kanawatvector

In this article, I provide an overview of the Global Dividend Growth Split Corp. (TSX:GDV:CA). I outline some basics for these Class A shares in the split corporation and explain why they may be attractive to investors. In addition, I explain some of the key risks that investors in split corps need to be aware of. Finally, I explain why I think that GDV:CA is a sensible buy at these levels.

GDV:CA is an actively managed split share corporation that invests in large, blue chip, dividend growing firms around the world. It is offered by Brompton Funds, which was founded in 2000 as a home for alternative and income-focused investment products. Since inception, their products have paid out over C$3 billion in distributions. They have seven split share corporations (including GDV:CA) as well as a range of other ETFs and listed funds.

The fund profile is clear on the aim, which is “To provide holders of Class A shares with regular monthly cash distributions and the opportunity for capital appreciation.”

Exposure and holdings

The top 10 holdings are 25.8% of the NAV, suggesting a reasonably high level of concentration. In addition to cash and other short-term investments, the remaining nine top holdings are:

- Eli Lilly and Co, 2.7% (LLY)

- UnitedHealth Group Inc 2.5% (UNH)

- Bristol-Myers Squibb Co 2.5% (BMY)

- AstraZeneca PLC 2.5% (AZN)

- Novo Nordisk A/S 2.5% (NVO)

- DTE Energy Co 2.4% (DTE)

- Waste Connections, Inc. 2.4% (WCN:CA)

- Hershey Co 2.4% (HSY)

- Automatic Data Processing, Inc. 2.4% (ADP)

Through these investments, there is a reasonable exposure to a range of sectors. There is a moderate exposure to healthcare (such as the big pharma companies listed above) as well as some notable IT sector companies (such as ADP). The type of companies it holds appears to be a good match with the purposes of the split share corporation and makes sense given each constituent company’s history of growing dividends and their overall quality.

| Sector Allocation | % of NAV |

| Healthcare | 21.50% |

| Information Technology | 15.10% |

| Consumer Staples | 11% |

| Consumer Discretionary | 10.50% |

| Financials | 9.70% |

| Materials 7.7% | 7.70% |

| Energy | 6.90% |

| Utilities | 6.80% |

| Industrials | 6.40% |

| Cash & short-term inv | 3.40% |

| Communication Services | 2.20% |

| Real Estate | 2.00% |

| Other net liabilities | 3.20% |

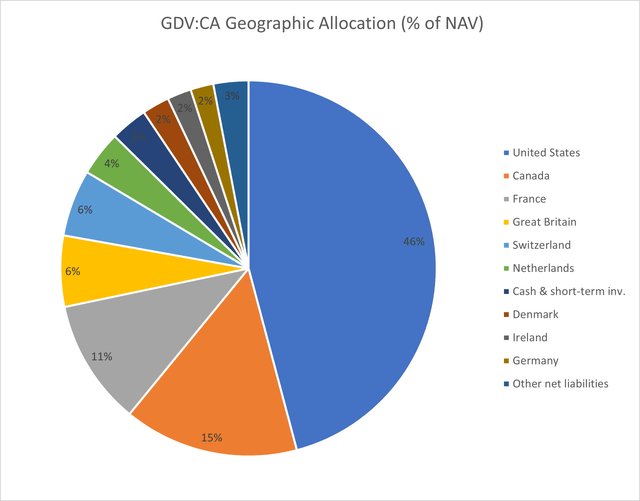

In terms of geographic allocation and diversification, the fund profile provides a table showing most holdings being U.S.-based. I like pie charts for this type of information, so I created one (Figure 1). From Figure 1, we can see that almost half of the allocation is to the U.S., suggesting that many international and U.S.-based investors will not gain significant diversification from this fund. However, there are several reasonable international allocations to France (11%) and Great Britain (6%). From this, I would assume that investors seeking additional geographic diversification from GDV:CA would be Canadian investors who are primarily invested in domestic companies.

Figure 1. GDV:CA Geographic Allocations (GDV:CA Fund Profile)

The overall quality of the companies is high, and the dividend-growing focus may provide a hedge against inflation. Brompton notes that “Dividend growth equities have historically outperformed in an inflationary environment […] the magnitude of outperformance tends to be bigger when inflation levels, as measured by the year over year change in CPI, are higher.” As a consequence, we might expect good performance over the last year and, if inflation persists further in the next few years, continued outperformance.

Distribution levels and growth

Split share corporations focus on high and stable distributions, with Class A shares receiving monthly distributions. GDV:CA is no exception, and the distribution yield is currently 10.5%.

What is a split share corporation?

The split share corporation is an interesting investment product that I have written about in a separate article. Readers that are unfamiliar with this type of product can find more details in that article. As a consequence, I will keep this explanation brief.

The Canadian split share corporation has two classes of shares that are invested in the portfolio of quality, dividend-focused companies. Both classes of shares trade separately. If we consider we might buy a stock with the hope of capital gains while receiving dividends, the split share corporation simply divides these two sources of returns into two distinct share classes that behave differently. Some fund managers such as Brompton go beyond simply collecting dividends from the underlying stocks in the portfolio and also actively write covered calls against the stocks, boosting the opportunity for higher distribution yields.

- Class A shares (GDV:CA) will magnify the underlying stock movements more than if you owned the underlying shares directly, much like if you were leveraged by borrowing money to buy the underlying shares. They will derive the distribution payments (monthly) from the remaining dividend income from the portfolio (following payments made to preferred shareholders) and other sources, such as a return of capital, capital gains, and any income from covered call writing on the portfolio.

- The Preferred shares (GDV.PRA:CA) receive quarterly fixed distributions. They do have a claim ahead of the Class A shares if they terminate the fund. But the shareholders receive no benefit if the stocks in the portfolio increase in price. Consequently, the market prices of a preferred share will be relatively stable. The income will primarily be driven by the portfolio’s dividend income.

Split share corporation’s risks and challenges

As noted, GDV:CA has good global exposure to different geographies and sectors, representing value to many Canadian investors. The diversification reduces risks of wider stock market downturns or sector-specific issues, such as the small allocation to REITs suggesting that a housing market bubble would not affect GDV:CA very much.

The “$15 rule” (covered more extensively in my other article) means that a slip below this level for the Unit NAV (not just the value of the Class A shares) would mean a suspension of the distributions for Class A shareholders. The diversification of the fund means that different exposures to sectors and geographies should balance each other out, reducing the likelihood of significant declines in the NAV, with exception of wider economic challenges facing multiple sectors and geographies, as we saw during the GFC in the late 2000s. If the Unit NAV approaches and slips below $15 and the distributions are suspended, the Class A shares may slide in value faster than expected, generating a capital loss for shareholders that may not be expected.

The investment is in Canadian currency and so U.S. and international investors will be exposed to currency fluctuations and exchange rate risks.

Comparison with peers

Selecting peers is always challenging. Here, I have selected a range of broadly comparable funds that U.S. or international investors may already own in their portfolios. This includes both ETFs and CEFs:

- iShares International Dividend Growth ETF (IGRO)

- Vanguard International Dividend Appreciation ETF (VIGI)

- Franklin International Core Dividend Tilt Index ETF (DIVI)

- BlackRock International Growth & Income Trust (BGY)

- WisdomTree International Quality Dividend Growth Fund (IQDG)

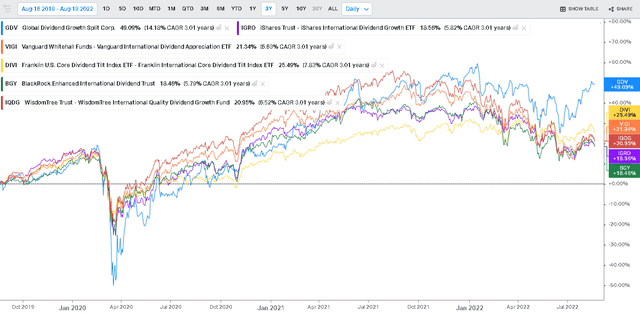

From Figure 2, we can see the impact of the ‘structural leverage’ that the split share corporation structure offers. GDV:CA outperforms over the period shown, but in 2020, we also see a substantial decline in returns that is of greater magnitude than its peers. Through 2020 and 2021, we see GDV:CA also grows rapidly but has curiously not declined much in early 2022 before shooting rapidly up over the July period in 2022.

Figure 2. Relative total return between GDV:CA and several comparable funds including the 2020 COVID Pandemic dip showing the impact of the leverage of GDV:CA (Koyfin)

What sort of investor will be interested in GDV:CA?

There are several issues here that I would consider if I wanted to add this fund to a portfolio. Here are some questions I would ask myself:

- Am I ‘over-paying’ for the fund? Is it trading at a discount or a premium?

- On 18 August, GDV:CA traded at the price of C$11.43 and listed a NAV of C$9.38, a 21.8% premium. While we expect split corps to trade at a premium, and we often see other high-yielding funds trading at steep premiums (such as CLM, for example), this is something to keep in mind.

- Will I be ‘caught out’ with the $15 rule and miss out on distributions? Recall that the NAV of both shares need to be above C$15 for the Class A shares to pay out distributions. In this case, the NAV for the Preferred shares are always about $10 (remember – they are designed for stable prices and a set income) and on 18 August they came in with the NAV at C$9.38, and the Unit NAV of C$19.45.

- This represents a moderately healthy Unit NAV in excess of the $15 level, where the distributions to Class A shares would be suspended.

- (Is this a real fear? Yes – several split share corporations do trade near the C$15 unit NAV level and are at risk of having the distributions suspended. If this were to happen, I would expect to see the fund then trade at a discount as investors sell out rapidly.)

- How does this fit within my wider portfolio composition?

- The holding provides global and sector diversification as you are not being shares of a company so much as a share in a fund holding many quality companies.

- If I were a Canadian investor, buying GDV:CA would provide exposure to some exceptional and globally focused blue chips and might, therefore, provide diversification away from the local Canadian markets.

- As an international investor or a US investor, GDV:CA may provide limited value in terms of the diversification offered. Many investors will already have exposure to the holdings of GDV:CA or similar companies within their portfolio or through current holdings of ETFs, mutual funds, or index tracking funds.

- Will this fit my income or growth objectives?

- If seeking consistent and reliable income, it is wise to keep in mind that the split share corps may suspend their distributions because of the $15 rule. If you need that income coming in each month or quarter, then you would find it hard to hold a split share corporation that suspends distributions possibly during tough economic times or market downturns.

- If looking for long-term growth, will a fund focusing on providing income provide that capital appreciation? Many younger investors with a long horizon of decades may not want large income payments in the interim (think about the tax implications) and may instead be focused on capital appreciation and growth stocks. However, as we can see from Figure 2, the structural leverage may also provide some long-term growth potential.

- Do I want to deal with international holdings?

- If I am not a Canadian, do I want to hold this? I will deal with currency exchange rates and international taxation. It may be a little complicated! Given that for many non-Canadian investors, the split corp will provide little diversification benefit, it may be wise to look for a comparable US-listed product.

Final thoughts

The Global Dividend Growth Split Corporation (GDV:CA) provides reasonable international exposure to a range of different business sectors. In this respect, if it was one of a few funds in the portfolio, it could be the cornerstone for a diversified core of the portfolio. However, used in this way, there is still heavy U.S. exposure and, for me, relatively less exposure to other sectors I like, such as REITs. It may need to be carefully supplemented with other funds in the core to provide increased diversification.

The structural leverage from the split share corporation structure, as shown by the volatility of GDV:CA in Figure 2, suggests that this should be carefully added to a portfolio. It is similar to either investing in a more leveraged CEF or buying an international dividend fund on margin. (Which may be a good use for this fund, if you can access GDV:CA but cannot access a margin account!)

Is it a good buy at these prices? I think, cautiously, that it is a reasonable buy, particularly for income-focused investors looking at the 10.5% distribution yield. GDV:CA holds good, quality companies. Looking down the top 10 list, none jump out at me as being horribly over-priced at the moment. As such, I think that buying at the current price provides moderately good value and security as the Unit NAV is comfortably over $15.

I like the fund and the composition, and I am comfortable with the leveraged aspect of the fund. I personally have a small exposure to the fund and, from the structural leverage effect discussed in this article, you might understand why you might hesitate to have a large portion of your portfolio in GDV:CA.

Thank you for reading my article and analysis. If you have any questions about the analysis or conclusions, leave a comment or get in touch and I will do my best to provide further insight.

Be the first to comment