Ridofranz/iStock via Getty Images

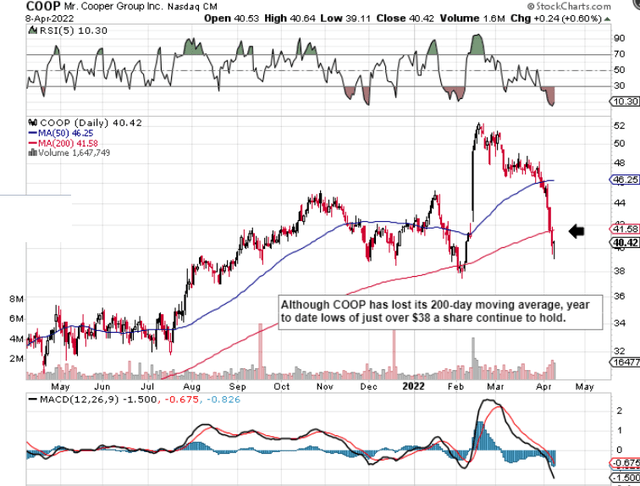

If we look at a technical chart of Mr. Cooper Group Inc. (NASDAQ:COOP), we can see that shares have slipped below their 200-day moving average and are now in oversold territory. Many trend-following traders usually liquidate or at least pear back on their holdings when the support of the 200-day average is breached to the downside. However, given the fact that shares are still only trading approximately 2.8% below the 200-day and the year-to-date lows printed in February are still holding, we would give COOP the benefit of doubt for the following reasons.

COOP Has Lost Its 200 Day Average But All Is Not Lost Here (Stockcharts.com)

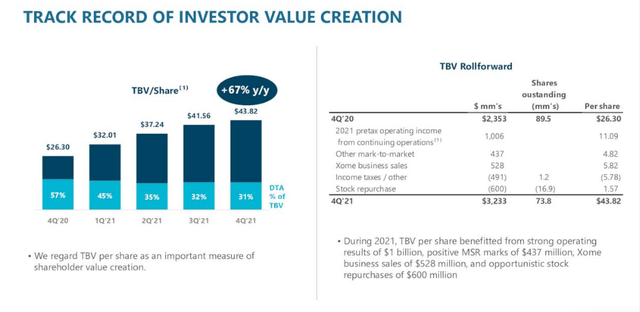

The trend for example with respect to Tangible Book Value per share is very encouraging and remains a good read on shareholder value. As we can see on the chart below, Tangible Book Value grew by 67% over the past 12 months due to over $1 billion in operating profit, $437 million of Mortgage Servicing Rights, share-buybacks of $600 million, and Xome business sales of $528 million. 20% of the company’s shares have now been bought back since the implementation of the scheme.

Investors should not underestimate the power of book value. Why? Because assets, as well as sales, are the drivers of COOP earnings (which consequently are directly correlated to share-price growth). Suffice it to say, since book value is the difference between COOP’s assets and liabilities, the larger this number grows, the more potential earnings (and the share price) have to grow also. Furthermore, the fact that COOP’s tangible book value per share remains well above the prevailing share price of just over $40 illustrates that investors can pick up this play at present well under the company’s intrinsic value.

Value Creation In COOP (Q4 Earnings Presentation)

COOP trades with a forward GAAP earnings multiple of 5.15 which is well over 50% lower than the sector in general. Although the earnings yield can sometimes not reflect the true valuation of a financial company, this pretence is thrown out the window somewhat when the above-mentioned book value per share is taken into account.

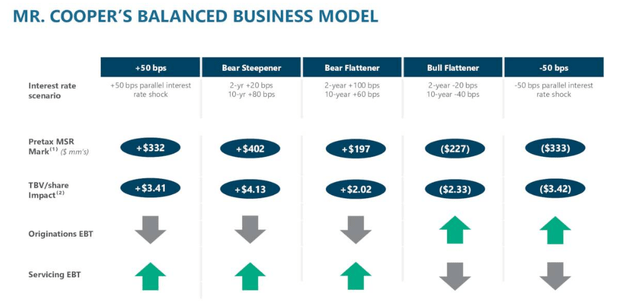

The rise in inflation and the Fed’s pivot to a more hawkish stance in recent meetings will affect the profitability of mortgage companies in due course. In terms of forward-looking projections, management gave a broad idea in the recent earnings presentation of how book value per share would potentially change in different interest rate environments. Essentially, it is all about how the long end of the curve changes compared to the short end. Suffice it to say, by taking current trading conditions of rising rates into account with respect to the yield curve and how it will change going forward, COOP’s balanced business model should be able to take advantage in multiple environments going forward.

How Interest Rates Will Affect COOP (Q4 Earnings Presentation)

Although the above numbers are subjective in one form or another, the attractiveness of COOP from our standpoint is the base from which it is working. The company’s liquidity remains very strong and sustained cash-flow generation puts the company in a strong position for MSR acquisitions. For example, COOP at the end of its most recent fourth-quarter reported $895 million in unrestricted cash as well as $840 million in unused MSR lines. COOP’s operating cash flow of more than $2.6 billion at the end of fiscal 2021 is a serious war-chest in this environment considering the company’s strategic focus on how it employs its capital. In effect, if portfolio growth and share buybacks can continue to take place without impairing the balance sheet unduly, share price gains should swiftly follow from present levels.

To increase one’s odds further, one could get long COOP by selling the at-the-money put options. The reason being is that the sharp fall in the share price this month has spiked implied volatility numbers to levels well above COOP’s averages. Although the sale of put options caps one’s profit potential, this strategy can be implemented over a recurring monthly basis for as long as implied volatility remains high in the underlying.

Therefore, to sum up, Mr. Cooper Group looks attractive at present due to its cheap valuation, its balanced business model, and its strong cash flow and liquidity profile. Based on current trends, we would expect the stock’s 2022 lows to hold here if indeed selling was to continue. We look forward to continued coverage.

Be the first to comment