kschulze

Introduction

Beazer Homes (NYSE:BZH) has been stuck between a rock and a hard place ever since the Global Financial Crisis. They went into that recession heavily levered, having grown their balance sheet significantly in the good times from 2000 onwards. Indeed, inventories of land and WIP grew from circa ~$600m at the turn of the millennium to $3.6bn in 2006.

The ensuing years were disastrous, with huge write-offs, net losses equivalent to more than their entire accumulated profits prior, and heavily dilutive equity issuance, all to try and prop up a balance sheet which was getting too toxic to touch. Retained profits for the corporation since inception are only just about to turn positive again. Pretty rough, for a 30 year history.

They made it through that tough patch: just. But Beazer, limping along, never really put the foundation beneath its own house. Even in 2013, when peers were marching along to recovery, Beazer was loss-making. It had around $1.5bn of debt against only $240m of stockholder’s equity. It was levered to the gills.

If that story of ancient history sounds like a strange place to start an investment idea today, consider that Beazer is still paying for the sins of its past, and perhaps will be doomed to repeat them.

Today, total debt sits at just over a billion dollars. They have managed to delever, and they’ve managed to grow EBITDA to improve their financial ratios.

Unfortunately for them, the rate cycle has turned at just the wrong time: and it seems to me that Beazer might be plunged right back into the abyss, with mortgage rates and falling home demand conspiring to snub out their nascent recovery.

But wait: look at the estimates!

Now, I know what you’re thinking – if you’re anything like me, that is, and a hound for cheap stocks. It’s at 1.5x forward earnings!

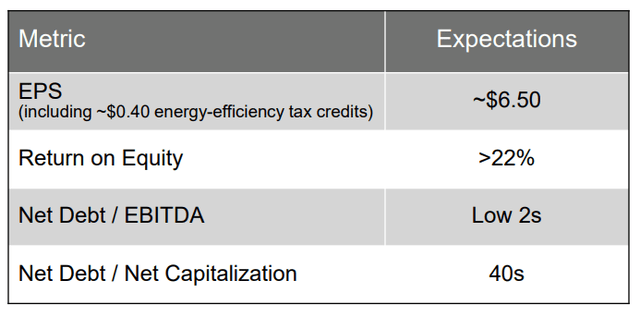

Indeed, management actually raised expectations at their most recent set of results, with EPS of $6.50 forecast against a stock price of around 10 bucks today:

Beazer Homes Investor Presentation

The trouble is, as with the other listed homebuilders, these earnings reflect the results of prior conditions which were much better than where things currently sit. They are delivering on a backlog forged in better times.

And those better times now look to be fading. The cancellation rate of homes under order is increasing rapidly. Beazer’s new home sales continue to track significantly below closings, meaning that they are depleting their order book faster than they are replenishing it. And the only saving grace is historically strong gross margins, propped up by an average selling price which has expanded significantly in the past few years, and even more explosively this year-to-date.

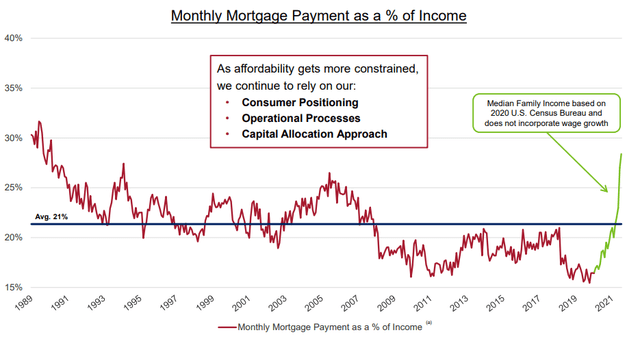

Is that last saving grace sustainable? The company highlights the problem well themselves in their recent investor deck:

Beazer Homes Investor Presentation

Affordability is getting much worse. In the words of Allan Merrill, Chairman & CEO:

“We’ve highlighted affordability risks in prior quarters, driven by higher home prices and higher mortgage rates. Those forces together with the highest inflation reading since 1981 finally reached a tipping point with consumers during the quarter, resulting in lower traffic in sales and an uptick in cancellation rates. This weakness represents an abrupt change from the past two years, and it reflects both economic and perceptual concerns.

Many consumers are having to confront the limits to their purchasing power, while others are reassessing their confidence in a home purchase decision, even though they can manage the payments arising from higher rates.”

As I’ve noted above, this won’t affect this fiscal year. The company will continue to close out its strong backlog at high gross margins. But the replenishment of that order book is dwindling, and sales prices will come under pressure, or will require more sweeteners.

Broker’s forecasts of $5.32 of EPS in 2023 seem to me to be incredibly optimistic in an environment where mortgages are now over 7%. This is not business as usual.

Note that this coming year’s EBIT forecast margin of ~11% compares to a prior peak of 6.9%. Assuming maintenance of 2022’s record earnings is extremely optimistic.

Why is Beazer Homes uniquely challenged?

To tie it back to where we started, it’s Beazer’s debt pile that creates such a challenge.

Sure, the stock is on a 1.5x forward P/E ratio: but on an EV/EBIT basis, its 5.4x forward valuation is not dramatically different from its peers. In fact, Lennar (LEN), D.R. Horton (DHI) and others are cheaper.

That comparison hints at the dynamics of this set-up. Beazer Homes is trading more like an option than an equity. It is, in absolute terms, no cheaper than its peers… but the sheer amount of financial leverage on top of a tiny equity stack creates a situation where the equity could easily be worthless in a negative scenario, or multiplicatively attractive in a bullish one. These ‘lottery ticket’ type investments attract speculative shareholders.

For the hell of it, take a look at the short-term option chain and the implied vols in the right hand column to get a sense of how traders are pricing Beazer:

You’re reading that right: at-the-money calls are returning you more than 10% on a two-month basis. At-the-money puts for the same time period cost you 10% of your principal. The market expects severe volatility.

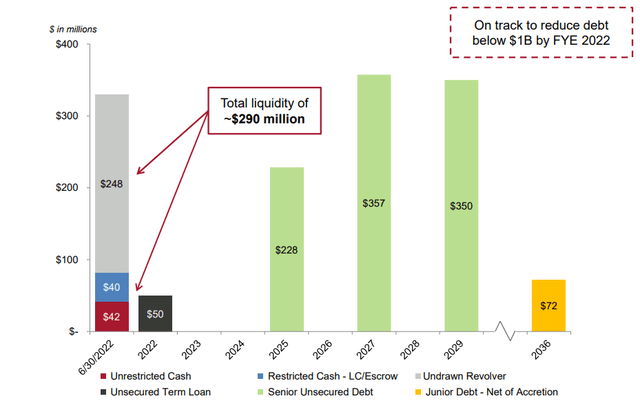

As I mentioned at the top, the one saving grace Beazer has is the structure of its term debt:

I would entirely ignore the grey bar on the left, as I don’t think we should be modelling a revolver as appropriate for repaying structural debt. But you can, at least, see that the business has staggered maturities in 2025, 2027 and 2029. Those debt burdens compare to operating cash flows which average circa ~$120m for the last five years.

That gives it some time to get its books in order.

But let’s be clear: we are a long way away from any form of shareholder returns. If earnings come off as I expect them to, Beazer has another few years of sweat and toil simply to try to scrape together enough liquidity to restructure its debts when they come due.

Conclusion

In my view, all of this makes it a poker chip more than a compelling equity story. It is no cheaper than other homebuilders on a fundamental basis; it is just more leveraged, and that gives both more upside and downside from an equity point of view.

I could perhaps deal with that if operations were best in class, but they are not. Beazer’s history of return on equity and operating margin are weak, and significantly lagging their peers.

In tough times, I want to be backing the long-term winners: even if that means passing up on a stock with an apparent 1.5x earnings multiple.

If I’m wrong, I’ll probably be spectacularly wrong: it’ll mean the housing market remains much stronger than currently expected, and Beazer’s deleveraging will accrue value to the equityholders rapidly. From a risk-reward basis, though, I still don’t think that makes it a good bet.

Be the first to comment