porpeller/iStock via Getty Images

Qorvo’s (NASDAQ:QRVO) last conference report stressed weakness in the China smartphone unit sales. The company’s larger exposure to this market leaves behind headwinds through at least the December quarter. But market’s often look past negativity if it sees light at a tunnel’s end. This company’s long-term vision remains much intact. For investors, the real issue focuses on, has bad news been priced in and is it light at the end of the tunnel rather than a train? So now, is it a good place to buy? Let’s go walk deeper and explore.

The Quarter

The quarterly report gave investors nothing special in results. Revenue equaled $1.04 billion, $10 million above guidance mid-point with mobile down year-over-year while IDP revenue grow double digit. The strength in the IDP markets was broad based and included: enterprise, smart home, automotive connectivity, electric vehicles, battery powered tools, infrastructure, and defense radar, and comms. Mobile strength continued outside of China with headwinds from China’s extreme weakness.

The company posted margins right at 50%. Cash flow from operations again impressed at $275 million. Free cash flow equaled $230 million. Qorvo repurchased $350 million worth of stock. It is carrying $2 billion in debt and approximately $1 billion in cash. Again, the Android ecosystem created most of the weakness in the overall mobile product business.

Management guided the September quarter slightly higher “between $1.120 billion and $1.150 billion, non-GAAP gross margin[s] between 49% and 50% and non-GAAP diluted earnings per share in the range of $2.45 to $2.65.” The usual significant revenue jump between June to September was missing.

The company wrote off approximately $110 million, GAAP only, from a past capacity reservation agreement commenced during a period of strong demand, a situation now past.

Design-in wins for the company were actually quite impressive and include:

- Ultra-wideband solution certification of Apple U1 use. (iPhone and Apple Watch models.)

- Power management with first time design wins for enterprise PMICs in data center applications.

- “For U.S. based Android OEM, we ramp shipments of our mid-high band PAD, antennaplexer with integrated LNA, ultra-high brand DRx, antenna tuners, and ultra-wideband solution in support of an upcoming smartphone launch. Both the ultra-high-band DRx and the antennaplexer with LNA represent new product categories for Qorvo.” (This is a very complex and broad reaching design win.)

We encourage investors to investigate the impressive laundry list contained in the quarterly results press release.

Qorvo at a Decision Point

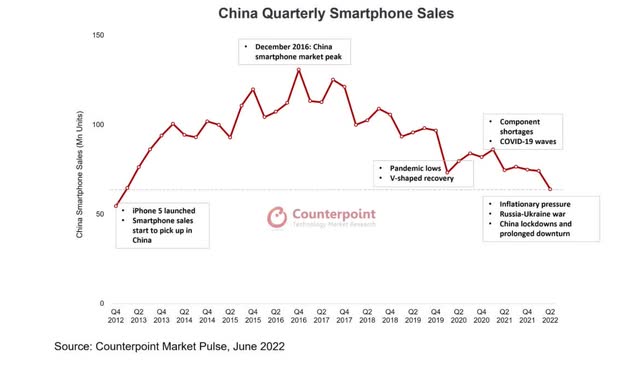

The company now faces a decision point. In the past, it has relied less on Apple and more on China/South Korea for growth in the mobile space. China, being kind, is in the tank 30%-45% off recent past performances. Longer-term it appears even worse. Perhaps the next slide shows the real issues with China. China reached peak unit volume sales in 2016 and is now approximately one half.

Constantly, we hear analysts pester management with questions concerning loss of content with cheaper China OEMs. Management constantly responds with, we know which phones are targeted and we know that we haven’t lost a single socket. That isn’t the issue in China and OEMs; it’s volume sales. With Qorvo’s deeply targeted business at China, the results are torpid and will continue without a change for at least the next few quarters.

New Organization

At the last conference, management made a quite a significant change. Bob Bruggeworth, CEO, closed his prepared remarks with “I’m pleased to announce a new organizational structure, Qorvo is now organized into three segments: connectivity and sensors, high performance analog and advanced cellular.”

- Connectivity and Sensors

- Headed by Eric Creviston.

- Ultra-wide band, Bluetooth, Matter, WiFi, cellular IoT and MEM sensors.

- Combines the connectivity businesses formally split between IDP and mobile.

- Markets: smart home, automotive connectivity, industrial automation, smartphones, wearables, gaming, and other high growth IoT connectivity and healthcare markets.

- Strong double-digit annual growth over the long-term.

- High Performance Analog

- Headed by Philip Chesley.

- RF and power management solutions for infrastructure, defense and aerospace automotive power and other high growth.

- Markets: electrification, renewable energy, the increasing semiconductor spend in defense and 5G deployments outside of China.

- Supports double-digit annual growth over the long-term.

- Advanced Cellular

- Headed by Frank Stewart.

- Cellular RF solutions for a variety of devices, primarily smartphones, wearables, laptops, and tablets.

- Supports high single-digit annual growth over the long-term.

An important change in vision drives the split, diversification from handsets in general. Management understands that mobile markets are marred with technology saturation and natural maturity. Qorvo’s last several acquisitions point to management’s understanding of this issue.

The China Problem Revisited

Above, we discussed China. Management cut its 5G unit phone sales last quarter and added a deeper reduction to its forecast for September through December. It also noted that China sales were off 45%, a steep decline. They expressed a belief that December was most likely the bottom. Adding depth to several questions, Bruggeworth stated, “but the weakness that we saw there implies a fiscal second half is down approximately 10% from the first half. But that said, we currently expect the December quarter to be the low point for our Android-based business.” High inventory issues exist adding to the uncertainty. Yet, Qorvo continues to win sockets in new phones and mobile devices especially with Samsung. Many of the devices will start to ramp in December and continue through March. In summary management noted, “So we’ve got a strong tailwind in terms of content and share gains, but just a massive headwind right now in digesting the channel inventory.”

The question asked at each conference about losing market share to low priced competitors once again appeared. Qorvo’s Head-Connectivity & Sensors, Eric Creviston answered, “Yes, it’s not a significant challenge. If you look into those suppliers, they are gaining some traction. We can say they aren’t, but they’re discrete players and discrete functions which, the market for that is extremely low tier iPhones. And we continue to have the playbook. We have everything in house, every filter switch PA packaging, power management, antenna, tuning, everything you need in one roof. And we put those into very highly value-added miniaturized modules, which aid and especially if you look at 5G handsets, I mean, it’s really required that use this type [meaning Qorvo] of technology.” It isn’t our target.

The Chart

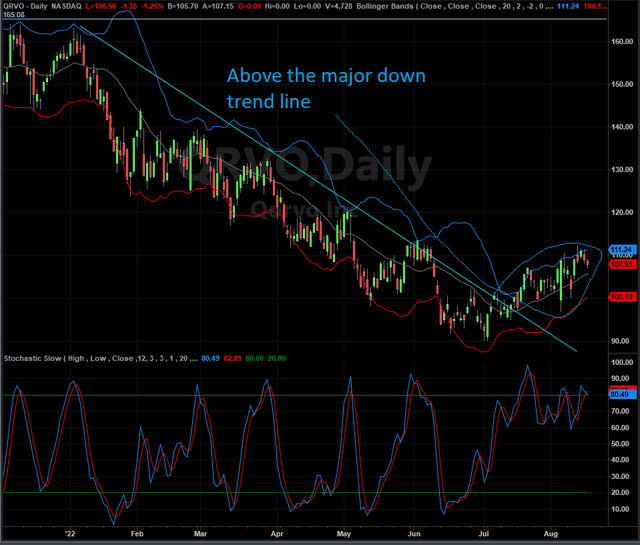

We included a chart made using TradeStation Securities of Qorvo’s day bar.

Notice the trend line, cyan, was broken several days ago. The stochastic, shown in the lower part of the chart, is still overbought, but downtrend forces eased opening opportunities to enter without being subjected to, at least at this point, a falling knife. Opportunistic opportunities will present themselves perhaps at points when the stochastic becomes underbought.

Investment & Risk

Qorvo is a different investment than two years ago. It encompasses less exposure to the more mature mobile device market. New meaningful markets include precise position, medical diagnostics, electric automobiles, and others. The growth rates in more pristine markets appears to equal near 15% yearly. Investors must understand that with greater diversity, growth becomes more measured and muted. The investment becomes longer-term in natural. The company bet a lot of its future away from Apple toward China OEMs. China is in some manner self-destructing. It is true that can and will change to some extent.

The major risk, in our view, is the macro economy. The marketplace is expecting a recession and perhaps a deep one. For example, Apple (AAPL) rumors claim a two week earlier announcement for its September releases was an attempt to mitigate softer demand most likely coming later in the year. Still in our belief, carefully orchestrated buying for those who are watching might be a great long-term strategy. The cold spell dissipated at least for now and the quivering stopped.

Be the first to comment