DariaRen/iStock via Getty Images

The following data is derived from trading activity on the Tradeweb Markets institutional European- and U.S.-listed ETF platforms.

European-Listed ETFs

Total traded volume

Trading activity on the Tradeweb European-listed ETF marketplace amounted to EUR 75.9 billion in March 2022, just EUR 4.3 billion below its strongest ever performance in March 2020. The proportion of transactions processed via Tradeweb’s Automated Intelligent Execution (AiEX) tool was 81%.

Adam Gould, head of equities at Tradeweb, said: “March marked the end of a record quarter for European ETF trading on Tradeweb, with total traded volume reaching EUR 206.5 billion. Amid intense market volatility, clients continued to use our platform to conduct their business in a robust and efficient way.”

Volume breakdown

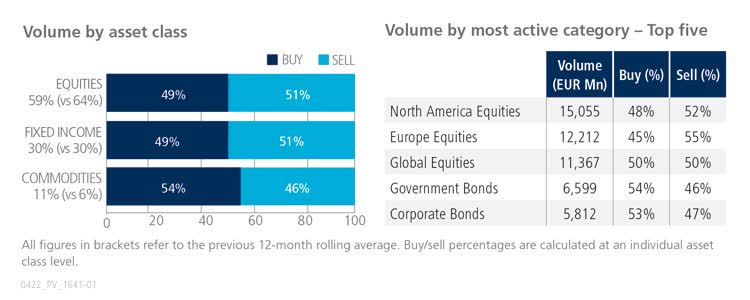

In contrast to their equity and fixed income counterparts, commodity ETFs saw net buying for another month. Activity in the asset class increased to 11% of the overall platform flow, beating the previous 12-month rolling average by five percentage points. More than EUR 15 billion was executed in North America Equities products during the month, with buys lagging sells by four percentage points.

Author

Top ten by traded notional volume

There were three commodity-based products among the ten most aggressively-traded ETFs in March. The iShares Core S&P 500 UCITS ETF held on to the top spot for the eighth month in a row.

Author

U.S.-Listed ETFs

Total traded volume

Total consolidated U.S. ETF notional value traded in March 2022 was a record USD 58.8 billion, beating the platform’s previous strongest performance in January 2022 by nearly USD 9 billion.

Volume breakdown

As a percentage of total notional value, equities accounted for 48% and fixed income for 46%, with the remainder comprising commodity and specialty ETFs.

Author

Adam Gould, head of equities at Tradeweb, said: “Record institutional client activity on our U.S. ETF platform was driven by elevated market volatility coupled with further adoption of the RFQ protocol. The ability to achieve competitive pricing in a fast, streamlined trading workflow continues to resonate with our clients, particularly during times of market stress.”

Top ten by traded notional volume

During March, a record 2,067 unique tickers traded on the Tradeweb U.S. ETF platform. Once again, fixed income ETFs dominated the top ten by traded notional volume, with the Vanguard Total Bond Market Index Fund ETF ranked first. The fund provides broad exposure to the taxable investment-grade U.S. dollar-denominated bond market, excluding inflation-protected and tax-exempt bonds.

Author

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment