hapabapa

HubSpot, Inc. (NYSE:HUBS) has been the benchmark for CRM platforms, combining everything companies need to deliver the best customer experience into a single software for SMB customers. While the company is a well-established name in the world of sales and marketing, we believe HubSpot is not immune to the challenging macroeconomic environment. We believe HubSpot business is at risk in the near term. We believe the company needs to lower estimates due to the increasing interest rate environment, inflation, and slowing growth. Since the multiple remains elevated and the estimates are up for reset, we recommend potential investors wait for a better entry point.

With inflationary pressures and spiking interest rates, we expect churn to increase for HubSpot as more companies look for cheaper alternatives. While HubSpot has around 150,000 customers worldwide, its subscription is not cheap for its mainly SMBs (small and medium-sized businesses) customers. It’ll be increasingly difficult for the company to maintain and grow its customer base while other more affordable alternatives exist. We believe many small-medium businesses will likely struggle with rising interest payments amidst the possible recession in the next few months, leaving less room to invest in expensive CRM subscriptions. We expect HubSpot business to be challenged in the near term, leading to negative estimate revision. HubSpot stock is expensive and will likely see estimate revision and multiple compression over the next few months/quarters. Therefore, we recommend investors wait for a better entry point on the stock, as we expect a pullback of shares from these levels

Too much noise to focus on investing in expensive CRMs

We expect HubSpot to face churn as fewer companies will likely look to invest/expand their business’ CRM under current inflationary pressures and rising interest rate environment. HubSpot offers an array of “Hubs”: MarketingHub, SalesHub, ServiceHub, Content Management System (“CMS”) Hub, and OperationsHub. Customers have the flexibility to mix-and-match different subscriptions relating to marketing and sales. We love the HubSpot service and the CRM universe it is building, but we don’t believe its product will be enough to offset current inflationary pressures and likely recession in the next few months. We believe small to medium companies are beginning to feel the impact of the rising interest rate environment the most and will be less eager to spend money on CRMs and other expensive software when they have interest payments on their back. In addition, there are cheaper alternatives in the market which will likely siphon off some demand from HubSpot.

Cheaper alternatives exist

HubSpot operates in the highly competitive CRM market. The CRM market is expected to grow at 13.3% CAGR, making it an attractive and highly competitive market. While HubSpot is well-regarded for its customer service and support (even rated as one of America’s best employers), we believe it is not immune to competition. The company’s biggest competitors include Zoho CRM, Salesforce, Adobe Marketo Engage, Dynamics 365 Marketing, and EngageBay. In addition, several other players, such as Freshdesk, Zendesk, Keap, Insightly, etc., have products that compete with HubSpot in some categories. Some competitors offer cheaper products than HubSpot, making them attractive to many small businesses. Now, more than ever, we believe price matters. Given this, we believe HubSpot growth may slow in the coming quarters putting estimates at risk.

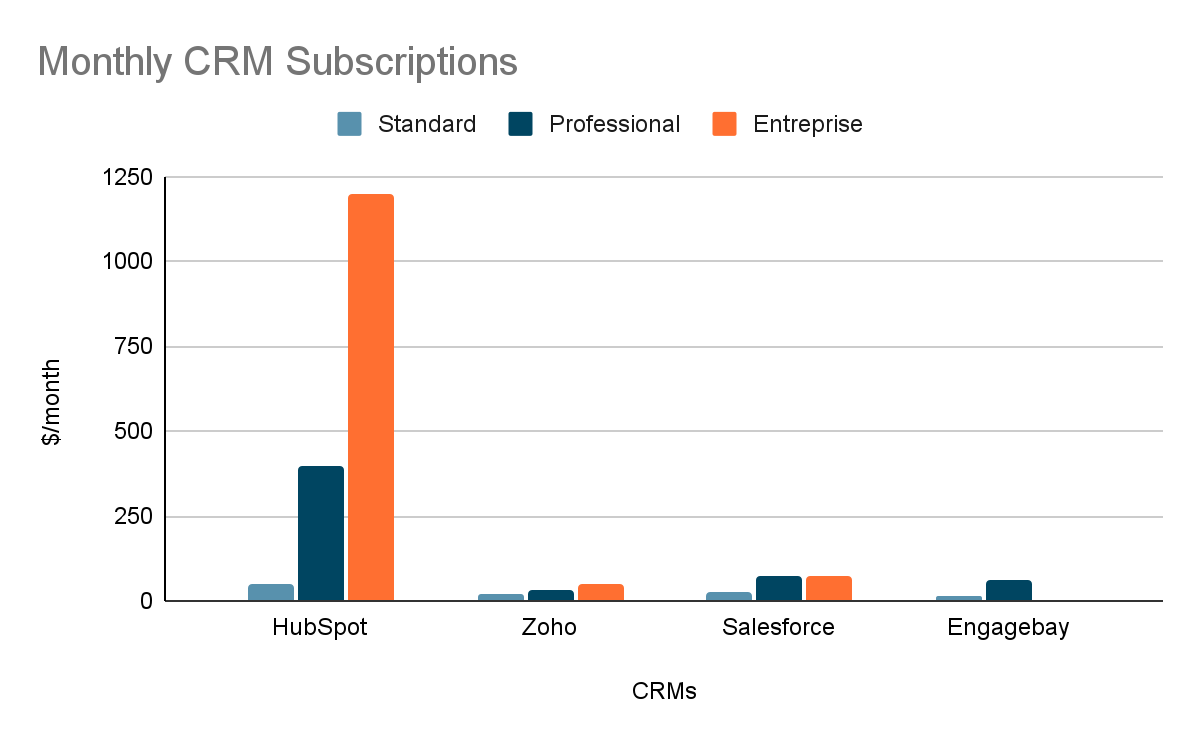

The following graph outlines subscription prices across HubSpot and its biggest competition.

CRM

While we believe HubSpot offers powerful analytics, CRM (customer relationship management) software, landing pages, and forms, it is relatively expensive compared to its peer group. The baseline for HubSpot Professional is $400 but can go as high as $890 per month, compared to the competition, whose products range between $50-100 per month. Of course, HubSpot does provide exceptional services that might not be found in competition, but we don’t believe that is enough to compensate for the price gap between their subscription and that of others.

Considering competitors also offer different editions and cheaper pricing, it’s less likely that HubSpot’s free subscribers will materialize into paid ones or won’t leave HubSpot for its competition. We are bullish on HubSpot’s long-term prospects and the globally increasing adoption of cloud CRM, but we believe the global financial downturn will likely take a toll on the company in the near term.

FX Translation also poses a threat.

HubSpot receives about 46% of its revenue from customers outside the US, primarily from Europe, Australia, Japan, and Singapore. Since the dollar continues to strengthen versus other currencies, we expect FX translation to impact revenue and earnings. Hence, we expect HubSpot’s operations to be impacted by foreign currency fluctuations and interest rates, inflation, and recession risks.

Stock Performance:

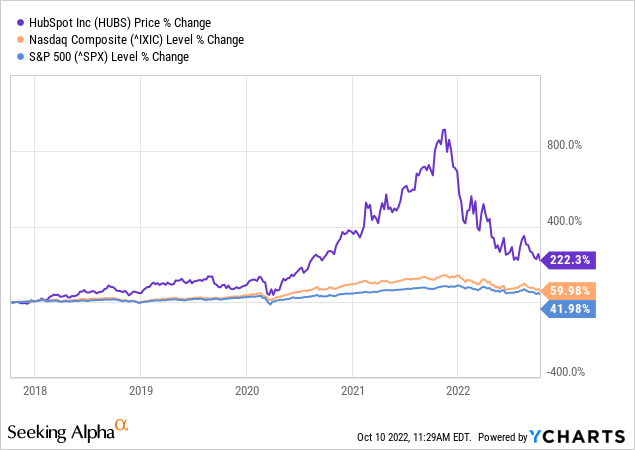

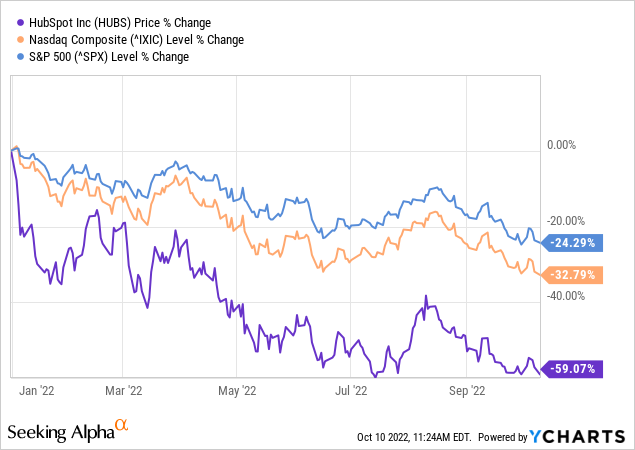

Over the past five years, HubSpot grew an impressive around-222%. HubSpot has dropped 59% YTD, underperforming the Nasdaq and S&P Indices by a wide margin. We expect HUBS business to be under pressure due to inflation and a slowing economy. We expect churn to increase from the current levels as customers look for cheaper alternatives under current macroeconomic pressures. We recommend investors wait for a better entry point before they buy HubSpot stock.

The following graphs show HubSpot’s performance over the past five years and YTD.

Ycharts

Ycharts

Valuation:

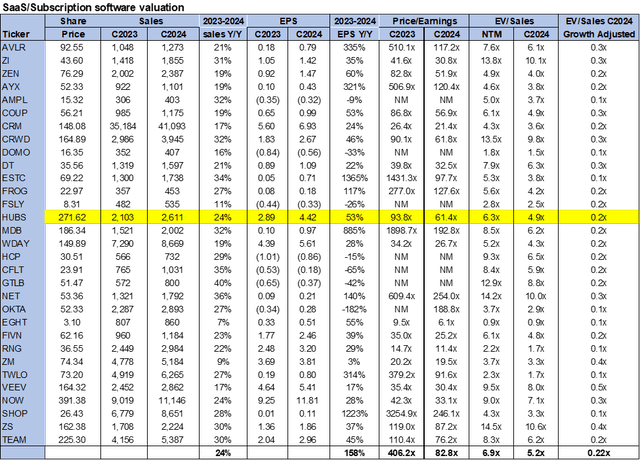

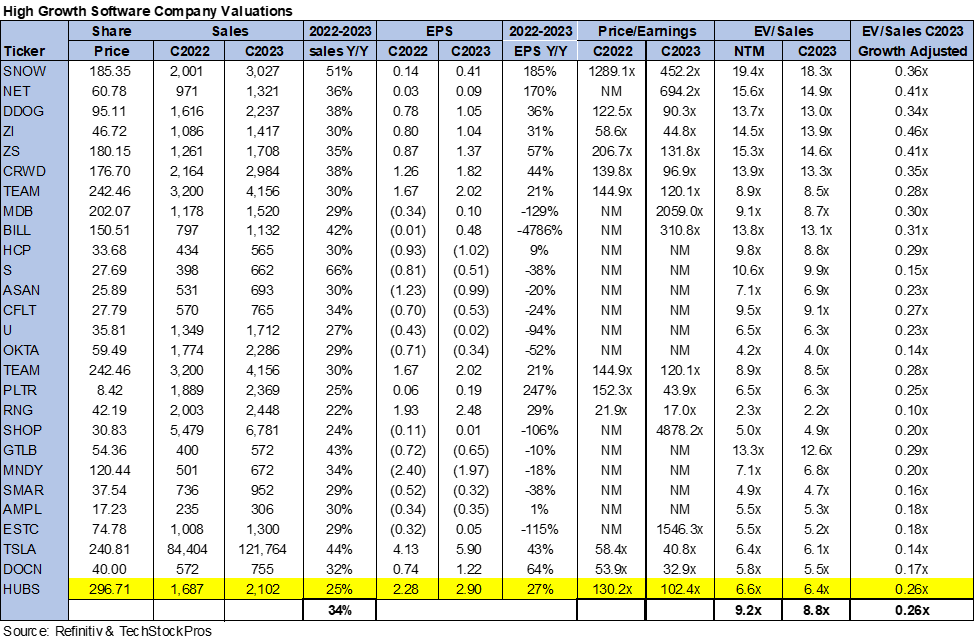

HubSpot stock is relatively cheap. On an EV/Sales, HubSpot is trading 6.3x NTM sales versus the peer group average of 6.9x. On a P/E basis, HubSpot is currently trading at 94x C2023 EPS of $2.89. We recommend investors be patient and wait for the estimate reset and accompanying multiple compression before buying the stock.

The following chart illustrates HUBS’ valuation relative to its peer group.

Refinitiv & Techstockpros Refinitiv & Techstockpros

Word on Wall Street:

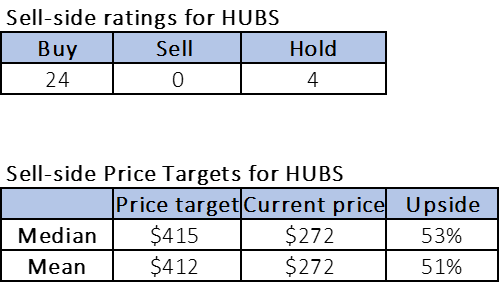

Of the 28 analysts how follow the company, 24 are buy-rated, and the remaining are hold-rated. HubSpot is currently trading at $272. The median and mean sell-side price targets are $415 and $412, respectively, with an upside of 51-53%. The following charts illustrate the sell-side ratings and price targets for HubSpot.

Refinitiv & Techstockpros

What to do with the stock:

We are hold-rated on HubSpot. We expect HubSpot to face churn in the near term due to inflationary pressures and rising interest rates. We believe there is more downside to be priced into the stock in the near term. HubSpot subscriptions are not cheap. Hence we expect cheaper alternatives will cause demand for HubSpot’s services to slow down. In the longer term, we are bullish on HubSpot’s position in the CRM market but recommend investors wait for a better entry point.

Be the first to comment