baona/E+ via Getty Images

This is my first article on BioCryst (NASDAQ:BCRX). I decided to check it out after its big down day on 04/08/2022.

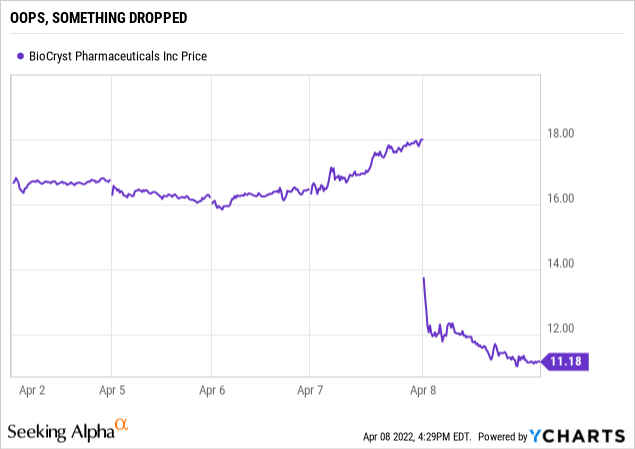

BioCryst’s violent downdraft on 04/08/2022 seemed an overreaction

Right before the market opened on 04/08/2022, BioCryst announced that it was pausing enrollment in clinical trials for its lead therapy, PCX9800. The pause applied to the following trials:

- REDEEM-1, NCT05116774, phase 2 trial for BCX9930 in treatment of PNH in subjects With inadequate response to C5 inhibitor therapy,

- REDEEM-2, NCT05116787, phase 2 trial for BCX9930 in treatment of PNH in subjects not receiving other complement inhibitor therapy, and

- RENEW, NCT05162066, for BCX9930 in treatment of C3G, IgAN, and PMN.

The estimated study completion dates for these trials prior to the pause was 10/2023 for REDEEM-1, 08/2023 for REDEEM-2 and 07/2023 for RENEW. BioCryst’s pause press release stated that patients already enrolled in these trials could continue on study drug.

The pause announcement coldcocked the stock, knocking it down by more than a third. The downdraft continued through much of the day as shown by the chart below:

seekingalpha.com

At first blush it seems puzzling indeed as to why a pause in phase 2 trials would have such an immediate and dramatic adverse impact on the stock. With 184 million shares outstanding its drop of >$6 per share knocked well over a billion $ from its market cap, a bit rich for a delay in phase 2 trials.

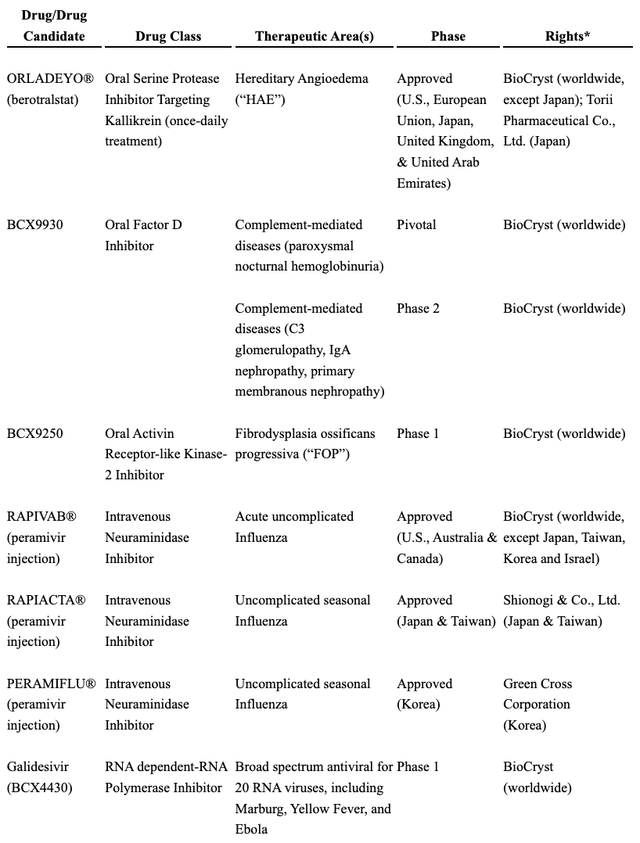

Consider the table below which provides an overview of BioCryst’s therapies:

BioCryst 2022 10-K listing of therapies approved and in development (seekingalpha.com)

It is not a one trick pony. It has plenty of other irons in the fire besides BCX9930.

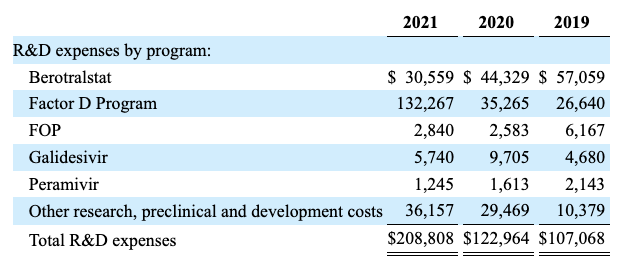

Its research and development expenses for its various programs listed below show that its PCX9800 has been enjoying the vast bulk of BioCryst’s R&D expenditures:

BioCryst 2022 10K listing of R&D expenses by program (seekingalpha.com)

Its violent stock reaction after a delay in one molecule’s development could be interpreted as a sign that there are a lot of uncommitted shareholders in BioCryst. These uncommitted shareholders bailed at the first sign of trouble. Such an interpretation would suggest that BioCryst’s price action over the near term is likely to be choppy.

BCX9930 is more than a random phase 2 asset; it is a material component of BioCryst’s value

A deeper look at BioCryst tells that there is another important factor at work. BCX9930 in treatment of PNH has orphan and fast track designations from the FDA. During BioCryst’s Q4, 2021 earnings call (the “Call”), CEO Stonehouse was over the top in his plans for BCX9930. He characterized it as a molecule having such a broad therapeutic impact that it could support an entire pipeline of different indications as follows:

What’s important to note here is not only do we have a late-stage program on the heels of the approval and launch of ORLADEYO, but this molecule has the potential to be an entire pipeline. Imagine having filings for major approvals, additional pivotal programs and many proof-of-concept studies in many different rare diseases. That’s what we have with 9930, and we’re allocating our capital into this program to compound value for years to come.

As a newcomer to the BioCryst story, I find it somewhat confusing to peg exactly where the REDEEM-1, and REDEEM-2 PNH trials stand on their development pathways. Clinicaltrials.gov lists them as phase 2 trials as stated above. BioCryst’s website pipeline page shows them as “LATE STAGE (PH 2-PHASE 3).

CEO Stonehouse characterizes the BCX9930 program as follows during the Call:

… [Our] lead molecule in our pipeline is, of course, BCX9930, our oral twice-daily Factor D inhibitor, which is being evaluated for the treatment of PNH and 2 global pivotal trials.

These trials are enrolling even as we are expanding to more countries and sites to reach full swing. The pivotal program is proceeding very well. What comes next, and we are starting to prepare for this, is filing for registration with the pivotal data set. We expect to be pursuing registration in multiple countries. And one strength of our program is the robust controlled data that the trial reads are designed to provide in both patients naive to prior therapy and those with an inadequate response to C5 inhibitors.

CEO Stonehouse is quite sanguine as to BCX9930’s future. Subsequently during the call he set an ambitious development timeline for it in treatment of PCH as follows:

So when we talk about our goals, for the Factor D inhibitor in PNH, we are talking about enrolling these pivotal trials, achieving the top line readout in both and initiating work towards submitting for global registration And that’s where we plan to be by the end of 2023.

After the pause shareholders need reassurance as to its status going forward. Management will likely be reluctant to do so until it learns more as to the status.

BioCryst can withstand BCX9930 delays, but shareholders will pay a price

With ORLADEYO (berotralstat) generating growing revenues and its cash on hand ($518 million at year’s end per the Call), BioCryst can withstand protracted BCX9930 delays. In 2020, the FDA approved BioCryst’s ORLADEYO oral capsules to prevent attacks of hereditary angioedema [HAE] in adults and pediatric patients 12 years and older.

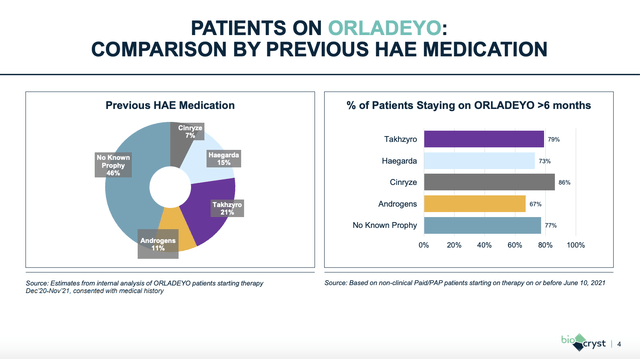

BioCryst launched ORLADEYO in Q1 2021 netting revenues of $10.9 million. HAE is a crowded space with eight FDA approved therapies. ORLADEYO is the only one taken orally. It has capitalized on patient’s preference for its oral form factor to wean patients that were otherwise satisfied with their medicines over to Orladeyo.

The slide below gives a visual presentation of the dynamic at work in this regard:

BioCryst Q4, 2021 earnings presentation slide (seekingalpha.com)

BioCryst expects to continue prospering with its future ORLADEYO revenues. BioCryst’s guidance during the Call called for $250 million in ORLADEYO revenues for 2022, with ORLADEYO’s peak revenues pegged at $1 billion. It supported its peak sales guidance as follows:

…The math to get there is both simple and achievable. Between 25% and 30% market share among diagnosed and treated HAE patients in the U.S., gets us to 2,000 patients and up to $800 million in sales, assuming a 15% to 20% gross to net adjustment. The U.S. will again account for the great majority of sales this year, but ORLADEYO has already launched in 7 other countries, and we expect several more regulatory approvals and launches this year. By the time we reach peak annual sales, we expect the rest of the world for at least $200 million annually.

In addition to ORLADEYO, BioCryst marketed products include its RAPIVAB (peramivir injection) for the treatment of acute uncomplicated influenza in the United States. To date its RAPIVAB revenues have derived from its procurement contract with the Assistant Secretary for Preparedness and Response within the United States Department of Health and Human Services. These revenues have been comparably minimal ranging from ~$13.9 million in 2019, to ~$6.9 million in 2021.

As revealed by its 2022 10-K, BioCryst has benefitted from a variety of government development contracts. Two that are ongoing include an NIAID/HHS galidesivir development contract with a potential value totaling $43.9 million, and a BARDA/HHS galidesivir development contract totaling $39.1 million.

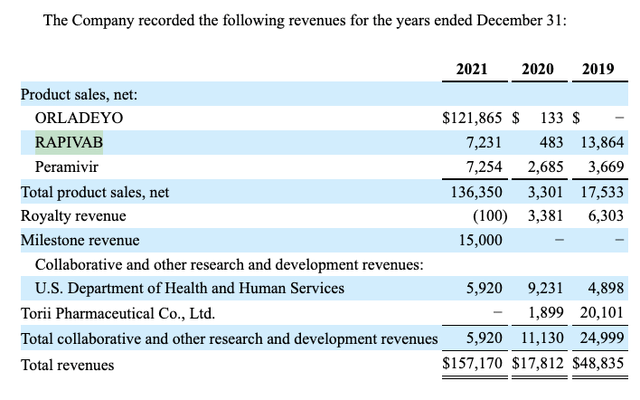

The table below reveals BioCryst’s aggregate revenues in recent years:

BioCryst 2022 10-K (seekingalpha.com)

During the Call, BioCryst guided 2022 expenses at a range of $440-$480 million. It has ambitious goals to become the “next great biotech”. It sees its path there as follows:

…ORLADEYO being a $1 billion drug, I feel very confident that we’ll get there. In fact, given 2021 revenues, ORLADEYO was already profitable on a direct contribution basis, which is a great achievement by the team.

Right now though our strategy is investing in maximizing value creation, allocating capital to continue to enhance and expand the ORLADEYO launch, to advance our Factor D pipeline across multiple indications, all while continuing to discover new drugs to ensure that we have a robust pipeline to repeat the process over and over again.

Conclusion

Investors know that BioCryst’s path to success will face many challenges. Its ambitions are heady. Its reality is revealed by the headline following release of its Q4 2021 earnings, “BioCryst Pharmaceuticals Non-GAAP EPS of -$0.40 misses by $0.11, revenue of $47.2M misses by $3.28M”.

Yes, the next great biotech is currently just another small biotech player losing money by the boatload. I am optimistic that it will turn things around, but that is my nature. Realistically, I fear its shares are going to struggle to find traction until it can resolve its BCX9930 trial issues.

Be the first to comment