MarianVejcik

Main Thesis and Background

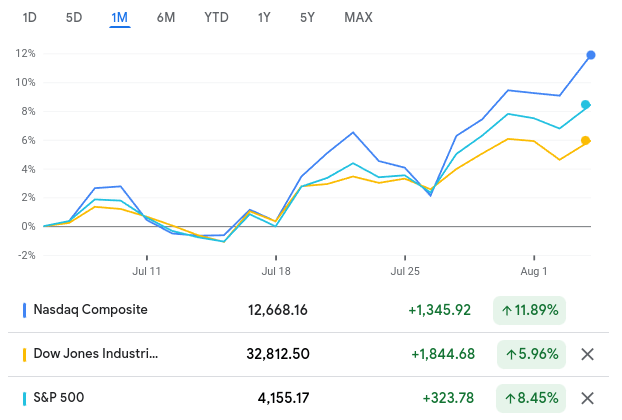

The purpose of this article is to discuss the state of the broader market, with a specific focus on equities. I think this is particularly timely because of the strong performance pretty much across the board over the past month. Pointedly, I had written a macro-review about three weeks ago when I discussed some areas that looked interesting and others I would avoid. What basically happened was everything has risen – including all three major indices. So while I was “right” on my buy calls, my “avoid” calls could have been buys anyway.

1-Month Performance (Major Indices) (Google Finance)

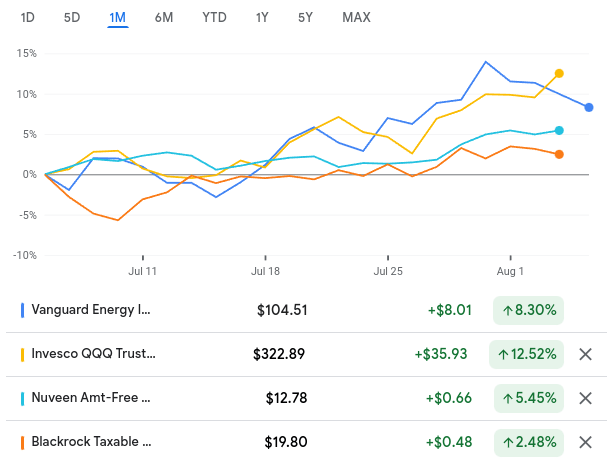

Digging down more specifically, in my most recent macro review, I suggested readers continue to add to positions in Energy, Technology, and Municipal bonds. My personal holdings in those areas have indeed done quite well:

1-Month Performance (Google Finance)

In contrast, I thought it would be wise to remain under-weight retail and consumer discretionary sectors as well as mainland Europe. Despite the different macro-headwinds facing both of these investment plays, they saw a rebound as well and posted strong performance:

1-Month Performance (FEZ and XRT) (Google Finance)

What I’m getting at here is that while I can pat myself on the back for getting some calls right, my “avoids” didn’t need to be avoided after all. This has been a broad equity recovery, which is certainly what investors have been waiting for.

This is definitely a positive development. But my concern now is that the short-term gains we’re seeing are a bit unsustainable. I think the key going forward will continue to mean being selective on positions and timing. Rather than using the recent surge in equities as an excuse to

*My personal holdings in Energy are the Vanguard Energy ETF (VDE). My holdings for Tech include Invesco QQQ (QQQ). My municipal holdings are the Nuveen AMT-Free Quality Municipal Income Fund (NEA) and the BlackRock Taxable Municipal Bond Trust (BBN). I also own the SPDR S&P Retail ETF (XRT) for Consumer Discretionary exposure.

What If Someone Just Wants To Stay Long The S&P 500?

To start, I want to provide some context for this review. I think stocks could continue to see some gains. I’m going to touch on a few reasons why I like some specific exposure more than others in this review, but that strategy may not be for everyone. Perhaps one just wants to buy the S&P 500 index or a related basket of sectors to take the guesswork out of it. I would never presume to argue against this option if a reader believes that’s the right move for them.

On this note, there’s an argument that can be made for just hanging tight with what’s working. Despite the recent gains in the S&P 500, the index is not near expensive levels. This has been partially the result of stronger-than-expected earnings that we are seeing of late, helping the “E” part of the P/E equation. Further, with the brutal sell-off from earlier this year still weighing on index levels, the price now isn’t that far above the 10-year median:

S&P 500 P/E Ratio (Yahoo Finance)

The takeaway for me is this isn’t a time to get overly cautious either. While I personally expect modest gains for the remainder of the year given the run we recently had, I’m not de-risking too much either. Large-cap U.S. companies are handling the difficult macro-environment reasonably well, and the S&P 500 is not expensive as a result. To be fair, it’s not “cheap” either, so I will be selective with any new buys going forward, but I don’t see this as a warning sign to flee the market either.

*My personal holdings are the Vanguard S&P 500 ETF (VOO) and the Invesco S&P 500 Equal Weight ETF (RSP).

Dividends Have A History Of Protection, But That Doesn’t Mean No Losses

I now want to dive into another area that has been working in 2022. This has been the “dividend” play, with many popular dividend ETFs out-performing the broader market this calendar year. The logic is simple. Investors are worried and are being drawn to the stability dividend-paying companies provide. With more consistent revenues and a willingness to return cash to shareholders, the value in dividend payers is transparent. Further, with inflation continuing to rise, dividend growers are especially attractive since rising income levels from these companies helps to buffer the impact from inflation.

Given this backdrop and my name as a “dividend seeker” it should not be much of a surprise that I have suggested dividend ETFs this year – as I do in most years. Fortunately, this is a theme that has produced alpha year-to-date:

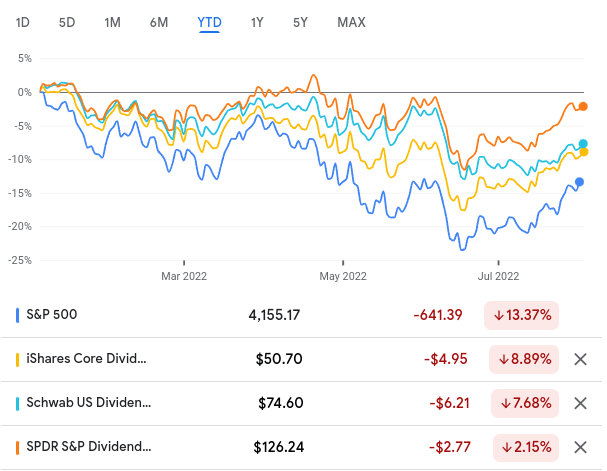

YTD Returns (S&P 500, DGRO, SCHD, and SDY) (Google Finance)

What this is showing is that some core dividend ETFs have out-performed the S&P 500 this year.

Good news, right? Well, readers also are probably noticing all the red. Each fund and the S&P 500 index are in negative territory still for the year. So while beating the S&P 500 is good, it isn’t really great either.

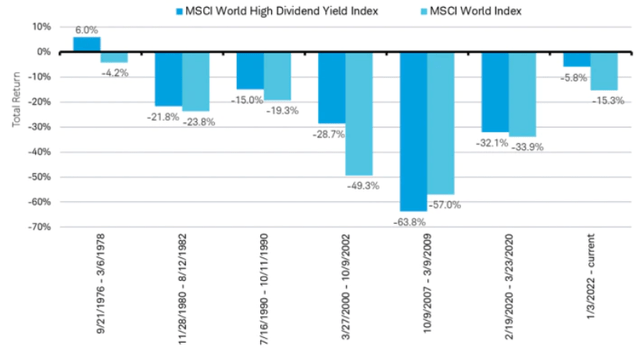

Therein lies the rub. Often what’s working in a given year or timeframe is only slightly comforting. Losses are still losses, even if they’re smaller losses. Importantly, this is not an unusual occurrence. If we look back at prior bear markets over the past 50 years, we see that dividend payers often do provide a relative hedge against a total market approach. But the reality is that still hasn’t prevented losses. Dividend paying funds will still fall, just by a smaller margin:

Dividend Out-Performance During Bear Markets (Charles Schwab)

I think this is important now because it highlights a real risk for the second half of the year. Beating the market may be possible, but it won’t necessarily translate into strong gains (or any gains at all). This harps back to my moderation advice that I led off with at the beginning of the article. With markets rising in the 6%-12% range over the past month, we should moderate what we expect the next few quarters to bring. Moving into quality, such as dividend-paying ETFs, may be the right move and one that I would advocate. But if the broader market sinks back in to bear market territory, that means losses will be difficult to avoid.

*My personal holdings are the iShares Core Dividend Growth ETF (DGRO), Schwab U.S. Dividend Equity ETF (SCHD), and SPDR S&P Dividend ETF (SDY).

Some Ways To Stay Ahead Of Inflation

Aside from moving into dividend plays, there is another area I think is ripe for continued buying at the moment. This relates to a major macro headwind facing not just equity and bond markets, but also American households. This is inflation, which has been extremely aggressive in 2022 without much let up in sight. Staying ahead of inflation is therefore a key focus for most investors, and the truth is there are limited ways to do that.

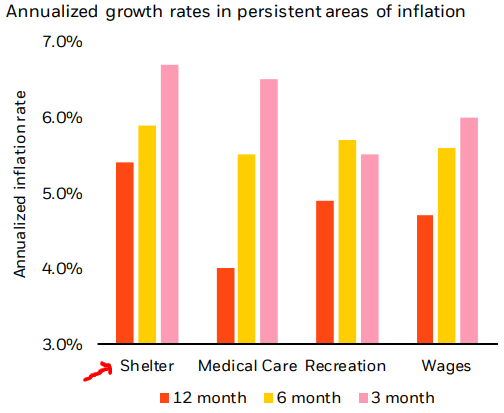

However, that does not mean there are no options. If we look at inflation more broadly, we see that wages are going up to, which is helping workers and households cope with some of the impact. However, areas such as medical care and shelter have been rising at faster rates than wages and also faster than other goods and services. Essentially, cost of healthcare and living are grabbing a larger chunk of American spending:

Annualized Growth Rates (Select Areas) (BlackRock)

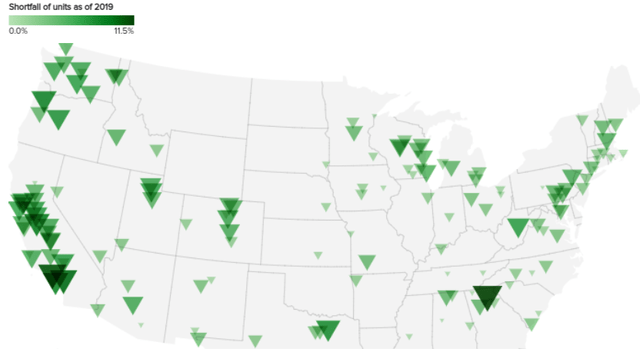

So, how can we use this to our benefit as investors? Personally, I see apartment REITs as a good way to beat inflation, since investors would now be owning an area whose price is rising faster than other areas. People always need a place to live, and there’s a housing shortage right now. That means that even though rents are rising fast, people are forced to sacrifice in other areas to pay those higher rents. And this is a national issue:

Estimated Housing Shortages (CBS News)

There are a few ways to play this idea. One is to buy funds that invest in agency and non-agency mortgage-backed securities. With housing in short supply and home values rising, this debt is safer than ever. This is more of an income and yield play, however, so for those who want equity exposure, buying apartment REITs makes more sense.

Personally, I have a holding in Mid-America Apartment Communities Inc. (MAA), but I also see value in other options such as Apartment Investment and Management Company (AIV) and Essex Property Trust (ESS).

Banking Sector Supported By Earnings

My last area of suggestion would be large-cap domestic banks. This is an area I have been long on for a while, and was a bit premature in recommending them earlier this year. Yet, the sector has finally started to find its footing, and there are a number of reasons for this.

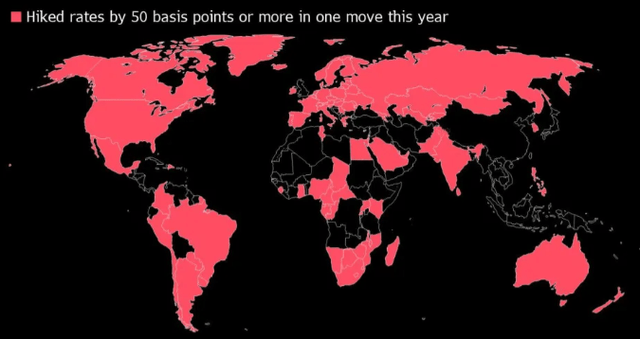

The first is that interest rates have been rising, which is generally a tailwind for banks and lenders. This is indeed the environment we are in right now, in the U.S. and around the global. Central banks across the board world have been raising their benchmark interest rates:

Countries Whose Central Bank Has Raised Rates (World Bank)

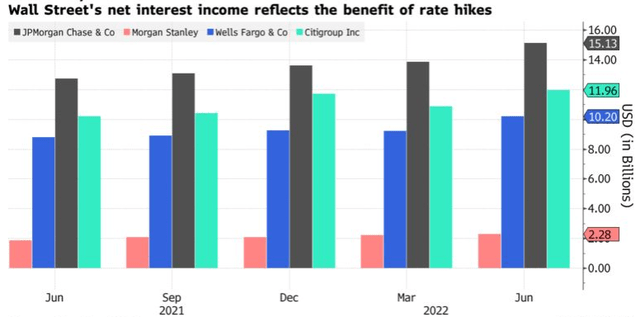

With this backdrop, it should make sense that large banks are doing well (or at least better). Fortunately, that’s indeed the case. While there are concerns about a recession in the U.S., as well as in other global economies, so far lending standards and payments have held up. Large banks especially have seen a boost to their bottom lines, with the U.S. majors benefiting from a rise in net interest income:

Large Banks See NII Increase (Bloomberg)

My takeaway here is that U.S. banks are performing fairly well and recent earnings reports should support prices going forward. While concerns about a recession and the impact on credit quality will certainly be a headwind for loan loss reserves and consumer delinquencies, for now the story has been positive. This is a unique sector that can benefit from what’s a headwind for most other sectors – rising interest rates. This, at the very least, suggests to me it’s wise to have some exposure here as a relative portfolio hedge.

*My personal holdings include JPMorgan Chase (JPM) and the Invesco KBW Bank ETF (KBWB).

Bottom line

Equity investors finally got some good news in July and that story has continued into August so far. This has made most equity plays look rewarding, but we have to remember how certain areas had fallen leading up to this rally. This tells me to remain cautious with entry points, stay diversified, and tilt toward plays that will benefit as long as inflation stays elevated and interest rates are rising. This includes investments in apartment REITs, Energy, and Banking. I also continue to favor technology through [QQQ due to the disproportionate drop this sector had in the first half of the year.

I’m hopeful this gives readers some productive food for thought on how to position themselves going forward. At the very least, we should expect some continued ups and downs as the market contends with upcoming U.S. elections, a prolonged military conflict in eastern Europe, and renewed tensions between the U.S. and China. I remain selective on my holdings and buy-in points, and suggest investors not get too carried away with the recent momentum. If 2022 has taught me anything, that momentum is probably not going to last uninterrupted.

Be the first to comment