HeliRy

DHT logo (DHT homepage)

Investment thesis

In May this year, my last article on DHT Holdings (NYSE:DHT) suggested that the market recovery was being pushed further out.

The freight market has started to gain some traction, and investors have pushed up the share price of DHT by 52% in just three months.

DHT share price the last 3 months (SA)

This has been backed up by an increase of 42% in their average time charter earnings per vessel and improvements in their balance sheet.

Let us look at the results from the first half of 2022.

FH 2022 Financial Results

The company managed to increase their average time charter earnings by 42% in the last quarter, from USD 17,100 per day to USD 24,300 per day.

This translates to an EPS of US cents 6.

Their cash position nearly doubled from USD 58.6 million at the end of Q1 to USD 105.8 million at the end of Q2.

At the same time, they also managed to decrease their interest-bearing debt from USD 521 million to USD 482 million in just this last quarter.

It means that the average debt per vessel now at only USD 15.7 million, is less than what you get if you were to scrap them.

The latest report of a VLCC sold for demolition was from 23 July 2022 when the M/T “Rowan” of 299,988 deadweight ton build in 2001 in Japan was sold for USD 26 million net of commissions. It had to be delivered to a beach in Bangladesh, so the seller has to spend money to get the vessel there. Still, you can see that each vessel is worth a lot more than the debt per vessel that DHT has on each vessel. Even at the end of its useful trading life.

The average age of their fleet is 9 years, so they still have many years of trading life in them.

All this is quite impressive.

They have decided to keep the dividend at just four cents in Q2. Their focus is clearly on buybacks rather than dividends at the moment.

They only spent USD 3.3 million last quarter on dividend payments. As a comparison, they spent USD 15.9 million in the quarter on buying back their own shares.

It is as we all know, not possible to predict what these VLCCs will earn in next year, but let us take a linear approach and say that they will average USD 25,000 per day per vessel. That is not far-fetched.

Their break-even is USD 15,100 per day. Free cash flow per quarter should run around USD 21 million. With the total number of shares presently outstanding of 164.15 million, it means FCF from the operation of USD 0.128 per share. Assuming they would distribute half of this, a quarterly dividend would be USD 0.06 per share, a 50% improvement from the present level.

However, the yield based on the present share price would still be quite low at just 3%

Business development

One explanation for DHT building up a strong cash position is that they are planning on installing scrubbers on 8 of their vessels, which are all built between 2015 and 2018. The cost for this retrofitting is USD 25 million, with an estimated payback time of less than one year.

Upon completion of this DHT will by the end of Q1 next year have a fleet of 23 vessels able to use the lower costing fuel. After the payback of the investment, this USD 25 million will add to their profit each year.

VLCC “DHT Stallion” (DHT home page)

In terms of supply and demand, we know that there are few new buildings coming into the market in the next two years.

As of the 1st of August, according to Allied Shipbrokers, the total fleet of VLCC was 860 vessels with 81 of them older than 20 years of age. These 81 older vessels do not have much trading value, but can still be used for storage and a few shuttle trades. These are not the ones competing with DHT.

There was 41 VLCC in the order book which is slated to be delivered this and next year. No vessels are due from 2024 onwards. With the present uncertainties around what type of propulsion new ships will be using, to comply with coming IMO regulations around emission, most ship owners are holding back on ordering any type of vessel at the moment.

During the last six months, we saw from IEA that some governments released parts of their strategic petroleum reserves in order to try to reduce the price of oil. China and India did not take part in this. They are the second and third largest consumers of crude oil.

Changes to trading patterns as a result of geopolitical events will mean longer voyages as some crude is sourced from further away.

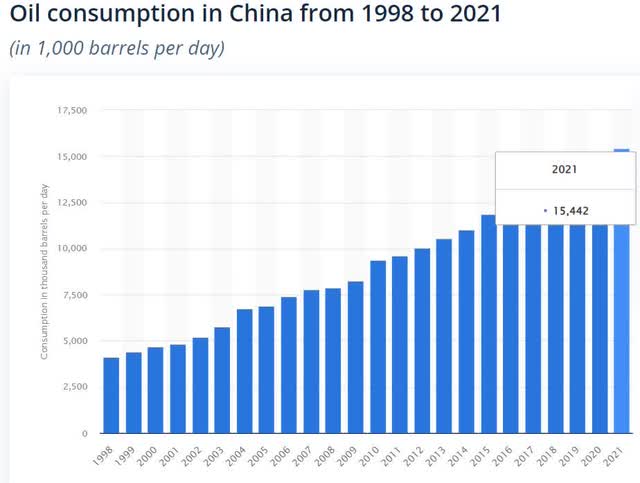

According to Statista, in 2021 China consumed 15.8 million barrels of crude oil per day.

China’s oil consumption per day (Statista)

In the period from January 1st to the 31st of May this year, it produced, according to China’s National Statistics department, only 2.48 million barrels/day and it imported just 6 million barrels/day.

That leaves them with a large shortfall.

From this, providing the data is correct, and even if we discount oil consumption by 10% in that period as a result of stricter quarantine and shutdowns, you still have insufficient production and import. China must have been drawing down from their refineries inventory and their own Strategic Petroleum Reserve or imported a lot more which has not been declared to their National Statistic department.

Last month, Senator Josh Hawley from Missouri sent a letter to the Department of Energy complaining that the U.S. was shipping off its own SPR with some of it going to China.

All in all, what is happening in the oil trading market should be a net positive on freight rates with more miles shipped for each ton of oil going forward.

The risk to the thesis would be demand destruction for oil as a result of a hard landing for the economy.

Conclusion

Last time around I downgraded my buy stance to that of a hold, based on a conclusion that I saw macroeconomic headwinds and general uncertainties in the market.

I believe that they will increase the dividend next year. Even if they did increase it by 50%, a yield of 3% for a company with such a risk profile would, in my opinion, be quite low.

Despite DHT’s buybacks of shares, the company still has a large number of shares outstanding, which obviously affects the earnings and dividend per share.

I think their strategy of focusing on share buybacks at this stage makes sense.

Shareholders that have jumped on the wagon over the last three months need to hope that DHL will bring the share count down further and that the earnings next year will stay closer to USD 30,000 per day.

If that happens, they will most likely be rewarded well.

My stance, therefore, reverts to a buy, as I think the risk to rewards looks quite positive

Be the first to comment