Ta Nu/iStock via Getty Images

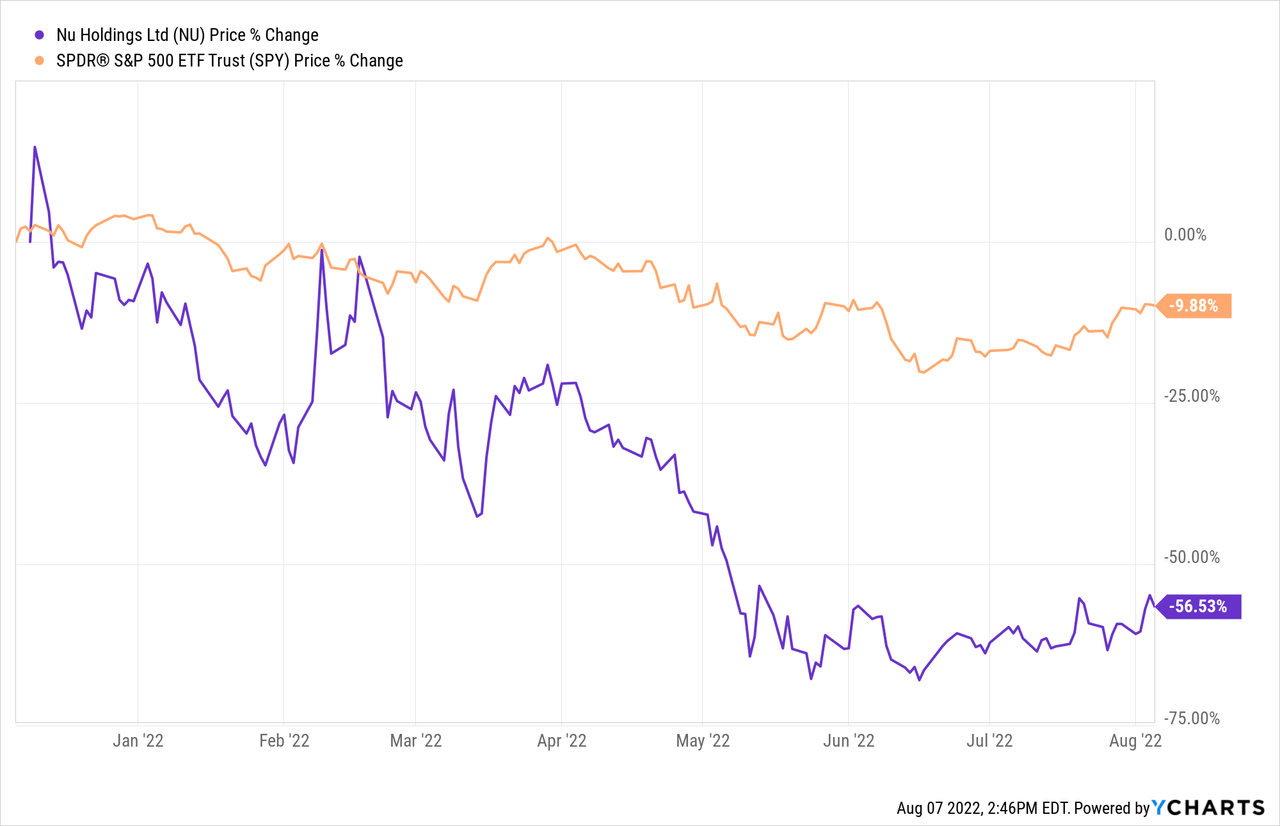

Nu Holdings Ltd. (NYSE:NU) is one of the biggest startup successes in LatAm. It has a huge untapped market opportunity in finance and a low-cost business model that was not easy to replicate. I covered NU two months ago in the previous article stating its long-term potential, and the stock has gone up 30%+ since then. However, NU is still underperforming overall SP500 year to date. Every growth story will have high highs and low lows. Here I will share some of my thought about some potential challenges NU will face.

NU’s product offerings work great but can they sustain their lead?

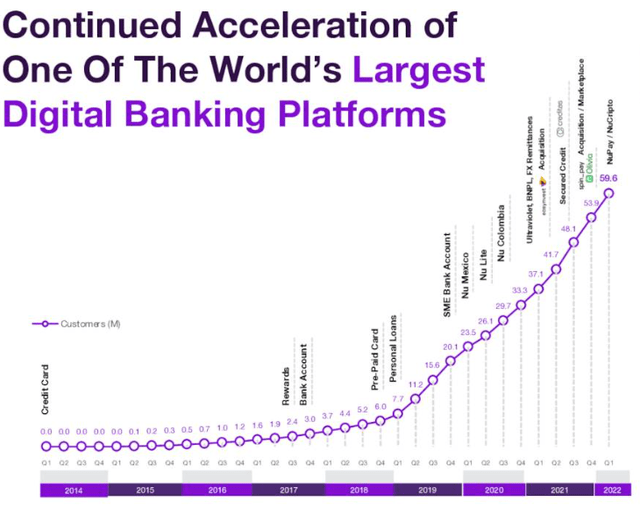

NU started its service back in 2014 before the arrival of fintech in Brazil. Its product offerings established a reputation as intuitive, simple, and lower fees. It is just so much better than traditional banks. Therefore, NU captured many young customers back then as a symbol of being cool. Their word-of-mouth and member-get-member marketing work great. This also leads to low marketing costs for them. However, with more and more other fintech startups joining the market and the digitalization of traditional banks, NU is not the only digital banking option anymore. NU had a first mover advantage, but how sustainable would it be? We need to watch NU’s competitive landscape closely as it continues to grow.

Attracting heavy spenders

With the advancement of the LatAm finance industry, both traditional banks and new digital banks offer a more or less similar value proposition for customers. Banking products are more or less commodity-like services and highly regulated.

While NU is already a giant in the credit card field with a large size of card holders, most customers are not earning and spending as much. NU customers (33% of Brazil’s adult population) only count for 2% of national deposits. This means those accounts are still not active enough. Currently, NU only has free credit card offerings that target low earners. Other banks such as C6 and Banco Inter offer platinum cards for large spenders.

NU needs to find ways to attract and acquire more heavy spenders. With its acquisition of Easynvest, NU has already started to offer some investment and insurance products to draw people over 30,35 years old. But it is still early to see if they can be successful.

Mortgage and payroll businesses are important to being a full-service bank

A mortgage is a business relationship that can last 30 years. Employer partnerships with mid-sized and large companies can also last decades if successful. These are large and important businesses for banks. To my knowledge, large size employers won’t use NU as payroll even if employees request it. The legacy banks have deep roots in these businesses and they are making 5-10x more money on per user basis. NU needs to work on these areas to dig a wider moat and be more financially connected with the overall economy. NU’s ARPAC is just around $5-6; it can easily triple if NU can successfully expand those products.

NU needs to keep the pace of innovation for the long-term which is not easy

NU has significantly expanded its product offerings in the past either organically or through acquisitions. Just last quarter, it released NuPay and NuCripto. But the product breadth and cross-sell capability are still not good enough to compete with large banks like Itaú Unibanco. NU needs to continue to move fast on product improvements without compromising its reputation of high quality. This won’t be easy.

Especially, as NU explores more and more B2B businesses, it will have head-to-head competition with large banks. It is possible that NU will have to hurt itself since large banks won’t play nice under NU’s threats. They won’t give up their big corporation customers easily.

NU’s product offerings (NU presentation)

Regulation uncertainties and Macro environments in LatAm will always be clouds hanging over NU.

I have some good faith in Brazil’s will to reform economic and political institutions. Their central bank also seems to be a strong advocate of open markets and fair competition which could help NU. However, as NU becomes bigger and more dominant, the government may go against NU with new rules that favor new entrants and limit NU.

On the other hand, the macro risk is always going to be a constraint on NU’s business. Given Brazil’s large income inequality, it is difficult to believe how the young and low-income classes can do well in the near future.

Bottom Line

Financial digitalization is an inevitable trend in LatAm. As the leader of this space, NU won’t waste this huge opportunity. It is going to continue to invest and innovate. The last 2020Q1 results just proved NU’s growth capabilities even with its relatively large size (it is expected to report Q2 earnings after the market close on August 15). Although its revenue is currently only at 1.5B, the credit portfolio is growing at YOY 126% and deposit at 94%. NU has many great early signs of future success. I think the market will eventually reward NU as it keeps expanding its business.

Be the first to comment