Mario Tama/Getty Images News

EV stocks have been pummeled for the most part this year, as growth stocks in general continue to be out of favor. However, that has created some opportunities in great companies that now have asymmetrical risk/reward propositions firmly in favor of the bulls.

One such stock I think appears to have made a long-term bottom is EV startup Fisker (NYSE:FSR), a company that still has essentially no revenue. This one requires some faith, which could explain why its stock is so volatile, but at the current price, I think the risk is much, much lower than the reward.

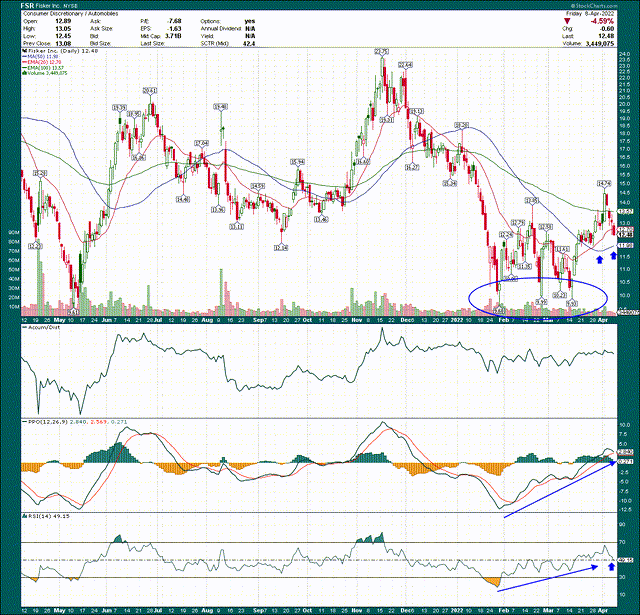

Two things stand out to me on the price chart, so let’s examine each. First and most importantly, the stock made a triple bottom in the area of $10 earlier this year, which was where it bottomed last May as well. That sort of bottom will take a huge effort from bears to breach, so I’d expect that to hold under just about any circumstance.

Second, the major moving averages – the 20-day EMA and the 50-day SMA – have turned higher and should provide support on the way up. Those are two conditions you need to see to know if a stock has made a sustainable bottom or not, and I believe Fisker has. That doesn’t mean it cannot go lower from here, but all indications are that it won’t go any lower than ~$10.

Momentum has improved significantly during this most recent rally as well, which is great news for those of us that think it has bottomed.

In addition to that, short interest is still sky high at 33%, meaning that if I’m right and Fisker is going to rally, as shorts take more and more pain, this thing could take off in a hurry. We saw this behavior last fall when the stock doubled in the space of a couple of months, and it happened in early-2021 as well. This is not the primary bull case, but it definitely helps.

Now, let’s take a look at the fundamental case, which does require some faith, as I mentioned above.

Low expectations = your opportunity

When I say “low expectations”, I’m not talking about Fisker itself. Indeed, the company has rather ambitious goals. However, the stock itself appears to be pricing in low expectations for revenue, and further out into the future, for earnings. Let’s start with revenue expectations from analysts.

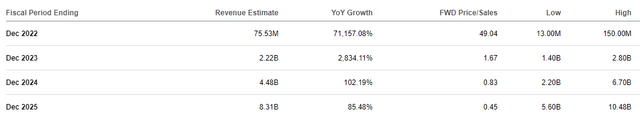

There’s still almost no revenue for this year because deliveries don’t start until November. That leaves almost no time to build volume, and the revenue total reflects that. Thus, this is a 2023+ story, but even so, I think it’s a good one.

First, all indications are that Fisker is on track to hit November deliveries. That’s a very good thing for the bull case because if that doesn’t end up happening, investors will almost certainly punish the stock in response. In this case, Fisker set this target a long time ago and it appears to be a reasonable one, so I’m not worried at the moment, but it’s a risk.

Profitability isn’t set to arrive until sometime in 2024 or 2025, so we really are talking about a startup here, and given that, we need to evaluate it differently to a company that is established. We can see the price-to-sales on consensus estimates is just 1.7 next year, and 0.8 the year after that. When I say the stock is pricing in low expectations, this is exactly what I mean.

Rivian (RIVN) is 5.4X next year’s sales, Tesla (TSLA) is 9.9X, Lucid (LCID) is 10X. None of these are directly comparable to Fisker but they are pretty close, and the multiples are way off. Fisker is being priced, in my view, like it will have delays and very low volumes. If it can get anywhere close to consensus estimates next year, the stock should be much higher than it is today.

Fisker – An attractive, asset-light model

One of the big problems with automakers is that it takes an enormous amount of capital and time to build scale. That’s been a problem since automaking began, and it is why Tesla, for instance, continues to invest billions of dollars in manufacturing capacity and expertise around the world. The other large automakers do the same thing, but they can only do this with billions of dollars in cash to spend, and patience to wait for it to take hold.

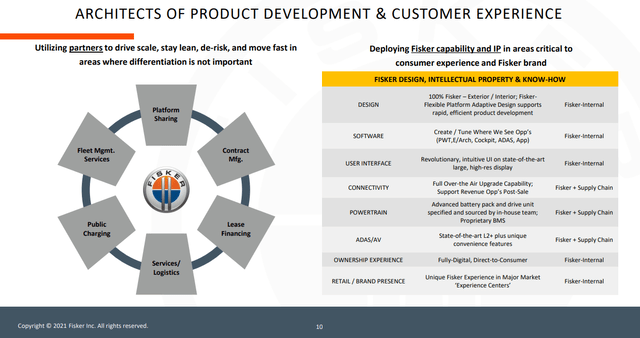

Fisker is different, and one of the reasons I really like it is because it is ignoring that model and going to one where it uses partners to do the heavy lifting, and capex-heavy work.

By using partners to make its vehicles, Fisker doesn’t need billions of dollars in cash for factories and supply chain investments, it doesn’t need to hire tens of thousands of people to make its vehicles, and it can scale rapidly, rather than waiting years for capacity to come online. It’s a bit like a fabless semiconductor company versus one that makes the chips themselves; it offers significant advantages.

The tradeoff is that Fisker doesn’t have direct control over the pricing of manufacturing, and it doesn’t have direct control over the ability to scale production higher if the need arises. The big boys and girls in the sector manufacture their own cars for these reasons, but those problems only arise when the company is fairly mature. If Fisker wants to make its own cars five years from now, it should easily be able to afford to do so. But for now, this is certainly the intelligent way to get off the ground.

This slide shows the benefits of the asset-light model. I’m not going to read it to you but it is more detail on the argument for Fisker’s strategy, and it is worth the read if you’re interested in the stock.

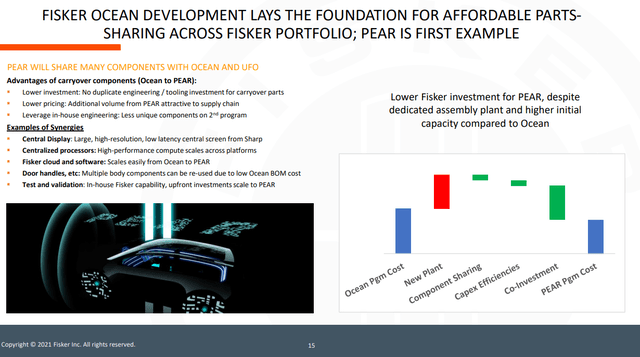

Now, the second thing I like about Fisker’s chosen path is that it is going to use as many common components in future models – subsequent to the Ocean – as it possibly can. This has a variety of benefits, as we can see below.

There are various cost benefits, as well as speed to market, no redundant engineering of designing the same part twice, and more. This is the scale benefit the big players have, and Fisker is looking to achieve it almost immediately with the second vehicle launch, which is likely to occur in 2024. For late-2022 and 2023, Ocean will carry the load.

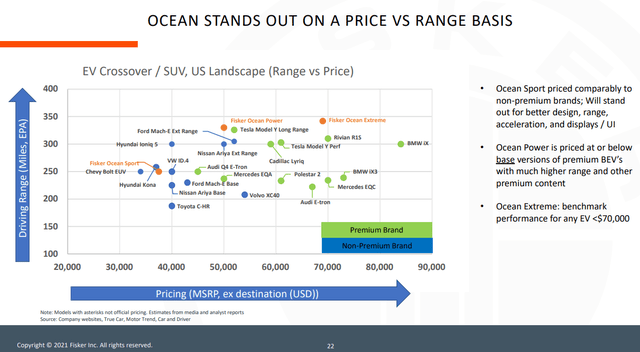

Fisker isn’t just a scale-at-low-cost play; I think the aesthetics of the Ocean and its features will make it a force for EV buyers. Fisker is going after the mid-size SUV market, which is extremely crowded, but that’s because that’s what a lot of buyers want. Given that, Fisker doesn’t need more than 1% market share to grow the company at huge rates.

The Ocean is very well-positioned at the moment in terms of power, features, and driving range among competitors. Fisker is trying to go after internal combustion competitors at similar prices, but with the advantage of being an EV. If Fisker can deliver on this, I think the stock stands to do very well.

Fisker’s cash burn

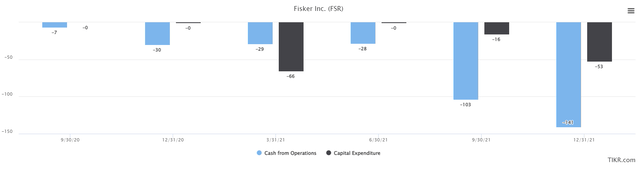

Obviously, since Fisker has no revenue, it is burning through cash, and that’s something that has to stop at some point. That “some point” is hopefully going to be around November of this year, when Ocean deliveries start. But for now, cash burn is an important consideration. Below we have quarterly operating cash and capex, the combination of which is free cash flow.

Operating cash is negative because there’s no revenue, and therefore, no profits. We can see spending is ramping, which makes sense because Ocean is nearing its first deliveries. Capex is choppy but the most recent quarter showed almost $200 million in total cash usage. We’ll see first quarter cash burn in mid-May when Fisker reports earnings, but for now, let’s assume $200 million per quarter.

Below we have the state of the balance sheet, where I’ve selected total cash and long-term debt. There are trade payables and other miscellaneous items but the amounts are small; cash burn is about what’s available to spend.

We can see the company has $659 million of LT debt as of the end of 2021, and about $1.2 billion in cash. If we assume $300 million per quarter in spending – which is 50% more than the highest quarter to date – Fisker will still have plenty of cash to get to Ocean deliveries.

Thus, importantly, I don’t consider cash burn to be a problem for Fisker at the moment. It also means that Fisker could miss the November delivery date target, and still have enough cash to carry it through into 2023 under any reasonable cash burn scenario. For a startup, I think that is quite important, and Fisker’s financing situation gets the stamp of approval.

Final thoughts

Obviously, I’m pretty bullish here. You have the potential for $4 billion to $5 billion in revenue in two years, and a stock that is trading at ~0.8X that value. I like the asset-light model for a variety of reasons, and I don’t think financing will be a problem. The potential for a short squeeze is very enticing as well, given we could see a rapid rally now that the stock has bottomed.

At the same time, there’s a lot that could go wrong with these projections between here and there. That’s a risk you have to be willing to take, and those risks would have been too much to bear with the share price in the $20s. However, at $12, I think these risks are priced in – and then some – and it is worth the risk to own it here.

So long as Fisker can hit its November delivery date for Ocean, I think there’s a lot of upside potential in this stock, and I think it made a sustainable bottom in early-2022.

Be the first to comment