Paul Zimmerman

Investment Thesis

I think that Etsy (NASDAQ:ETSY) is a solid business. The company has created a stable moat in the ecommerce market. I think that its business model is sustainable and its finances are healthy. But shares are trading at a very expensive valuation. Stock-based compensation is also very high. For these reasons, I’m avoiding the stock right now.

Flattening Growth And An Uncertain Future

Etsy has successfully established its own space in the crowded ecommerce market. Its focus on independent sellers and handmade goods has created a strong brand and moat. The company has differentiated itself from industry giants like Amazon (AMZN). This has led to an incredible amount of growth. Over the past five years, Etsy’s gross merchandise sales increased 382%.

But the economy is pulling back. Inflation is running high, and core expenses such as food and housing are surging. Etsy’s products mostly seem like discretionary expenses. This would make its revenue base especially vulnerable in a recession.

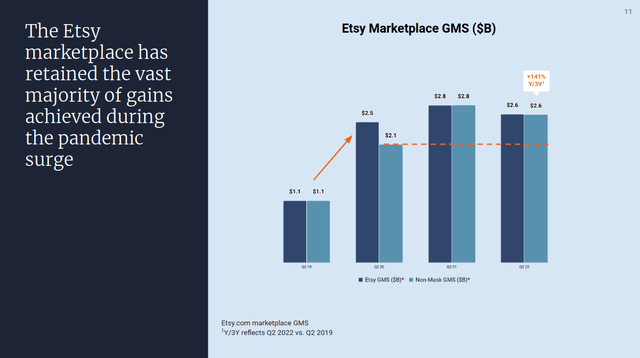

But so far, Etsy is retaining its pandemic gains. The company’s consolidated Q2 GMS was flat year over year in nominal terms. On a constant currency basis, its GMS was up 2.6%. The company’s core Etsy platform also performed well. Adjusted for one-time mask purchases, Etsy’s Q2 GMS was still up 24% from 2020 levels. In nominal terms, it was down 7% year over year. This was negatively impacted by currency headwinds.

Etsy July 2022 Investor Presentation

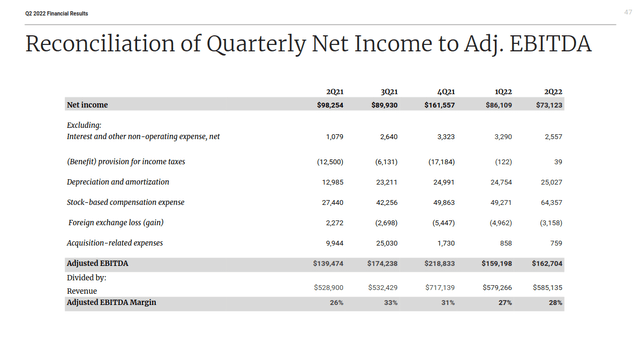

Although GMS growth has stalled, Etsy was able to take some measures to boost its topline. The company increased the transaction fees on its platform from 5% to 6.5%. This led to revenue growth of 10.6% year over year. Adjusted EBITDA moved upwards by 16.6%.

I’m not a fan of this strategy in the long term. Yes, companies can boost near-term revenues by increasing their take rate. But this is not a sustainable growth driver. Sellers will eventually leave the platform if the costs become too high. However, I don’t believe that is a concern for Etsy. Even after the recent hike, Etsy’s direct fees are still a lot lower than its competition. The company currently charges 20 cents per listing plus 6.5% of the purchase price. This compares favorably to eBay (EBAY), which charges 30 cents per order plus 12.9% of the purchase price on most items. Amazon’s referral fee is 30 cents per unit plus 15% for most categories.

In the long term, Etsy likely has some room to increase prices further. This is a lever the company can rely on if it needs to generate more profit. But the business will ultimately have to return to GMS growth to justify its price. It’s unclear when or if this will happen.

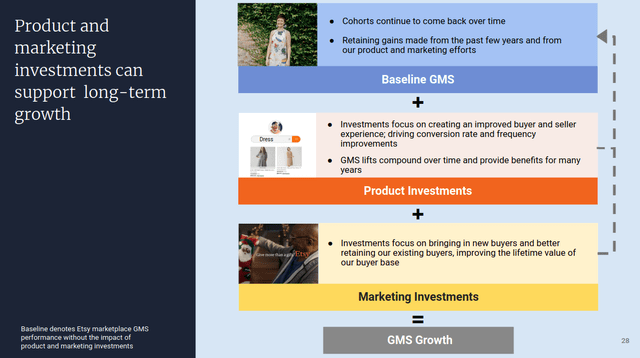

Etsy July 2022 Investor Presentation

In the long term, I think that Etsy has the potential to generate solid incremental growth. One of the major drivers for the company’s topline is the quality of its product discovery. There are over 7.4 million sellers on Etsy’s platform, many offering unique products. This massive number of options creates a lot of friction. That reduces conversion rates and reduces sales on the platform. The company can boost its GMS by getting the right products in front of the right buyers at the right time. I believe that Etsy has a lot of opportunities to drive incremental GMS by boosting customer conversion.

When it comes to retaining growth, I believe that the upcoming holiday season is likely to be the main test of Etsy’s business. The rate of GMS declines is starting to decelerate. But management still stressed that they have little visibility into the future. They don’t know if their platform sales have hit a bottom yet.

Etsy has only been around for 14 years. The company hasn’t ever been through a major recession. There’s limited information on how well it will perform. We already know that Etsy’s core categories are somewhat discretionary. I think this could be a significant near-term risk to the business.

Etsy’s Solid Financial Health

Etsy has solid financial health. The company is consistently profitable on a GAAP basis. It generates solid free cash flow. Its adjusted EBITDA margins are solid. The company regularly reports adjusted EBITDA margins in the 30% range. The company is currently guiding for Q3 adjusted EBITDA of 26%. This includes a 400 basis point headwind related to Depop and Elo7. These are Etsy’s earlier-stage marketplaces, which aren’t very profitable.

Etsy’s business model has fewer risks than other companies in its category. The business doesn’t carry any inventory. It isn’t as affected by the high markdowns in its core markets. This should allow the company to maintain its healthy gross margins. On their last earnings call, management discussed how they are navigating this environment.

We are also seeing a lot of discounting in the market, Walmart reported yesterday that they’ve got oversupply. And so they’re having to do a lot of discounting it, it’s moments like that when I continue to be grateful that our model does not require us to spend billions of dollars buying inventory in advance on the hopes that there will be demand for it when it finally arrives weeks or months later.

But nonetheless, there is a lot of discounting in the market… We’ve also launched a lot of sales and promotion tools that our sellers can use to put things on sale and our sellers are using those tools and they’re using them with increasing frequency. The result of that is actually that it completely offsets the increase in item prices, meaning that the net item price has been basically flat for five straight years.

This operating model adds some resilience to Etsy’s operations. Even if the broader market pulls back, Etsy should be able to continue generating a decent profit.

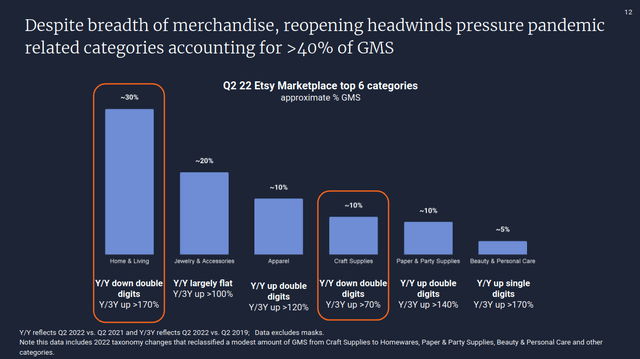

Etsy July 2022 Investor Presentation

The key source of GMS losses is in Etsy’s Home & Living category. The company reports that this segment is down double digits year over year. This is in line with what peers like Wayfair (W) are reporting. This is a major segment, accounting for about 30% of the platform’s revenue. But Etsy is diversified enough that other categories are partially offsetting this trend. Apparel and Paper & Party Supplies categories are both up double digits. Jewelry & Accessories are largely flat year over year.

Overall, Etsy has a solid financial position. It is likely to generate substantial free cash flow even if GMS growth continues to stall. I believe that Etsy’s solid competitive positioning gives it a long-term edge in its core markets.

An Expensive Valuation

Etsy shares are trading at a forward non-GAAP P/E of 28.6 times and a forward EV/EBITDA of 22.2 times. The company generates a modest return on invested capital of 8.8%. This valuation is clearly pricing in a lot of future growth, and I think that it is very expensive. I don’t believe that the risks associated with all the current growth headwinds are fully priced in.

Etsy has a healthy balance sheet, with over a billion dollars in cash on hand and short-term investments. This is offset by $2.3 billion in long-term debt. Most of this debt is very low interest and not due until the second half of the decade. A lot of the notes can be converted into shares, but the conversion prices are very high. The company’s 2021 notes have a conversion price of $246.80, 156% higher than the last closing price.

The business generates strong free cash flow. During the last twelve months, Etsy reported $540 million in FCF. This gives shares an LTM P/FCF of 22.6 times. This is solid, but I still have to consider the company’s very high stock-based compensation expenses. Etsy reported SBC charges of $64.4 million in the last quarter, compared to $73.1 million in GAAP net income. This is a significant cost that is excluded from adjusted EBITDA and other non-GAAP results. Adjusted for these expenses, the company’s forward P/E is 48.9 times.

Etsy July 2022 Investor Presentation

The business has offset this dilution with share buybacks. Etsy’s share count has been relatively flat since the third quarter of 2020. But in this period, the company spent $866 million buying back its own shares. The business had to spend a lot of money just to offset all of its dilution.

Final Verdict

I think that Etsy’s core platform is a long-term winner. In general, I’d like to own shares of the company. But the stock’s current valuation is very expensive, making this a risky prospect. The business has high stock-based compensation expenses. This makes me hesitate to buy shares right now. With the company’s uncertain future, I want a larger margin of safety. For these reasons, I think that shares still have some room to fall before being good value.

Be the first to comment