davidhills/iStock Unreleased via Getty Images

Thesis

Yum! Brands, Inc. (NYSE:YUM) is the parent company of powerhouse fast food chains which include KFC, Taco Bell, and Pizza Hut. Despite these prominent fast-food restaurants, YUM has struggled to produce revenue and earnings growth in recent years. In addition to this lackluster sales growth, there appears to be little value at YUM’s current share price. YUM’s restaurants are an excellent choice if you’re looking for a delicious and quick meal, but investors should look elsewhere for exceptional long-term investment opportunities.

Company Background

Yum! Brands operates four fast-food restaurant chains: KFC, Taco Bell, Pizza Hut, and Habit Burger Grill. Altogether, YUM has over 53,000 restaurants, including 26,394 KFC restaurants, 18,381 Pizza Hut restaurants, 7791 Taco Bell restaurants, and 318 Habit Burger Grill restaurants. You can find YUM restaurants in 157 different countries and territories. Each of YUM’s restaurants is a well-known, established brand and specializes in a different style of food. YUM’s oldest brand, KFC, was founded by the infamous Colonel Harland Sanders in Kentucky in 1930 and specializes in fried chicken. Pizza Hut was founded in 1958 and specializes in pizza. Taco Bell has been serving tacos since 1962. The smallest restaurant, Habit Burger Grill, specializes in charbroiled hamburgers and was founded in 1969. Though each of YUM’s restaurants has humble beginnings, collectively, these restaurants have raked in over $6.71 billion in revenues over the past 12 months.

YUM’s roots trace back to 1997, when it was spun off of PepsiCo, Inc. (PEP) after it decided to exit from the restaurant industry. As a result of the spinoff, all YUM restaurants have a lifetime contract to sell Pepsi products. Initially, the company was called Tricon Global Restaurants Inc. The company didn’t go by YUM! Brands until 2002, when Tricon merged with another restaurant chain called Yorkshire, the parent company of Long John Silver’s and A&W Restaurants. However, in 2011 YUM decided to divest Long John Silver’s and A&W to focus on its original core brands of KFC, Pizza Hut, and Taco Bell. In March 2020, YUM! agreed to purchase Habit Burger Grill for $375 million, effectively creating the YUM! Brands we know today.

YUM has four reportable operating segments, one for each of its restaurants, which include KFC, Taco Bell, Pizza Hut, and Habit Burger Grill. In YUMs most recent Q3 quarterly report, KFC reported the highest revenue among the four operating segments with $704 million, a 1.7% increase year-over-year. Taco Bell had the subsequent highest quarterly revenue with $568 million, a 6.3% year-over-year increase. Pizza Hut and Habit Burger Grill reported a year-over-year decline in revenues for the period. Pizza Hut’s revenues were $237 million, down 4%. Habit Burger Grill’s revenues were $131 million, down 1.5%. Over the last five years, KFC has grown operating profits the fastest, from $874 million in 2016 to $1.2 billion in 2021, a 40.7% increase. Taco Bell has grown operating profits by 27.8% over the same period, while Pizza Hut has managed just 4.6% operating profits over the last five years.

What’s the Story

Over the past five years, YUM has been a steady company but has not grown much. In 2017, YUM had $5.88 billion in revenue, and over the last 12 months, $6.71 billion in revenue is just a 14.1% gain over this 5-year period.

Like YUM’s top line, YUM has struggled to grow its bottom line. In 2017, YUM recorded earnings of $3.77 per share and managed to increase the earnings to $4.38 per share over the trailing 12 months. Therefore, YUM grew its earnings by just 16.3% over the five years.

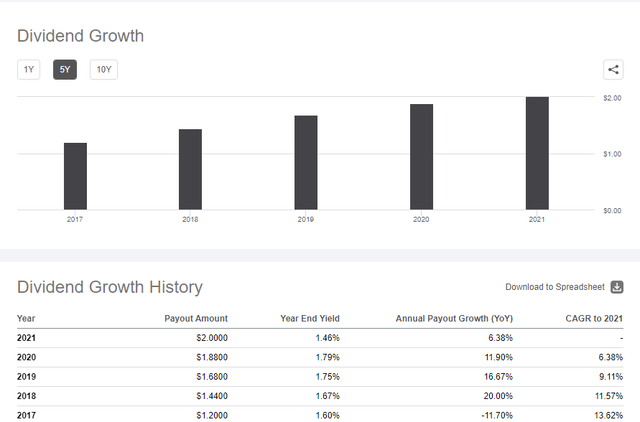

YUM does pay a dividend and has managed to grow its dividend much faster than it has increased its revenue and EPS over the last five years. In 2017, YUM paid investors a dividend of $1.20 per share. YUM gradually grew that dividend to $2.00 per share in 2021, a gain of 66%. This level of growth is encouraging to dividend investors, but without meaningful revenue and earnings growth, the dividend growth appears to be limited from here.

This lackluster growth for YUM over the past five years is concerning. I typically look for companies that persistently grow earnings year over year at a rate of at least 7% per year. Unfortunately, YUM has yet to show that it can grow at a rate of 7% per year, as it’s barely been able to increase its revenue and earnings at all over the past five years. Ultimately, without persistent earnings growth, the only way for YUM’s share price to increase is for investors to perceive the company differently and pay a higher premium for the shares, which isn’t impossible.

Investors are constantly rotating through a cycle of extreme optimism and severe pessimism. However, I prefer not to predict investor behavior. I believe it’s a much better strategy to identify the companies with a unique competitive advantage and that are run by outstanding management teams that consistently produce superior results. When you’ve identified these high-quality companies, you can invest in them when the market has grown severely pessimistic about them for whatever reason. Then you have two ways to win, first as the company continues to increase its earnings, and second as the market grows optimistic about the company and starts paying a higher premium for the shares. Looking at YUMs revenue and earnings over the past five years, YUM does not appear to fit this description. It doesn’t help that YUM operates in a notoriously competitive restaurant industry filled with increasingly more choices for hungry customers.

Valuation

We will run comparative and discounted cash flow (“DCF”) analyses to place a value on YUM. To begin, we’ll start with the comparative analysis, and we’ll look at the highest, lowest, and average price-to-earnings ratios the market has paid for YUM over the past five years, which are 31.65, 18.80, and 24.84. We’ll also look at the sector median P/E, which is 10.74. Finally, we’ll multiply these ratios by the average analyst estimate of 2023 earnings, which is $5.10.

| Scenario | P/E | 2023 Earnings Estimate | Intrinsic Value Estimate | % Change from Current price |

| Bear Case | 18.80 – 2018 PE | $5.10 | $95.88 | -24.29% |

| Average | 24.84 – 5-year average | $5.10 | $126.68 | 0.03% |

| Bull Case | 31.65 – 2020 P/E | $5.10 | $161.42 | 27.46% |

| Sector Median Valuation | 10.74 | $5.10 | $54.77 | -56.75% |

On a comparative analysis, YUM appears to have a more significant downside than an upside. Investors would realize a nice 27.46% return if the market were bullish and applied the 31.65 multiple we saw in 2020 to next year’s earnings estimate. However, if the market were to value YUM at the bearish multiple that we saw in 2018 or, even worse, if the market were to value YUM at the sector median multiple, investors could see as much as a -56.75% return on their investment. This shows me that YUM has minimal upside from here; however, sometimes a comparative analysis can be misleading, because in this scenario YUM actually earned $4.80 a share in 2018 and $2.99 a share in 2020. Therefore, from an earnings perspective, YUM had a better year in the bear case scenario and a worse year in the bull case scenario. This is why it’s essential to use multiple different valuation techniques when estimating the intrinsic value of a stock.

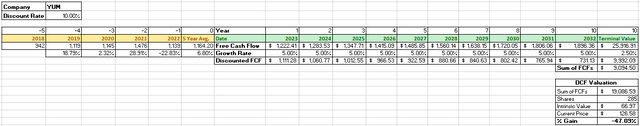

Turning to the discounted cash flow analysis, we will begin by taking the average of the last five years of free cash flows, which is $1.1 billion. Then we will apply a modest 5% growth rate for the next ten years, followed by a 2.5% growth rate into perpetuity to figure out the terminal value. We will then use a discount rate of 10%. With these inputs, the DCF analysis gives us an intrinsic value of $66.97, representing a downside of -47.09% from YUM’s current share price. As I suspected, YUM isn’t trading at an appealing valuation based on a comparative and DCF analysis.

Summary

Yum! Brands, Inc. operates four famous restaurant chains that are beloved by millions. The restaurant business is competitive, but there’s no denying the brand strength of KFC, Taco Bell, Pizza Hut, and Habit Burger Grill. YUM is the type of business in which I enjoy their products but cannot invest. I need to see more top and bottom-line growth to consider this a company I want to own for the next several years. In addition to the stagnant growth, Yum! Brands, Inc. appears to be overvalued at today’s share price based on comparative and DCF analysis. For now, I’ll look at other investment opportunities, but if you disagree, please let me know in the comments section below. Thank you for reading!

Be the first to comment