Likewise, when we look at AIRC’s enterprise value (incorporating debt and market capitalization) to EBITDA, we find AIRC sitting at the bottom of the heap.

Now, there are two factors that the market probably has in mind when assigning AIRC this discount:

- The REIT’s history of substandard performance and high leverage back when it was combined with AIV, and

- AIRC’s lack of development capability, which now solely resides in AIV.

Having the ability to develop properties in-house is an advantage for multifamily REITs in today’s ultra-low cap rate environment, even despite supply chain difficulties raising the cost and time-to-completion of development projects.

Most developers can still build properties for a stabilized NOI yield of 6% or better. Compare that to buying an already stabilized property for a 4% to 4.5% cap rate.

But AIRC does boast of one competitive advantage, and that is its “AIR Edge” platform that allows for very low operating expenses even as rent growth continues unabated. This should allow the effective cap rate on acquisitions to rise faster for AIRC than it would for a competitor with higher operating costs.

If the total asset base grows on net over time, AIRC’s higher NOI margin should make up for its lack of in-house development capabilities.

Bottom Line

AIRC is a good company trading at a good value. I would call it neither a wonderful company nor a wonderful price. But it is at least a decent price for a strong operator of properties that make a great inflation hedge.

AIRC expects to pay an annual dividend of $1.80 in 2022, which would represent 75% of expected FFO. At today’s price, that dividend would represent a yield of ~3.3%. And assuming FFO per share growth declined gradually to mid-single-digits thereafter, AIRC’s forward price-to-FFO would fall below 20x within a few years.

AIRC’s total returns going forward, then, are likely to average in the high single-digits or low double-digits. Of course, if inflation and rent growth continue longer than expected, then total returns are likely to be higher than that. But I do not believe AIRC has as much downside as some of its richer valued peers in the case that inflation and rent growth cool down going forward.

Be the first to comment