NicoElNino/iStock via Getty Images

The EIA’s Short-Term Energy Outlook data is presented as “Petroleum and Other Liquids”. The EIA definition:

“Petroleum and other liquids: All petroleum including crude oil and products of petroleum refining, natural gas liquids, biofuels, and liquids derived from other hydrocarbon sources (including coal to liquids and gas to liquids). Not included are liquefied natural gas (LNG) and liquid hydrogen.”

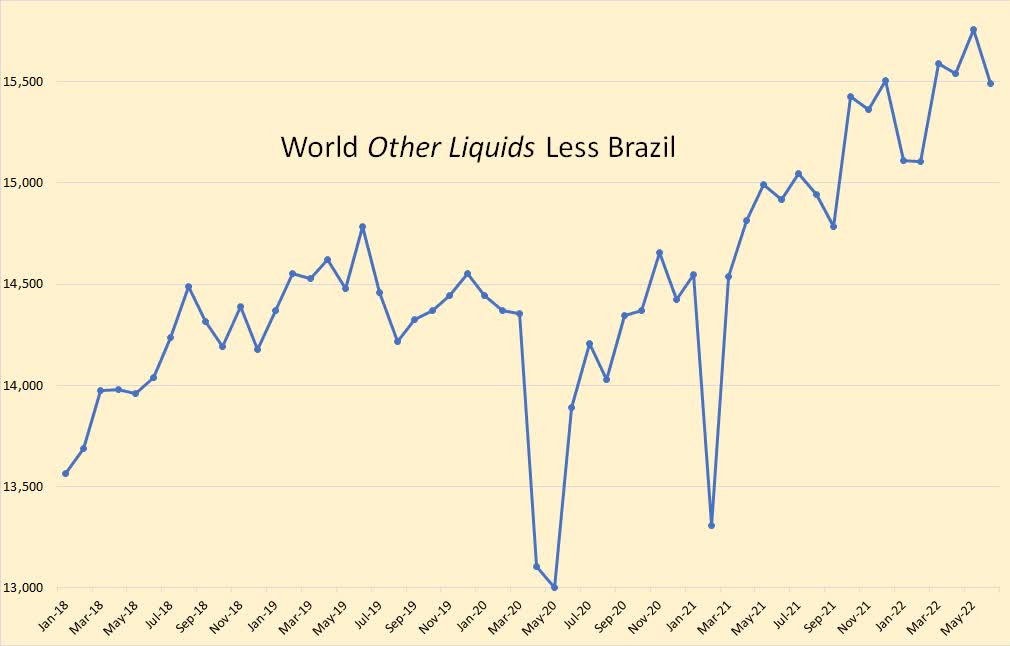

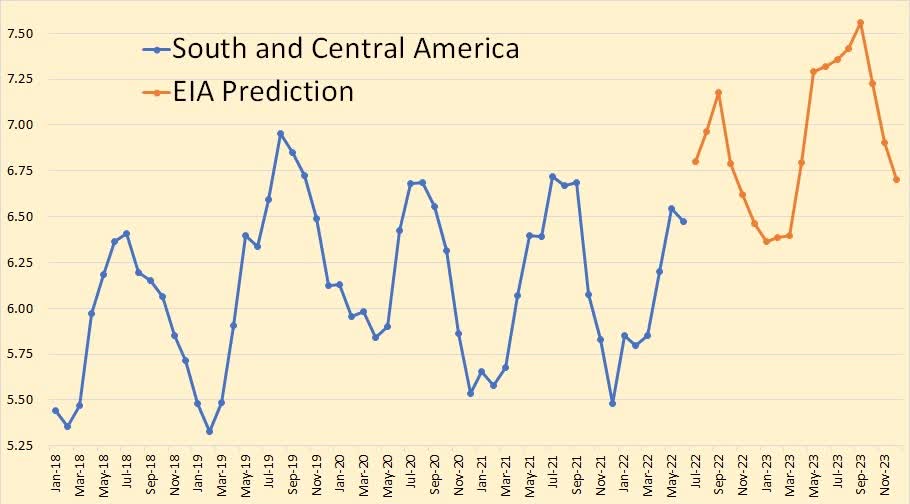

Other liquids include biofuels. Most biofuels come from Brazil. Brazil produces about one million barrels per day of ethanol during its winter months there and none during its summer months. The cane is cut in the fall and has fermented to alcohol by the winter months. So they have huge seasonal swings in production. In order to get a meaningful chart of other liquids, you must remove the Brazil biofuels from the mix.

From January 2018 to June 2022, World Other Liquids, less Brazil, increased by two million barrels per day. The data in the chart above is in thousand barrels per day. Total World Other Liquids, in June 2022, stood at 15.5 million barrels per day.

All charts below are Petroleum plus Other Liquids unless otherwise specified. None of the charts, except the OPEC C+C chart, and the World Liquids chart above, includes OPEC countries.

The EIA has World Petroleum plus Other Liquids approaching the 2018 peak but not quite making it before falling by two million barrels per day by March, then finishing out 2023 about a million bp/d below September 2022. The known data, in blue, is through June 2022. Data in this chart and all charts below is in Million barrels per day.

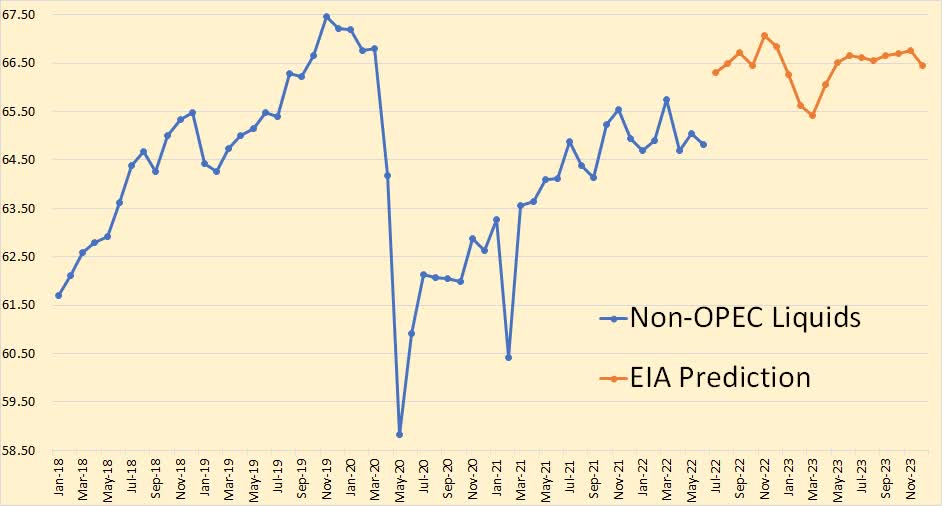

The EIA has Non-OPEC liquids dropping by about a million barrels per day by March, then finishing 2023 at about the same level it held in August 2022. The known data is through June 2022.

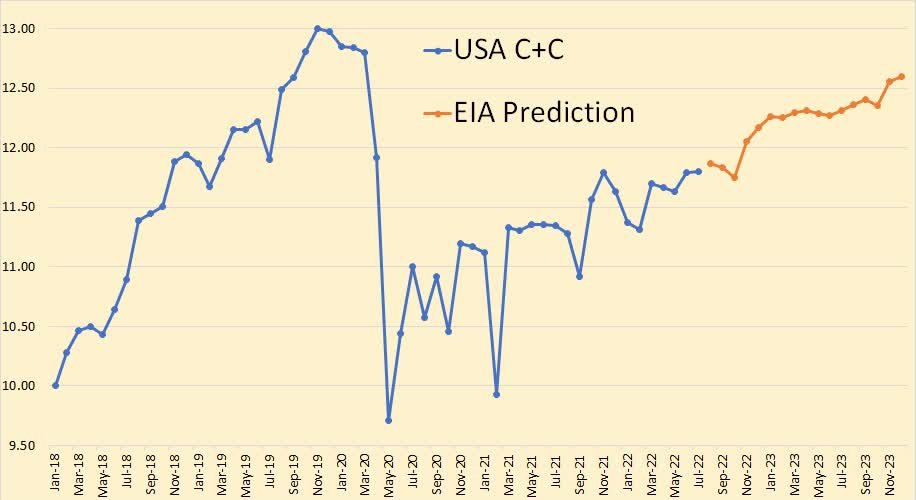

The EIA had US C+C continuing on its current upward track, increasing by another 800,000 barrels per day by the end of 2023. The known data is through July 2022.

The EIA has the Gulf of Mexico dropping in October of 2022 and 2023. I think that is supposed to be the height of the hurricane season. They have the GOM finishing 2023 up only slightly from where it is today. The known data is through July 2022.

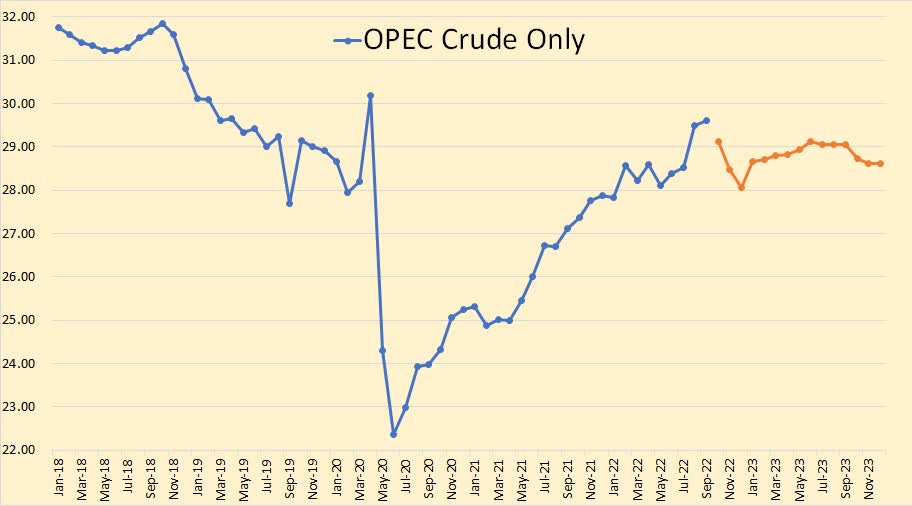

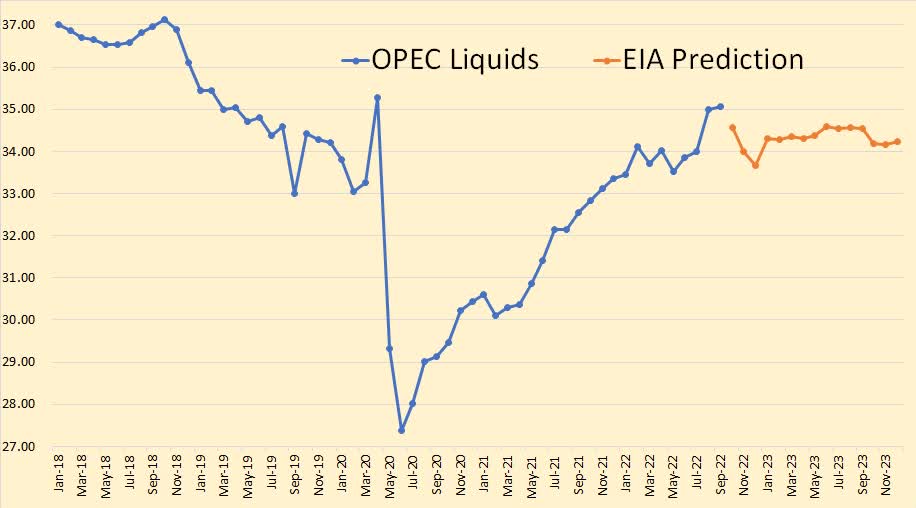

The EIA has OPEC crude only at 29.61 barrels per day at the end of September and dropping about 1.5 million barrels per day by December 2022, then recovering before finishing 2023 at about 1 million barrels per day below the September 2022 level. The known data is through September 2022.

OPEC Liquids look about the same as OPEC Crude only, except they average about 5.4 million barrels per day higher. OPEC Liquids added only 200 Kbp/d from January 2018 to June 2022 compared to over 1.8 million barrels per day Non-OPEC added over the same period.

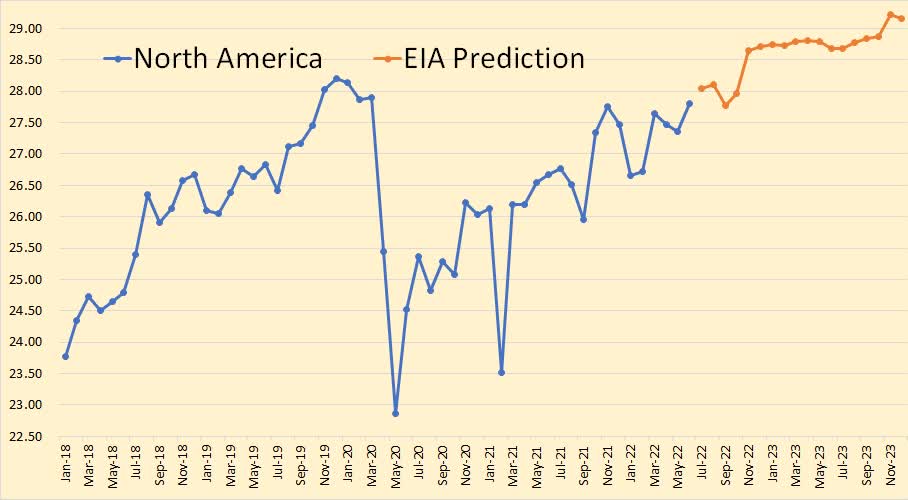

North America is the USA, Canada, and Mexico. Remember, this is petroleum and other liquids. And in the past few years, other liquids have grown while C+C has declined. The EIA sees North American liquids growing by just over 1 million barrels per day by the end of 2023. This data, as well as the data for all the charts below, is through June 2022.

Brazil, Colombia, Argentina, and Ecuador and .75 million barrels per day from various other countries make up South and Central America. The approximately 1 million annual swings in production is because of the seasonal production of sugar cane ethanol in Brazil.

Eurasian liquids production comes from Azerbaijan, Kazakhstan, Russia, Turkmenistan, and a few smaller producers. The 1.8 million barrel per day decline between September 2022 and March 2023 was all Russia.

The EIA has Russia dropping 2 million barrels per day between July 2022 and March 2013, then recovering a bit before holding in slight downward trend. Remember, this is petroleum plus other liquids. If you were to convert this to C+C only, you would need to subtract at least half a million bp/d from that data. That would mean Russia would produce about 8.75 million bp/d throughout 2023.

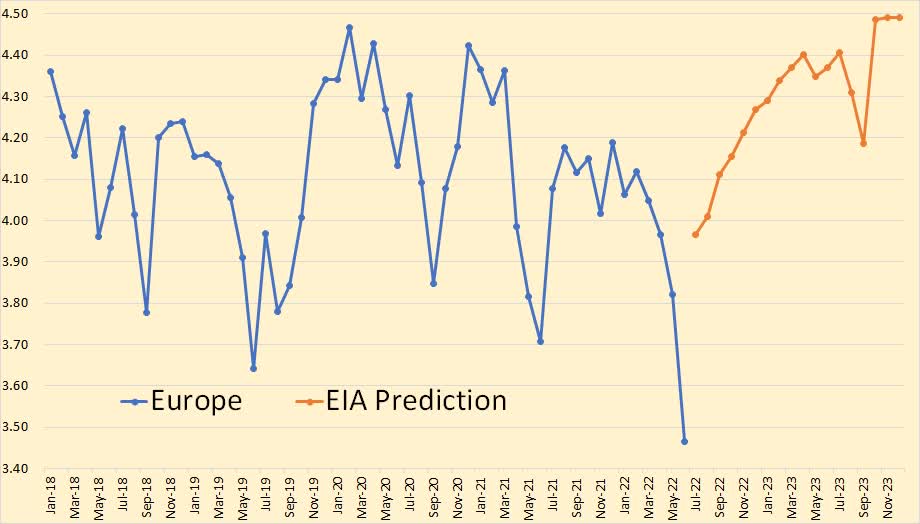

Europe is mostly the North Sea, Norway, UK, and Denmark, with a bit from other places. The EIA sees their production increasing from about 4.1 to 4.5 million barrels per day by the end of 2023.

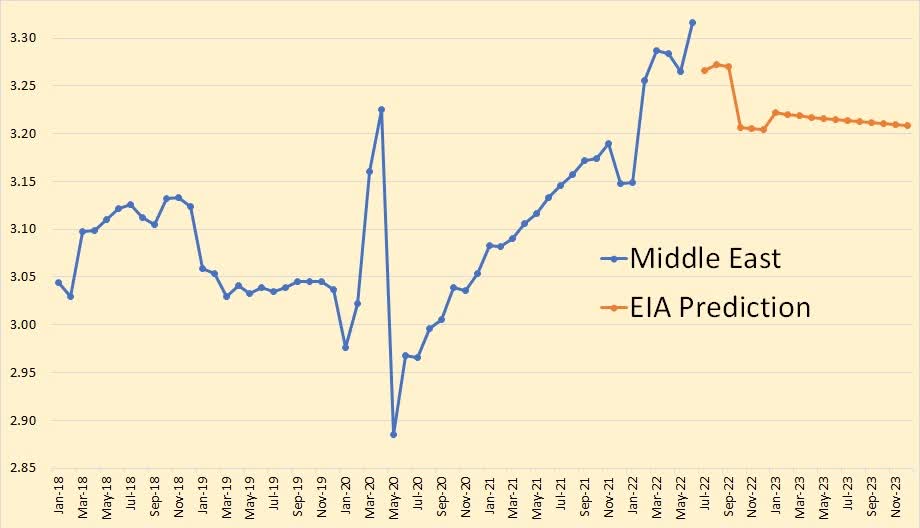

Oman and Qatar are the only major Middle East country that is not OPEC. There are other small producers.

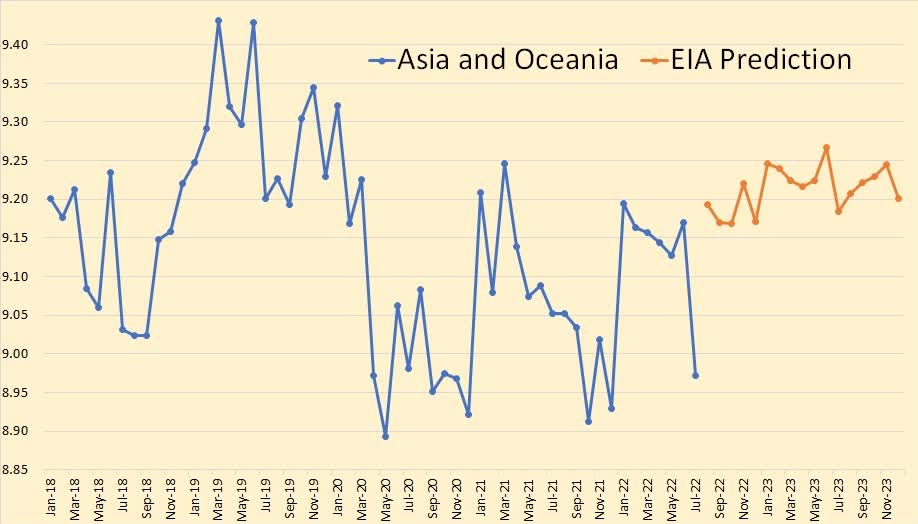

Australia, China, India, Indonesia, Malaysia, and Vietnam are the nations that make up Asia and Oceania. The EIA has them increasing production by 220 Kbp/d from July to August.

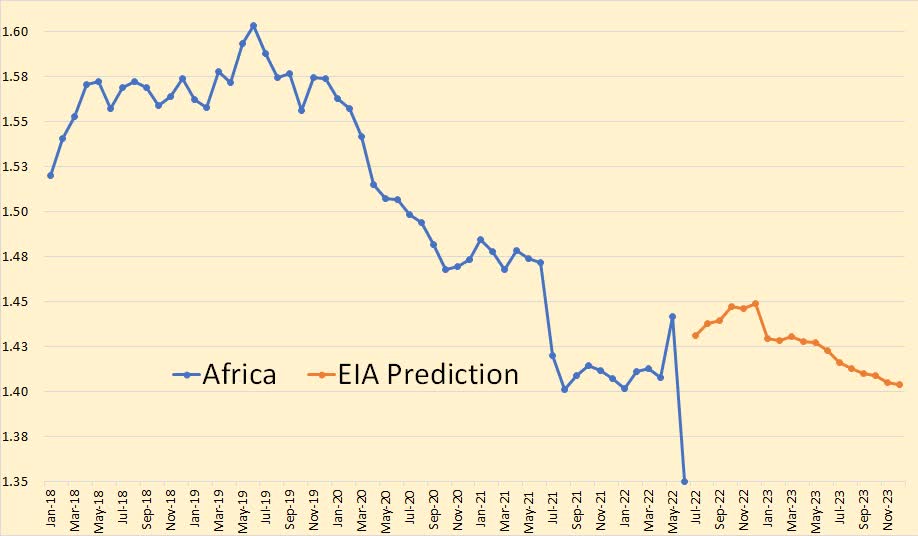

Egypt and South Sudan are the only major African producers that are not OPEC. There are a few other small producers.

So far, both World C+C and World Petroleum and Other Liquids peaked in November 2018. In June 2022, World Petroleum and Other liquids production stood at 3,536,000 barrels per day below that November 2018 peak. In the same month, World C+C stood at 5,270,000 barrels per day below that November 2018 peak. It is my prediction that this 2018 C+C peak will never be breached. However, I will not make that same prediction for Petroleum and Other Liquids, especially since the latter, in additional to natural gas liquids, includes biofuels. I really don’t think cane and corn ethanol should be added to the mix.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment