CVS is expanding digital and telehealth SDI Productions/E+ via Getty Images

We are bullish on CVS Health Corporation (NYSE:CVS). CVS has been in and out of our portfolio for several years, though we do not currently own any shares. This year’s stock price pullback (-13.5%) encourages us to believe the price dip is a potential opportunity to invest and profit during the 12 months coming.

Opportunities

CVS Health Corporation shares are up 8.35% over the past 12 months and +24.4% over the past 5 years. The share price is down about 11% to ~$90 currently. The dip started in mid-August when the high hit over $108 per share. Their Beta is 0.85; that is down from a 1.13 Beta rating one year ago. The low volatility is welcome news for retail value investors who do not value uncertainty.

We expect the share price to continue climbing, reaching an average share price target above $115 over the next 12 months. There will be occasional stumbles and tumbles. The current dip has been attributed foremost to a potential acquisition of Cano Health (CANO) and other issues.

In 2019, the share price slumped into the low $50s through most of that year. It followed the CVS-Aetna $69 billion merger. Aetna was the third-largest health insurance and services provider. We are confident CVS shares will rise again after closing and absorbing CANO.

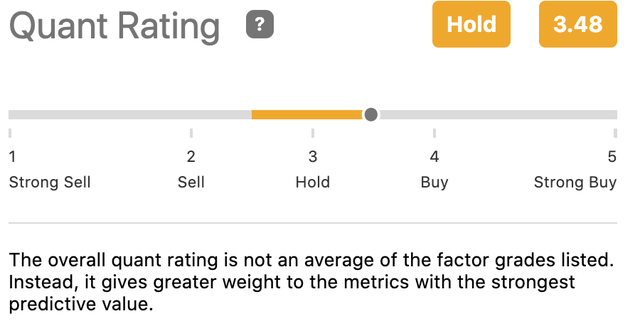

Despite down winds, Seeking Alpha authors and Wall Street analysts rate CVS a buying opportunity. Seeking Alpha’s Quant Rating of the stock is to hold, but the rating bar is about halfway up the slide rule to the buy side.

Quant Rating, CVS (seekingalpha.com)

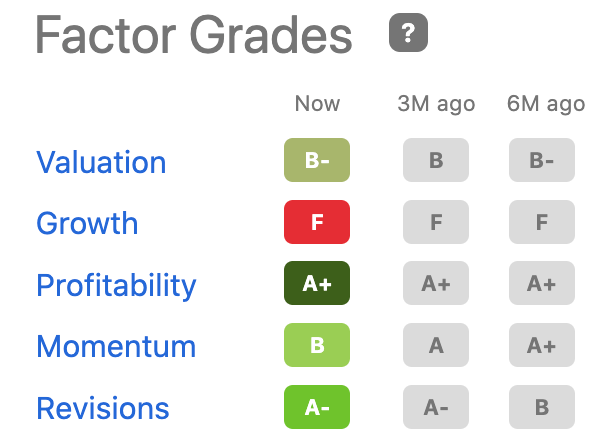

The bullish positions complement excellent Seeking Alpha Factor Grades. In our opinion, CVS is going to continue enjoying good momentum, superior profitability, and revisions going forward, recession or not; shares are slightly undervalued. They are at low risk of plummeting. A slew of studies and reports conclude health care and personal care products are high on consumers’ spending priorities.

Seeking Alpha assigns an F grade to growth for the last 6 months, but forecasts revenue increases from $291B in 2021 to an estimated $312B at the end of 2022, and $326B in 2023. In quarters one and two, 2022, earnings beat estimates. EPS for Q3 will probably be reported at around $2.00, down from $2.40 per share in Q2 ’22.

Factor Grades, CVS (seekingalpha.com)

The Company

CVS Health Corp walk-in stores and services are staffed by over 250,000 office and front-line workers. The company grew retail stores in the last decade from 5,474 in 2005 to 9,932 stores in 2021. CVS operates retail pharmacies/general merchandise stores in 49 states, D. C., and Puerto Rico.

Minute Clinics operate as urgent care walk-in operations inside stores offering 125 different services. Over 50 million patients have been screened and treated since their inception.

Another strategy CVS employs to expand its footprint is piggybacking on another top-tier retailer. CVS acquired Target Corporation’s (TGT) 1,672 pharmacies and clinics at the start of the pandemic.

CVS offers pharmacy services, health plans for commercial and specialty insurance, telehealth care, drug coverage for chronic conditions, and destination deliveries.

Hedge funds increased their holdings by nearly 300K shares in the last quarter. There is no significant trend regarding corporate insider trading. Media coverage is plentiful. There is strong sentiment for the stock that underpins our outperform expectations for the stock. Negative sentiment generates from the CANO move despite the 11% return on equity CVS reports. Short interest is a mere 1.12% with almost three days to cover.

The Last Pill

The investment mood in the retail pharma and health services industry dampened in recent weeks. Seeking Alpha’s Hold Quant Rating for CVS mirrors what it has for peers.

In CVS, investors can benefit from the safe 2.44% dividend yield or greater if the share price drops further or meanders in the $90 current range for some time. The CVS ex-dividend date is October 20, ’22, the expected earnings release date is November 2. We forecast the stock will pop higher if CVS beats our EPS Q3 estimate of $2 compared to the same quarter in FY ’21. Management might raise the dividend as an incentive to investors since the payout ratio is about a low 25%.

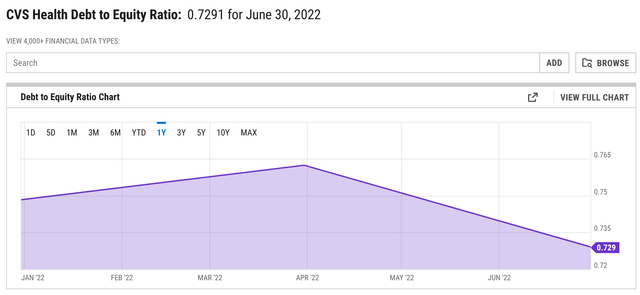

However, keep in mind retail operations devour cash. CVS had $53.4B of debt at the end of June after reducing it from +$59B the year before. The company holds over $15B in cash. CVS has a market capitalization of $116.19B. Cash and debt are being employed wisely, and there is little if any risk to the company’s liquidity.

Debt to Equity Ratio (ycharts.com)

CVS is building its digital prowess to enhance future growth. That takes money. They are spending $3B optimizing their digital footprint to improve efficiency and personalize healthcare by transforming its digital operations. Between September 2020 and January 2021, during the pandemic, hits almost tripled from 3.6M to +9M. It was a 13.77% increase. More impressive was the +14.17% from mobile devices. Management learned a lot from the experience. 45M digital customers visited CVS in the three months ending June 30, ’22. Online is the future for filling and delivering prescription medications.

Investors can feel assured that management takes Mark Twain’s observation to heart to “plan for the future because that’s where you are going to spend the rest of your life.”

Be the first to comment